CS-08-108 -IRS Stakeholder Liaison Headquarters; CS-08-109 - AUTOMATED COLLECTION SYSTEM (ACS) SURVEY; CS-08-110 - Automated Collection System (ACS) Support ; CS-08-111- COMPLIANCE SERVICE COLLE

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-08-108

CS-08-108 -IRS Stakeholder Liaison Headquarters; CS-08-109 - AUTOMATED COLLECTION SYSTEM (ACS) SURVEY; CS-08-110 - Automated Collection System (ACS) Support ; CS-08-111- COMPLIANCE SERVICE COLLE

OMB: 1545-1432

OMB Submission 2009 Nationwide Tax Forums

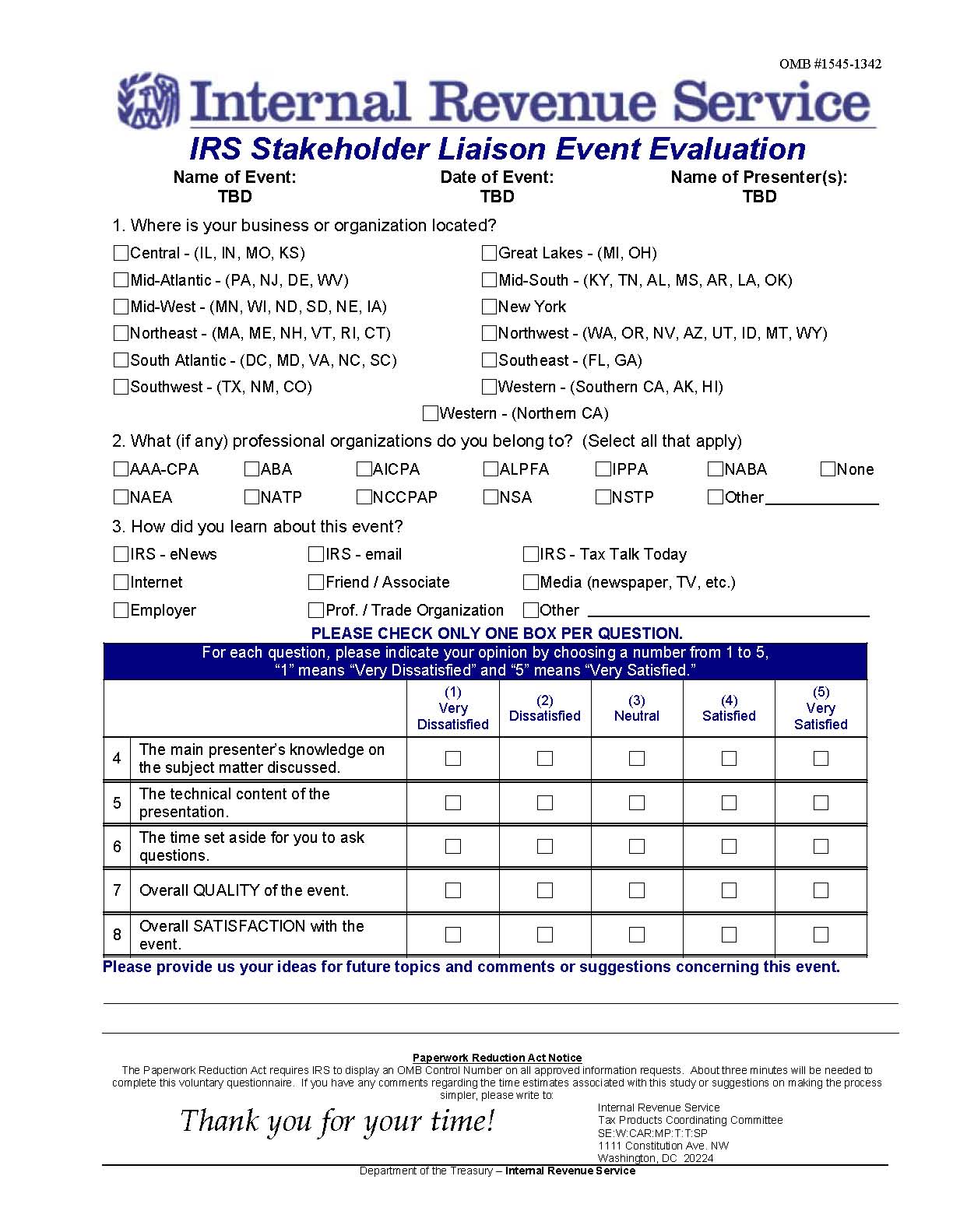

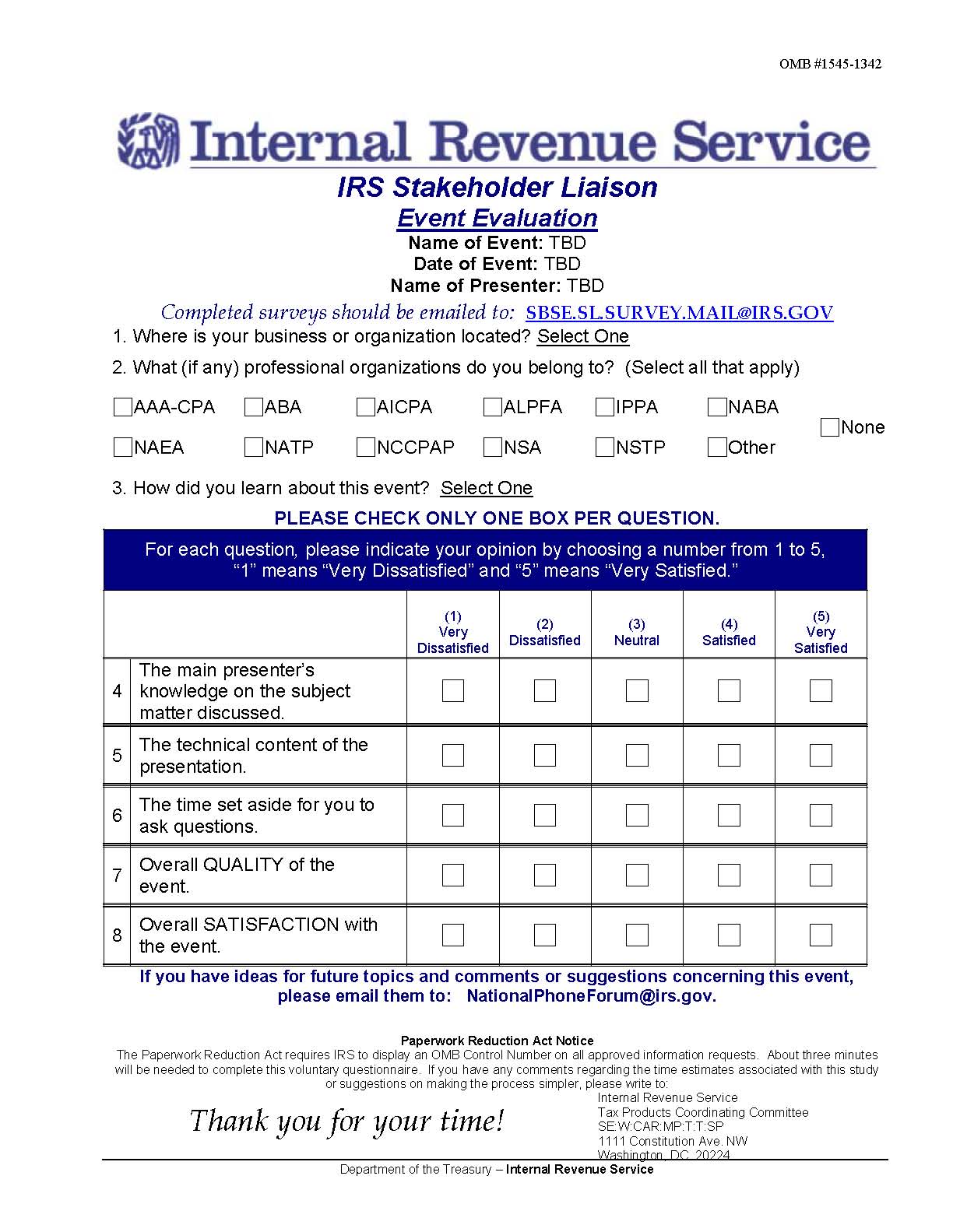

Attachment I: Printable Phone Forum Event Evaluation:

Attachment II: NPF IRS.gov Advertisement Example:

Nationwide Practitioner Liaison Meetings, Phone Forums and Seminars |

|

|

|

|

|

|

|

Accessibility | FirstGov.gov | Freedom of Information Act | Important Links | IRS Privacy Policy | U.S. Treasury

Attachment III: Talk Tax Today Advertisement Example:

IRS Stakeholder Liaison presents:

Forms 1099: Information Reporting

Date: November 28, 2007

L

Be

our guest:

Cost:

FREE

Tax professionals

Industry association members

Representatives from small business organizations

Small business owners, accountants or bookkeepers

Government agencies

Learn

about Information Reporting:

Overview of Information Reporting

Form 1099-MISC and issues

Filing requirements & methods

How to make corrections

Earn

Continuing Professional Education credit:

Enrolled agents receive one CPE credit for a minimum 50-minute participation

Other tax professionals may receive credit if they qualify per their organization

Register individually and use PIN to receive credit

Call in on a separate line to verify attendance

Attachment IV: NPF Enrollment Confirmation Notice Example:

Thank you for registering to attend the Nationwide Phone Forum on Foreign Bank and Financial Account Reporting.

Conference Title: Foreign Bank Account Reporting (FBAR)

Moderator Name: Mary Marcotte, Stakeholder Liaison

This conference is scheduled to begin: Wednesday, June 20, 2007, 10:00 a.m. Eastern

(9:00 a.m. Central, 8:00 a.m. Mountain, 7:00 a.m. Pacific)

Time zones shown are Daylight Savings Time.

Conference dial-in number: Toll free: 1-866-216-6835

Conference access code: 358400

Participant PIN:

Participant information:

Please dial in 3-5 minutes prior to conference start time.

Enter your access code, followed by the pound (#) sign.

Enter your Personal Identification Number (PIN), followed by the pound (#) sign.

Your line will be placed on hold with music until conference start.

Our guest speakers will be Sheila Andrews, Stakeholder Liaison; Gary Watkins, Program Analyst, Bank Secrecy Act; and Elizabeth Witzgall, Senior Bank Secrecy Act Analyst.

Your Syllabus is attached below.

Requirements:

Adobe Acrobat Reader must be installed on your computer to view/print the Acrobat files. You can download Adobe Reader from the following link: http://www.adobe.com/products/acrobat/readstep2.html

Your e-mail client/program should be configured to view e-mails in HTML format instead of text so that your CPE Certificate of Completion will properly format.

Your e-mail spam filter should be set to accept e-mail from [email protected].

Note: Enrolled Agents will be entitled to 1 CPE credit provided they participate in the phone forum for at least 50 minutes; other tax professionals may qualify depending on the requirements of their organizations. You must register individually and use your PIN to receive CPE credit. Each person must call in on a separate line so attendance can be verified.

P hone

Forum Syllabus

hone

Forum Syllabus

Foreign Bank Account Reporting (FBAR)

Forum Date: Wednesday, June 20, 2007

Forum Time: 10:00 a.m. EDT

Description and Learning Objectives:

Learn about FBAR and how it works:

Combats the use of foreign financial accounts to circumvent U.S. Tax Law

Requires U.S. taxpayers with certain foreign accounts to file TD F 90-22.1

Provides leads to investigators to identify and trace funds used for illicit purposes

Presentation Method and Instructor(s):

An IRS phone forum is an interactive learning experience with live instruction via conference call. This forum’s instructors are:

Gary Watkins, Program Analyst, Bank Secrecy Act – Gary has been in his current position since October 2005. He began his IRS career with the IRS in 1986 as a Revenue Agent assigned to the Compliance Enforcement Team. Previous to his current position, he was a Senior Tax Specialist in Taxpayer Education and Communication (TEC). Gary has a BS in Business Administration from The Citadel, Military College of South Carolina and an MBA from the University of Tennessee.

Elizabeth Witzgall, Senior Bank Secrecy Act Analyst – Elizabeth has developed and instructed numerous classes on the Bank Secrecy Act from the mid 1990’s to present, including several classes on FBAR. She was a presenter on FBAR during two IRS Video Teleconferences (2003 and 2004) and also assisted in the development of an FBAR DVD in 2004. She has a J.D. from Columbia University School of Law and is a member of the District of Columbia Bar Association.

Sheila Andrews, Stakeholder Liaison – Sheila has been with the IRS for over 20 years. Her prior positions with the IRS include: Analyst in the Taxpayer Advocate Service; Manager in the Customer Service Division, including several years as the Accounts Manager; Taxpayer Educational Specialist in the Volunteer and Education Program; and a Taxpayer Service Representative. She is a graduate of Purdue University and has completed graduate studies at Auburn University and College of Saint Frances.

Presentation Materials (to be sent in a separate e-mail):

Publication 4261, Do You Have a Foreign Bank Account?

Power Point presentation (in PDF format) entitled Report of Foreign Bank and Financial Accounts

Please note that all presentation slides are numbered. The instructors will be referring to slide numbers so that you can easily follow along.

Resources/Handouts:

The Tax Gap is the difference between the amount of tax that taxpayers should pay and the amount that is paid voluntarily and on time. The tax gap can also be thought of as the sum of non-compliance with the tax law. To find more information on visit our Web site page at: http://www.irs.gov/newsroom/article/0,,id=158619,00.html.

Issue Management Resolution System (IMRS) - The IRS Stakeholder Liaison (SL) function has established the Issue Management Resolution System (IMRS), a streamlined and structured process that facilitates stakeholder issue identification, resolution and feedback. (http://www.irs.gov/businesses/small/article/0,,id=158507,00.html)

Practitioner Local Liaison Meetings, Phone Forums and Seminars (http://www.irs.gov/businesses/small/article/0,,id=127801,00.html)

Join e-News For Tax Professionals (http://www.irs.gov/newsroom/content/0,,id=164580,00.html)

Point of Contact: If you have questions, please contact Sheila Andrews at 317-685-7549, or e-mail [email protected].

Evaluation: Please send any comments or observations to [email protected].

Course records retained by:

Internal Revenue Service, Stakeholder Liaison

Shane Ferguson

1720 S. Southeastern Avenue, #100

Sioux Falls, South Dakota 57103

|

|

|

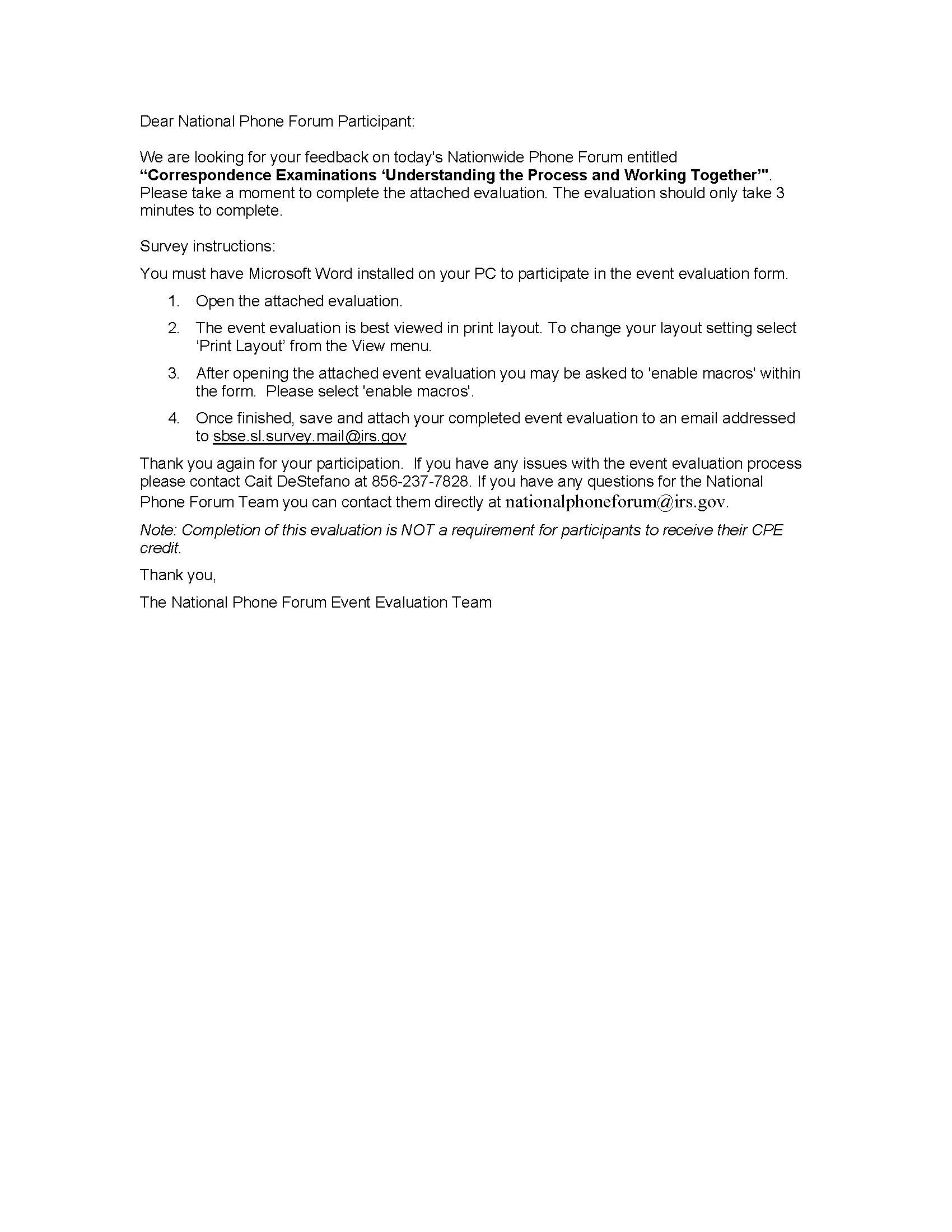

Attachment V: Event Evaluation Cover letter Example:

Attachment VI: Phone Forum Event Evaluation:

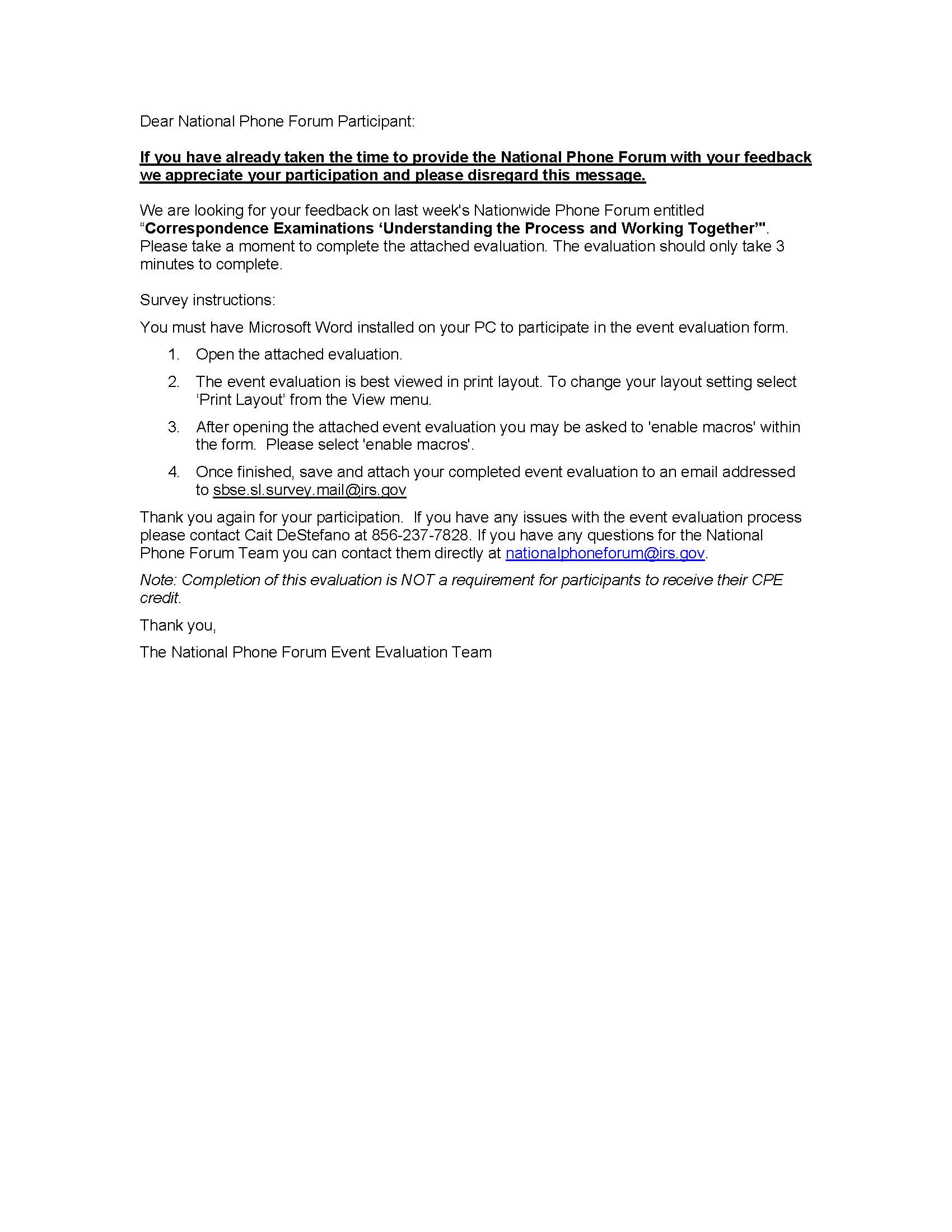

Attachment VII: Event Evaluation Reminder Letter Example:

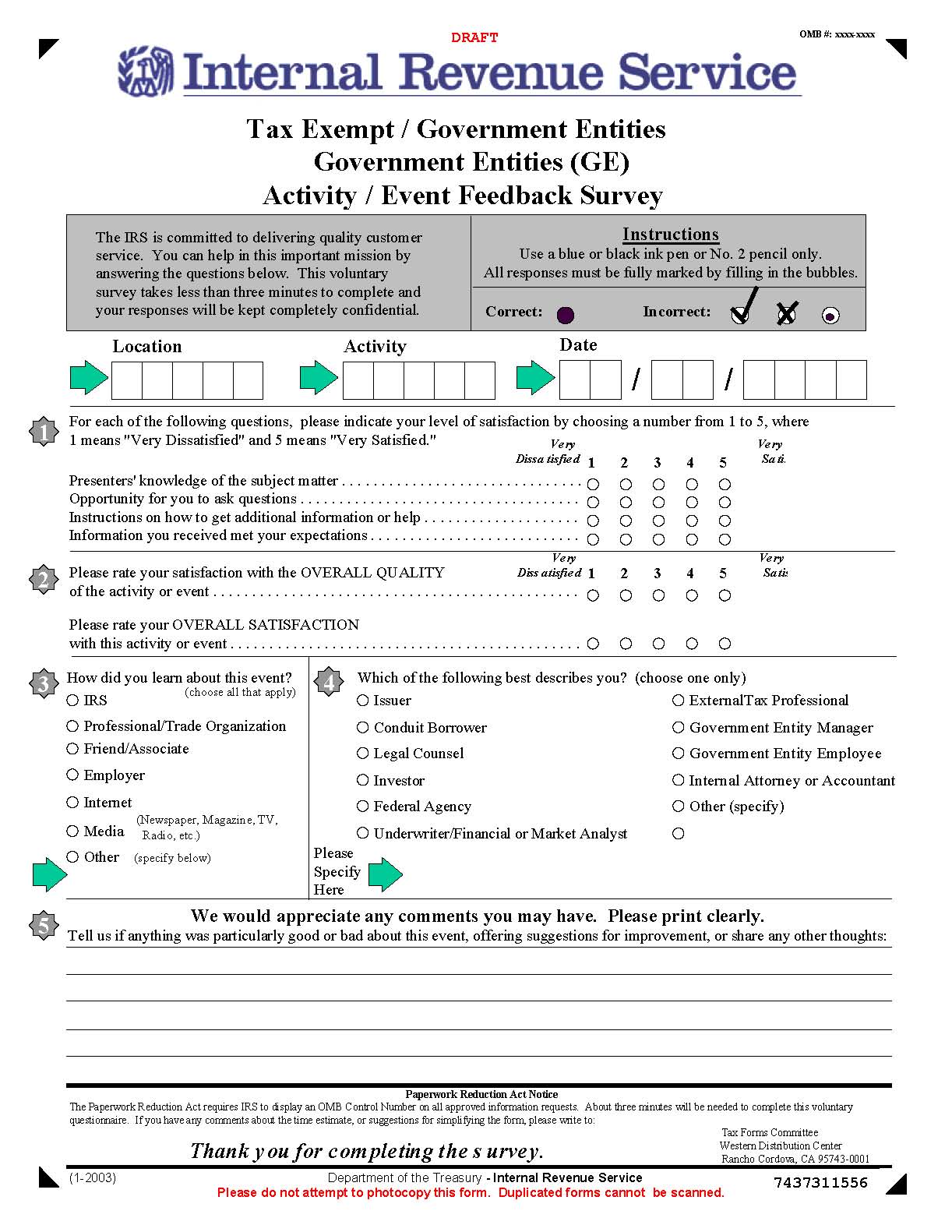

Attachment VIII: TEGE Survey Example:

| File Type | application/msword |

| File Title | Office of Management and Budget |

| Author | 9f2hb |

| Last Modified By | qhrfb |

| File Modified | 2008-10-06 |

| File Created | 2008-10-06 |

© 2026 OMB.report | Privacy Policy