Justification Statement for 1513-0014 Non-substantive Change

1513-0014 - Justification for Non-Substantive Change 2025-05-19.docx

Power of Attorney

Justification Statement for 1513-0014 Non-substantive Change

OMB: 1513-0014

May 19, 2025

Non-substantive Change Justification Statement for

OMB No. 1513–0014, Power of Attorney

The Internal Revenue Code (IRC) at 26 U.S.C. 6061 provides that any return, statement, or other document submitted under the IRC’s provisions must be signed in accordance with the forms or regulations prescribed by the Secretary of the Treasury (the Secretary). Also, the Federal Alcohol Administration Act (FAA Act) at 27 U.S.C. 204(c) authorizes the Secretary to prescribe the manner and form of applications for basic permits issued under the Act. Under those authorities, the Alcohol and Tobacco Tax and Trade Bureau (TTB) regulations require individuals signing documents and forms filed with TTB on behalf of an applicant or principal to have specific authority to do so. As such, applicants and principals use form TTB F 5000.8, Power of Attorney, to delegate such authority to a designated individual and to report that delegation to TTB. Many documents and forms submitted to TTB are legally binding and have penalties for omissions or falsification, and TTB uses the collected information to determine who legally represents an applicant or permittee doing business with the agency.

TTB is making two non-substantive changes to TTB F 5000.8, Power of Attorney form to better identify the appointed attorney and their redelegation authority, if any.

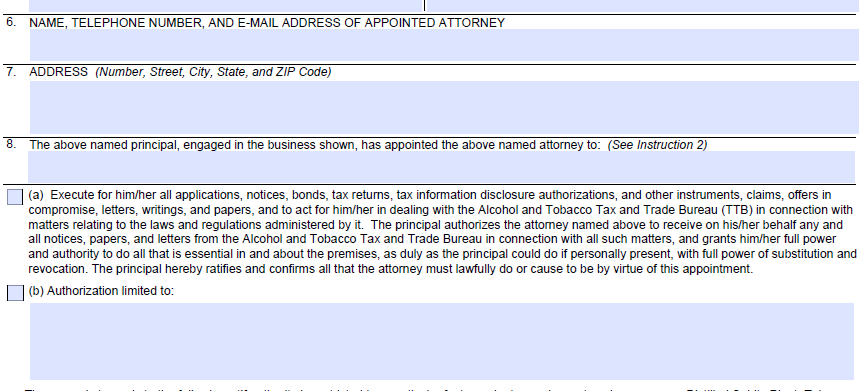

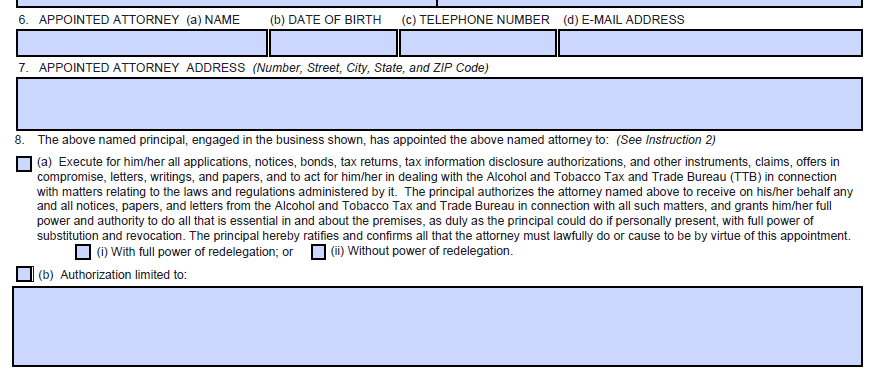

Specifically, in Item 6 on the previous addition of the form (02/2016 version), there was one data field for the appointed attorney’s name, telephone number, and email address. In Item 6 on the new version of the form (03/2025 version), TTB is revising Item 6 to include separate data fields for the appointed attorney’s name, telephone number, and email address, and TTB is adding a data field for the appointed attorney’s date of birth. The TTB is making this change to separate the collected information for clarity and to better identify the appointed attorney, particularly in cases of persons with the same or similar names.

In Item 8a, the power of attorney designation, TTB is adding two check boxes on the new version of the form to allow the principal to clearly state if the appointed attorney does or does not have power to redelegate their designated authorities. See the relevant portion of the form below for the described changes.

TTB believes that these minor changes to its Power of Attorney form do not affect its per-respondent or total annual burden. The addition of the new date of birth data field in Item 6 and the addition of the two check boxes in Item 8 merely requires information that is already known by and immediately available to the appointed attorney and the principal making the power of attorney appointment. These changes do not introduce new concepts and entail no burden other than that necessary to identify the attorney and clarify the scope of the delegation. As such, TTB believes that these changes are non-substantive in nature.

Previous version (02/2016) of TTB F 5000.8:

New version (03/2025 of TTB F 5000.8 showing the addition of a Date of Birth data field in Item 6 and the two check boxes added to Item 8a:

[END]

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 2025-05-23 |

© 2026 OMB.report | Privacy Policy