CS-11-315 AUR Survey

CS-11-315 OMB Supporting Statement for SBSE 2012 AUR Mail survey.doc

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-11-315 AUR Survey

OMB: 1545-1432

Supporting Statement

Approval Request to Conduct Customer Satisfaction Research (OMB #1545-1432)

Automated Underreporter (AUR) Customer Satisfaction Mail Survey

JUSTIFICATION

Circumstances Making the Collection of Information Necessary

The Internal Revenue Service (IRS) enlists a balanced measurement system consisting of business results, customer satisfaction, and employee satisfaction. This initiative is part of the Service-wide effort to maintain a system of balanced organizational performance measures mandated by the IRS Restructuring and Reform Act (RRA) of 1998. This is also a result of Executive Order 12862 that requires all government agencies to survey their customers.

These customer surveys have also produced significant information about the key dimensions of the customers’ experience in dealing with IRS and SB/SE in their tax matters as well as pointers to where improvement opportunities might lie.

Purpose and Use of the Information Collection

In addition to the objective of measuring customer satisfaction to meet a balanced measures requirement, AUR management is motivated to use survey results to identify improvement opportunities and as the basis for enacting improvements.

The key goals of the survey are 1) to survey our external customers on an ongoing basis regarding their expectations, 2) track customer satisfaction progress over time nationwide and 3) identify operational improvements within SB/SE AUR. The feedback received will not institute new policy, yet will enable the Service to meet taxpayer needs effectively.

Consideration Given to Information Technology

The AUR survey will be administered by mail on a monthly basis.

Duplication of Information

This survey will provide valuable information that is not available in any internal IRS data source.

Reducing the Burden on Small Entities

The survey has been designed to minimize burden on the taxpayer. The time that a respondent takes to complete a survey has been carefully considered and only the most important areas are being surveyed. The current selection criteria established in the survey methodology will allow the respondent to participate in only one survey. This will aid in decreasing taxpayer burden.

Consequences of Not Conducting Collection

SB/SE initiatives fall under the IRS goal to “IMPROVE SERVICE TO MAKE VOLUNTARY COMPLIANCE EASIER, and ENFORCE THE LAW TO ENSURE EVERYONE MEETS THEIR OBLIGATION TO PAY TAXES. If the requirement is not funded, SB/SE will not have the external measures used to assess their success in meeting IRS goals. This will also cause SB/SE to be less effective as it will not have the data to know which products and services identified by customers need improvement or need to be developed to service these populations.

Special Circumstances

There are no special circumstances. The information collected will be voluntary. These statistics could be used in making management decisions such as in business improvement opportunities.

Consultations with Persons Outside the Agency

N/A

Payment or Gift

N/A

Confidentiality

No PII will be collected during the survey.

Sensitive Nature

No questions will be asked that are of a personal or sensitive nature.

Burden of Information Collection

The survey interview is designed to minimize burden on the taxpayer. The time that a respondent takes to complete the mail survey is carefully considered and only the most important areas are being surveyed. The average time of survey completion is expected to be 7 minutes. The questions are generally one sentence in structure and on an elementary concept level.

Based on a sample of potential respondents of 6,480 (3 sites, average of 540 per site each quarter) and a response rate of 30%, we expect 1,944 survey participants, leaving 4,536 non-participants. The contact time to determine non-participants could take up to two minutes to read the pre-contact letter, with the resulting burden for non-participants being 4,536 x 2 minutes = 9,072/60 minutes = 151.2 burden hours.

For participants, the time to complete the survey is 7 minutes. This reflects the time to read the pre-notification letter (2 minutes) and time needed to complete the survey (5 minutes maximum). The time burden for participants is 1,944 x 7 = 13,608 minutes/60 minutes = 226.8 burden hours.

The total burden hours for the survey is (151.2 + 226.8) = 378 burden hours

Minor revisions, that will not impact the burden hours, may be made to the survey questionnaire.

AUR Mail Survey

Category of Respondent |

No. of Respondents |

Participation Time |

Burden |

AUR Non-participant |

4,536 |

2 min |

151.2 |

AUR Expected Participants |

1,944 |

7 min |

226.8 |

Totals |

6,480 |

|

378 |

Estimated Response Rate: 30%

Total Burden Estimate = 378 hrs

Costs to Respondents

N/A

Cost to Federal Government

$62,626

Reason for Change

N/A

Tabulation of Results, Schedule, Analysis Plans

The survey data is collected via mail questionnaire and is an established and tested survey instrument. If changes are made to the questionnaire, they are expected to be minor. The survey includes several ratings questions evaluating service delivery during the AUR process as well as several demographic items. In addition, ample space is provided for suggestions for improvement.

Survey scoring for this contract is based on the Customer Satisfaction Survey Score response average to the keystone question – “Regardless of whether you agree or disagree with the final outcome, how would you rate your overall experience with the way your discrepancy was handled?” Questions utilize a 5-point rating scale, with 1 being very dissatisfied and 5 being very satisfied. All survey responses will be released only as summaries. The contractor shall hold the identities, of the taxpayers responding to the survey, private to the extent permitted by law. The contractor ensures that taxpayers responding to the survey are guaranteed anonymity. The contractor will not provide the IRS with data or status updates that are linked to individual respondents. Upon completion of data collection and cleaning, the contractor will provide de-identified survey data to the IRS. This data will not include any individually identifying information such as name, address, or taxpayer identification number.

Display of OMB Approval Date

N/A

Exceptions to Certification for Paperwork Reduction Act Submissions

N/A

Dates collection will begin and end

April 1, 2012 through September 30, 2013

B. STATISTICAL METHODS

Data collection methods and procedures will vary; however, the primary purpose of these collections will be for internal management purposes; there are no plans to publish or otherwise release this information.

Universe and Respondent Selection

Survey participants are pulled from Automated Underreporter closed cases in a random sample from each of the AUR site locations.

Procedures for Collecting Information

The vendor will administer the survey by mail on a monthly basis. Standard procedures will be used in order to obtain the highest response rate possible for the mail survey. These will include: 1) a pre-notification letter on IRS letterhead about the survey, 2) cover letter and questionnaire, 3) a postcard reminder, and 4) a cover letter and a copy of questionnaire to non-respondents.

Methods to Maximize Response

The questionnaire length is minimized to reduce respondent burden; thereby, tending to increase response rates. Respondents are assured anonymity of their responses. Also, weighting procedures can be applied to adjust aggregated data from those who do respond.

Testing of Procedures

The questionnaire is an established and tested survey instrument. If changes are made to the questionnaire, only minor changes are expected. Revising the coding scheme for open-ended questions is one example.

Contacts for Statistical Aspects and Data Collection

For questions regarding the study or questionnaire design or statistical methodology, contact:

Sharon Luckett

SB/SE, Policy Analyst

202-283-4883

Survey instruments include the following and are attached below.

Pre-notification letter on IRS letterhead

Cover letter and questionnaire

Postcard reminder

Cover letter for non-respondents

Dear

I need your help with an important initiative I am undertaking to improve our service to America’s taxpayers. I want to get feedback from taxpayers like you who have received a notice from the IRS pointing out a discrepancy between the earnings information reported on their tax return and the information provided to us by organizations such as banks and employers.

In a few days, you will receive a questionnaire asking your opinions about the process of resolving such discrepancies with the IRS. Please direct it to the person who had the most contact with the IRS on this matter. The questionnaire should take less than 5 minutes to complete. Your answers will be combined with others to give us an evaluation of customer satisfaction with IRS service.

To keep all replies anonymous to the IRS, we have asked an independent research company to administer the survey. Fors Marsh Group employees will process the questionnaires and report only statistical totals to us.

I am committed to improving IRS service to every taxpayer. Please help me in this effort by completing and returning the questionnaire as soon as possible. If you do not receive a questionnaire, please contact the Survey Helpline at 1-800-521-7177.

Sincerely,

Denice D. Vaughan

Director, Campus Compliance Services

L1_13257-C

Dear

A few days ago, you received a letter from Denice D. Vaughan, Director, Campus Compliance Services, asking for your help with an important research project.

We are administering a nationwide survey among people who have had contact with the Internal Revenue Service (IRS). We want to know your opinions about the process of resolving a discrepancy between the earnings information reported on your tax return and information provided to the IRS by organizations such as banks and employers. Your responses are critical to the accuracy of this research.

We are sending questionnaires to a random sample of taxpayers who have had such discrepancies. All responses will be anonymous to the IRS, and your participation is voluntary. We will group your responses with others, so that no individual reply can be traced back to any one person.

The questionnaire is quite brief and should take less than 5 minutes to complete. Please use the postage-paid reply envelope to return your completed questionnaire. If you have any questions about this survey, please feel free to call us toll-free at 1-800-521-7177, or email us at [email protected].

To verify the authenticity of this survey, please visit IRS.gov and enter the search term ‘customer surveys.’ The IRS Customer Satisfaction Survey page contains a list of valid, current and unexpired, IRS surveys and as of this issuance should provide a reference to SB/SE Automated Underreporter.

The IRS is committed to improving its performance and service to the American public. A first step in this process is to gather reliable information from those who have had contact with IRS services and employees. Your honest opinions will help bring about this improvement.

Thank you in advance for your cooperation.

Sincerely,

Brian K. Griepentrog, Ph.D.

Director of Research

Fors Marsh Group LLC

L2_13257-C

IRS CUSTOMER SATISFACTION SURVEY

In an effort to improve its services to the public, the IRS is seeking the opinions of taxpayers who received a notice from the IRS pointing out a possible discrepancy on their tax return. Please assist us by completing this brief voluntary survey, which should take less than 5 minutes of your time. ICF will keep your identity private to the extent permitted by law. If you have any questions about this survey, you may call the ICF Survey Helpline at 1-888-260-0052.

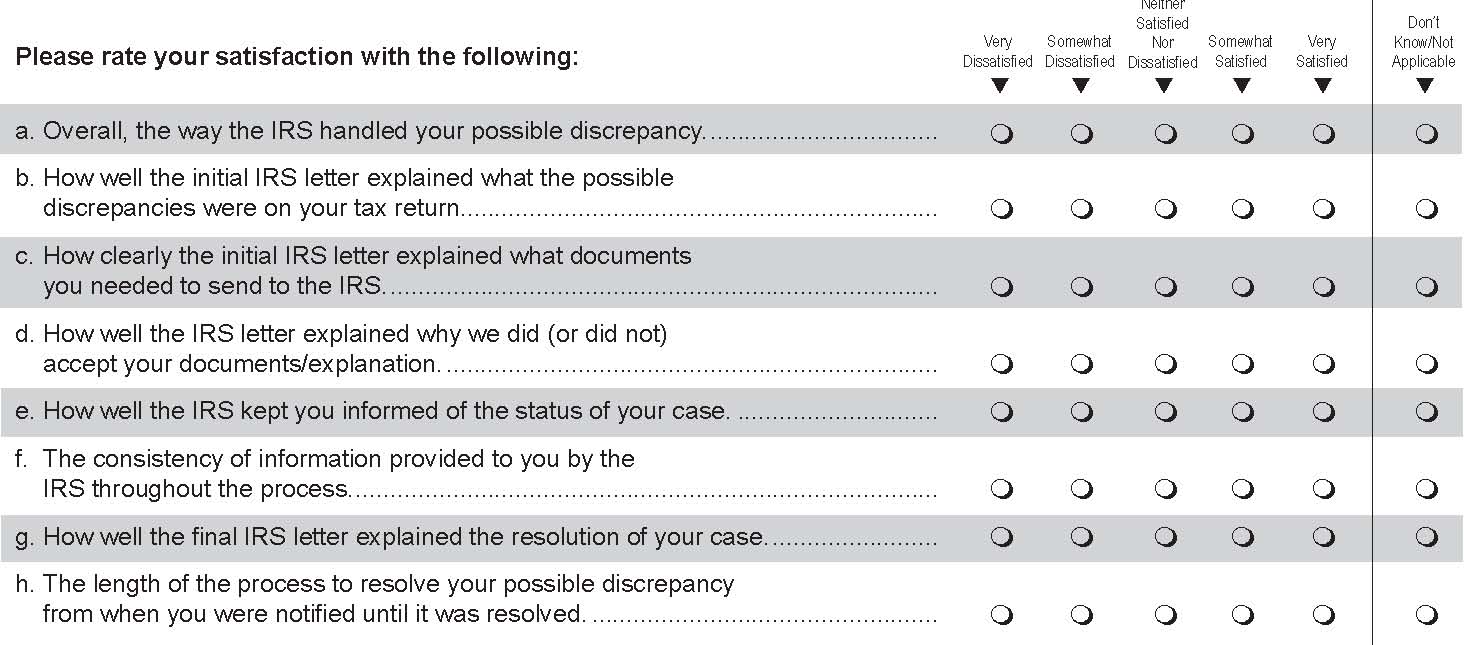

Thinking of your experience with the process of resolving this possible discrepancy with the IRS, regardless of whether you agreed or disagreed with the final outcome, please mark the option that best represents your experiences throughout the resolution process.

2. If you answered “Very Dissatisfied” or “Somewhat Dissatisfied” to any of the

above questions, can you describe what caused you to feel that way? _______

___________________________________________________________________________

___________________________________________________________________________

3. Did you call the IRS about your possible discrepancy using a telephone number

listed on any of the letters?

Yes (continue to 4)

No (skip to 5)

Don’t recall (skip to 5)

4. Regardless of the outcome of your case, how satisfied were you with the service

you received on these calls? Very Dissatisfied; Somewhat Dissatisfied; Neither

Satisfied Nor Dissatisfied; Somewhat Satisfied; Very Satisfied; Don’t Know/Not

Applicable

5. During the process to resolve your possible discrepancy, approximately how many

times did you contact the IRS? (Please enter zero if you did not contact the

IRS by this method). Mail ___Times; Telephone ____ Times; Fax ____ Times

6. When you were first notified of the possible discrepancy, how many months did

you expect it would take to resolve?_____ Months

7. Was the actual amount of time…?

Shorter than you expected

About equal to your expectations

Longer than you expected

8. How much do you agree with the following statements?

Strongly Disagree; Disagree; Neutral; Agree; Strongly Agree; N/A

a. I received an adequate description of the process to resolve my possible

discrepancy

b. My experience reflected the described process

c. I had the opportunity to provide information important to my case

d. I was treated with respect during the process

9. Overall, how well did the IRS meet your expectations while handling the

possible discrepancy? Much better than expected; Better than expected;

As expected; Worse than expected; Much worse than expected; N/A

If you answered “Worse than expected” or “Much worse than expected” to the above question, can you describe what caused you to feel that way?

___________________________________________________________________________

___________________________________________________________________________

10. Who prepared your taxes? (Mark only one.) You; IRS service representative at an IRS office; Professional tax preparer; Volunteer (at a volunteer tax preparation location); Friend or relative; Other;

The IRS continually looks for ways to improve its service to taxpayers who have received a notice pointing out a possible discrepancy on their tax return. Please use this space to provide your comments or suggestions for improvement. We welcome your feedback. ____________________________________________________________________________

_____________________________________________________________________________

Occasionally, the IRS asks ICF to conduct additional in-depth research on tax-related issues. Research participants may receive a small monetary incentive to participate depending on the research. If you are interested in participating in future research, please provide us with your telephone number and e-mail address (if available). This information will not be shared with the IRS and will be used only for the purpose of this research. If you have any questions about this, please contact the ICF Survey Helpline at 1-888-260-0052. Telephone number: ( __ __ __ ) __ __ __ - __ __ __ __

E-mail address:_____________________________________________________________

If you have been unable to resolve any specific problems with your tax matter through the normal IRS channels, or now face a significant hardship due to the application of the tax law, we encourage you to contact the Taxpayer Advocate Service at 1-877-777-4778.

Paperwork Reduction Act Notice

The Paperwork Reduction Act requires that the IRS display an Office of Management and Budget (OMB) control number on all public information requests. The OMB Control Number for this study is 1545-1432. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the: Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

Thank you for completing the survey. Please return this questionnaire to ICF/Scantron, P.O. Box 64529, St. Paul, MN 55164-9614.

Do We Have Your Input Yet?

Recently, you received a questionnaire asking your opinions about the service you received from the IRS in a recent contact. If you have already completed and returned the questionnaire, please accept our sincere thanks. If not, please take a few minutes to complete it and return it today. We want to be sure we have your opinions and suggestions.

If you did not receive the questionnaire, or it got misplaced, please call us at 1-800-521-7177.

Brian K. Griepentrog, Ph.D.

Project Director

L3_13257C

Dear

A few weeks ago, you received a letter from Denice D. Vaughan, Director, Campus Compliance Services, asking for your help with an important research project. If you have already completed the survey, thank you. If you have not already done so, please take a few minutes to fill in your responses.

We are administering a nationwide survey among people who have had contact with the Internal Revenue Service (IRS). We want to know your opinions about the process of resolving a discrepancy between the earnings information reported on tax returns and information provided to the IRS by organizations such as banks and employers. Your responses are critical to the accuracy of this research.

We are sending questionnaires to a random sample of taxpayers who have had such discrepancies. All responses will be anonymous to the IRS, and your participation is voluntary. We will group your responses with others, so that no individual reply can be traced back to any one person.

The questionnaire is quite brief and should take less than 5 minutes to complete. Please use the postage-paid reply envelope to return your completed questionnaire. If you have any questions about this survey, please feel free to call us toll-free at 1-800-521-7177, or email us at [email protected].

To verify the authenticity of this survey, please visit IRS.gov and enter the search term ‘customer surveys.’ The IRS Customer Satisfaction Survey page contains a list of valid, current and unexpired, IRS surveys and as of this issuance should provide a reference to SB/SE Automated Underreporter.

The IRS is committed to improving its performance and service to the American public. A first step in this process is to gather reliable information from those who have had contact with IRS services and employees. Your honest opinions will help bring about this improvement.

Thank you in advance for your cooperation.

Sincerely,

Brian K. Griepentrog, Ph.D.

Director of Research

Fors Marsh Group LLC

L4_13257-C2048 • Arlington, VA 22204-9048

| File Type | application/msword |

| File Title | DOCUMENTATION FOR THE GENERIC CLEARANCE |

| Author | 558022 |

| Last Modified By | mdsloa00 |

| File Modified | 2012-04-10 |

| File Created | 2012-04-10 |

© 2026 OMB.report | Privacy Policy