CS-08-116 - Cash Economy Web-based Survey; CS-08-117 - Survey of Statistical Information Services Customers

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-08-116

CS-08-116 - Cash Economy Web-based Survey; CS-08-117 - Survey of Statistical Information Services Customers

OMB: 1545-1432

VII. Appendices

Appendix 1

Questionnaire for Previous Focus Group Participants: Proposals for Improving Small Business/Self-Employed Tax Compliance

Please consider the following list of proposals the IRS CLD has received from individuals and business people for improving small business/self-employed federal tax compliance.

Score each proposal on a scale of 1 through 5, where 1 is worst (you believe it would be ineffective) and 5 is best (you believe it would be very effective).

Institute backup withholding on payments to taxpayers who have demonstrated “substantial noncompliance.” _____

Register and identify unenrolled (uncertified) return preparers, and strengthen standards. _____

Making collection alternatives, such as partial payment installment agreements and improved access to the Offer in Compromise (OIC) program more readily available to taxpayers who can pay some but not all of their liabilities. _____

Offering IRS workshops for sole proprietorship taxpayers upon receipt of their Employer Identification Numbers (EINs). _____

Requiring information reporting for service payments to corporate independent contractors. _____

Increasing IRS use of information from states and other federal agencies for compliance verification, (i.e. sales tax, ABC board, motor fuel, licensing, etc). _____

Requiring employers to verify each new employee’s Social Security Number (SSN) with the Social Security Agency (SSA). _____

Requiring written notification to independent contractors of their tax obligations and rights. _____

Increasing penalties for failure to file information returns. _____

Simplifying worker classification rules. _____

Expanding tip reporting programs to service providers beyond the food and beverage industry – to hairdressers, cabbies, bellhops, valets, concierges, etc. _____

Requiring reporting of ratios of cash to credit card receipts – would supplement credit card reporting requirement. _____

Increasing priority of IRS examination regarding compliance with Form 1099-Misc reporting requirements. _____

Making repeated failure to file a tax return a felony. _____

Revising Schedule C to include a line item for “Gross Receipts from Cash” ____

Requiring tax practitioners to tell their clients that cash is taxable income, even if they do not receive a Form 1099 because their income was less than $600. _____.

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this questionnaire is 1545-1432. Also, if you have any comments regarding the time estimates associated with this questionnaire, or suggestions on making this process simpler, please write to the:

Internal Revenue Service

Tax Products Coordinating Committee

SE:W:CAR:MP:T:T:SP

1111 Constitution Ave. NW, Washington, DC 20224

Appendix 2

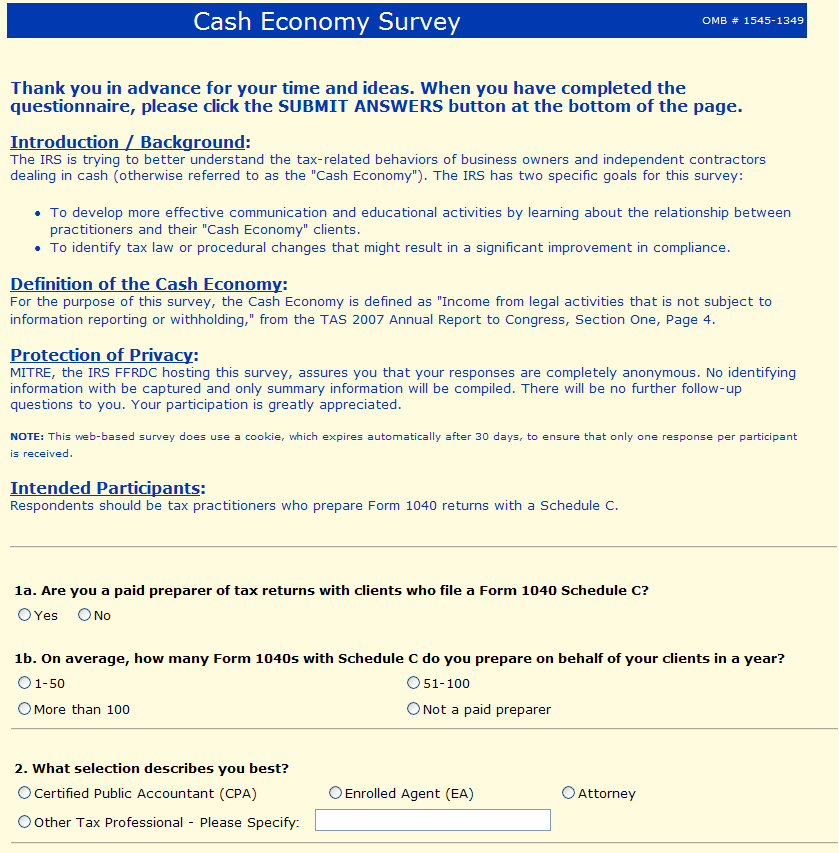

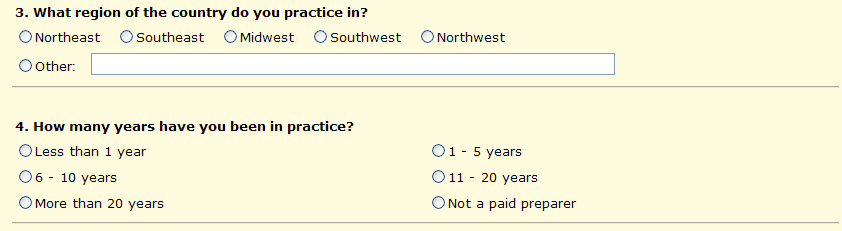

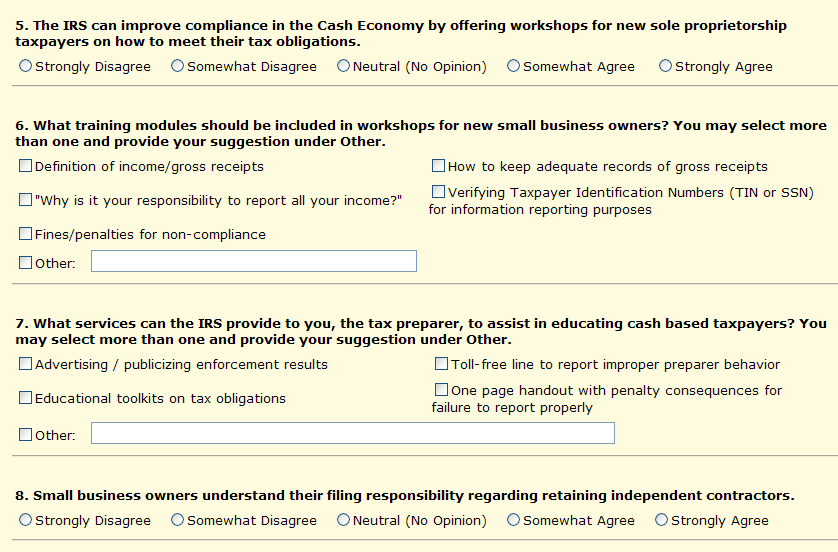

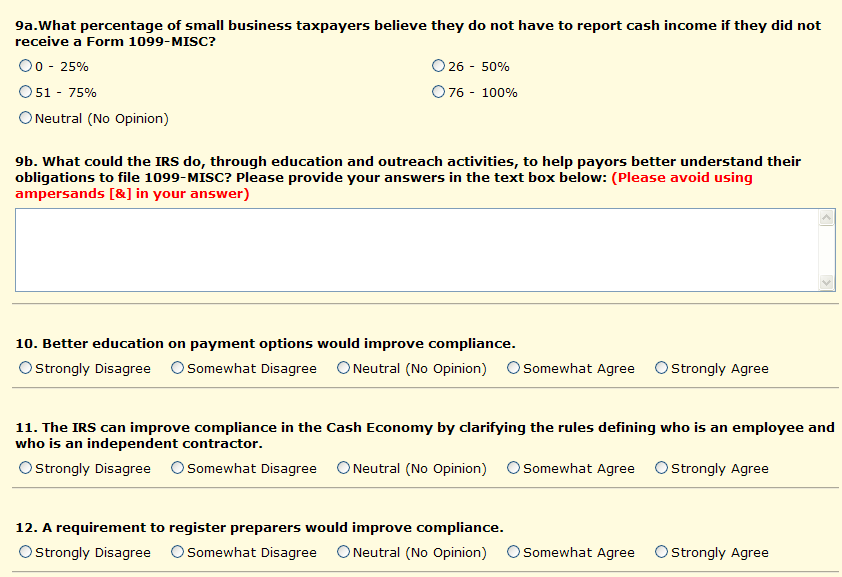

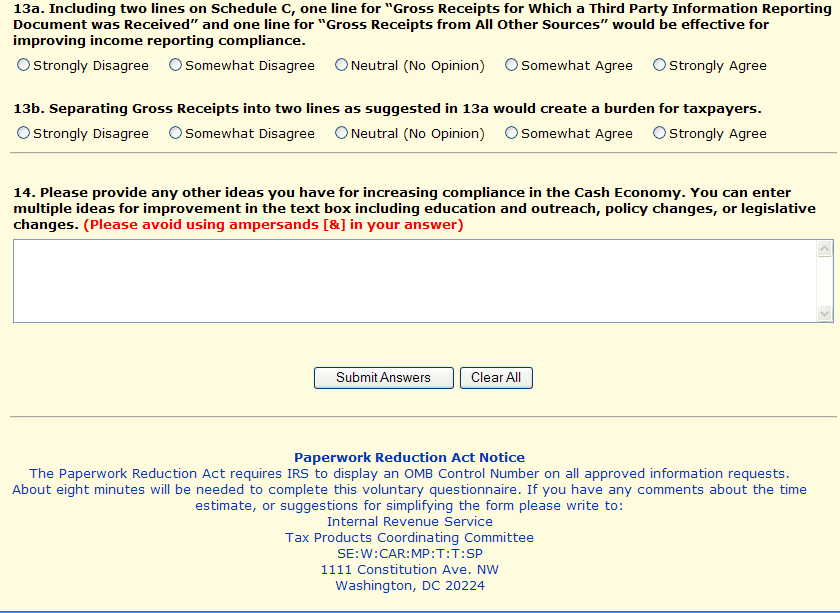

Questions for Cash Economy Web-based Survey: Survey Paid Tax Preparers for Their Input on Rating Education Strategies and Procedural and Legislative Initiatives for Improving Small Business/Self-Employed Tax Compliance in the Cash Economy

Appendix 3

Small Business/Self-Employed Example Web-based Survey Web Site Invitation with Link

Web-Based

Cash Economy Survey

Click

to Participate!

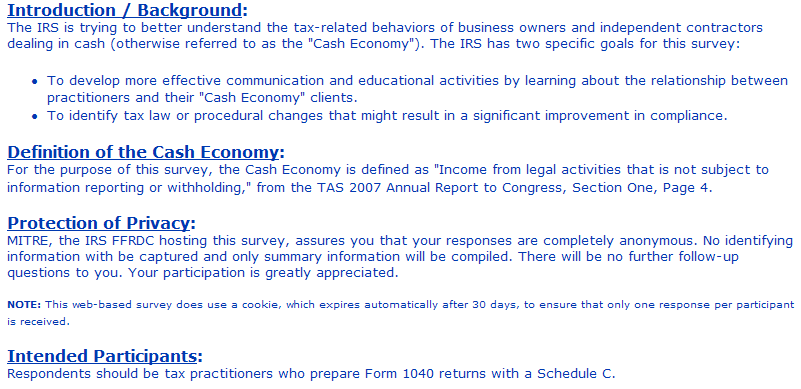

Cash Economy Web Survey – Understanding Tax-Related Behaviors in the Cash Economy

IRS

Small Business/Self-Employed Research

| File Type | application/msword |

| File Title | Office of Management and Budget Clearance Package |

| Subject | Cash Economy Web Survey |

| Author | MITRE |

| Last Modified By | qhrfb |

| File Modified | 2008-11-07 |

| File Created | 2008-11-07 |

© 2026 OMB.report | Privacy Policy