Supporting Statement - 1545-0074 - MS

Supporting Statement - 1545-0074 - MS.docx

U.S. Individual Income Tax Return

OMB: 1545-0074

SUPPORTING STATEMENT

Internal Revenue Service

U.S. Income Tax Return for Individual Taxpayers

OMB Control Number 1545-0074

1. CIRCUMSTANCES NECESSITATING COLLECTION OF INFORMATION

Sections 6011 & 6012 of the Internal Revenue Code (IRC) require individuals to prepare and file income tax returns annually. These forms and related schedules are used by individuals to report their income subject to tax and compute their correct tax liability.

Regulations section 1.6011-1 explains that every person subject to any tax, or required to collect any tax, under Subtitle A of the Code, shall make such returns or statements as are required by the regulations. The return or statement shall include therein the information required by the applicable regulations or forms. Section 1.6012-1 explains the general guidelines for individuals required to make returns of income.

Copies of the prescribed return forms are so far as possible furnished to taxpayers by the Internal Revenue Service (IRS). A taxpayer will not be excused from making a return, however, by the fact that no return form has been furnished to him. Taxpayers not supplied with the proper forms should make application therefor to the district director in ample time to have their returns prepared, verified, and filed on or before the due date with the internal revenue office where such returns are required to be filed. Each taxpayer should carefully prepare his return and set forth fully and clearly the information required to be included therein. Returns which have not been so prepared will not be accepted as meeting the requirements of the Code. In the absence of a prescribed form, a statement made by a taxpayer disclosing his gross income and the deductions there from may be accepted as a tentative return, and, if filed within the prescribed time, the statement so made will relieve the taxpayer from liability for the addition to tax imposed for the delinquent filing of the return, provided that without unnecessary delay such a tentative return is supplemented by a return made on the proper form.

This information collection request (ICR) covers the actual reporting burden associated with preparing and submitting the prescribed return forms, by individuals required to file Form 1040 and any of its affiliated forms.

OMB clearance for the burden estimate will be requested before the relevant tax filing season but after the IRS has had the opportunity to update its models with prior year data and to make necessary revisions to draft forms (including providing drafts to public for comment) and is sought on an annual basis instead of on the regular 3-year Paperwork Reduction Act (PRA) cycle. Doing so ensures that new and updated forms can be made available for use on a timelier basis.

-

Form No.

Form Description

Form 1040

__

Annual income tax return filed by citizens or residents of the United States.

Form 1040(SP)

__

Spanish version of the annual income tax return filed by citizens or residents of the United States.

Form 1040 Schedule 1

__

This form is used by Form 1040 filers who have income or adjustments not listed on the Form 1040.

Form 1040 Schedule 1 (SP)

__

This form is used by 1040 (SP) or 1040SR (SP) filers who have additional income or adjustments to income not listed of F 1040 (SP) or F 1040SR (SP).

Form 1040 Schedule 2

__

Form 1040 Sch 2 is used by F 1040 or F 1040-SR filers who have income or adjustments to income not entered directly on F 1040 or F 1040-SR.

Form 1040 Schedule 2 (SP)

__

This form is used by 1040(SP) or 1040-SR(SP) filers who have income or adjustments to income not listed on F 1040(SP) or F 1040-SR(SP).

Form 1040 Schedule 3

__

This form is used by Form 1040 filers who have additional nonrefundable credits not entered on the Form 1040.

Form 1040 Schedule 3 (SP)

__

This form is used by 1040 (SP) or 1040SR (SP) filers who have additional credits or payments not listed on Form 1040 (SP) or Form 1040SR (SP).

Form 1040-C

__

Form 1040-C is used by departing aliens who intend to depart from the U.S., for purposes of reporting income received or expected to be received for the entire taxable year, determined as nearly as may be, up to and including the date of intended departure.

Form 1040 X

__

Used by individual taxpayers to amend prior year tax returns.

Form 1040 NR

__

Used by all nonresident alien individuals whether or not engaged in trade or business within the United States; required for filing nonresident alien fiduciary (estates and trusts) returns.

Form 1040 NR (SP)

__

Used by all nonresident alien individuals whether or not engaged in trade or business within the United States; required for filing nonresident alien fiduciary (estates and trusts) returns.

1040 NR (Schedule NEC)

__

Report gains and losses from the sales or exchanges of capital assets that are not effectively connected with a trade or business in the United States

1040 NR (Schedule NEC) (SP)

__

Report gains and losses from the sales or exchanges of capital assets that are not effectively connected with a trade or business in the United States.

1040 NR (Schedule A)

__

This form is used by Form 1040NR filers who have income or adjustments not reported directly on the Form 1040NR.

1040 NR (Schedule A) (SP)

__

This form is used by Form 1040NR filers who have income or adjustments not reported directly on the Form 1040NR.

1040 NR (Schedule OI)

__

This form is used by Form 1040NR filers who have additional nonrefundable credits not entered on the Form 1040NR for additional credits or payments not entered directly on Form 1040NR.

1040 NR (Schedule OI) (SP)

__

This form is used by Form 1040NR filers who have additional nonrefundable credits not entered on the Form 1040NR for additional credits or payments not entered directly on Form 1040NR.

1040 NR (Schedule P)

__

Schedule P (Form 1040-NR) is used by a nonresident alien, foreign trust, or foreign estate (“transferor”) to report information and calculate gain or loss regarding its transfer of an interest in a partnership.

Form 1040-PR

__

Self-employed persons in Puerto Rico use Form 1040 (PR) to compute self-employment tax.

Form 1040-SR

__

Annual income tax return filed by citizens or residents of the United States who are 65 or older.

Form 1040-SR (SP)

__

Annual income tax filed by taxpayers 65 years and older whose language preference is Spanish.

Form 1040-SS

__

Residents of the U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), and Puerto Rico use Form 1040-SS to report self-employment taxes, household employment taxes, uncollected tax on tips or certain life insurance, and to claim excess social security tax and - for Puerto Rico only - to claim the additional child or health coverage tax credits.

Form 1040-SS (SP)

__

Residents of the U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), and Puerto Rico use Form 1040-SS to report self-employment taxes, household employment taxes, uncollected tax on tips or certain life insurance, and to claim excess social security tax and - for Puerto Rico only - to claim the additional child or health coverage tax credits.

Schedule A (Form 1040)

__

Effective with the 2019 revision, use Schedule A to report item deductions and file with either Form 1040 or Form 1040-SR.

Schedule B (Form 1040)

__

Form 1040 Schedule B is used to report interest and ordinary dividend income.

Schedule C (Form 1040)

__

Use Schedule C to report income or loss from a business operated or profession practiced as a sole proprietor or to report wages and expenses as a statutory employee.

Schedule C (Form 1040 SP)

__

Use Schedule C to report income or loss from a business operated or profession practiced as a sole proprietor or to report wages and expenses as a statutory employee. (Spanish Version)

Schedule D (Form 1040)

__

Form 1040 filers use Schedule D to report sales or exchanges or certain involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts.

Schedule E (Form 1040)

__

Use Schedule E to report income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

Schedule EIC (Form 1040)

__

Forms 1040 and 1040A filers who claim the earned income credit use Schedule EIC to give IRS information about the qualifying child.

Schedule EIC (SP) (F. 1040)

__

Used by Forms 1040 and 1040-SR filers who claim the earned income credit use Schedule EIC to give IRS information about the qualifying child. (Spanish version)

Schedule F (Form 1040)

__

Farmers use Schedule F with their Forms 1040, 1040-SR, 1041, 1065, or 1065-B to report farm income or losses, and expenses.

Schedule F (Form 1040 SP)

__

Farmers use Schedule F with their Forms 1040, 1040-SR, 1041, 1065, or 1065-B to report farm income or losses, and expenses. (Spsnaish Version)

Schedule H (Form 1040)

__

Household employers use Schedule H (Form 1040) with their Forms 1040, 1040NR, 1040-SS, or 1041 to report household employment taxes.

Schedule H (SP) (Form 1040)

__

Household employers use Schedule H (Form 1040) with their Forms 1040, 1040NR, 1040-SS, or 1041 to report household employment taxes.

Schedule H (PR) (Form 1040)

__

Household employers use Schedule H (Form 1040) with their Forms 1040, 1040NR, 1040-SS, or 1041 to report household employment taxes.

Schedule J (Form 1040)

__

Farmers use Schedule J with Form 1040 to elect to figure their tax over the previous three years if their income is high for the current year and was low in one or more of the previous three years.

Schedule LEP (Form 1040)

__

This product will be used by individuals to elect to receive certain types of written correspondence from the IRS in a Limited English Proficiency (LEP) format.

Schedule LEP (SP) (Form 1040(SP))

__

This product will be used by individuals to receive certain types of written correspondence from the IRS in Spanish.

Schedule R (Form 1040)

__

Use Schedule R to figure the credit for the elderly or the disabled.

Schedule SE (Form 1040)

__

Self-employed persons use Schedule SE to figure the self-employment tax due on their net earnings.

Schedule SE (Form 1040 SP)

__

Self-employed persons use Schedule SE to figure the self-employment tax due on their net earnings. (Spansih Version)

Form 1040 V

__

Individual taxpayers who have a balance due on their Form 1040, Form 1040SR or Form 1040NR, can send Form 1040-V With their payment to allow IRS to process the payment more accurately and efficiently.

Form 1040 ES/OCR

__

Form 1040-ES(OCR) estimated tax payment vouchers. Form 1040-ES(OCR) contains four estimated tax payment vouchers.

Form 1040 ES

__

Persons with income not subject to tax withholding use Form 1040-ES to figure and pay estimated tax.

Form 1040 ES (NR)

__

Nonresident aliens use Form 1040-ES (NR) to figure estimated tax on income not subject to tax withholding.

Form 1040 ES (PR)

__

Persons in Puerto Rico use Form 1040-ES (PR), which has four (4) declaration vouchers, to pay self-employment tax.

Schedule 8812 (Form 1040)

__

Form 1040 Schedule 8812 is used by taxpayers to calculate and report the Child Tax Credit and the Additional Child Tax Credit.

Schedule 8812(SP) (Form 1040)

__

Form 1040 Schedule 8812 is used by taxpayers to calculate and report the Child Tax Credit and the Additional Child Tax Credit (Spanish version).

Form 172

__

Form 172 is used for figuring net operating losses (NOLs).

Form 461

__

This form is used to calculate the limitation on trade or businesses losses as defined by IRC 461(I).

Form 673

__

Form 673 is to be filed with your U.S. employer to claim an exemption from U.S. income tax withholding on wages earned abroad to the extent of the foreign earned income exclusion and foreign housing exclusion.

Form 926

__

This form is used to report certain transfers by individuals, partnerships, corporations, or estates or trusts of tangible or intangible property to a foreign corporation.

Form 965-A

__

Corporate Report of Net Tax Liability by reason of Section 965

Form 965-C

__

Instructions for Form 965-C, Transfer Agreement Under 965(h)(3)

Form 970

__

Used by taxpayers to elect to use the last-in, first-out (LIFO) inventory method.

Form 972

__

Shareholders use Form 972 to agree to report as a taxable dividend on their own tax return a consent dividend even though they received no distribution.

Form 982

__

Form 982 is used to determine under certain circumstances described in section 108 the amount of discharged indebtedness that can be excluded from gross income.

Form 1045

__

For use by taxpayers (other than corporations) who have a net operating loss carryback and desire a quick refund of taxes.

Form 1098-F

__

Fines, Penalties and Other Amounts

Form 1116

__

Used to support the foreign tax credit claimed for the amount of any income, war profits, and excess profits tax paid or accrued during the taxable year to any foreign country or U.S. possession.

Form 1127

__

Form 1127 is used by taxpayers to request extension of time to pay taxes.

Form 1128

__

Form 1128 is used by taxpayers to request a change in tax year.

Form 1310

__

Form 1310 is used to claim a refund on behalf of a deceased taxpayer.

Form 2106

__

For optional use to support deductions from income tax for travel, transportation, outside salesman or educational expenses (except moving expenses).

Form 2120

__

Persons claiming a dependent under the multiple support rules use Form 2120 to identify all other eligible persons and to indicate they have signed statements from them waiving their rights to claim that person as a dependent.

Form 2210

__

Form 2210 is filed as an explanation to avoid penalty for underpayment of estimated tax.

Form 2210-F

__

Persons whose gross income from farming or fishing is at least two-thirds of their gross annual income use Form 2210-F to see if they owe a penalty for underpaying their estimated tax.

Form 2350

__

U.S. citizens and resident aliens abroad use Form 2350 to ask for an extension of time to file their tax returns if they need the time to meet the bona fide residence or physical presence test to qualify for special tax treatment.

Form 2350 SP

__

U.S. citizens and resident aliens abroad use Form 2350 (SP) to ask for an extension of time to file their tax returns if they need the time to meet the bona fide residence or physical presence test to qualify for special tax treatment.

Form 2441

__

If you paid someone to care for your child or other qualifying person so you (and your spouse if filing a joint return) could work or look for work, you may be able to take the credit for child and dependent care expenses. Use Form 2441 to figure the amount of your credit.

Form 2555

__

If you are a U.S. citizen or a U.S. resident alien living in a foreign country, you are subject to the same U.S. income tax laws that apply to citizens and resident aliens living in the United States. But if you qualify, use Form 2555 to exclude a limited amount of your foreign earned income.

Form 3115

__

Taxpayers use Form 3115 to request a change in either an overall accounting method or the accounting treatment of any item.

Form 3468

__

Use Form 3468 to claim the investment credit.

Form 3520

__

U.S. persons file Form 3520 to report certain transactions with foreign trusts, and receipt of certain large gifts of bequests from certain foreign persons.

Form 3520-A

__

A foreign trust with a U.S. owner files Form 3520-A annually to provide information about the trust, its U.S. beneficiaries, and any U.S. person who is treated as an owner of any portion of the foreign trust.

Form 3800

__

Filers use Form 3800 to claim any of the general business credits.

Form 3903

__

Form 3903 is used to report moving expenses that can be deducted on Form 1040 for a move related to the start of a new job.

Form 4070

__

This form is not filed with IRS but is completed by the employee who receives tips and given to employer each month (may be required more frequently than monthly by certain employers). The information for this form is contained in Pub 1244.

Form 4070A

__

Form 4070 A is not filed with IRS but is used by employees to keep a record of daily tips. The information for this form is contained in Pub 1244.

Form 4136

__

Taxpayers (other than partnerships who are not electing large partnerships) use Form 4136 to claim a credit for certain nontaxable uses or sales of fuel during the tax year.

Form 4137

__

Employees who did not report tips to their employers, including any allocated tips shown in box 8 of their Form(s) W-2, use Form 4137 to figure the social security and Medicare tax owed on those tips.

Form 4255

__

Taxpayers who dispose of (or whose property ceases to be) investment credit property before the end of the useful life used in computing the investment credit, use Form 4255 to figure the increase in tax for the recapture of investment credit claimed.

Form 4361

__

Ministers, members of religious orders who have not taken a vow of poverty, and Christian Science practitioners use Form 4361 to claim exemption from tax on self-employment income.

Form 4562

__

Taxpayers use Form 4562 to claim a deduction for depreciation or amortization, to make the section 179 election to expense certain property, and to provide information on the business/investment use of cars and other listed property.

Form 4563

__

Bona fide residents of American Samoa for the entire tax year use Form 4563 to figure the amount of income they may exclude from gross income.

Form 4684

__

This form is for optional use by individual as a guide for reporting gains and losses resulting from casualties and thefts.

Form 4797

__

This form is used to report the details of gains and losses from the sale, exchange, involuntary conversion (from other than casualty or theft loss), or disposition of the following: property used in your trade or business, depreciable or amortizable property, capital and non-capital (other than inventory) assets held in connection with the trade or business, or capital assets not reported on Schedule D.

Form 4835

__

Used by landowner (or sublessor) to report gross farm rental income based on crops or livestock shares where the taxpayer does not materially participate in the operation or management of the farm.

Form 4852

__

Form is used by taxpayers to estimate wages and income taxes withheld when Form W-2 is not available from employer.

Form 4852(SP)

__

Form is used by taxpayers to estimate wages and income taxes withheld when Form W-2 is not available from employer.

Form 4868

__

Individuals use Form 4868 to apply for six (6) more months to file Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ.

Form 4868 SP

__

Individuals use Form 4868 (SP) to apply for four (4) more months to file Form 1040, 1040A, 1040EZ, or 1040NR-EZ.

Form 4952

__

Individuals, estates, and trusts use Form 4952 to figure the amount of investment interest expense (interest paid on loans allocable to investment property) they can deduct and the amount they can carry forward to future years.

Form 4970

__

Beneficiaries who receive an accumulation distribution from certain domestic trust use Form 4970 to figure the partial tax on the distribution.

Form 4972

__

Form used in averaging lump-sum distributions to determine whether the income tax computed under the averaging provisions is the most advantageous.

Form 5074

__

U.S. citizens and residents with adjusted gross income of $50,000 or more that includes at least $5,000 from Guam or Commonwealth of the Northern Mariana Islands (CNMI) sources use Form 5074 to provide information to the US.

Form 5213

__

Individuals, trusts, estates, and S corporations use Form 5213 to elect to postpone an IRS determination as to whether the presumption applies that an activity is engaged in for profit.

Form 5329

__

Form used by any individual who has established a retirement account, annuity or retirement bond.

Form 5405

__

Use Form 5405 to claim the first-time homebuyer credit.

Form 5471

__

Certain U.S. citizens or residents who are officers, directors, or shareholders in certain foreign corporations use Form 5471 to report required information.

Schedule J (Form 5471)

__

Filers of Form 5471 use Schedule J to report accumulated Earnings and Profits (E&P), in functional currency, computed under sections 964(a) and 986(b).

Schedule M (Form 5471)

__

U.S. persons who had control of a foreign corporation for an uninterrupted period of at least 30 days use Schedule M with Form 5471 to report certain transactions that occurred during the corporation's annual accounting period.

Schedule O (Form 5471)

__

Certain officers, directors, and shareholders of foreign corporations use Schedule O with Form 5471 to report (re)organization and acquisition/disposition of its stock.

Form 5695

__

Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Form 5713

__

Persons having operations in or related to countries which require participation in or cooperation with an international boycott may be required to report these operations on Form 5713.

Schedule A (Form 5713)

__

Persons who participated in or cooperated with an international boycott use Schedule A with Form 5713 to figure the international boycott factor to use in figuring the loss of tax benefits.

Schedule B (Form 5713)

__

Persons who participated in or cooperated with an international boycott use Schedule B with Form 5713 to specifically attribute taxes and income in order to figure the loss of tax benefits.

Schedule C (Form 5713)

__

Filers of Schedule A or B (Form 5713) use Schedule C to compute the loss of tax benefits from participation in or cooperation with an international boycott.

Form 5884

__

Form 5884 is used to claim the work opportunity credit for the first year wages paid to or incurred for targeted group employees (including Hurricane Katrina employees) during the tax year.

Form 5884-A

__

Form 5884-A is used to figure certain credits for disaster area employers.

Form 6198

__

Individuals, estates, trusts, and certain corporations use Form 6198 to figure the profit (loss) from an at-risk activity, the amount at risk, and the deductible amount of the loss.

Form 6251

__

Used to figure alternative minimum tax for individuals.

Form 6252

__

Use Form 6252 to report income from the sale of real property or the casual sale of personal property other than inventory, if you are a dealer.

Form 6478

__

Use Form 6478 to figure your biofuel producer credit.

Form 6765

__

Individuals, estates, trusts, organizations, or corporations use Form 6765 to figure and claim the credit for increasing research activities.

Form 6781

__

Taxpayers use Form 6781 to report gains and losses on section 1256 contracts under the mark-to-market rules and under section 1092 from straddle positions.

Form 7203

__

Use Form 7203 to figure potential limitations of your share of the S corporation's deductions, credits, and other items that can be deducted on your return.

Form 7204

__

Consent To Extend the Time To Assess Tax Related to Contested Foreign Income Taxes— Provisional Foreign Tax Credit Agreement.

Form 7205

__

Use Form 7205 to claim the deduction for qualifying energy efficient commercial building property (EECBP) placed in service during the tax year.

Form 7206

__

Use Form 7206 to determine any amount of the self-employed health insurance deduction you may be able to report on Schedule 1 (Form 1040).

Form 7207

__

Advanced Manufacturing Production Credit.

Form 7210

__

Form 7210 is used to claim the section 45V clean hydrogen production credit.

Form 7211

__

IRA22 adds the clean electricity production credit. New Form 7211

and its separate instructions will be used to claim the credit.

Form 7213

__

Form 7213 is used to claim the section 45J credit for production from advanced nuclear power facilities. Beginning in 2024, Form 7213 will be used to claim the section 45U zero-emission nuclear power production credit.

Form 7217

__

Form 7217 will be used to track section 732 transactions. The form will be required when partners receive actual distributions of property from a partnership.

Form 7218

__

IRA22 added IRC section 45Z and created the new Clean Fuel Production Credit (CFPC). A filer must file a separate Form 7218 for each qualified facility for which they claim the credit.

Form 8082

__

Partners, S corporation shareholder, beneficiary of an estate or trust, owner of a foreign trust, or residual interest holder in a real estate mortgage investment conduit (REMIC), use Form 8082 to notify IRS of inconsistencies between the tax treatment of an item on their returns vs. the way the pass-through entity treated and reported the item on its return.

Form 8275

__

Taxpayers and preparers use Form 8275 to disclose items or positions, except those taken contrary to a regulation, that are not otherwise adequately disclosed on a tax return to avoid certain penalties.

Form 8275-R

__

Taxpayers and preparers use Form 8275-R to disclose positions taken on a tax return that are contrary to Treasury regulations, to avoid certain portions of the accuracy-related penalty, if the return position has a reasonable basis.

Form 8283

__

To claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

Form 8332

__

Custodial parents use Form 8332 to release their claim to their child's exemption. They give the form to the noncustodial parent who will claim the child's exemption, and that parent attaches it to his or her income tax return.

Form 8379

__

Injured spouses use Form 8379 to compute their share of a joint tax refund when all or part of the refund was applied against their spouse's past-due Federal tax or nontax debt, such as child or spousal support, or state income tax, etc.

Form 8396

__

Form 8396 is used to figure mortgage interest credit and any carryover there may be to a subsequent year.

Form 8404

__

Interest Charge on DISC-Related Deferred Tax Liability.

Form 8453

__

Form 8453 is completed by taxpayers, or their ERO, who need to submit certain paper documents to their electronically filed tax return.

Form 8453(SP)

__

Form 8453 (SP) is completed by taxpayers who file their individual tax return electronically using a third party.

Form 8582

__

Individuals, estates, and trusts with losses from passive activities use Form 8582 to figure the amount of any passive activity loss allowed for the current tax year.

Form 8582-CR

__

Individuals, estates, and trusts with certain credits from passive activities use Form 8582-CR to figure the amount of any passive activity credit allowed for the current tax year.

Form 8586

__

Owners of qualified residential rental buildings in low-income housing projects use Form 8586 to figure the amount of their low-income housing credit, a component of the general business credit.

Form 8594

__

The buyers and sellers of a group of assets that make up a business use Form 8594 when goodwill or going concern value attaches.

Form 8606

__

Taxpayers use Form 8606 to report nondeductible contributions to their traditional IRA(s), distributions from certain IRAs where their basis was more than zero, distributions from Roth IRAs, and amounts converted.

Form 8609-A

__

Pursuant to section 42(I), Form 8609-A must be completed by the building owner each year of the 15-year compliance period, whether or not a low-income housing credit (LIHC) is claimed for the tax year.

Form 8611

__

Owners of residential low-income rental buildings use Form 8611 to recapture the low-income housing credit taken in previous years due to a decrease in the qualified basis of a building or its disposition without posting a satisfactory bond.

Form 8615

__

Children under age 18 with investment income of more than $1,800 (indexed for inflation), who are required to file a tax return, and whose tax rate is lower than their parents' tax rate use Form 8615 to figure their tax.

Form 8621

__

Used by direct or indirect shareholder of a passive foreign investment company or qualified electing fund who is a U.S. person must file Form 8621 for each tax year in which the shareholder holds stock in a passive foreign investment company or qualified electing fund.

Form 8621-A

__

This form is used by shareholders of a former Passive Foreign Investment Company (PFIC) or a Section 1297(e)PFIC to make a late purging election under Section 1298(b)(1) to terminate their subjection to taxation under Section 1291.

Form 8689

__

Form 8689 is used to figure the amount of U.S. tax allocable to the U.S. Virgin Islands.

Form 8697

__

Persons who complete long-term contracts that were accounted for using the percentage of completion or completion-capitalized cost methods use Form 8697 to figure the interest due or to be refunded under the look-back method.

Form 8801

__

Individuals, trusts, and estates use Form 8801 to figure the minimum tax credit for alternative minimum tax and any minimum tax credit carryforward.

Form 8814

__

Use Form 8814 if you elect to report your child's income on your return. If you do, your child will not have to file a return.

Form 8815

__

Individuals who cashed certain savings bonds to pay qualified higher education expenses use Form 8815 to exclude part or all of the interest on the bonds.

Form 8818

__

Individuals who cashed certain savings bonds and paid qualified higher education expenses can use Form 8818 to keep a record of the bonds.

Form 8820

__

Individuals, estates, trusts, organizations, and corporations that elects to claim an orphan drug credit use Form 8820 to claim it.

Form 8824

__

Taxpayers use Form 8824 to report each exchange of business or investment property for property of a like kind.

Form 8826

__

Eligible small businesses use Form 8826 to claim the disabled access credit, a part of the general business credit.

Form 8828

__

Homeowners with federal mortgage subsidies use Form 8828 to figure and report the recapture tax on the subsidy if they sold or otherwise disposed of the home.

Form 8829

__

Filers of Schedule C (Form 1040) use Form 8829 to figure the allowable expenses for business use of their home and any carryover to the following year of amounts not deductible in the current year.

Form 8833

__

Taxpayers, including dual-resident taxpayers, use Form 8833 to make the treaty-based return position disclosure.

Form 8834

__

Taxpayers use Form 8834 to claim any qualified electric vehicle passive activity credit allowed for the current tax year.

Form 8835

__

Use Form 8835 to claim the renewable electricity, refined coal, and Indian coal production credit.

Form 8838

__

U.S. transferors that entered into a gain recognition agreement under section 367(a) and 367(e)(2) use Form 8838 with their income tax return for the tax year the transfer is made.

Form 8838-P

__

Form 8838-P is an information return for partnerships to extend the statue when one is claming anelection under section 721(c).

Form 8839

__

Individuals use Form 8839 to figure the amount of their adoption credit and any employer-provided adoption benefits they can exclude from income.

Form 8840

__

Form 8840 is used by Alien individuals to claim the closer connection to a foreign country(ies) exception to the substantial presence test.

Form 8843

__

Alien individuals use Form 8843 to explain the basis of their claim that they can exclude days of presence in the United States for purposes of the substantial presence test.

Form 8844

__

Employers use Form 8844 to claim the empowerment zone and renewal community employment credit.

Form 8845

__

Employers of American Indians who are qualified employees use Form 8845 to claim the Indian employment credit.

Form 8846

__

Certain food and beverage establishments use Form 8846 to claim a credit for social security and Medicare taxes paid or incurred by the employer on certain employees' tips.

Form 8853

__

Individuals use Form 8853 to report contributions to and figure deductions for Archer MSAs, to report distributions from MSAs, to report payments from long-term care insurance contracts, and to report accelerated death benefits from life insurance policies.

Form 8854

__

Use Form 8854 if you expatriated or terminated your long-term resident status after June 3, 2004, to provide the information required by sections 6039G and 7701(n).

Form 8858

__

Form 8858 is used by certain U.S. persons that own a foreign disregarded entity (FDE) or foreign branch (FB) directly or, in certain circumstance, indirectly or constructively.

Schedule M (Form 8858)

__

Used by certain U.S. persons that are required to file a Form 8858 for a foreign disregarded entity (FDE) or foreign branch (FB) that entered into any transaction with the filer of the Form 8858 or other entities during the annual accounting period of the FDE or FB. This also used by certain U.S. person that are required to file a Form 5471 with respect to a CFC or Form 8865 with respect to a CFP, that is a tax owner of an FDE or FB, such as Category 4 filers of Form 5471, and Category 1 filers of Form 8865.

Form 8859

__

Individuals use Form 8859 to claim the District of Columbia first-time homebuyer credit.

Form 8862

__

Complete Form 8862 and attach it to your tax return if both of the following apply: Your EIC was reduced or disallowed for any reason other than a math or clerical error for a year after 1996; and you now want to claim the EIC and you meet all of the requirements.

Form 8862(SP)

__

You must complete Form 8862 (SP) and attach it to your tax return if both of the following apply. 1. Your EIC was reduced or disallowed for any reason other than a math or clerical error for a year after 1996. 2. You now want to claim the EIC and you meet all the requirements.

Form 8863

__

Individuals use Form 8863 to figure and claim education credits (i.e., the Hope credit and the lifetime learning credit).

Form 8864

__

This form will be used to claim the biodiesel and renewable diesel fuels credit.

Form 8865

__

Use Form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038B (reporting of transfers to foreign partnerships), or section 6046A (reporting acquisitions, dispositions, and changes in foreign partnership interests).

Schedule K-1 (Form 8865)

__

Used to report the information required under section 6038, section 6038B, or section 6046A.

Schedule K-2 (Form 8865)

__

Schedule K-2 is an extension of Schedule K-1 of the Form 8865 and is used to report items of international tax relevance from the operation of a partnership.

Schedule K-3 (Form 8865)

__

Schedule K-3 is an extension of Schedule K-1 (Form 8865) and is generally used to report the share of the items reported on Schedule K-2.

Schedule O (Form 8865)

__

Used to report the information required under section 6038, section 6038B, or section 6046A.

Schedule P (Form 8865)

__

Used to report the information required under section 6038, section 6038B, or section 6046A.

Form 8866

__

Taxpayers who depreciated certain property using the income forecast method (generally limited to motion picture films, video tapes, sound recordings, copyrights, books and patents) use Form 8866 to figure the interest due or to be refunded under the look-back method.

Form 8867

__

Paid preparers of Federal income tax returns or claims for refund involving the Earned Income Credit (EIC), Child Tax Credit (CTC)/Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), American Opportunity Tax Credit (AOTC) and/or Head of Household (HOH) filing status must complete Form 8867 and meet the due diligence requirements in determining if the taxpayer is eligible for the credit(s).

Form 8873

__

Form 8873 is used to figure the amount of extraterritorial income excluded from gross income for the tax year.

Form 8874

__

Form 8874 is used to claim the new markets credit for qualified equity investments made in qualified community development entities (CDEs).

Form 8878

__

The taxpayer can choose to use Form 8878 to: certify the truthfulness, correctness and completeness of the form; selected a personal identification number (PIN) as his or her signature for the electronic application and, if applicable, electronic funds withdrawal consent, and to authorize the electronic return originator (ERO) to enter the taxpayers self-selected PIN on the electronic application for an extension of time to file and if applicable electronic funds withdrawal consent.

Form 8878 SP

__

The taxpayer can choose to use Form 8878 (SP) to: Certify the truthfulness, correctness and completeness of the form; Selected a personal identification number (PIN) as his or her signature for the electronic application and if applicable, Electronic Funds Withdrawal consent and to Authorize the electronic return originator (ERO) to enter the taxpayers self-selected PIN on the electronic application for an extension of time to file and if applicable Electronic Funds Withdrawal Consent.

Form 8879

__

Taxpayers use Form 8879 when their return is e-filed using the practitioner PIN method or when the taxpayer authorizes the electronic return originator to enter the taxpayer's PIN on his or her e-filed return.

Form 8879 SP

__

To certify the truthfulness, correctness, and completeness of the taxpayer’s electronic income tax. (Spanish Version)

Form 8880

__

Individuals use Form 8880 to figure the amount, if any, of their retirement savings contributions credit.

Form 8881

__

Eligible small employers use Form 8881 to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan.

Form 8882

__

Employers use Form 8882 to claim the credit for qualified childcare facility and resource and referral expenditures.

Form 8886

__

Used to disclose participation in reportable transactions by taxpayers as described in regulations 1.6011-4.

Form 8888

__

This form allows a taxpayer who requests a direct deposit of his or her refund to split the refund among two or three accounts.

Form 8889

__

Report activity in a health savings account.

Form 8896

__

Eligible small refiners will use this form to claim the credit for qualified low sulfur diesel fuel production costs.

Form 8898

__

Use Form 8898 to notify the IRS that you became or ceased to be a bona fide resident of a U.S. possession in accordance with section 937(c).

Form 8900

__

Eligible taxpayers use Form 8900 to claim the railroad track maintenance credit (RTMC) with respect to qualified railroad track maintenance expenditures (QRTME) paid or incurred during the tax year.

Form 8903

__

Form 8903 is used by corporations, individuals, partners (including partners of electing large partnerships). S corporation shareholders, estate and trusts, beneficiaries of estates and trusts, cooperatives, and patrons of cooperatives to calculate and report the domestic production activities deduction.

Form 8906

__

Form 8906 is used to claim the distilled spirits credit, which is part of the general business credit.

Form 8908

__

Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence.

Form 8910

__

Use Form 8910 to figure your credit for alternative motor vehicles you placed in service during your tax year.

Form 8911

__

Use Form 8911 to figure your credit for alternative fuel vehicle refueling property you placed in service during the tax year.

Schedule A (Form 8911)

__

Schedule A (Form 8911) is used in reporting the existing IRC 30C Alternative

fuel vehicle refueling property credit.

Form 8912

__

This form is used to claim the credit for holding tax credit bonds.

Form 8915-D

__

For 8915-D is used by taxpayers adversely affected by a Presidentially declared2019 disaster and who later received distribution out of their retirement plan which may qualify for favorable tax treatment.

Form 8915-F

Taxpayers use Form 8915-F to report retirement plan distributions for major 2021 and later disasters receiving favorable tax treatment.

Form 8919

__

Employees must file Form 8919 if all of the following apply: You performed services for a firm; The firm did not withhold your share of social security and Medicare taxes from your pay; One or more of the reasons listed under Reason codes apply to you; Your pay from the firm was not for services as an independent contractor.

Form 8925

__

Form 8925 is required to be attached to the employer's income tax return to report all employer-owned life insurance contracts.

Form 8932

__

Taxpayers use Form 8932 to claim the credit for eligible differential wage payments you made to qualified employees during the tax year.

Form 8933

__

Use Form 8933 to claim the carbon oxide sequestration credit.

Schedule A (Form 8933)

__

Use Schedule A for Disposal or Enhanced Oil Recovery Owner Certification.

Schedule B (Form 8933)

__

Use Schedule B for Disposal Operator Certification.

Schedule C (Form 8933)

__

Use Schedule C for Enhanced Oil Recovery Operator Certification.

Schedule D (Form 8933)

__

Use Schedule D for Recapture Certification.

Schedule E (Form 8933)

__

Use Schedule E for Election Certification .

Form 8936

__

For tax years beginning after 2008, use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year.

Schedule A (Form 8936)

__

Clean Vehicle Credit Amount.

Form 8941

__

Eligible small employers use Form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009.

Form 8949

__

Form 8949 is used to list all capital gain and loss transactions.

Form 8958

__

Use Form 8958 to determine the allocation of tax amounts between married filing separate spouses, California same-sex spouses, or registered domestic partners (RDPs) with community property rights. If you need more room, attach a statement listing the source of the item and the total plus the allocated amounts.

Form 8960

__

Taxpayers use Form 8960 to figure the amount of net investment income tax (NIIT).

Form 8962

__

IRC Section 36B creates a refundable tax credit providing premium assistance for coverage under a qualified health plan.

Form 8993

__

New form required for deduction for foreign-derived intangible income and global intangible low-taxed income.

Form 8994

__

Eligible employers use Form 8994 to figure the employer credit for paid family and medical leave.

Form 8995

__

Use Form 8995 to figure your qualified business income (QBI) deduction.

Form 8995-A

__

The form is used to help taxpayer to determine if they meet the requirements of IRC 199A and take the qualified business income deduction.

Schedule A (Form 8995-A)

__

The form is used to help taxpayers determine if they meet the requirements of IRC 199A and take the qualified business income deduction.

Schedule B (Form 8995-A)

__

The form is used to help taxpayers to determine if they meet the requirement of IRC 199A and take the qualified business income. Taxpayers will use this form to aggregate multiple trades or businesses into a single trade or business for purposes of applying the W-2 wage limitation or the unadjusted basis immediately after acquisition (UBIA) limitation.

Schedule C (Form 8995-A)

__

This form is used to help taxpayers to determine if they meet the requirements of IRC 100A and take the qualified business income deduction. A taxpayer must complete this form if they have any trades or businesses with a net loss for the current year or a qualified business with a net loss carryforward from prior years.

Schedule D (Form 8995-A)

__

Taxpayers use Schedule D with their Form 8895-A to report if they are a patron of agricultural or horticultural cooperatives to determine if they meet the requirements of IRC 199A and take the qualified business income deduction.

Form 9000

__

This form is used by taxpayers to request receipt of certain types of written communications from the IRS in an alternative format or language.

Form 9000(SP)

__

This form is used by taxpayers to request receipt of certain types of written communications from the IRS in an alternative format or language.

Form 9465

__

Taxpayers use Form 9465 to request a monthly installment plan if they cannot pay the full amount of tax they owe.

Form 9465(SP)

__

Taxpayers use Form 9465 to request a monthly installment plan if they cannot pay the full amount of tax they owe. (Spanish Version)

Form T (Timber)

__

Use Form T (Timber), Forest Activities Schedule, to provide information on timber accounts when a sale or deemed sale under sections 631(a), 631(b), or other exchange has occurred during the tax year.

Form W-4

__

Employees complete Form W-4 and gives it to their employer so their employer withholds the correct Federal income tax from their pay.

Form W-4 (SP)

__

Complete Form W-4 (SP) so that your employer can withhold the correct federal income tax from your pay. Because your tax situation may change, you may want to refigure your withholding each year. (Spanish Version)

Form W-4 (KO)

__

This is a Korean language translation version of Form W-4.

Form W-4 (RU)

__

This is a Russian language translation version of Form W-4.

Form W-4 (VIE)

__

This is a Vietnamese version of Form W-4.

Form W-4 (ZH-S)

__

This is a Chinese-Simplified language translation version of Form W-4.

Form W-4 (ZH-T)

__

This is a Chinese-Traditional version of Form W-4.

Form W--4 P

__

Recipients of annuity, pension, or certain other deferred compensation payments use Form W-4P to tell payers the correct amount of federal income tax to withhold.

Form W-4 S

__

Give Form W-4S to the third-party payer of your sick pay, such as an insurance company, if you want Federal income tax withheld from the payments.

Form W-4 V

__

Recipients of certain government payments can complete and give Form W-4V to the payer to request voluntary Federal income tax withholding from their payments.

Form W-4 R

__

Recipients of retirement payments other than pensions or annuities use this form to tell payers the correct amount of federal income tax to withhold.

Form W-7

__

Alien individuals who are required to furnish a U.S. taxpayer identification number to the IRS but who do not have, and are not eligible to obtain, an SSN use Form W-7 to apply for an IRS individual taxpayer identification number (ITIN).

Form W-7 A

__

Use Form W-7A to apply for an Internal Revenue Service (IRS) adoption taxpayer identification number (ATIN) for a child who is placed in your home for purposes of legal adoption.

Form W-7 (SP)

__

Use Form W-7 (SP) to apply for an IRS individual taxpayer identification number (ITIN).

Form W-7 (COA)

__

Form W-7 (COA) is an external facing product that is to be used by Certified Acceptance Agents (CAAs) and required to be attached to each Form W-7, Application for IRS Individual Taxpayer Identification Number (ITIN) that is submitted to the IRS.

Form 15620

__

Use Form 15620 for Section 83(b) Election.

2. USE OF DATA

The data on Form 1040 and its schedules will be used in computing the tax liability and IRS uses the information in determining that the items claimed are properly allowable. It is also used for general statistical use.

3. USE OF IMPROVED INFORMATION TECHNOLOGY TO REDUCE BURDEN

We are currently offering electronic filing for these forms and schedules.

4. EFFORTS TO IDENTIFY DUPLICATION

The information obtained through this collection is unique and is not already available for use or adaptation from another source.

5. METHODS TO MINIMIZE BURDEN ON SMALL BUSINESSES OR OTHER SMALL ENTITIES

The IRS proactively works with both internal and external stakeholders to minimize the burden on small businesses, while maintaining tax compliance. The Agency also seeks input regarding the burden estimates from the public via notices and tax product instructions. The forms can be filed electronically, which further reduces any burden to small businesses.

6. CONSEQUENCES OF LESS FREQUENT COLLECTION ON FEDERAL PROGRAMS OR POLICY ACTIVITIES

Consequences of less frequent collection on federal programs or policy activities could consist of a decrease in the amount of taxes collected by the IRS, inaccurate and untimely filing of tax returns, and an increase in tax violations.

7. SPECIAL CIRCUMSTANCES REQUIRING DATA COLLECTION TO BE INCONSISTENT WITH GUIDELINES IN 5 CFR 1320.5(d)(2)

There are no special circumstances requiring data collection to be inconsistent with guidelines in 5 CFR 1320.5(d)(2).

8. CONSULTATION WITH INDIVIDUALS OUTSIDE OF THE AGENCY ON AVAILABILITY OF DATA, FREQUENCY OF COLLECTION, CLARITY OF INSTRUCTIONS AND FORMS, AND DATA ELEMENTS

In response to the Federal register notice dated September 5, 2024 (89 FR 72699), we received four comment letters during the comment period.

Bureau Economic Analysis:

Povided a letter of support.

Democrats Abroad:

Appendix A outlines in detail many problems posed by this Information Collection, framed

against the questions posed in the Federal Register notice.

Appendix B aggregates current and historical IRS estimates of the hours to complete many

additional forms that international taxpayers are typically required to file.

Appendix C provides common scenarios for international taxpayers and the cumulative burden

of the additional forms.

Appendix D included recommendations:

Include burden estimates by specific demographic groups, particularly for known

underserved communities.

Include individual burden estimates for forms that may be attached to the 1040.

Consult with organizations that submit Paperwork Reduction Act comments and undertake rulemaking to address identified opportunities for burden reduction.

The Association of Americans Resident Overseas:

The letter believes that the IRS seriously understates the paperwork burden created by tax-related filing requirements.

Missing forms for overseas filers.

There are concerns with the accuracy and methodology.

Direct File is not available to overseas taxpayers.

The IRS needs to scan and digitalize all incoming paper forms, returns and communications.

The University of Pittsburg School of Law:

Pre-populated Tax Returns for Low-Income Taxpayers.

Reforming the Earned Icome Tax Credit (EITC).

Calibrating the Tax Burden for Individual Forms.

Creating a Standardized Evidence Form.

These letters have been forwarded to the appropriate offices for review and/or comment. The IRS appreciates the support and feedback received. The IRS recognizes the complexity that taxpayers living abroad incur in connection with their U.S. income tax filing obligations. Filing characteristics specific to filers living abroad or those who have investment and/or business activity abroad are included in the medium and high complex categories in the Taxpayer Compliance Burden Modeling methodology. The Taxpayer Compliance Burden Model is used to estimate the average time and out-of pocket costs that taxpayers incur to comply with their income tax filing obligations. The total estimate is not determined on a form-by-form basis. Instead, it uses a taxpayer-centric approach to burden estimation. It begins with the main form filed and is adjusted by complexity drivers that are exhibited by the main form, schedules, and associated forms. The process is explained in Publication 5743, Taxpayer Compliance Burden, https://www.irs.gov/pub/irs-pdf/p5743.pdf.

We recognize that international taxpayers struggle to have access to high quality filing options. Direct File is considering how we can expand the scope of Direct File in future years and will consider the needs of international taxpayers in that prioritization. These recommendations will be considered for tax season beyond 2025.

9. EXPLANATION OF DECISION TO PROVIDE ANY PAYMENT OR GIFT TO RESPONDENTS

No payment or gift has been provided to any respondents.

10. ASSURANCE OF CONFIDENTIALITY OF RESPONSES

Generally, tax returns and tax return information are confidential as required by 26 USC 6103.

11. JUSTIFICATION OF SENSITIVE QUESTIONS

A privacy impact assessment (PIA) has been conducted for information collected under this request as part of the “Individual Master File (IMF)” system and a Privacy Act System of Records notice (SORN) has been issued for this system under IRS 24.030--Customer Account Data Engine Individual Master File, formerly Individual Master File, and IRS 34.037--IRS Audit Trail and Security Records System. The Internal Revenue Service PIAs can be found at https://www.irs.gov/uac/Privacy-Impact-Assessments-PIA

Title 26 USC 6109 requires inclusion of identifying numbers in returns, statements, or other documents for securing proper identification of persons required to make such returns, statements, or documents and is the authority for social security numbers (SSNs) in IRS systems.

12./13. ESTIMATED BURDEN OF INFORMATION COLLECTION/ESTIMATED TOTAL ANNUAL COST BURDEN TO RESPONDENTS

PRA Approval of Forms Used by Individual Taxpayers

Under the PRA, OMB assigns a control number to each ''collection of information'' that it reviews and approves for use by an agency. The PRA also requires agencies to estimate the burden for each collection of information. Burden estimates for each control number are displayed in (1) PRA supporting statement that accompanies collections of information, (2) Federal Register notices, and (3) OMB's database of approved information collections.

Forms 1040, 1040-SR, 1040-NR, 1040-SS, 1040-X, and all attachments to these forms (see the Appendix-A to this supporting statement) are used by individual taxpayers to meet their tax return filing obligations.

Taxpayer Compliance Burden Model

Taxpayer compliance burden is defined as the time and money taxpayers spend to comply with their information and tax reporting responsibilities. Time-related activities include recordkeeping, tax planning, gathering tax materials, learning about the law and what the taxpayer needs to do, and completing and submitting the return. Out-of-pocket costs include expenses such as purchasing tax software, paying a third-party preparer, and printing and postage. Taxpayer compliance burden does not include a taxpayer’s tax liability, economic inefficiencies caused by sub-optimal choices related to tax deductions or credits, or psychological costs.

The IRS uses the Taxpayer Compliance Burden Model for Individual Taxpayer Reporting Burden to estimate the burden experienced by individuals when complying with Federal tax laws. The model is based on a survey of Tax Year 2022 individual tax return filers that was fielded in 2023 and 2024. The model is updated annually to account for legislative and regulatory changes. This methodology for estimating burden focuses on the characteristics and activities undertaken by individual taxpayers in meeting their tax return filing obligations.

The methodology is based on the primary drivers associated with observed individual taxpayer reporting burden. These include tax return preparation method (self-prepared with or without software, use of a paid preparer or tax professional, use of Volunteer Income Tax Assistance (VITA) Program, Tax Counseling for the Elderly (TCE), or use of Direct File), total income, type of filer (wage and investment or business), and the complexity of the individual’s income generated from assets and investments. Indicators of tax law and administrative complexity, as reflected in the tax laws and instructions, are incorporated into the model.

There is significant variation in taxpayer activity across different taxpayer groups. For example, non-business taxpayers are expected to have an average burden of about 8 hours and $160, while business taxpayers are expected to have an average burden of about 24 hours and $620. Similarly, tax preparation and other out-of-pocket costs vary extensively depending on the tax situation of the taxpayer, the type of software or professional preparer used, and the geographic location.

Taxpayer Burden Estimates

Summary results for Fiscal Year 2025 using the Taxpayer Compliance Burden Model burden estimation methodology for individual taxpayers are presented below. The data shown are the best forward-looking estimates available for individual tax returns filed for Tax Year 2024. The burden estimates are based on statutory requirements as of December 1, 2024.

Total Burden Table

Burden Estimates for the 1040/SR/NR/SS/X series of returns and supporting forms, schedules, and regulations |

|||||

FY2025 |

|||||

|

Fiscal Year 2024 |

Program Change due to Technical Adjustment |

Program Change due to Legislative Adjustment |

Program Change due to Agency Adjustment |

Fiscal Year 2025 |

Number of Taxpayers |

171,800,000 |

(3,000,000) |

- |

- |

168,800,000 |

Burden in Hours |

2,249,000,000 |

(120,000,000) |

- |

- |

2,129,000,000 |

Monetized Time |

$46,342,000,000 |

($1,356,000,000) |

$7,000,000 |

$4,000,000 |

$44,997,000,000 |

Out-of-Pocket Costs |

$45,365,000,000 |

$3,350,000,000 |

$9,000,000 |

($41,000,000) |

$48,683,000,000 |

Monetized Total Burden* |

$91,707,000,000 |

$1,994,000,000 |

$16,000,000 |

($37,000,000) |

$93,680,000,000 |

Source: IRS:RAAS:KDA:TBL (11-25-2024) *Monetized Total Burden = Monetized Time + Out-of-Pocket Costs Note: Reported time and cost burdens are national averages and do not necessarily reflect a “typical” case. Most taxpayers experience lower than average burden, with taxpayer burden varying considerably by taxpayer type. Detail may not add to total due to rounding. |

|||||

Tax return data are used to calculate a monetization rate for individual taxpayers. We assign an after-tax hourly wage rate based on the taxpayer’s marginal tax rate, FICA tax rate (if applicable to income at the marginal rate) and Medicare tax rate. For self-employed taxpayers, we control for changes in net income by using a three-year average for year one and the two prior years. All taxpayers are assigned a monetization rate no less than federal minimum wage, which is the lower bound. An upper bound limitation is applied to take into account the fact that above a certain wage rate, taxpayers tend to use a paid preparer because the value of their time generally exceeds what they would pay a preparer to complete the return. Upper bound limitation rates are from the Bureau of Labor Statistics Occupational Employment Statistics Survey.

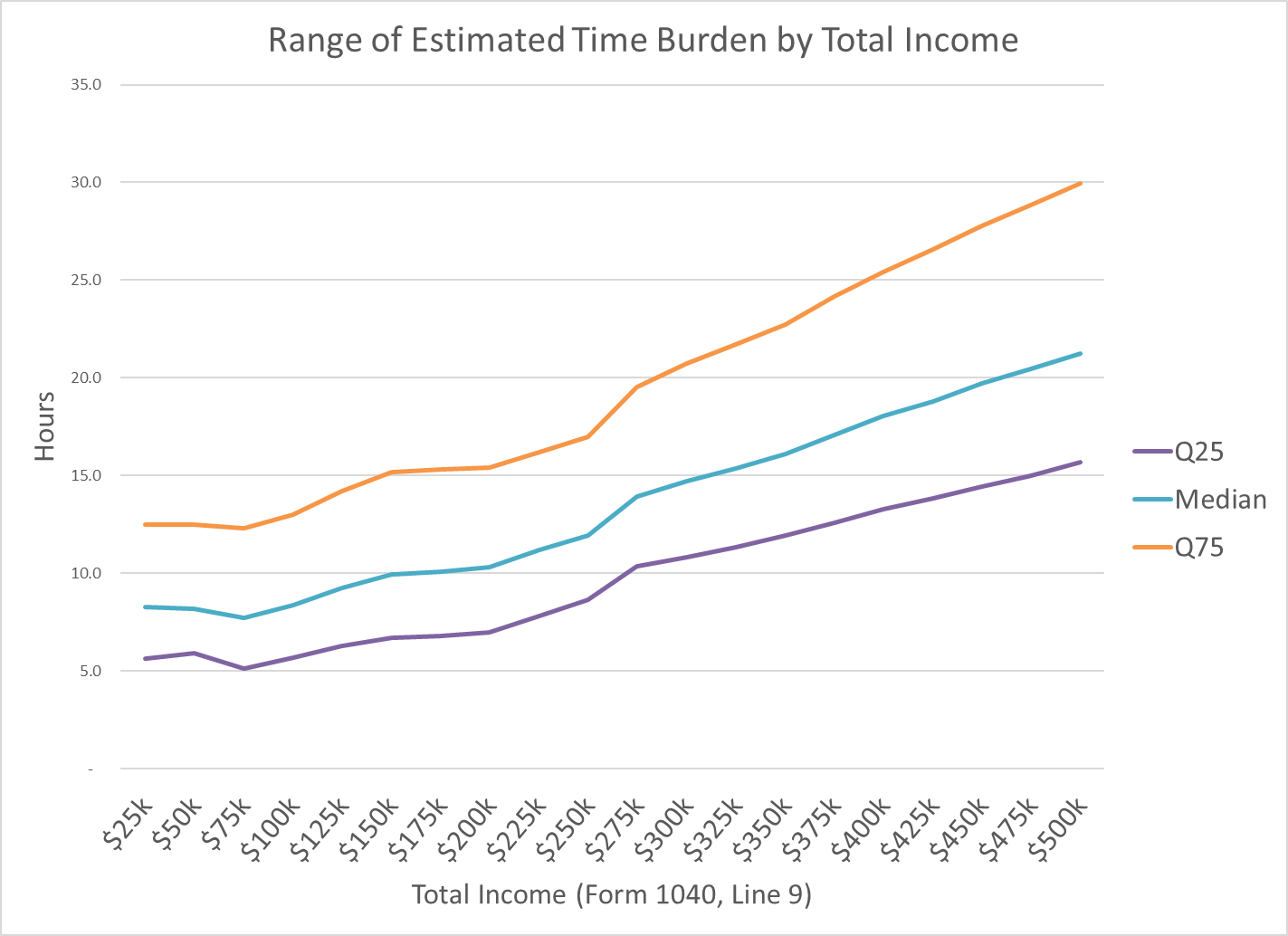

The following additional breakouts of average burden are provided for transparency in understanding the average estimated burden experienced by taxpayers. Table 1 shows the average burden by business and nonbusiness taxpayers. Table 2 shows the average burden by total positive income for all taxpayers, wage and investment taxpayers, and self-employed taxpayers. Table 3 shows the average and median burden for all taxpayers by total income.

Table 1 - Fiscal Year 2025 Estimated Average Taxpayer Burden for Individuals Filing a 1040 by Activity |

||||||||||

Primary Form Filed or Type of Taxpayer |

Time Burden |

Money Burden |

||||||||

|

Percentage of Returns |

Average Time Burden (Hours) |

Average Cost (Dollars) |

Total Monetized Burden (Dollars) |

||||||

Total Time |

Record Keeping |

Tax Planning |

Form Completion |

All Other |

||||||

All Taxpayers |

and Submission |

|||||||||

100% |

13 |

5 |

3 |

4 |

1 |

$290 |

$560 |

|||

Type of |

|

|

|

|

|

|

|

|

||

Taxpayer |

||||||||||

Nonbusiness* |

71% |

8 |

3 |

1 |

3 |

1 |

$160 |

$310 |

||

Business* |

29% |

24 |

11 |

5 |

6 |

2 |

$620 |

$1,170 |

||

|

|

|

|

|

|

|

|

|

|

|

Note: Detail may not add to total due to rounding. Dollars rounded to the nearest $10. |

||||||||||

*A "business" filer files one or more of the following with Form 1040: Schedule C, E, F, or Form 2106. A "nonbusiness" filer does not file any of these schedules or forms with Form 1040. |

||||||||||

Source: IRS:RAAS:KDA:TBL (11-25-2024) |

||||||||||

The total estimated time and out-of-pocket costs, represent the federal income tax compliance burden for the estimated 168.8 million individual taxpayers who will file a Tax Year 2024 federal income tax return as estimated using the IRS Taxpayer Compliance Burden Model burden estimation methodology. Due to rounding, the per respondent burden calculated using the total amounts above will be different. As a result, estimates of the cost burdens were calculated at $288 per taxpayer, with a combined estimate total of $48,683,000,000.

-

Table 2 – Fiscal Year 2025 Taxpayer Burden Statistics by Total Positive Income Quintile

All Filers

Total Positive Income Quintiles

Average Time (hours)

Average Out-of-Pocket Costs

Average Total Monetized Burden

0 to 20

7.8

$80

$146

20 to 40

10.9

$128

$242

40 to 60

11.6

$165

$327

60 to 80

13.1

$232

$480

80 to 100

22.7

$726

$1,497

Wage and Investment Filers

Total Positive Income Quintiles

Average Time (hours)

Average Out-of-Pocket Costs

Average Total Monetized Burden

0 to 20

6.9

$71

$129

20 to 40

9.3

$112

$212

40 to 60

9.0

$139

$277

60 to 80

9.1

$185

$384

80 to 100

10.8

$322

$737

Self Employed Filers

Total Positive Income Quintiles

Average Time (hours)

Average Out-of-Pocket Costs

Average Total Monetized Burden

0 to 20

11.9

$125

$225

20 to 40

18.5

$204

$379

40 to 60

21.0

$258

$507

60 to 80

22.0

$338

$697

80 to 100

33.1

$1,077

$2,155

Source IRS:RAAS:KDA:TBL (11-25-2024)

Table 3 – Fiscal Year 2025 Taxpayer Burden Statistics by Total Income |

||||

|

Average |

Median |

||

Time (hours) |

Out-of-Pocket Costs |

Time (hours) |

Out-of-Pocket Costs |

|

Under $25k |

10.9 |

$122 |

8.3 |

$81 |

$25k to $50k |

11.4 |

$164 |

8.2 |

$130 |

$50k to $75k |

11.1 |

$200 |

7.7 |

$165 |

$75k to $100k |

11.5 |

$254 |

8.4 |

$201 |

$100k to $125k |

12.3 |

$307 |

9.2 |

$248 |

$125k to $150k |

13.0 |

$360 |

9.9 |

$291 |

$150k to $175k |

13.2 |

$415 |

10.1 |

$336 |

$175k to $200k |

13.4 |

$467 |

10.3 |

$377 |

$200k to $225k |

14.2 |

$543 |

11.2 |

$437 |

$225k to $250k |

15.0 |

$614 |

11.9 |

$498 |

$250k to $275k |

17.5 |

$745 |

13.9 |

$610 |

$275k to $300k |

18.6 |

$836 |

14.7 |

$689 |

$300k to $325k |

19.3 |

$917 |

15.3 |

$757 |

$325k to $350k |

20.3 |

$994 |

16.1 |

$825 |

$350k to $375k |

21.7 |

$1,084 |

17.1 |

$901 |

$375k to $400k |

22.7 |

$1,158 |

18.0 |

$963 |

$400k to $425k |

23.9 |

$1,230 |

18.8 |

$1,028 |

$425k to $450k |

24.7 |

$1,315 |

19.7 |

$1,095 |

$450k to $475k |

25.9 |

$1,393 |

20.5 |

$1,152 |

$475k to $500k |

26.5 |

$1,459 |

21.2 |

$1,206 |

Source RAAS:KDA (11-25-2024)

We are asking for continued approval of these regulations that are associated with Form 1040. Please continue to assign OMB number 1545-0074 to these regulations.

-

1.23-5

1.333-1

1.1383-1

1.31.2

1.351-3

1.1385-1

1.37-2 and 3

1.383-1

1.1402(a)-2,5,11,15

1.41-4

1.442-1

161.1402(c)-2

1.41-4A

1.446-1

1.1402(e)-(2)-1

1.43-2

1.451-5 thru 7

1.1402(f)-1

1.44A-3

1.52-4

1.6001-1

1.6072-1

1.461-1

1.6060-1

1.61-15

1.466-1

1.454-1

1.63-1

1.551-4

1.6107-1

1.64(c)6

1.612-4

1.6109-1 and 2

1.71-1

1.642(c)-5 and 6

1.6011-1

1.72

1.702-1

1.6012-1

1.79-2 and 3

1.706-1

1.6013-1, 6, 7

1.83-2 thru 5

1.736-1

1.6017-1

1.105

1.743-1

1.6060-1

1.151-1

1.751-1

1.6072-1

1.152-4 and 4T

1.852-7 and 9

1.6107-1

1.162-24

1.861-4

1.6109-1

1.163-10T

1.931-1

1.6151-1

1.166-10

1.934-1

1.6695-1

1.17

1.935-1

1.6696-1

1.170A

1.937-1

1.9100-1

1.172

1.1012-1

5c.0

1.180-2

1.1041-1T

7

1.182-6

1.1081-11

16A.126-2

1.190-3

1.1101-4

18.1-7

1.213-1

1.1211-1

31.6011(a)-1 and 7

1.215-1

1.1212-1

301.6110-3 and 5

1.254-1

1.1231-2

301.6316-4 thru 6

1.265-1

1.1232-3

301.6361-1 and 3

1.274-5T and 6T

1.1248-7

301.6501

1.280A-3

1.1251-2

301.6501(d)

1.280F-3T

1.1254-1 and 3

301.6905-1

1.302-4

1.1304-1 thru 5

301.7216-2

1.307-2

1.1311(a)-1

14. ESTIMATED ANNUALIZED COST TO THE FEDERAL GOVERNMENT

The Federal government cost estimate for product development is based on a model that considers the following three cost factors for each information product: aggregate labor costs for development, including annualized startup expenses, operating and maintenance expenses, and distribution of the product that collects the information. These costs do not include any activities such as taxpayer assistance and enforcement.

The government computes cost using a multi-step process. First, the government creates a weighted factor for the level of effort to create each information collection product based on variables such as complexity, number of pages, type of product and frequency of revision. Second, the total costs associated with developing the product such as labor cost, and operating expenses associated with the downstream impact such as support functions, are added together to obtain the aggregated total cost. Then, the aggregated total cost and factor are multiplied together to obtain the aggregated cost per product. Lastly, the aggregated cost per product is added to the cost of shipping and printing each product to IRS offices, National Distribution Center, libraries, and other outlets. The result is the Government cost estimate per product.

The government cost estimate for this collection is summarized in the table below.

Product |

Aggregate Cost per Product (factor applied) |

|

Print & Distribution |

|

Government Cost Estimate per Product |

All Forms attached* |

$ 15,618,729 |

+ |

$ 533,545 |

= |

$ 16,152,274 |

Total |

|

|

|

|

$ 16,152,274 |

Table costs are based on 2023 actuals obtained from IRS Chief Financial Office and Media and Publications *New product costs will be included in the next collection update. |

|||||

See the attached Government Cost document in the supplementary documents section for more information. The government cost estimates for processing tax returns and performing related functions in the Submission Processing Campus(es) includes salaries and benefits only. Other costs such as real estate, programming, recruitment, equipment, and supplies are not included.

Estimated Filers |

Processing Cost - Paper Returns* |

|

Processing Cost - Electronic Returns* |

|

Government Cost Estimate |

168,800,000 |

$ 73,006,000 |

+ |

$ 36,882,800 |

= |

$ 109,888,800 |

Total |

|

|

|

|

$ 109,888,800 |

*Table costs estimates are based on FY2023 IRS Cost Estimate References. |

|||||

The total government cost estimate for this collection is $126,041,074.

15. REASONS FOR CHANGE IN BURDEN

The year-over-year change in burden is analyzed and reported by technical adjustments, legislative adjustments, and agency adjustments.

Changes Due to Technical Adjustment: The majority of the year-over-year change is due to technical adjustments. The table provided below breaks down the major changes by technical adjustment type.

An overestimate of the number of Fiscal Year 2024 filers results in a 1% decrease in average time and out-of-pocket costs per response. Updated tax return data result in a 3% decrease in average time burden and a 3% decrease in out-of-pocket cost per response. New survey data and the associated updated model result in a slight increase in total monetized burden per response (1%). The new survey data also allocates a slightly larger share of total monetized burden to out-of-pocket costs from time. This shift in the allocation of total monetized burden results in a 2% decrease in average time burden per response and a 7% increase in out-of-pocket costs per response.

The Fiscal Year 2025 population adjustments transition the underlying data file from Fiscal Year 2024 to Fiscal Year 2025 which includes aging the data for macroeconomic factors and adjusting weights to account for changes in the year-over-year population differences. A forecasted increase in filers is expected to lead an increase in aggregate time and out-of-pocket costs. Forecasted changes in macroeconomic factors are also expected to lead to increases in average monetized time, out-of-pocket costs, and monetized burden.

-

Change in Filers

Change in Time (Hrs)

Change in Monetized Time

Change in Dollars

Change in Total Monetized Burden*

Updated Fiscal Year 2024 Baseline

(4,100,000)

(31,000,000)

($519,000,000)

($436,000,000)

($954,000,000)

Updated Tax Return Data

-

(68,000,000)

($232,000,000)

($1,253,000,000)

($1,485,000,000)

Updated Survey Data and Model

-

(42,000,000)

($2,487,000,000)

$3,080,000,000

$592,000,000

Fiscal Year 2025 Population Estimates

1,100,000

21,000,000

$1,882,000,000

$1,959,000,000

$3,841,000,000

Total

(3,000,000)

(120,000,000)

($1,356,000,000)

$3,350,000,000

$1,994,000,000

Source:

RAAS:KDA (11-25-2024)

*Change in Total Monetized Time =

Change in Monetized Time + Change in Dollars

Changes Due to Legislative Adjustment: Year-over-year changes to burden for provisions from the Inflation Reduction Act are provided under legislative adjustments this year. The table below provides updated burden estimates for clean energy incentives and clean vehicle credits for Fiscal Year 2024 and Fiscal Year 2025 as well as estimates for changes to Form 1099K reporting. The Fiscal Year 2025 year-over-year legislative adjustments for clean energy incentives and the clean vehicle credits is the difference between their respective Fiscal Year 2024 and Fiscal Year 2025 aggregate estimates. Participation for clean energy incentives in Fiscal Year 2025 is expected to be lower than Fiscal Year 2024 so the year-over-year change for clean energy incentives is negative. Participation for clean vehicle credits in Fiscal Year 2025 is expected to be higher than Fiscal Year 2024 so the year-over-year change for clean vehicle incentives is positive.

In Fiscal Year 2025, Individual filers claiming the clean energy incentives are expected to in aggregate incur an additional 1,000,000 burden hours and $26,000,000 in out-of-pocket costs. At the filer level, claimants are expected to on average incur under an hour of additional time burden and less than $20 of additional out-of-pocket costs. Individual filers claiming clean vehicle credits are expected to in aggregate incur an addition 250,000 to 500,000 burden hours and $6,000,000 in out-of-pocket costs. At the filer level, claimants are expected to on average incur under an hour of additional time burden and less than $20 of additional out-of-pocket costs. There is uncertainty about participation rates in Fiscal Year 2025. A more precise estimate will be possible when tax year 2024 returns are available in calendar year 2025.

Individuals receiving Form 1099K due to changes to the reporting threshold are expected to experience a range of different burdens. There will be a de minimis impact on many filers while others are expected to incur the equivalent of adding a new sole proprietor revenue stream. To account for the uncertainty, burden is estimated to be between 0 and 60 minutes in time per response and 0 and $30 in out-of-pocket costs per response. The mid-point between estimates for a de minimis impact and a new revenue stream are used to estimate burden. This approach estimates aggregate burden to increase by 1,000,000 hours and $33,000,000 in out-pocket-costs.

-

Clean Energy Incentives

Clean Vehicle Credits

Changes to Form 1099K Reporting

Total

Fiscal Year 2024

Time

2,000,000

-

NA

2,000,000

Money

$51,000,000

$5,000,000

NA

$56,000,000

Burden

$99,000,000

$10,000,000

NA

$109,000,000

Fiscal Year 2025

Time

1,000,000

-

1,000,000

2,000,000

Money

$26,000,000

$6,000,000

$33,000,000

$65,000,000

Burden

$50,000,000

$12,000,000

$63,000,000

$125,000,000

Year-Over-Year Difference

Time

(1,000,000)

-

1,000,000

-