Cs-09-195; Cd-09-196; Cs-09-197; Cs-09-198; Cs-09-199; Cs-09-200; Cs-09-201; Cs-09-202; Cs-09-203; Cs-09-204; Cs-09-205; Cs-09-206; Cs09-207: Cs09-208; Cs-09209; Cs09-210; Cs09-212; Cs09-213; Cs09-214

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-10-213 Survey

CS-09-195; CD-09-196; CS-09-197; CS-09-198; CS-09-199; CS-09-200; CS-09-201; CS-09-202; CS-09-203; CS-09-204; CS-09-205; CS-09-206; CS09-207: CS09-208; CS-09209; CS09-210; CS09-212; CS09-213; CS09-214

OMB: 1545-1432

Appendix 1

Screener

We are conducting a web-based survey for the IRS to determine the effectiveness of its notices. The survey is voluntary and your identity will remain anonymous. The survey will only take about 20 minutes to complete. It involves reading and answering questions about two notices; there are XX pages in all.

What is your gender?

( ) Male

( ) Female

What is your age?

( ) 18 and under

( ) 18–29

( ) 30–39

( ) 40–49

( ) 50–59

( ) 60+

What is your marital status?

( ) Married

( ) Single

( ) Divorced/Separated

( ) Widowed

Which of the following categories includes your annual household income?

( ) Under $25,000

( ) $25,000–$34,999

( ) $35,000–$49,999

( ) $50,000–$75,000

( ) $100,000–$149,000

( ) $150,000 or more

( ) Prefer not to say

Which of the following best describes your race?

( ) American Indian or Alaskan Native

( ) Asian or Pacific Islander

( ) Black

( ) White

Ethnicity:

( ) Hispanic origin

( ) Not of Hispanic origin

In which state is your primary residence?

(Please select)

We have one preliminary question to further determine your eligibility:

Have you paid federal taxes in the past 5 years?

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1432. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

Appendix 2

Questions for Notice Simplification Web-based survey- Participant Questionnaire: CP08

Introduction to CP08

Read through the document; you must review all the pages. You can use the thumbnails and arrows at the top to go from page to page. Use the scroll bar on the right to scroll through each page.

If you find a section confusing or hard to understand, click on it with your mouse to indicate that it’s confusing.

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The participant reads (and clicks) through all pages and is taken to a series of comprehension questions. The participant is able to go back and review the document at any time. If the participant doesn’t click on anything, before advancing to the comprehension questions, a reminder will pop up:

“Do you want to mark anything as confusing or hard to understand? If you do, you can go back to any page and mark the document. Otherwise, you can continue to the questions”

If the participant has marked items, an open-ended question will appear:

You marked [X] section(s) as confusing or hard to understand. Describe what was most confusing to you.

Comprehension questions (this header is just for review purposes)

Now that you’ve read through the document, please answer the following series of questions. If necessary, you can browse through the document at any point.

Why have you received this notice?

(x) I may qualify for a tax credit

( ) I made a mistake in adding up my taxes

( ) I need to file an amended return for 2006

( ) I don’t know

What three criteria must the child meet to qualify:

(x) The child was born on or after January 1, 1990

( ) The child was born in the US

( ) The child is your biological son or daughter

(x) The child is related to you

(x) The child is a citizen

( ) The child has no source of income

What action(s) does the notice instruct you to take? Mark all that apply:

(x) Fill out the worksheet

(x) Mail the worksheet and form if you qualify

( ) Redo your taxes (file an amended return) to claim the credit

( ) Submit paperwork to prove the amount of income you reported was correct

What do you need to do next year in order to qualify for the credit?

(x) Attach a completed Form 8812 to your return

( ) Wait for the IRS to mail me this notice, worksheet and form

( ) The notice doesn’t say

If you qualify, will you receive a refund check?

( ) Yes, it should arrive in 6–8 weeks

( ) No

(x) Maybe, it depends if I still owe taxes

These questions will be timed. After answering these comprehension questions, the participant is taken to questions about the perception of the document.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

Inspiration

The notice makes me feel that the IRS wants me to be well informed

Rating and behavioral questions

To what extent does the presentation and tone of the notice make you more likely to read the entire document?

If you received this notice what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/ weeks until I had the time to focus on it

( ) Contact an accountant for help

( ) Call the IRS

( ) Go to the IRS website (www.irs.gov <http://www.irs.gov> ) for help

( ) Find an IRS publication for an explanation

( ) Find an IRS tax clinic

( ) Mail in the form and worksheet

( ) Wait to see if I receive another notice

( ) Other _________________________

Show wireframe document and allow respondent to click on only 1 document

Click on the document that provided a clearer explanation for what you needed to do.

What is it about this notice that made it clearer?

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 3

Questions for Notice Simplification Web-based survey- Participant Questionnaire: CP59

Introduction to CP59

Read through the document; you must review all the pages. You can use the thumbnails and arrows at the top to go from page to page. Use the scroll bar on the right to scroll through each page.

If you find a section confusing or hard to understand, click on it with your mouse to indicate that it’s confusing.

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The participant reads (and clicks) through all pages and is taken to a series of comprehension questions. The participant is able to go back and review the document at any time. If the participant doesn’t click on anything, before advancing to the comprehension questions, a reminder will pop up:

“Do you want to mark anything as confusing or hard to understand? If you do, you can go back to any page and mark the document. Otherwise, you can continue to the questions”

If the participant has marked items, an open-ended question will appear:

You marked [X] section(s) as confusing or hard to understand. Describe what was most confusing to you.

Comprehension questions (this header is just for review purposes)

Now that you’ve read through the document, please answer the following series of questions. If necessary, you can browse through the document at any point.

Why have you received this notice?

(x) I haven't filed my taxes for 2005.

( ) I am late on my installment plan payment to the IRS

( ) I made a mistake in calculating my expenses

( ) I don't know

If you need to file a return, what does the notice say you need to do immediately?

( ) It doesn't suggest any actions

( ) Submit an amended return

(x) Submit all required tax forms and payments

( ) Complete and mail the response form

What does the notice suggest you do if you already filed a return?

( ) It doesn't suggest any actions

( ) Write and send a certified letter

(x) Complete and mail the response form

( ) Call the IRS

What publication can provide me information on cancelled debt?

Publication 4681

These questions will be timed. After answering these comprehension questions, the participant is taken to questions about the perception of the document.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand my situation

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides factual information for me to base my decision on

Inspiration

The notice makes me feel that the IRS wants me to be well informed

Rating and behavioral questions

To what extent does the presentation and tone of the notice make you more likely to read the entire document?

If you received this notice what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/ weeks until I had the time to focus on it

( ) Contact an accountant for help

( ) Call the IRS

( ) Go to the IRS website (www.irs.gov <http://www.irs.gov> ) for help

( ) Find an IRS publication for an explanation

( ) Find an IRS tax clinic

( ) Mail in the form and worksheet

( ) Wait to see if I receive another notice

( ) Pay the amount in full

( ) Other _________________________

Show wireframe document and allow respondent to click on only 1 document

Click on the document that provided a clearer explanation for what you needed to do.

What is it about this notice that made it clearer?

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 4

Questions for Notice Simplification Web-based survey- Participant Questionnaire: CP14

Introduction to CP14

Read through the document; you must review all the pages. You can use the thumbnails and arrows at the top to go from page to page. Use the scroll bar on the right to scroll through each page.

If you find a section confusing or hard to understand, click on it with your mouse to indicate that it’s confusing.

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The participant reads (and clicks) through all pages and is taken to a series of comprehension questions. The participant is able to go back and review the document at any time. If the participant doesn’t click on anything, before advancing to the comprehension questions, a reminder will pop up:

“Do you want to mark anything as confusing or hard to understand? If you do, you can go back to any page and mark the document. Otherwise, you can continue to the questions”

If the participant has marked items, an open-ended question will appear:

You marked [X] section(s) as confusing or hard to understand. Describe what was most confusing to you.

Comprehension questions (this header is just for review purposes)

Now that you’ve read through the document, please answer the following series of questions. If necessary, you can browse through the document at any point

Why have you received this notice?

(x) I owe additional taxes and must also pay penalties and interest

( ) I filed a 1040EZ instead of a 1040.

( ) I need to file an amended return for 2006

( ) I don’t know

What is the total amount you need to pay the IRS?

$537.14

What amount of interest is shown on the notice?

$123.61

What action does the notice instruct me to take?

(x) Pay immediately

( ) Redo my taxes (file an amended return).

( ) Contact an accountant to help me

( ) Submit paperwork to prove the amount of income you reported was correct

If you can't pay the full amount, which of these actions does the notice instruct you to take?

( ) It doesn’t suggest any actions

(x) Call to make payment arrangements

( ) Appeal in writing by sending a certified letter

( ) Pay the interest and penalties

If you don't respond, what will happen?

( ) The notice doesn’t say

(x) You will owe more money since there will be additional interest and, possibly, penalties

( ) You will be audited

( ) The IRS will immediately seize your property

Mark all the reasons you're being charged penalties:

( ) The notice doesn't say

(x) I filed my taxes late

(x) I paid my taxes late

(x) I didn't estimate my taxes properly

These questions will be timed. After answering these comprehension questions, the participant is taken to questions about the perception of the document.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand my situation

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides factual information for me to base my decision on

Inspiration

The notice makes me feel that the IRS wants me to be well informed

Rating and behavioral questions

To what extent does the presentation and tone of the notice make you more likely to read the entire document?

If you received this notice what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/ weeks until I had the time to focus on it

( ) Contact an accountant for help

( ) Call the IRS

( ) Go to the IRS website (www.irs.gov <http://www.irs.gov> ) for help

( ) Find an IRS publication for an explanation

( ) Find an IRS tax clinic

( ) Mail in the form and worksheet

( ) Wait to see if I receive another notice

( ) Pay the amount in full

( ) Other _________________________

Show wireframe document and allow respondent to click on only 1 document

Click on the document that provided a clearer explanation for what you needed to do.

What is it about this notice that made it clearer?

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 5

Questions for Notice Simplification Web-based survey- Participant Questionnaire: CP501

Introduction to CP501

Read through the document; you must review all the pages. You can use the thumbnails and arrows at the top to go from page to page. Use the scroll bar on the right to scroll through each page.

If you find a section confusing or hard to understand, click on it with your mouse to indicate that it’s confusing.

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The participant reads (and clicks) through all pages and is taken to a series of comprehension questions. The participant is able to go back and review the document at any time. If the participant doesn’t click on anything, before advancing to the comprehension questions, a reminder will pop up:

“Do you want to mark anything as confusing or hard to understand? If you do, you can go back to any page and mark the document. Otherwise, you can continue to the questions”

If the participant has marked items, an open-ended question will appear:

You marked [X] section(s) as confusing or hard to understand. Describe what was most confusing to you.

Comprehension questions (this header is just for review purposes)

Now that you’ve read through the document, please answer the following series of questions. If necessary, you can browse through the document at any point

Why have you received this notice?

(x) I owe additional taxes and must also pay penalties and interest"

( ) I filed a 1040EZ instead of a 1040.

( ) I need to file an amended return for 2006

( ) I don’t know

What is the total amount you need to pay the IRS?

$9,533.53

What amount of penalty charges is/are shown on the notice?

$34.98

What action does the notice instruct me to take?

(x) Pay the amount right away

( ) Redo my taxes (file an amended return).

( ) Contact an accountant to help me

( ) Submit paperwork to prove the amount of income you reported was correct

If you can't pay the amount due, what action does the notice instruct you to take?

( ) It doesn't suggest any actions

( ) Write and send a certified letter

( ) Pay the interest and penalties

(x) Make payment arrangements

If you can't pay the full amount, which of these actions does the notice instruct you to take?

( ) The notice doesn’t say

(x) You will owe more money since there will be additional interest and, possibly, penalties

( ) You will be audited

( ) The IRS will immediately seize your property

If you don't respond, what will happen?

( ) The notice doesn’t say

(x) You will owe more money since there will be additional interest and, possibly, penalties

( ) You will be audited

( ) The IRS will immediately seize your property

These questions will be timed. After answering these comprehension questions, the participant is taken to questions about the perception of the document.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand my situation

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides factual information for me to base my decision on

Inspiration

The notice makes me feel that the IRS wants me to be well informed

Rating and behavioral questions

To what extent does the presentation and tone of the notice make you more likely to read the entire document?

If you received this notice what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/ weeks until I had the time to focus on it

( ) Contact an accountant for help

( ) Call the IRS

( ) Go to the IRS website (www.irs.gov <http://www.irs.gov> ) for help

( ) Find an IRS publication for an explanation

( ) Find an IRS tax clinic

( ) Mail in the form and worksheet

( ) Wait to see if I receive another notice

( ) Pay the amount in full

( ) Other _________________________

Show wireframe document and allow respondent to click on only 1 document

Click on the document that provided a clearer explanation for what you needed to do.

What is it about this notice that made it clearer?

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 6

Questions for Notice Simplification Web-based survey- Participant Questionnaire: CP11V1

Introduction to CP11V1

Read through the document; you must review all the pages. You can use the thumbnails and arrows at the top to go from page to page. Use the scroll bar on the right to scroll through each page.

If you find a section confusing or hard to understand, click on it with your mouse to indicate that it’s confusing.

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The participant reads (and clicks) through all pages and is taken to a series of comprehension questions. The participant is able to go back and review the document at any time. If the participant doesn’t click on anything, before advancing to the comprehension questions, a reminder will pop up:

“Do you want to mark anything as confusing or hard to understand? If you do, you can go back to any page and mark the document. Otherwise, you can continue to the questions”

If the participant has marked items, an open-ended question will appear:

You marked [X] section(s) as confusing or hard to understand. Describe what was most confusing to you.

Comprehension questions (this header is just for review purposes)

Now that you’ve read through the document, please answer the following series of questions. If necessary, you can browse through the document at any point

Why have you received this notice?

(x) I owe additional taxes and must also pay penalties and interest

( ) I filed a 1040EZ instead of a 1040.

( ) I need to file an amended return for 2006

( ) I don’t know

What is the total amount you need to pay the IRS?

$3,196.16

What amount of interest is shown on the notice?

$137.81

If you agree with the changes, what action does the notice instruct you to take?

(x) Make a payment

( ) Redo my taxes (file an amended return).

( ) Contact an accountant to help me

( ) Submit paperwork to prove the amount of income you reported was correct

If you don't agree with the amount due, what action does the notice instruct you to take?

( ) It doesn't suggest any actions

(x) Contact the IRS to review my account

( ) Request a Collection Due Process hearing

( ) File an amended return

If you can't pay the full amount, which of these actions does the notice instruct you to take?

( ) The notice doesn’t say

(x) You will owe more money since there will be additional interest and, possibly, penalties

( ) You will be audited

( ) The IRS will immediately seize your property

If you don't respond, what will happen?

( ) The notice doesn’t say

(x) You will owe more money since there will be additional interest and, possibly, penalties

( ) You will be audited

( ) The IRS will immediately seize your property

These questions will be timed. After answering these comprehension questions, the participant is taken to questions about the perception of the document.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand my situation

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides factual information for me to base my decision on

Inspiration

The notice makes me feel that the IRS wants me to be well informed

Rating and behavioral questions

To what extent does the presentation and tone of the notice make you more likely to read the entire document?

If you received this notice what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/ weeks until I had the time to focus on it

( ) Contact an accountant for help

( ) Call the IRS

( ) Go to the IRS website (www.irs.gov <http://www.irs.gov> ) for help

( ) Find an IRS publication for an explanation

( ) Find an IRS tax clinic

( ) Mail in the form and worksheet

( ) Wait to see if I receive another notice

( ) Pay the amount in full

( ) Other _________________________

Show wireframe document and allow respondent to click on only 1 document

Click on the document that provided a clearer explanation for what you needed to do.

What is it about this notice that made it clearer?

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 7

Questions for Notice Simplification Web-based survey- Participant Questionnaire: Initial Contact Letter from Field Exam

Introduction to Initial Contact Letter from Field Exam

Read through the document; you must review all the pages. You can use the thumbnails and arrows at the top to go from page to page. Use the scroll bar on the right to scroll through each page.

If you find a section confusing or hard to understand, click on it with your mouse to indicate that it’s confusing.

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The participant reads (and clicks) through all pages and is taken to a series of comprehension questions. The participant is able to go back and review the document at any time. If the participant doesn’t click on anything, before advancing to the comprehension questions, a reminder will pop up:

“Do you want to mark anything as confusing or hard to understand? If you do, you can go back to any page and mark the document. Otherwise, you can continue to the questions”

If the participant has marked items, an open-ended question will appear:

You marked [X] section(s) as confusing or hard to understand. Describe what was most confusing to you.

Comprehension questions (this header is just for review purposes)

Now that you’ve read through the document, please answer the following series of questions. If necessary, you can browse through the document at any point

Why have you received this notice?

( ) I owe additional taxes and must also pay penalties and interest

( ) I underreported my income in 2005

(x) My tax return is being reviewed and I need to contact the IRS for an appointment

( ) I don't know

Which item won't be discussed (mark all that apply)

( ) Items on my return

( ) The examination process

(x) Payment arrangements

( ) Documentation I'll need to have on hand

What date do I need to contact the IRS by?

What action(s) does the notice instruct you to take?

( ) It doesn't suggest any action

(x) Call the IRS

( ) Re-do my taxes

( ) Submit an amended return

These questions will be timed. After answering these comprehension questions, the participant is taken to questions about the perception of the document.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand my situation

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides factual information for me to base my decision on

Inspiration

The notice makes me feel that the IRS wants me to be well informed

Rating and behavioral questions

To what extent does the presentation and tone of the notice make you more likely to read the entire document?

If you received this notice what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/ weeks until I had the time to focus on it

( ) Contact an accountant for help

( ) Call the IRS

( ) Go to the IRS website (www.irs.gov <http://www.irs.gov> ) for help

( ) Find an IRS publication for an explanation

( ) Find an IRS tax clinic

( ) Mail in the form and worksheet

( ) Wait to see if I receive another notice

( ) Other _________________________

Show wireframe document and allow respondent to click on only 1 document

Click on the document that provided a clearer explanation for what you needed to do.

What is it about this notice that made it clearer?

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 8

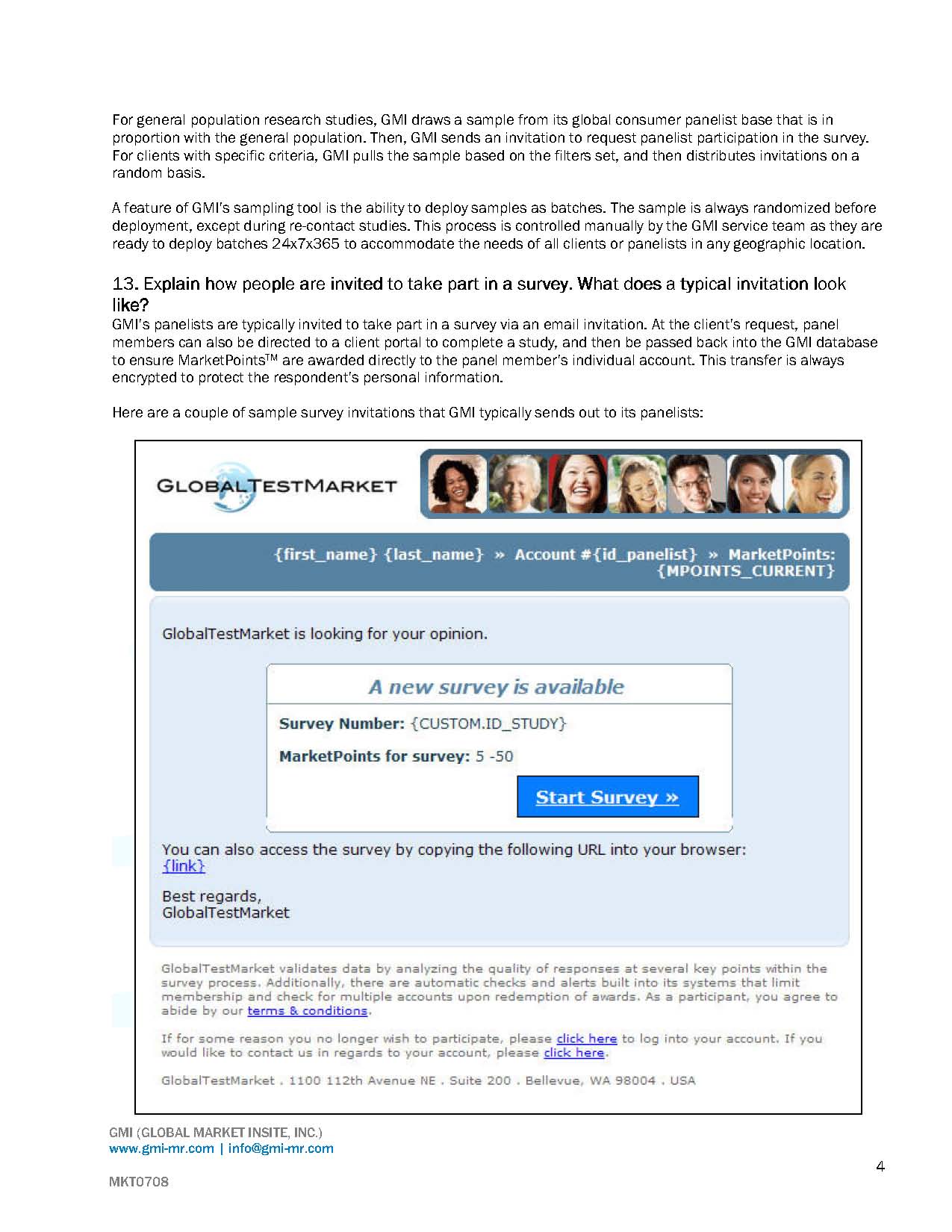

Sample Survey Invitations

| File Type | application/msword |

| File Title | Appendix 1 |

| Author | XHFNB |

| Last Modified By | XHFNB |

| File Modified | 2010-01-29 |

| File Created | 2010-01-29 |

© 2026 OMB.report | Privacy Policy