Supporting Statement

CS-11-303_supporting statement.doc

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

Supporting Statement

OMB: 1545-1432

Request for Approval for the Collection of Customer Feedback

(OMB Control Number: 1545-1432)

T ITLE

OF INFORMATION COLLECTION: 2012 W&I CAS Injured Spouse

Customer Satisfaction Survey

ITLE

OF INFORMATION COLLECTION: 2012 W&I CAS Injured Spouse

Customer Satisfaction Survey

PURPOSE:

The purpose of the Injured Spouse Customer Satisfaction project is to gauge the level of customer satisfaction with the services provided by the Wage and Investment (W&I) Customer Account Services (CAS) Injured Spouse operations. W&I is employing a contractor to perform a survey that will collect information regarding the customers’ satisfaction with the Injured Spouse services.

DESCRIPTION OF RESPONDENTS:

Respondents are individuals who have filed an Injured Spouse claim with the IRS, and these individuals are external to the IRS. They are randomly selected as survey participants from a population of closed case files.

TYPE OF COLLECTION: (Check one)

[ ] Customer Comment Card/Complaint Form [X] Customer Satisfaction Survey

[ ] Usability Testing (e.g., Website or Software [ ] Small Discussion Group

[ ] Focus Group [ ] Other: ______________________

CERTIFICATION:

I certify the following to be true:

The collection is voluntary.

The collection is low-burden for respondents and low-cost for the Federal Government.

The collection is non-controversial and does not raise issues of concern to other federal agencies.

The results are not intended to be disseminated to the public.

Information gathered will not be used for the purpose of substantially informing influential policy decisions.

The collection is targeted to the solicitation of opinions from respondents who have experience with the program or may have experience with the program in the future.

Name:_Veronica Ogletree_____________

To assist review, please provide answers to the following question:

Personally Identifiable Information:

Is personally identifiable information (PII) collected? [ ] Yes [X] No

If Yes, is the information that will be collected included in records that are subject to the Privacy Act of 1974? [ ] Yes [ ] No

If Applicable, has a System or Records Notice been published? [ ] Yes [ ] No

Gifts or Payments:

Is an incentive (e.g., money or reimbursement of expenses, token of appreciation) provided to participants? [ ] Yes [X] No

BURDEN HOURS

Category of Respondent |

No. of Respondents |

Participation Time |

Burden |

Random Sample of Injured Spouse closed cases (asked to participate) |

20,000 |

2 minute |

666.67 hrs |

Customers who respond to survey (subset of above) |

5,000 |

7 minutes |

583.33 hrs |

Totals |

|

|

1,250 hrs |

Estimated Response Rate: 25%

FEDERAL COST: The estimated annual cost to the Federal government is ___$97,000.___

If you are conducting a focus group, survey, or plan to employ statistical methods, please provide answers to the following questions:

The selection of your targeted respondents

Do you have a customer list or something similar that defines the universe of potential respondents and do you have a sampling plan for selecting from this universe? [X] Yes [ ] No

If the answer is yes, please provide a description of both below (or attach the sampling plan)? If the answer is no, please provide a description of how you plan to identify your potential group of respondents and how you will select them?

Anyone who submits an Injured Spouse claim during the survey period may be randomly selected to participate in the customer satisfaction survey. The sample plan will be developed by the contractor based on volumes of Injured Spouse claims at the 8 sites. This sampling plan will include the target population and sampling frame, sampling specifications, expected reliability of the sample estimates, preliminary sampling weights, and the strategy of achieving target quotas within key strata. The sampling plan will be designed to result in 20,000 mail-outs per year, with an expected response of 5,000. The sample design will provide a precision margin of 5% and confidence interval of 95%. The Accounts Management Injured Spouse function will provide the contractor a complete database each month from which a random sample can be drawn. The database will consist of a unique identifying number, customer name and address, and relevant database information about each Injured Spouse case, all in a single record. Upon receipt of the data file, the vendor will run the file through standard checks to ensure a complete mailing address and to remove duplicate cases both within the file, and across files of other surveys that are being conducted. The contractor provides the sampling specifications to W&I to apply to the sampling databases. Each site reports its sampling efforts to the vendor on a weekly basis. The contractor monitors the sampling process to ensure the procedures are producing the desired number of respondents and coordinates with appropriate W&I personnel on sampling and related matters.

Administration of the Instrument

How will you collect the information? (Check all that apply)

[ ] Web-based or other forms of Social Media

[ ] Telephone

[ ] In-person

[X] Mail

[ ] Other, Explain

Will interviewers or facilitators be used? [ ] Yes [X] No.

Please make sure that all instruments, instructions, and scripts are submitted with the request.

Attachments

Procedure: The Dillman Method will be used and includes the (1st Wave) a prenote, (2nd Wave) a letter with the survey and postage paid reply envelope, (3rd Wave) a reminder postcard, and (4th Wave) a reminder letter with the survey, along with postage paid reply envelope. These mailings and the survey questions are attached below:

Note: The survey will be corrected to indicate that it will take 7 minutes to complete instead of 5 minutes prior to distribution.

Supporting Statement

Approval Request to Conduct Customer Satisfaction Research (OMB #1545-1432)

2012 W&I CAS Injured Spouse Customer Satisfaction Survey

JUSTIFICATION

Circumstances Making the Collection of Information Necessary

The Internal Revenue Service (IRS) enlists a balanced measurement system consisting of business results, customer satisfaction, and employee satisfaction. This initiative is part of the Service-wide effort to maintain a system of balanced organizational performance measures mandated by the IRS Restructuring and Reform Act (RRA) of 1998. This is also a result of Executive Order 12862 that requires all government agencies to survey their customers.

The Injured Spouse operation within the Customer Accounts Services (CAS) Operating Unit of the W&I Business Operating Division (BOD) is responsible for responding to written customer technical and account inquiries, resolving customer account issues, providing account settlement (payment options), and working related issues. W&I requires feedback from customers to continually improve the Injured Spouse operations. W&I solicits this feedback through customer satisfaction research.

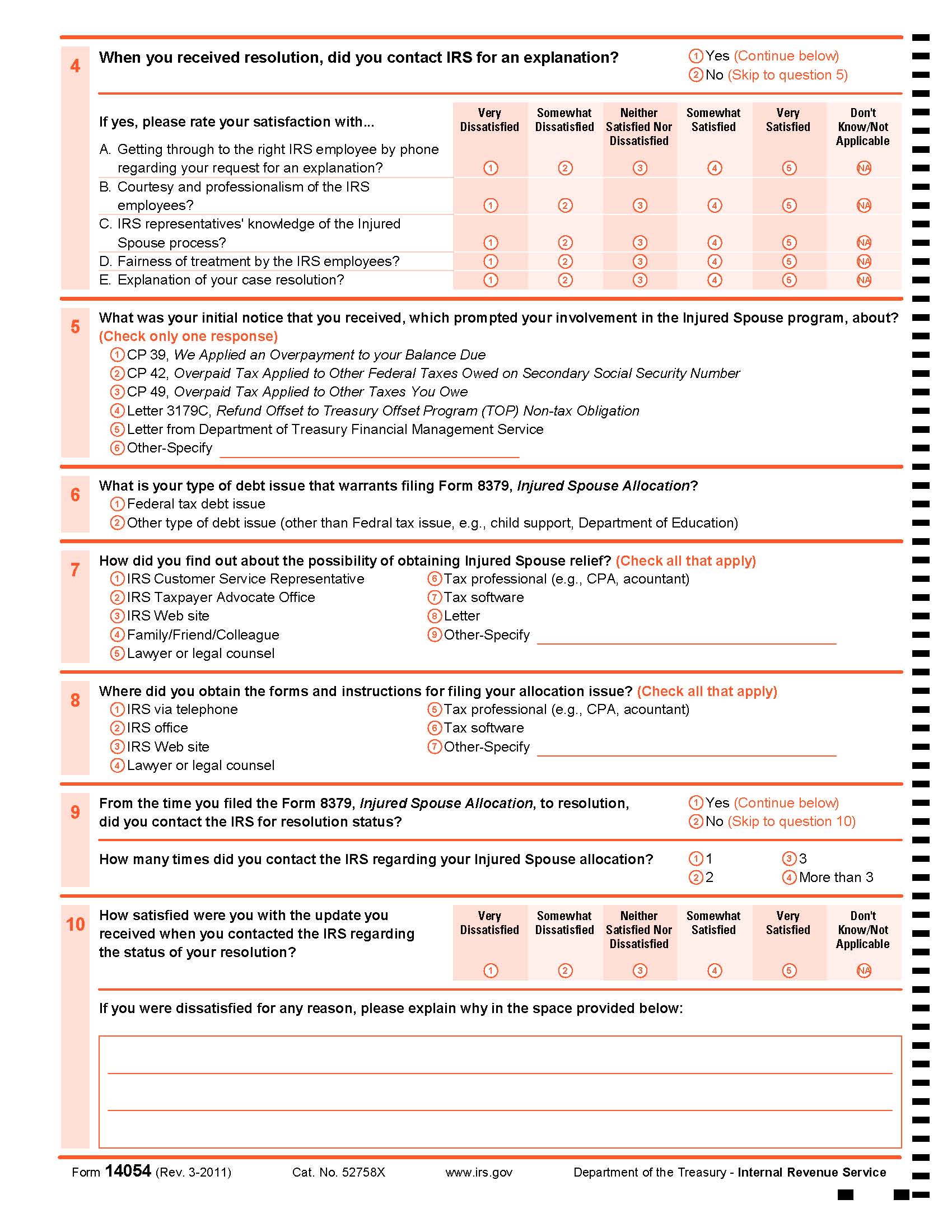

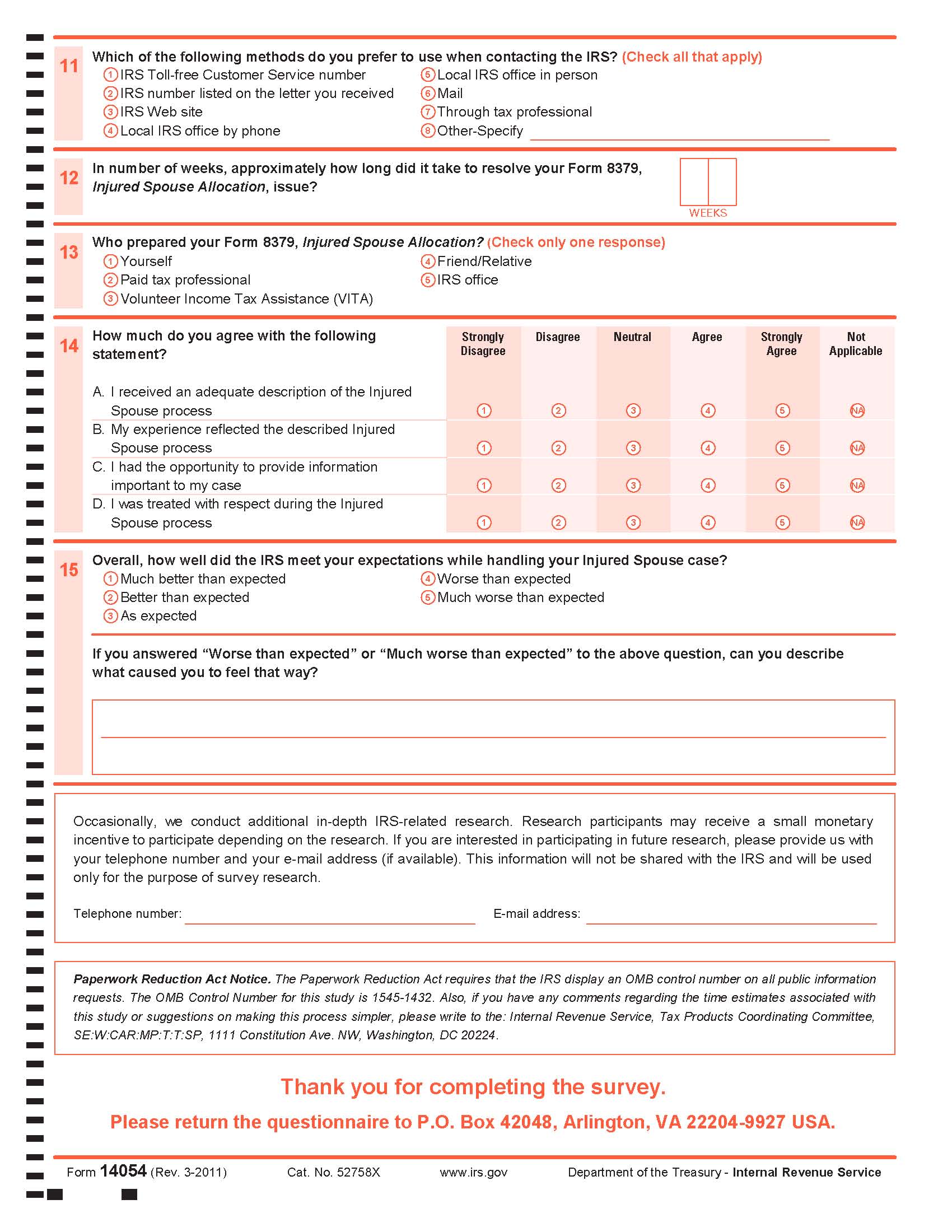

Purpose and Use of the Information Collection

Improving agency programs requires ongoing assessment of service delivery, by which we mean systematic review of the operation of a program compared to a set of explicit or implicit standards, as a means of contributing to the continuous improvement of the program. W&I will employ a contractor to collect, analyze, and interpret information gathered to identify strengths and weaknesses of current Injured Spouse services and make improvements in service delivery based on feedback. The solicitation of feedback will target areas such as: timeliness, appropriateness, accuracy of information, courtesy, efficiency of service delivery, and resolution of issues with service delivery. Responses will be assessed to plan and inform efforts to improve or maintain the quality of service offered to the public. If this information is not collected, vital feedback from customers and stakeholders on Injured Spouse services will be unavailable.

By conducting this survey, W&I CAS expects to accomplish the following objectives:

To measure the level of customer satisfaction concerning services provided to the customer during their Injured Spouse interaction.

To identify problems that customers encounter when interacting with the Injured Spouse function.

To gain insight on improvements that can be made to Injured Spouse services.

To improve the service that Injured Spouse provides to their customers.

To assess improvements/problems by comparing this year’s results to prior years’.

From the survey responses, W&I CAS will be able to assess the current level of customer satisfaction for the Injured Spouse operations and draw on customer input to improve our products and services.

Consideration Given to Information Technology

Surveys will be distributed through U.S Postal mail.

Duplication of Information

This survey will provide valuable information that is not available in any internal IRS data source.

Reducing the Burden on Small Entities

The survey has been designed to minimize burden on the respondent. The time that a respondent takes to complete a survey has been carefully considered and only the most important areas are being surveyed.

Consequences of Not Conducting Collection

Without these types of feedback, the Injured Spouse operations will not have timely information to adjust its services to meet customer needs.

Special Circumstances

The statistics derived from the customer satisfaction measures could be used in making management decisions such as business improvement opportunities.

Consultations with Persons Outside the Agency

IRS will employ a contractor to conduct the research.

Payment or Gift

Injured Spouse operations will not provide payment or other forms of remuneration to respondents of its various forms of collecting feedback.

Confidentiality

All participants will be subject to the provisions of the Taxpayer Bill of Rights II during this study and the vendor will ensure that all participants are treated fairly and appropriately.

The security of the data used in this project and the privacy of taxpayers as allowed by law will be carefully safeguarded at all times. Security requirements are based on the Computer Security Act of 1987 and Office of Management and Budget Circular A-130, Appendices A & B. Physical security measures include a locked, secure office. Notes are stored in locked cabinets or shredded. Data security at the C-2 level is accomplished via the Windows NT operating system. Systems are password protected, users profiled for authorized use, and individual audit trails generated and reviewed periodically.

The IRS will apply and meet fair information and record-keeping practices to ensure privacy protection of all taxpayers as allowed by law. This includes criteria for disclosure—laid out in the Privacy Act of 1974, the Freedom of Information Act, and Section 6103 of the Internal Revenue Code—all of which provide for the protection of taxpayer information as well as its release to authorized recipients.

The survey will not contain tax return or taxpayer information. Survey participants will not be identified in any of the documents or files used for this project. We will limit and control the amount of information we collect to those items that are necessary to accomplish the research questions. We will carefully safeguard the security of data utilized as well as the privacy of the survey respondents. We will apply the fair information and record-keeping practices to ensure protection of all survey respondents. The criterion for disclosure laid out in the Privacy Act, the Freedom of Information Act, and section 6103 of the Internal Revenue Code provides for the protection of information as well as its releases to authorized recipients.

Sensitive Nature

No questions will be asked that are of a personal or sensitive nature.

Burden of Information Collection

The estimated time to complete the survey is seven minutes, but some variation in the length of time required to answer the survey is expected. Assuming a 25% response rate, the total annual burden hours requested (1,250 hrs) are based on the number of collections we expect to conduct over the requested period for this clearance (collection start date: January 1, 2012; collection end date: June 30, 2013).

Estimated Annual Reporting Burden |

||||

Type of Collection |

No. of Respondents |

Annual Frequency per Response |

Hours per Response |

Total Hours |

Asking Injured Spouse customers to participate |

20,000 |

1 |

2 minutes |

666.67 |

Customers who respond to survey (subset of above) |

5,000 |

1 |

7 minutes |

583.33 |

Total |

|

|

|

1,250 hrs |

Note: The survey will be corrected to indicate that it will take 7 minutes to complete instead of 5 minutes prior to distribution.

Costs to Respondents

No costs are anticipated.

Costs to Federal Government

$97,000

Reason for Change

Not applicable.

Tabulation of Results, Schedule, Analysis Plans

Findings will be used for general service improvement, but are not for publication or other public release. Although IRS does not intend to publish its findings, IRS may receive requests to release the information (e.g., congressional inquiry, Freedom of Information Act requests). IRS will disseminate the findings when appropriate, strictly following IRS’s "Guidelines for Ensuring the Quality of Information Disseminated to the Public", and will include specific discussion of the limitation of the results.

Display of OMB Approval Date

We are requesting no exemption.

Exceptions to Certification for Paperwork Reduction Act Submissions

These activities comply with the requirements in 5 CFR 1320.9.

B.

STATISTICAL METHODS

The primary purpose of these collections will be for internal management purposes; there are no plans to publish or otherwise release this information.

Universe and Respondent Selection

The sampling frame consists of W&I taxpayers who file an Injured Spouse claim with IRS.

Procedures for Collecting Information

Participants for the survey will be randomly selected and offered the survey through the mail.

Methods to Maximize Response

Standards procedures, including Dillman Method mail waves, will be used in order to obtain the highest response rate possible for the Injured Spouse operations Customer Satisfaction Survey.

Testing of Procedures

The function and the contractor have worked together to refine the survey instrument over the years so additional testing is not needed during this administrative period.

Contacts for Statistical Aspects and Data Collection

The IRS employs a contractor to develop, design and conduct the Injured Spouse customer satisfaction survey and to analyze the data and generate appropriate reports. Contact with the contractor can be arranged through the IRS Contracting Officer’s Representative, Veronica Ogletree, who may be reached at (404) 338-8531.

| File Type | application/msword |

| File Title | DOCUMENTATION FOR THE GENERIC CLEARANCE |

| Author | 558022 |

| Last Modified By | mdsloa00 |

| File Modified | 2011-10-27 |

| File Created | 2011-10-27 |

© 2026 OMB.report | Privacy Policy