Impact Aid Program – Application for Section 7002 Assistance

Impact Aid Program – Application for Section 7002 Assistance

1810-0036 FY 2027_Sec_7002_Appl_Instructions

Impact Aid Program – Application for Section 7002 Assistance

OMB: 1810-0036

FORM APPROVED OMB NO. 1810-0036

EXPIRATION DATE: xx/xx/xxxx

U.S. DEPARTMENT OF EDUCATION IMPACT AID PROGRAM (IAP)

INSTRUCTIONS FOR COMPLETING THE FISCAL YEAR (FY) 2027 APPLICATION FOR IMPACT AID, SECTION 7002

Impact Aid Information Portal: https://impactaid.ed.gov

Email: [email protected]

DEADLINE: 11:59 p.m. EST, Monday, February 2, 2026

Paperwork Burden Statement: According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. The valid OMB control number for this information collection is 1810-0036. The time required to complete this information collection is estimated to average 1.5 hour per response, including the time for reviewing instructions, searching existing data sources, gathering, and maintaining the data needed, and completing and reviewing the collection of information. The obligation to respond to this collection is required to obtain or retain a benefit (20 USC 7702). If you have any comments or concerns regarding the status of your individual submission of this form, write directly to: Impact Aid Program, U.S. Department of Education, 400 Maryland Ave., S.W., Washington, D.C. 20202-6244, or email [email protected].

The Impact Aid Section 7002 Program 2

Start a New 7002 Application- Home Page 5

Revenue from Eligible Federal Property 7

Opt-Out Option for Acreage, Taxable Value, and Tax Rate 9

Total Acreage and Taxable Value in the LEA 9

Required Verification Documentation for Acreage and Taxable Value 10

The Impact Aid Section 7002 Program

Section 7002 Payments for Federal Property under section 7002 of the Elementary and Secondary Education Act (ESEA), as amended, assist local educational agencies (LEAs) that have lost a portion of their local tax base because of federal ownership of property. To be eligible, an LEA must demonstrate that the federal government has acquired, since 1938, real property with an assessed valuation of at least 10 percent of all real property in the district at the time of acquisition. For detailed requirements on eligibility, definition of terms, and other requirements, see ESEA section 7002, and the program regulations, 34 CFR §§222.20 -.24, as amended September 20, 2016 (available https://www.ecfr.gov/current/title-34/subtitle-B/chapter-II/part-222 ).

Eligibility Threshold

Any LEA in which the Federal Government has acquired significant amounts of local real property since 1938 may apply for assistance.

Who May Apply

Any LEA that provides free, public education and contains a significant proportion of federal property may apply for assistance.

When to Apply

Deadline

The deadline for submitting this electronic application is 11:59 p.m., Eastern Standard Time, February 2, 2026.

How to Apply

An LEA must submit this application using the Impact Aid Grant System

(IAGS) which is available at

https://impactaid.ed.gov.

An LEA

must have

one registered core

user and a Login.Gov

account to begin the application process. To register or

change a core user, please visit the Request

Access form, read the directions at the top of the page and

submit a fully completed form. Your state

assigned Impact Aid analyst will review the request and make any

necessary changes to the LEAs account. All users must have a

login.gov account to access IAGS. If the core user does not have a

Login.Gov account, they may create one at

https://www.login.gov/create-an-account/.

Once the core user is established, they may sign into IAGS by

clicking on the Sign in with Login.Gov button.

![]() Complete instructions

on how

to use

Login.gov to

connect to

the IAGS are available on our website here.

We encourage

you to

log on

to the site and familiarize yourself with it at your earliest

convenience, and to complete the application

process well

before

February 2, 2026.

Videos covering

how to

start an

application and

navigate the IAGS are available here.

Complete instructions

on how

to use

Login.gov to

connect to

the IAGS are available on our website here.

We encourage

you to

log on

to the site and familiarize yourself with it at your earliest

convenience, and to complete the application

process well

before

February 2, 2026.

Videos covering

how to

start an

application and

navigate the IAGS are available here.

Ask for Help

Contact IAP by clicking the Ask for Help button at the top of the application page if you have questions about these instructions.

Late Applications

Applications that are incomplete on February 2, 2026 (e.g., missing documentation or not fully signed and submitted through IAGS) but are completed before April 3, 2026, will receive payments for that fiscal year with a 10% late penalty. See the Mandatory Forms section for a list of required documents for a complete application.

Amendments

LEAs may amend their application to modify and update their applications until June 30, 2026.

Mandatory Forms

To be considered complete, your application must contain all mandatory forms and data, including:

Federal properties

Revenue received from federal activities (If applicable) or Opt-Out Form

Total LEA Acreage and Taxable Value (if not opting out) *

Acreage and Taxable Value Verification Documentation

*LEAs that are new or that report revenue must complete the entire application and cannot elect the opt-out option.

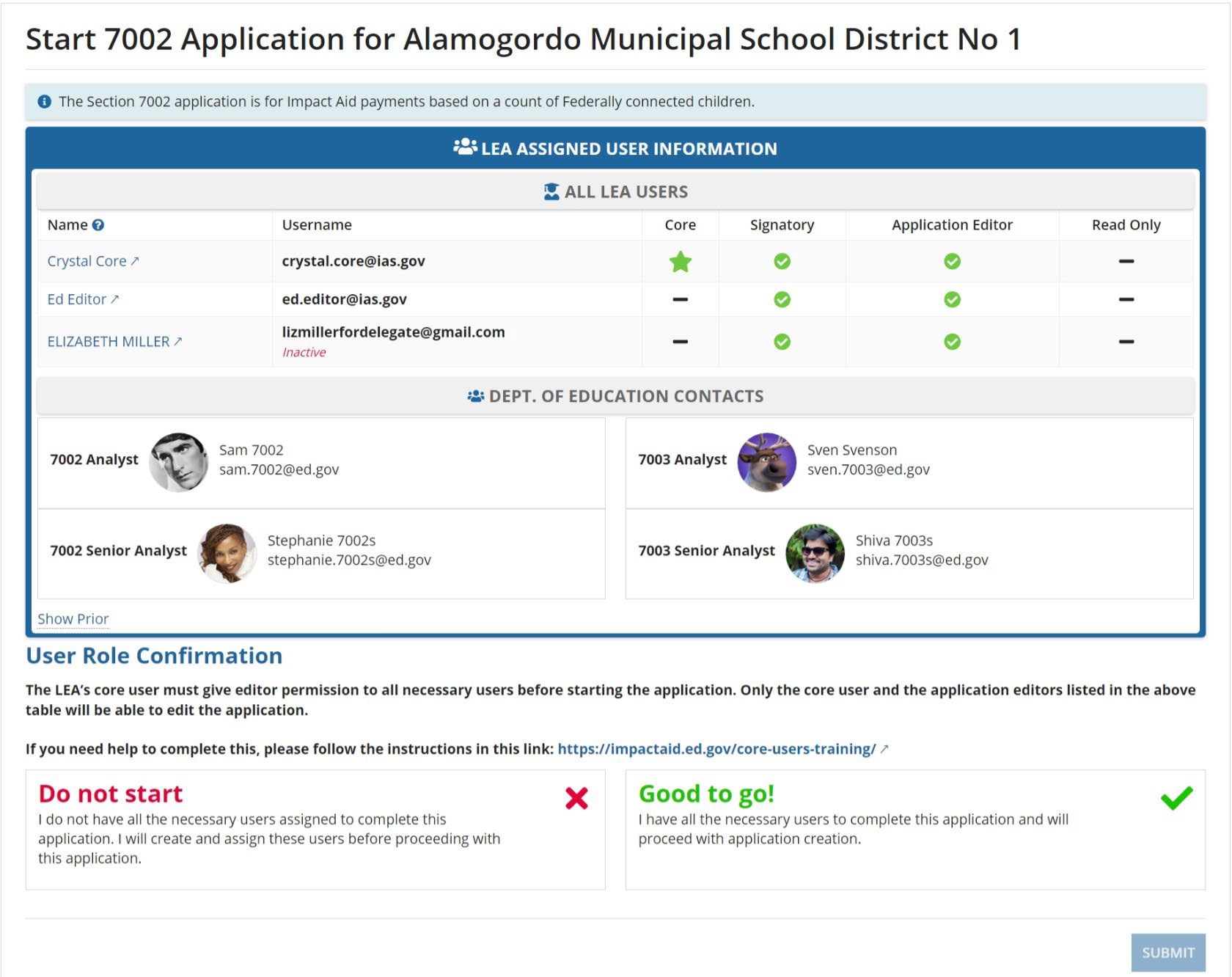

Confirm Users are Set Up

The LEA’s core user must give editor permission to all necessary users before starting the application. Only the core user and the application editors can edit the application. If the core user starts the application before all users are established, the additional users will not be able to see the application.

If all the users are activated and their permissions are correct:

Check the box with “Good to Go”

Click Submit” to move to the application.

If the core user needs to update users, click the box marked “Do not start”.

Click Users

Update permissions for users

Click Start 7002 Application to start the process again.

After you click submit, a confirmation box will pop up on the screen. Click “Confirm”.

Start a New 7002 Application- Home Page

The dashboard on your Home page helps you find all your information in one location. You will see that you can select the fiscal year you want to view (green arrow), and all the application deadlines associated with that application. The FY 2027 application closes February 2, 2026.

To start an application, you will click on the name of the LEA for which you want to start the application (red arrow). When you save and exit the application, you will need to click on the related task in the TASKS section (blue arrow) to resume the application.

LEA Information

For returning LEAs, most of the first page will be pre-filled using data from your prior year application. Make any necessary corrections on this page before submitting the application. New applicants must, at a minimum, complete every field with an asterisk.

Applicant Name and Address—Your LEA’s name and address will be displayed as they are listed in the Impact Aid Grant System. The name should be your LEA’s legal name, and the address should be the mailing address of your local educational agency (LEA) offices.

Contact Person — The contact person’s information you provide should be for the person on your LEA’s staff who is most knowledgeable about this application and the data used to create it. If the contact person has changed, please update the contact person to ensure proper and timely communication with the LEA. To update the contact person, you can do this from your LEA’s record.

If

all the

information is

correct, click Go

to Page

2 ![]()

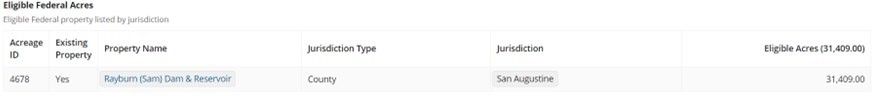

Federal Properties

You will need to list all Section 7002-eligible federal properties in the LEA. Since not all federal acres in your LEA may be eligible, it is essential that you only include previously approved federal properties and their corresponding acres on the application. For returning LEAs, the information from the prior year application should automatically display. Contact your program analyst if you have any questions about the approved federal properties and acres in your LEA. New LEA applicants, must:

In column 1, enter the name of the Section 7002-eligible federal property.

In column 2, enter the name of the corresponding taxing jurisdiction type.

In column 3, enter the name of the corresponding taxing jurisdiction.

In column 4, enter the number of approved federal acres associated with the property in column 1.

If you need to add new properties that are not currently displayed, click on “Add Property”

If you change acres to an existing property or add a new property, you must submit official documentation supporting the changes. Formal documentation may be a deed or other formal documentation showing the property has been acquired by the Federal Government (increase in acres) or returned to the tax roll (decrease in acres). Submit this documentation to the IAP by uploading it in PDF format to the documents section of the application by clicking New Document.

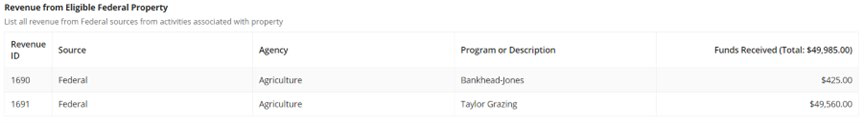

Revenue from Eligible Federal Property

If the federal property claimed on Page 2 of the application generated revenue from federal activities, you need to list all revenue from federal during the second preceding FY (e.g., FY 2024-2025 data for the FY 2027 application). If revenue is from federal programs, provide the name of each federal program and the name of the federal agency responsible for administering that program.

Example

Do not report:

Payments in Lieu of Taxes (PILT) administered by the Department of Interior (DOI) under the authority of Chapter 69 of Title 31 of the U.S. Code. For more information about these DOI PILT payments, see www.fas.org/sgp/crs/misc/RL31392.pdf.

Payments from Department of Defense to support education

Any payments from the U.S. Department of Education (ED), such as your Impact Aid payments.

Federal payments that must be reported include payments from the U.S. Forest Service, Bureau of Land Management, Fish and Wildlife Service, and Federal Energy Regulatory Commission, including payments under the following laws:

Bankhead-Jones Farm Tenant Act

Mineral Leasing Act for Acquired Lands

Material Disposal Act

Refuge Revenue Sharing Act

Federal Power Act

Secure Rural School and Community Self-Determination Act

Taylor Grazing Act

Any other federal revenue derived from activities associated with Section 7002- eligible federal property

If only a portion of the federal property generating the revenue is eligible under Section 7002, prorate the revenue to reflect the share attributable to the section 7002-eligible property. For example:

The LEA has 10,000 acres of U.S. Forest Service property, but only 2,000 of these acres are eligible under section 7002

The LEA received $20,000 in timber revenues for the 10,000 acres

The LEA should report one- fifth (20 %) of the total revenues, or $4,000 on the application.

2,000 eligible federal U.S. Forest Service acres ÷ 10,000 total U.S. Forest Service acres = 20%

$20,000 total revenues * 20% percent of eligible federal acres = $4,000

If you receive no other revenue for the Section 7002-eligible acreage, leave the section blank and mark the form as complete.

Opt-Out Option for Acreage, Taxable Value, and Tax Rate

An LEA that has received a payment under Section 7002 for any year since FY 2010, and that has no other federal revenue(s) to report, may choose to “Opt-Out” of consideration for any available “remaining funds”, which is the distribution of the balance of the appropriation minus the total foundation payments. If the LEA does not want to be considered for remaining funds under Section 7002(h)(3), the LEA must answer “No” to the question, “Other than Impact Aid funds, does your LEA receive any revenue generated from the 7002-eligible federal acres?” Upon answering, a checkbox will appear with the statement, “I only wish to receive a foundation payment and don’t need to fill out the rest of the application.” Check this box to continue with the application.

Total Acreage and Taxable Value in the LEA

An LEA must obtain official documentation such as a tax assessor certification or information from an appropriate state website that clearly shows the taxable value of the eligible federal property. If the information was obtained directly from a local official (e.g., local tax assessor), you must submit a certification by that official that includes the person’s name, title, email address, and telephone number. The LEA must upload this documentation with the application. The failure to upload the verification documentation in IAGS, will result in an incomplete application and your LEA will not be eligible for payment.

Enter the type and name of the taxing jurisdiction. This information must match the jurisdictions listed under the Federal Properties section. If the LEA is in more than one taxing jurisdiction (e.g., two counties) or contains more than one taxing jurisdiction (e.g., two townships), enter the information for each jurisdiction on a separate line.

Enter the total number of acres located in the LEA or taxing jurisdiction. Include all types of property (taxable and non-taxable, including the federal acres) in the total acreage amount. This number should include all land and water acreage in the LEA. If you submit data from the U.S. Census Bureau it must be data from the most recent data collection, AND you must include a certification from your local assessor that your LEA’s boundaries have not changed and, therefore, that these numbers are still current. Without this certification, we will not accept the Census Bureau data. It is preferred that you obtain this data from your local assessor or other local/state source.

Enter the total taxable (assessed) value of real property located within the boundaries of the LEA for the purpose of levying property tax for school purposes for current expenditures. Current expenditures do not include construction or debt service and should not include personal property taxes. This data is for the prior FY (e.g., for the FY 2027 application, enter the taxable value for the 2025-2026 year, or the specific value as of January 2026). If the LEA is in more than one taxing jurisdiction (e.g., two counties) or contains more than one taxing jurisdiction (e.g., two townships), enter the information for each jurisdiction separately.

Required Verification Documentation for Acreage and Taxable Value

Upload a PDF version of the official report or record showing the taxable value of real property. Failure to upload the verification documentation in IAGS, will result in an incomplete application and your LEA will not be eligible for payment. Because the IAP must analyze the sufficiency of the supporting documentation, you should apply early in case there are problems that may need correction. Also, to assist LEAs in supplying the required documentation, we have provided templates at the end of this document. Providing complete and accurate information ensures your application is reviewed and approved in a timely manner.

If your application is incomplete on the application deadline, you may submit until the late application deadline. Late complete applications will be assessed a 10% penalty for all payments related to the application.

Tax Levy Information

In the Tax Levy section, enter the local real property tax levy, in mills or dollars, that was used to generate local revenues for current expenditures for the LEA for the prior fiscal year (e.g., FY 2025-2026 data for the FY 2027 application). Enter a single tax rate for school operations expenditures for all types of real property in the jurisdiction using the dropdown box to indicate measurement (i.e., mills, dollars, etc.). When local revenues for current expenditures for the LEA are generated by more than one taxing jurisdiction, enter the tax rate information for each additional jurisdiction on a separate line.

California LEAs will be contacted separately for the data necessary to impute their tax rates. If this data is currently available, it can be submitted with the application in the documents section.

Submission

On the 7002 Application Review page, you will see a summary of all the data you have entered on the application. Please confirm that all required documents are uploaded. When you are satisfied that the application is complete, click the “Ready for Signature” button. If the page does not change, there are likely errors on that page. Please scroll up and look at the items highlighted in red or with a red text message. Once all errors are cleared, click the Ready for Signature button again. You should receive a pop-up message that the application will be sent to users in your LEA who are able to sign the application. Users who can sign, (Signatories and Core users), can log in to IAGS, navigate to the task list on the left side of the dashboard. Click on the task “7002 Application Signature.”

When the task opens, the signatory can review the application information and make any edits necessary. The user must select yes or no to the question “Do you intend to amend the application after you submit?”. The answer will not stop you from amending if you need to later.

Once the application is complete, the user can review the assurances at the bottom of the page and check the box at the bottom indicating that the user has read and understands the assurances.

If the LEA has opted out of receiving a “remaining funds” payment, the user who is signing will need to consent by checking the appropriate box before submitting the application. Then, the user can click the Submit button, and the application will be complete.

If the page does not change, there are likely errors on that page. Please scroll up and look at the items highlighted in red or with a red text message. Once all errors are cleared, click the Submit button again. You should receive a pop-up message that submission is successful. Check the status of your submission on the home page; where you can see submission date and whether the application was timely filed. Users for the LEA will also receive a confirmation email.

Sample Certification Verification Document

1. Name of Local Educational Agency (LEA) and application year: Example: Trigg County, FY 2027 |

|

2. Name of taxing jurisdiction: Example: Trigg County |

|

3. Total number of acres in the LEA: Includes taxable, non-taxable, and water acreage. |

|

4. Total assessed value of real property in the LEA for the 2025-2026 school year, or the specific value as of January 2026: Do not include personal property taxes. |

|

5. Did LEA boundary changes occur since last application? |

|

6. If you answered yes to Question 5, briefly explain the change. This could include any changes in the geographical boundaries of the LEA, such as acre increases, decreases or consolidations. |

|

Certifying Official Name: |

|

Certifying Official Title: |

|

Certifying Official Phone: |

|

Certifying Official Email: |

|

Certifying Official Signature |

|

Signature Date: |

|

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Microsoft Word - FY_2025_Sec_7002_Appl_Instructions |

| Author | Walls, Kristen |

| File Modified | 0000-00-00 |

| File Created | 2025-09-18 |

© 2026 OMB.report | Privacy Policy