Customer Surveys; CS-10-220, CS-10-221, CS-10-222, CS-10-223, CS-10-224, CS-10-225, CS-10-226, and CS-10-227

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-10-224

Customer Surveys; CS-10-220, CS-10-221, CS-10-222, CS-10-223, CS-10-224, CS-10-225, CS-10-226, and CS-10-227

OMB: 1545-1432

OMB #1545-1432

VII. Appendices

Appendix 1 – Prior OMB Package Focus Group Discussion Questions (for information only)

FOCUS GROUP DISCUSSION QUESTIONS

Small Business Participants from California, Texas, Miami and New York

Trusted Sources of Information

If a friend or relative who just started a business asked you about tax obligations, where would you tell them to go for help? Why did you identify those resources?

How did you learn about your tax obligations? What specific information and education have you received that has helped you understand your tax obligations? How can the IRS assist you to better understand your tax obligations?

If you were to be contacted by the IRS about tax compliance, who would you go to first for advice? Why?

Do you have community-based organizations that offer you advice on important matters (tax and non-tax related)? How do you get that information from the organization? What are some examples of groups you trust when receiving government, financial or tax related information? Would you like to receive that type of information directly from the IRS?

Although many businesses use a tax professional for assistance, it is important for small businesses themselves to remain aware of legislative changes that impact them. For example, are you aware that in the next few years, credit card issuers will provide the IRS with information relative to the volume of business generated through credit card transactions? Where did you or where would you be likely to hear about a change such as this? How would you like to receive this type of information and from what types of sources?

IRS Awareness and Perception

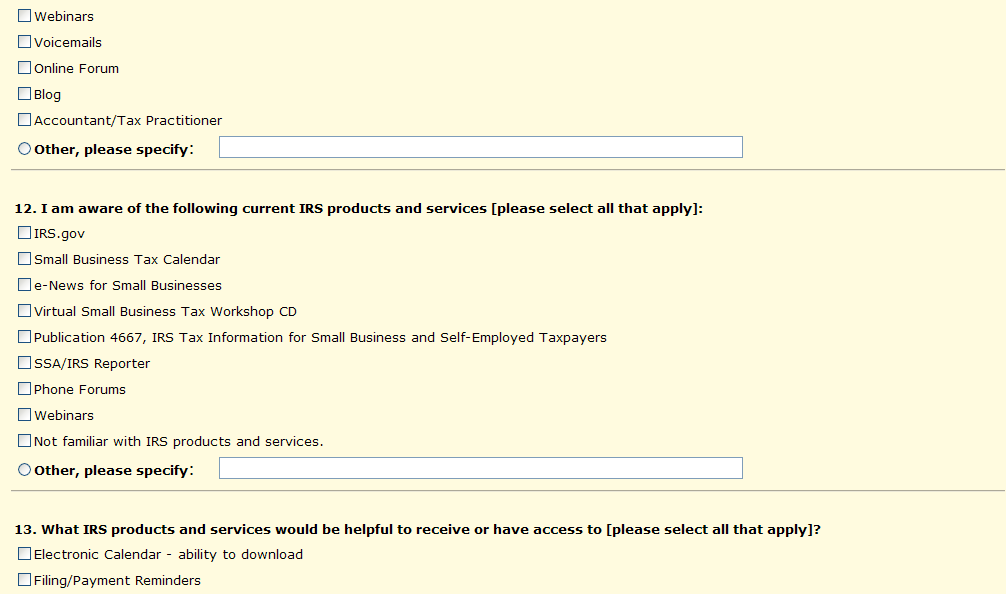

Are you aware of various IRS products and services including:

IRS Web Site:

e-News for Small Businesses

FAQs, Etc.

Small Business Self Employed (SBSE) 2010 Tax Calendar (Publication 1518)

Tax Information for Small Business and Self-Employed Taxpayers (Publication 4667)

Small Businesses Tax Responsibilities (Publication 4591)

Small Business Tax Workshops

In person

On line / virtual

CD / DVD format

How did you learn about these products and services? Were any especially useful for starting and continuing to run your business and why? Were any of these products useful in resolving tax issues? Why?

Is there anything that keeps you from contacting the IRS directly for assistance (i.e. obstacles, lack of information, IRS perceptions)? What can the IRS do to increase your level of comfort in communicating about your tax questions?

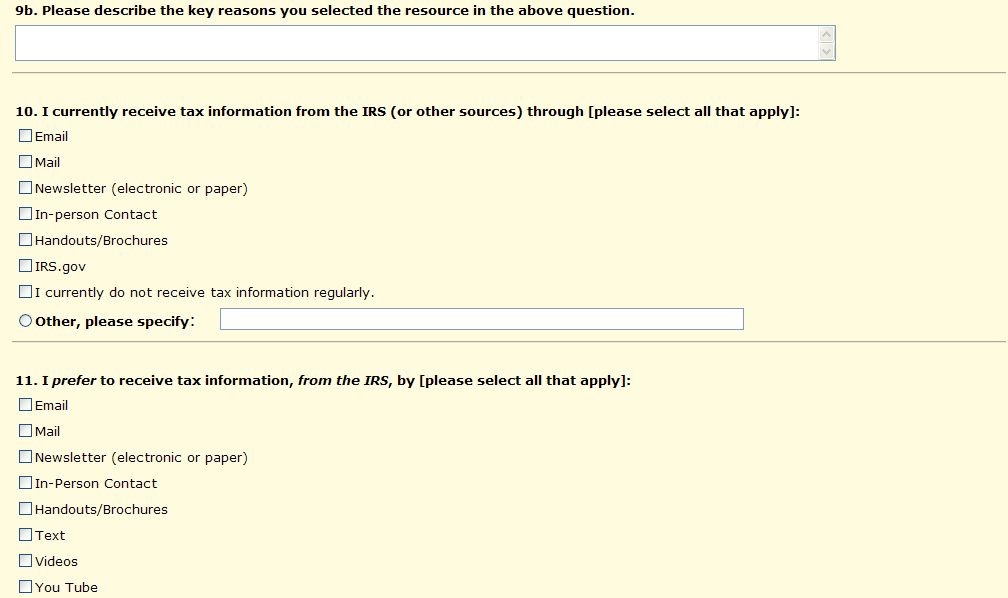

Are you currently receiving routine tax information or reminders from sources other than the IRS? What are you receiving, what is most helpful and from whom? What routine tax reminders/resources would be helpful to receive from the IRS and how would you prefer to receive them (i.e., email, text, videos, YouTube, twitter, webinars, voice, other)?

Tax Lessons Learned

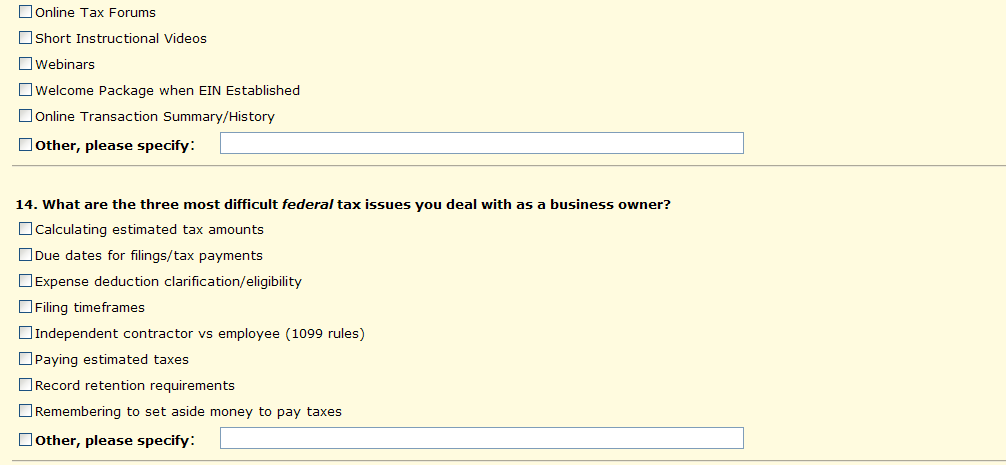

If a friend or relative started a business today, what are the top three pieces of advice you would give regarding federal tax obligations? Regarding your federal tax obligations, what top three things do you wish you had more information on? How can the IRS better assist you in these areas?

What is the most difficult tax issue you deal with as a small business owner? Why is it so difficult? How have you dealt with it and where did you go to solve the problem? How can the IRS better assist you in working with this issue in terms of outreach and education?

Compliance

What can IRS do to make it easier to meet your tax responsibilities relating to reporting, filing and payment (i.e., receiving tax guidance, understanding instructions, completing forms, cost to complete and submit forms, finding dollars to pay taxes, YouTube, Form Wizards, etc.)? What might the IRS do to make things easier for you to be compliant?

A lot of small businesses have tax compliance issues – it happens! What factors (i.e., lack of knowledge, too difficult, economic situation) would most influence a small business to be non-compliant? How can the IRS provide a small business with information to increase the level of compliance?

Communications

Have you had any direct contact with the IRS or any of its representatives in the past 5 years? If so, could you share what the most recent experience was like?

If you were given the opportunity, would you provide the IRS with an email address for communications purposes so that the IRS could send you emails that would contain links to relevant tax information and other alerts related to small business owners (filing date reminders, 1099 contractor payment levels, etc.)? Why or why not?

What is your experience in working with or communicating with the IRS as compared to other federal agencies (e.g., SSA, OSHA, etc), state agencies or other companies? Are there parts of those examples that the IRS should consider using? How could IRS communications be improved?

Do you have any communication examples from private industry that could serve as best practices for the IRS to model? (i.e., sign up for alerts / email distribution for interested topics, tracking of returns similar to FedEx, tailored communications based on small business attributes, etc.)

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this focus group is 1545-1432 so, if you have any comments, questions or concerns regarding this focus study, please write to the:

Internal Revenue Service

Tax Products Coordinating Committee

SE:W:CAR:MP:T:T:SP

1111 Constitution Ave. NW, Washington, DC 20224

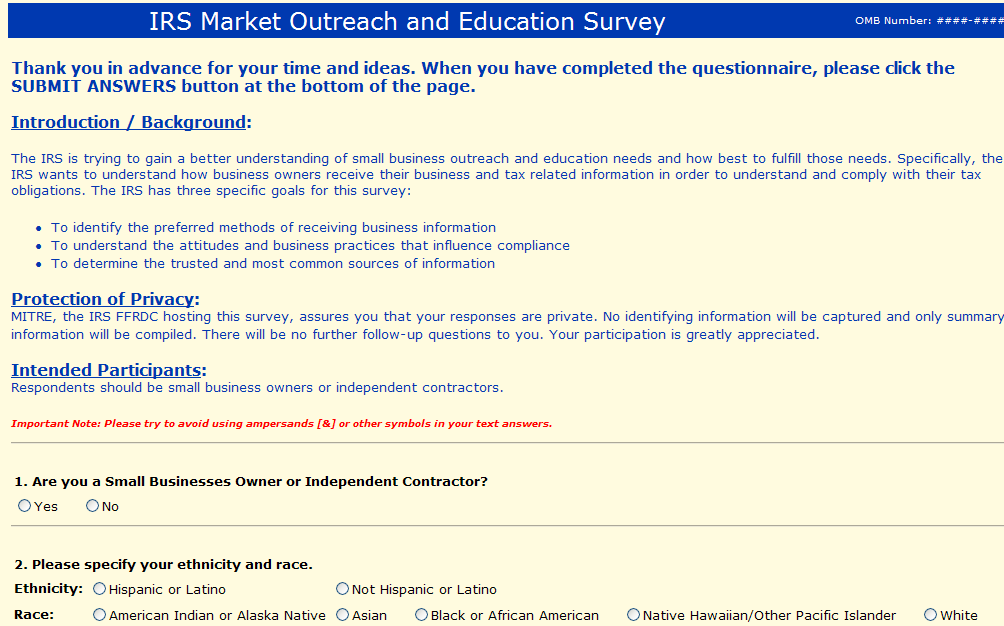

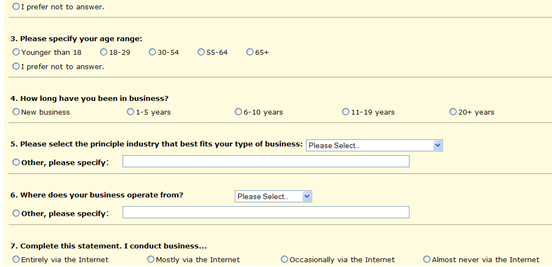

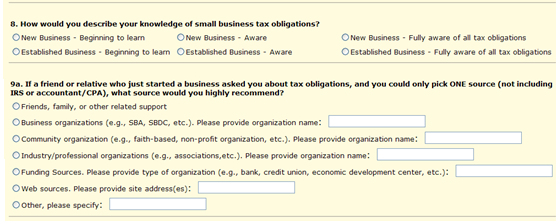

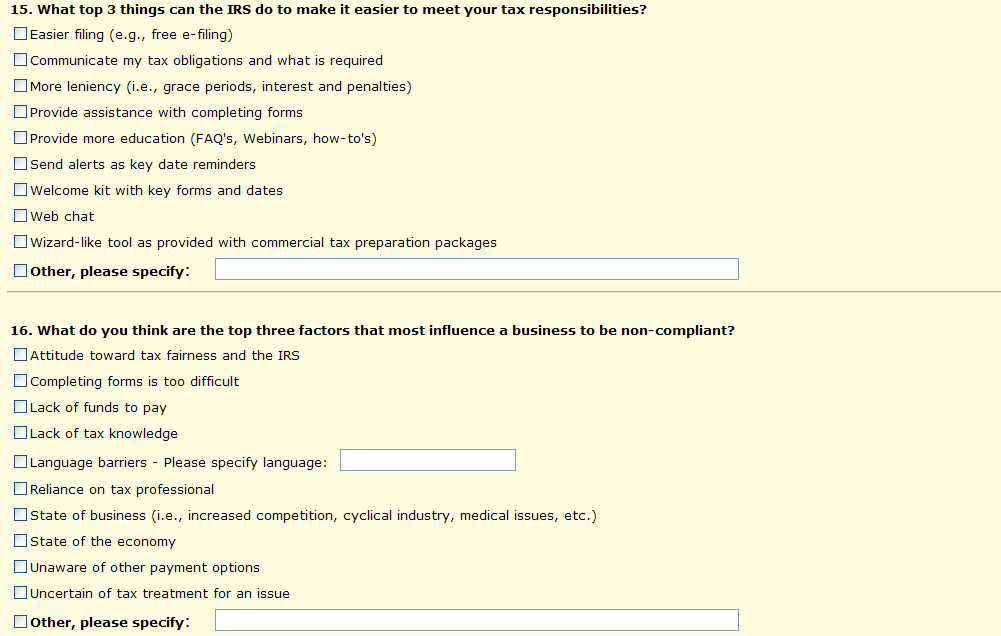

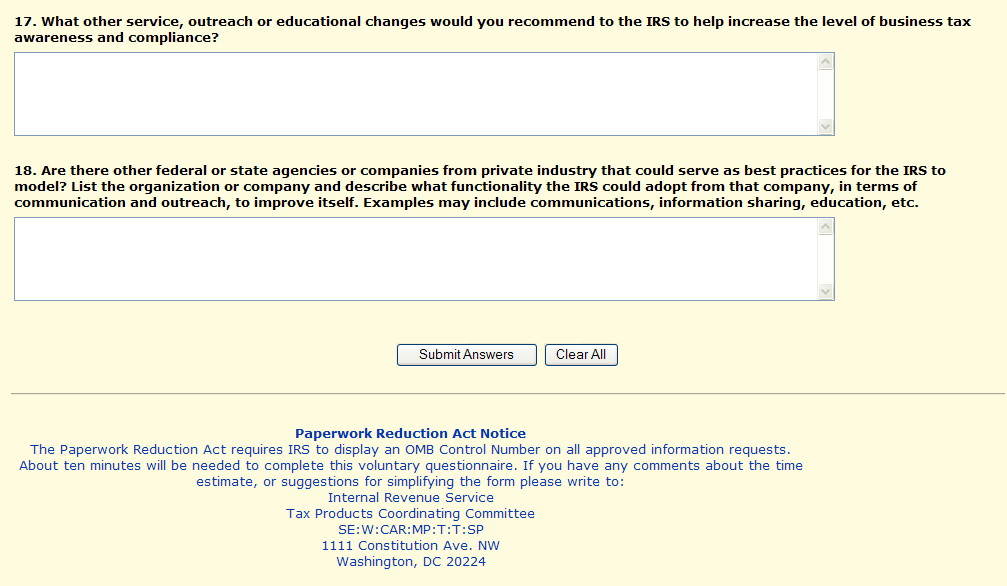

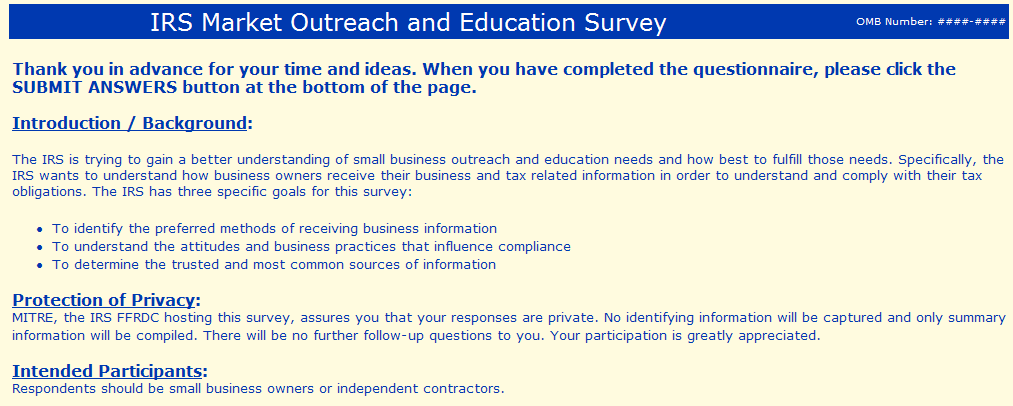

Appendix 2 – Online Web Survey

Appendix 3 – Advertisement Soliciting Participation for the Web Survey with Link for Participants to Take the Survey

Sample

Survey Link Text

Click

to Participate!

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this focus group is 1545-1432 so, if you have any comments, questions or concerns regarding this focus study, please write to the:

Internal Revenue Service

Tax Products Coordinating Committee

SE:W:CAR:MP:T:T:SP

1111 Constitution Ave. NW, Washington, DC 20224

| File Type | application/msword |

| File Title | Office of Management and Budget (OMB) Clearance Package |

| Author | Melodye Creason |

| Last Modified By | qhrfb |

| File Modified | 2010-06-07 |

| File Created | 2010-05-10 |

© 2026 OMB.report | Privacy Policy