NPEFS 2012-14 Appendix A Communication Materials

NPEFS 2012-14 Appendix A Communication Materials.docx

NPEFS 2011-2014: Common Core of Data (CCD) National Public Education Financial Survey

NPEFS 2012-14 Appendix A Communication Materials

OMB: 1850-0067

Table of Contents

Federal Register Notice: Submission of Data by State Educational Agencies;

Submission Dates for State Revenue and Expenditure Reports for Fiscal Year

(FY) 2011, Revisions to those Reports, and Revisions to prior Fiscal Year Reports ii

Initial Cover Letter to Respondents vi

Submission letter vii

Crosswalk Letter viii

Closeout Letter ix

NPEFS FY11 Instruction Manual x

4000-01-U

DEPARTMENT OF EDUCATION

Submission of Data by State Educational Agencies; Submission Dates for State Revenue and Expenditure Reports for Fiscal Year (FY) 2012, Revisions to Those Reports, and Revisions to Prior Fiscal Year Reports

AGENCY: National Center for Education Statistics, Institute of Education Sciences, Department of Education.

ACTION: Notice.

SUMMARY: The Secretary announces dates for the submission by state educational agencies (SEAs) of expenditure and revenue data and average daily attendance statistics on ED Form 2447 (the National Public Education Financial Survey (NPEFS)) for FY 2012. The Secretary sets these dates to ensure that data are available to serve as the basis for timely distribution of Federal funds. The U.S. Census Bureau is the data collection agent for the National Center for Education Statistics (NCES). The data will be published by NCES and will be used by the Secretary in the calculation of allocations for FY 2014 appropriated funds.

DATES: SEAs can begin submitting data on Wednesday, January 30, 2013. The deadline for the final submission of all data, including any revisions to previously submitted data for FY 2011 and FY 2012, is Thursday, August 15, 2013. Any resubmissions of FY 2011 or FY 2012 data by SEAs in response to requests for clarification, reconciliation or other inquiries by NCES or the Census Bureau must be completed by Tuesday, September 3, 2013. All outstanding data issues must be reconciled or resolved by the SEAs, NCES, and the Census Bureau prior to September 3, 2013.

Addresses and Submission Information: SEAs may mail ED Form 2447 to: U.S. Census Bureau, ATTENTION: Governments Division, Washington, DC 20233-6800.

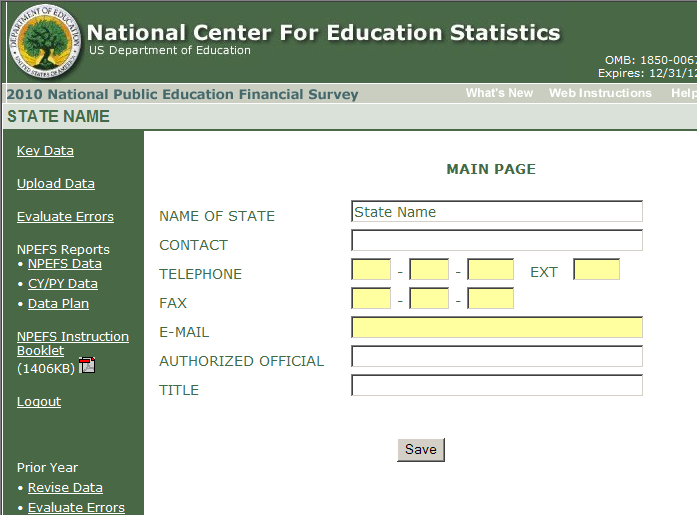

SEAs may submit data via the World Wide Web (“Web”) using the interactive survey form at: http://surveys.nces.ed.gov/ccdnpefs. The Web form includes a digital confirmation page where a pin number may be entered. A successful entry of the pin number serves as a signature by the authorizing official. A certification form also may be printed from the Web site, and signed by the authorizing official and mailed to the Governments Division of the Census Bureau, at the address listed in the previous paragraph. This signed form must be mailed within five business days of Web form data submission.

Alternatively, SEAs may hand-deliver submissions by August 15, 2013 at 4:00 p.m. (Eastern Time) to: Governments Division, U.S. Census Bureau, 4600 Silver Hill Road, Suitland, MD, 20746.

FOR FURTHER INFORMATION CONTACT: Mr. Stephen Q. Cornman, National Center for Education Statistics, Institute of Education Sciences, U.S. Department of Education. Telephone: (202)502-7338 or by email: [email protected]; or Mr. Jumaane Young, NPEFS Project Manager, or an NPEFS team member (Census Bureau). Telephone: 1-800-437-4196 or (301) 763-1571 or email: [email protected]. If you use a telecommunications device for the deaf (TDD) or a text telephone (TTY), call the Federal Relay Service (FRS), toll free, at 1-800-877-8339.

Individuals with disabilities may obtain this document in an accessible format (e.g., braille, large print, audiotape, or CD-ROM) on request to: Mr. Stephen Q. Cornman, National Center for Education Statistics, Institute of Education Sciences, U.S. Department of Education. Telephone: (202) 502-7338 or email: [email protected].

SUPPLEMENTARY INFORMATION: Under the authority of section 153(a)(1)(I) of the Education Sciences Reform Act of 2002, 20 U.S.C. 9543, which authorizes NCES to gather data on the financing of education, NCES collects data annually from SEAs through ED Form 2447. The report from SEAs includes attendance, revenue, and expenditure data from which NCES determines a State’s “average per-pupil expenditure” (SPPE) for elementary and secondary education, as defined in section 9101(2) of the Elementary and Secondary Education Act of 1965, as amended (ESEA) (20 U.S.C. 7801(2)).

In addition to using the SPPE data as general information on the financing of elementary and secondary education, the Secretary uses these data directly in calculating allocations for certain formula grant programs, including, but not limited to, Title I, Part A of the ESEA, Impact Aid, and Indian Education programs. Other programs, such as the Education for Homeless Children and Youth program under Title VII of the McKinney-Vento Homeless Assistance Act and the Teacher Quality State Grants program (Title II, Part A of the ESEA), make use of SPPE data indirectly because their formulas are based, in whole or in part, on State Title I, Part A allocations.

In January 2013, the Census Bureau, acting as the data collection agent for NCES, will email to SEAs ED Form 2447 with instructions and request that SEAs commence submitting FY 2012 data to the Census Bureau on Wednesday, January 30, 2013. SEAs are urged to submit accurate and complete data by Friday, March 15, 2013, to facilitate timely processing. Submissions by SEAs to the Census Bureau will be analyzed for accuracy and returned to each SEA for verification. All data, including any revisions to FY 2011 and FY 2012 data, must be submitted to the Census Bureau by an SEA not later than Thursday, August 15, 2013. Any resubmissions of FY 2011 or FY 2012 data by SEAs in response to requests for clarification, reconciliation or other inquiries by NCES or the Census Bureau must be completed by Tuesday, September 3, 2013. Between August 15, 2013 and September 3, 2013, States may also, on their own initiative, resubmit data to resolve data issues not addressed in their final submission of NPEFS data by August 15, 2013. All outstanding data issues must be reconciled or resolved by the SEAs, NCES, and the Census Bureau prior to September 3, 2013.

In order to facilitate timely submission of data, the Census Bureau will send reminder notices to SEAs in June and July of 2013.

Having accurate and consistent information on time is critical to an efficient and fair allocation process and to the NCES statistical process. To ensure timely distribution of Federal education funds based on the best, most accurate data available, NCES establishes, for program funding allocation purposes, Thursday, August 15, 2013, as the final date by which the NPEFS Web form or ED Form 2447 must be submitted. Any resubmissions of FY 2011 or FY 2012 data by SEAs in response to requests for clarification or reconciliation, or other inquiries, by NCES or the Census Bureau must be completed through the NPEFS Web form or ED Form 2447 by Tuesday, September 3, 2013. If an SEA submits revised data after the final deadline that result in a lower SPPE figure, its allocations may be adjusted downward or the Department may direct the SEA to return funds. SEAs should be aware that all of these data are subject to audit and that, if any inaccuracies are discovered in the audit process, the Department may seek recovery of overpayments for the applicable programs.

Note: The following are important dates in the data collection process for FY 2012:

January 30, 2013 |

SEAs can begin to submit accurate and complete data for FY 2011 and FY 2012. |

March 15, 2013 |

SEAs are urged to submit accurate and complete data for FY 2011 and FY 2012. |

August 15, 2013 |

Mandatory final submission date for FY 2011 and FY 2012 data to be used for program funding allocation purposes. |

September 3, 2013 |

Response by SEA’s to requests for clarification, reconciliation or other inquiries by NCES or the Census Bureau. All data issues to be resolved. |

If an SEA’s submission is received by the Census Bureau after August 15, 2013, the SEA must show one of the following as proof that the submission was mailed on or before that date:

1. A legibly dated U.S. Postal Service postmark.

2. A legible mail receipt with the date of mailing stamped by the U.S. Postal Service.

3. A dated shipping label, invoice, or receipt from a commercial carrier.

4. Any other proof of mailing acceptable to the Secretary.

If the SEA mails ED Form 2447 through the U.S. Postal Service, the Secretary does not accept either of the following as proof of mailing:

1. A private metered postmark.

2. A mail receipt that is not dated by the U.S. Postal Service.

Note: The U.S. Postal Service does not uniformly provide a dated postmark. Before relying on this method, an SEA should check with its local post office.

Electronic Access to This Document: The official version of this document is the document published in the Federal Register. Free Internet access to the official edition of the Federal Register and the Code of Federal Regulations is available via the Federal Digital System at: www.gpo.gov/fdsys. At this site you can view this document, as well as all other documents of this Department published in the Federal Register, in text or Adobe Portable Document Format (PDF). To use PDF you must have Adobe Acrobat Reader, which is available free at this site.

You may also access documents of the Department published in the Federal Register by using the article search feature at: www.federalregister.gov. Specifically, through the advanced search feature at this site, you can limit your search to documents published by the Department.

Authority: 20 U.S.C. 9543.

Dated:

John Q. Easton,

Director, Institute of Education Sciences.

Initial cover letter to respondents

Date

State Contact

State Address

Dear _________:

The National Center for Education Statistics (NCES) requests your state’s continued participation in the Fiscal Year 2010 National Public Education Financial Survey (NPEFS). The U.S. Census Bureau will once again act as the collection agency on behalf of NCES. Your participation in this voluntary survey is important as the data are used to allocate federal funds for education. In addition, the data are widely published as the official data on revenues and expenditures for public education in your state.

We have several methods for you to use to report your survey data. Most of our respondents use the Internet reporting option and we encourage you to utilize this time and cost saving alternative. As a part of the Internet application, we also offer the crosswalk software. All crosswalk users may upload their table files on line. Each Crosswalk state that logs into the application will be immediately directed to the Crosswalk section of the application to begin the processing of your state’s files.

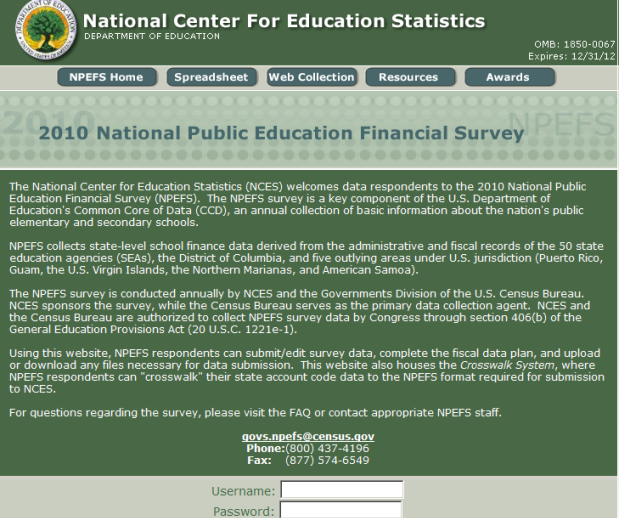

You may access the NPEFS questionnaire at http://suveys.nces.ed.gov/ccdNPEFS/. We have enclosed your new username and password, along with general instructions for accessing the Internet application. Note that detailed instructions for using the Internet application can also be found in Appendix A of the on-line instruction manual. You may contact our office at the numbers given below if you would like a hard copy of the NPEFS questionnaire and instruction manual. Crosswalk users will also find specific Crosswalk information and detailed instructions in a manual, also on-line.

Survey replies and data plans should be submitted directly to the Census Bureau by March 15, 2011. To request an extension, please contact the NPEFS staff at the U.S. Census Bureau, at 1(800) 437-4196 or (301) 763-1571. Please note that data submissions received after August 15, 2012 cannot be accepted for purposes of federal program allocations. Any resubmissions of FY 2010 or FY 2011 data by SEAs in response to requests for clarification, reconciliation or other inquiries by NCES or the Census Bureau must be completed by Tuesday, September 4, 2012. All outstanding data issues must be reconciled and/or resolved by the SEAs, NCES, and the Census Bureau prior to September 4, 2012. The Census Bureau address for Federal Express mailing, survey contact names, telephone numbers, and e-mail addresses are all located in the survey contact section of the instruction manual.

Sincerely yours,

Stephen Q. Cornman

Project Director

NATIONAL CENTER FOR EDUCATION STATISTICS

February 2011

The National Public Education Financial Survey Instruction

FY 2011 Instruction Booklet

U.S. Department of Education

Institute of Education Sciences

U.S. Department of Education

Arne Duncan

Secretary

Institute of Education Sciences

John Q. Easton

Director

National Center for Education Statistics

Jack Buckley

Commissioner

Elementary/Secondary and Libraries Studies Division

Jeffrey Owings

Associate Commissioner

Elementary/Secondary Cooperative System and Institutional Studies Program

Marie Stetser

Program Director

The National Center for Education Statistics (NCES) is the primary federal entity for collecting, analyzing, and reporting data related to education in the United States and other nations. It fulfills a congressional mandate to collect, collate, analyze, and report full and complete statistics on the condition of education in the United States; conduct and publish reports and specialized analyses of the meaning and significance of such statistics; assist state and local education agencies in improving their statistical systems; and review and report on education activities in foreign countries.

January 2012

Contact:

Stephen Q. Cornman

NCES

(202) 502-7338

NPEFS Staff

U.S. Census Bureau

(301) 763-1571

1 (800) 437-4196

TABLE OF CONTENTS

Figure 1: Responsibilities of NCES and Census 3

STEPS IN DATA COLLECTION CYCLE 5

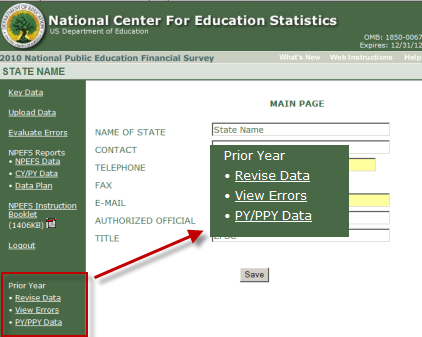

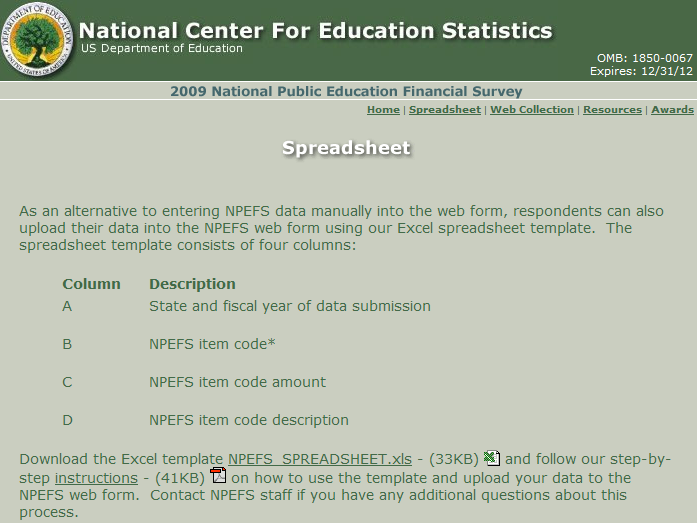

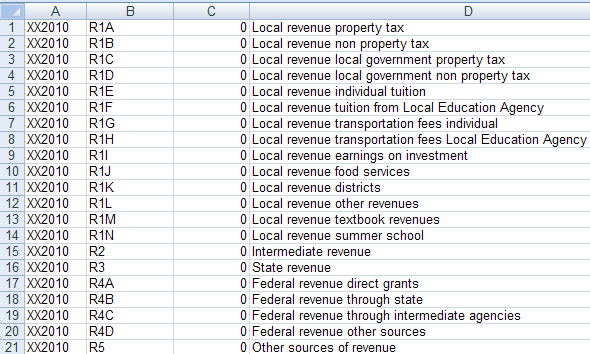

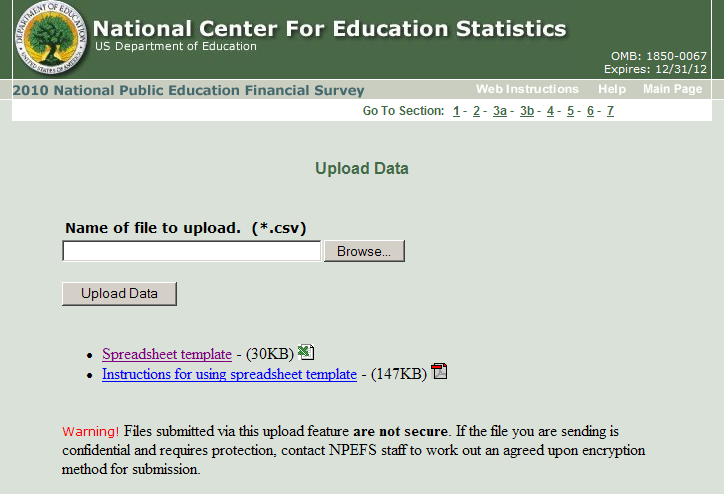

Instructions for Electronic Data Submissions 8

Instructions for Mail Submissions 8

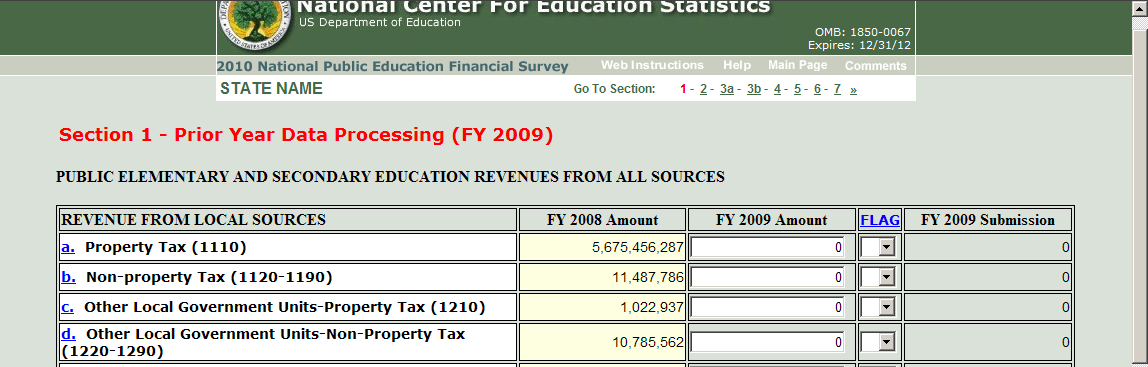

Instructions for Prior Year Data Submissions 9

DATA PREPARATION, COLLECTION, REVIEW, AND SUBMISSION 10

Fiscal Respondent Preparation Prior to Data Collection 10

PREPARING AND SUBMITTING COMPARABLE DATA 11

The Importance of Submitting Comparable Data 11

Ensuring Comparability of Submitted Data During Data Collection 12

Figure 3. Criteria for Distinguishing Supplies from Equipment 16

Completing the National Public Education Financial Survey 19

Data Review Prior to Submitting the NPEFS Survey 22

Federal Program Classifications 24

Universal Service Fund Schools and Libraries Program 24

NCES Support for Fiscal Respondents 27

PUBLIC ELEMENTARY AND SECONDARY EDUCATION REVENUES FROM ALL SOURCES 27

I. REVENUE FROM LOCAL SOURCES (1000) 29

Details for Revenue from Local Sources 30

II. REVENUE FROM INTERMEDIATE SOURCES (2000) 33

Details for Revenue from Intermediate Sources 33

III. REVENUE FROM STATE SOURCES (3000) 34

Details for Revenue from State Sources 34

IV. REVENUE FROM FEDERAL SOURCES (4000) 35

Details for Revenue from Federal Sources 35

V. OTHER SOURCES OF REVENUE (5000) 36

PUBLIC ELEMENTARY AND SECONDARY EDUCATION EXPENDITURES 37

Distinguishing Between Current and Total Expenditures 37

Programs Included in Current and Total Expenditures 38

Expenditure Categories Included in NPEFS Survey 40

II. SUPPORT SERVICES (2000) 47

Support Services—Students (2100) 49

Support Services – Instruction (2200) 50

Support Services – General Administration (2300) 51

Support Services – School Administration (2400) 53

Support Services – Operation and Maintenance (2600) 54

Support Services – Student Transportation (2700) 55

Support Services – Other (2500, 2900) 56

Central Support Services (2500) 57

Other Support Services (2900) 58

III. OPERATION OF NON-INSTRUCTIONAL SERVICES (3000) 59

Food Services Operations (3100) 59

Enterprise Operations (3200) 60

Expenditure Details for Direct Program Support 63

VI. FACILITIES ACQUISITION AND CONSTRUCTION SERVICES (4000) 64

Expenditure Details for Facilities Acquisition and Construction Services 65

Expenditure Details for Other Uses 67

VIII. COMMUNITY SERVICES (3300) 68

Expenditure Details for Community Services 68

Expenditure Details for Direct Cost Programs 70

XII. EXCLUSIONS FROM CURRENT EXPENDITURES FOR PURPOSES OF DETERMINING SPPE 72

Consolidating funds under ESEA 76

XIII. NET CURRENT EXPENDITURES 77

XIV. AVERAGE DAILY ATTENDANCE (ADA) 77

Current Expenditures and Average Daily Attendance 78

TABLE OF FIGURES AND APPENDICES

Figure 1: Responsibilities of NCES and Census…………………………………….……3

Figure 2. NPEF Schedule FY 2010 Data Collection…………….……………….….……6

Figure 3. Criteria for Distinguishing Supplies from Equipment…………………….…..16

Figure 4: Programs Included in Total Expenditures…………………………….……….39

Figure 5: Examples of Calculation of Average Daily Attendance (ADA) ……….……..80

Figure 6: Calculation of State Per Pupil Expenditures (SPPE)…………………….…….81

Appendix A: Internet Data Collection for the NPEFS Survey…………….…….………86

Appendix B: National Center for Education Statistics Internet Site……………..….….102

Appendix C: Governmental Accounting Reference Materials………………………….105

THE NATIONAL PUBLIC EDUCATION FINANCIAL SURVEY

OVERVIEW

The National Public Education Financial Survey (NPEFS) is a key component of the U.S. Department of Education's Common Core of Data (CCD), the annual collection of basic information about the nation’s public elementary and secondary schools. The CCD consists of six surveys: The School Universe Survey, Local Education Agency Universe Survey, Local Education Agency Finance Survey (F-33), State Non-fiscal Survey, Teacher Compensation Survey, and the National Public Education Financial Survey (NPEFS).

NPEFS collects school finance data derived from administrative and fiscal records from the 50 state education agencies (SEAs), the District of Columbia, and five outlying areas under U.S. jurisdiction: American Samoa, Northern Marianas, Guam, Puerto Rico, and the Virgin Islands.

HOW FISCAL DATA ARE USED

Federal Grants

Data from the NPEFS survey are used to calculate a State Per Pupil Expenditure (SPPE) that is used in the formula for allocating a number of federal program funds to states and school districts, including:

1. Title I (College and Career Ready Students) of the Elementary and Secondary Education Act (ESEA) of 1965 as amended by the No Child Left Behind Act of 2001;

2. Impact Aid; and

3. Indian Education.

Other programs make use of SPPE data indirectly because their allocation formulas are based, in whole or in part, on State Title I allocations. These include:

Educational Technology State Grants (Title II, Part D);

Education for Homeless Children and Youth Program under Title VI of the Stewart B. McKinney Homeless Assistance Act;

Teacher Quality State Grants Program (Title II, Part A); and

Safe and Drug-Free Schools and Communities Programs.

The data are used to determine grant allocations. State fiscal submissions and records may be audited by the Office of the Inspector General of the U.S. Department of Education, as well as authorized representatives of the Comptroller General of the United States. The Single Audit Act of 1984 requires that non-federal auditors and the U.S. General Accounting Office may conduct audits.

Please see the section in this manual entitled, “NCES Response,” for a discussion of overpayments of allocations and the recovery of funds.

Other Uses of NPEFS Data

NPEFS data are used by state and local officials, researchers and journalists to generate and compare state rankings in various categories of revenues and expenditures. They can also use the information in the Local Education Agency survey for information on school district finances by state. Researchers and private education trade groups also make use of the data supplied by NPEFS for papers, briefings, and background for presentations to private and public entities.

Publications

NCES publishes fiscal data reported by states in many different types of publications, ranging from the First Look series (tabular displays of fiscal data) to the annual Digest of Education Statistics. The most recent NPEFS First Look Publication TAB is Revenues and Expenditures for Public Elementary and Secondary Education: School Year 2007-08 (Fiscal Year 2008).

Other NCES publications include the 2009 Digest of Education Statistics and State Profiles of Public Elementary and Secondary Education. All NCES publications are available on-line at http://nces.ed.gov/ and hard copies of most NCES publications can be obtained for free by calling ED PUBS toll free at 1 (877) 433-7827.

U.S. CENSUS BUREAU

The Census Bureau is the collection agent for NPEFS. All survey data are collected by the Census Bureau and analyzed and edited before being sent to NCES. The relationship between the two agencies and responsibilities for the various aspects of collecting and publishing the data are illustrated below.

Figure 1: Responsibilities of NCES and Census

-

NCES

CENSUS

Sets all parameters and controls for NPEFS data collection;

Coordinates and publishes Federal Accounting Handbook;

Finalizes all scheduling;

Resolves all subject-matter and data issues;

Sets up all training sessions, workshops, and conferences;

Prepares data for Title I office;

Publishes and disseminates final data for all CCD surveys.

Collects data and maintains all databases;

Edits and analyzes data;

Sets-up and maintains all survey instruments including Internet site;

Maintains all aspects of crosswalk applications;

Participates in respondent training and conferences;

Maintains and runs imputation program;

Provides final data set of NPEFS data to NCES;

Coordinates and publishes

CCD Fiscal newsletter.

Data Collection

The Census Bureau collects NPEFS data several ways:

Internet application

Hard copy (mailed or hand–delivered)

Other electronic file

The Crosswalk application output (described below)

Fiscal Crosswalk Project

As part of the NPEFS survey, NCES funds the “Crosswalk Project.” This project creates a computer program that crosswalks data from a state’s format to the NPEFS survey administered by the Census Bureau. Participation in the Crosswalk Project is voluntary.

Through this project, an extensive study is made of the participating state’s accounting and reporting systems. A program for translating the data from the state’s system to the NPEFS survey is then developed with assistance and review by the state’s data coordinator. Detailed fiscal data from the state is then entered into the program, which combines or disaggregates the data as necessary to meet NPEFS requirements.

This process has identified difficulties the states are likely to encounter in attempting to report fiscal data in accordance with NCES standards. The Crosswalk Project has enabled NCES to tailor training to individual states and to develop a protocol for state fiscal coordinators to use in responding to the survey.

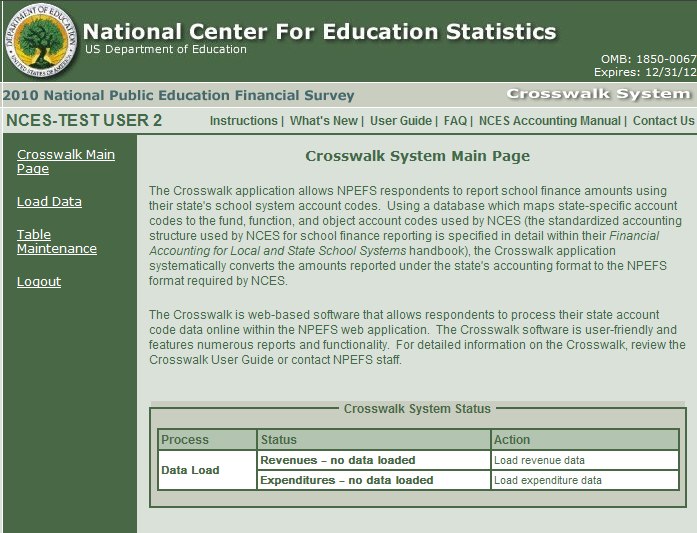

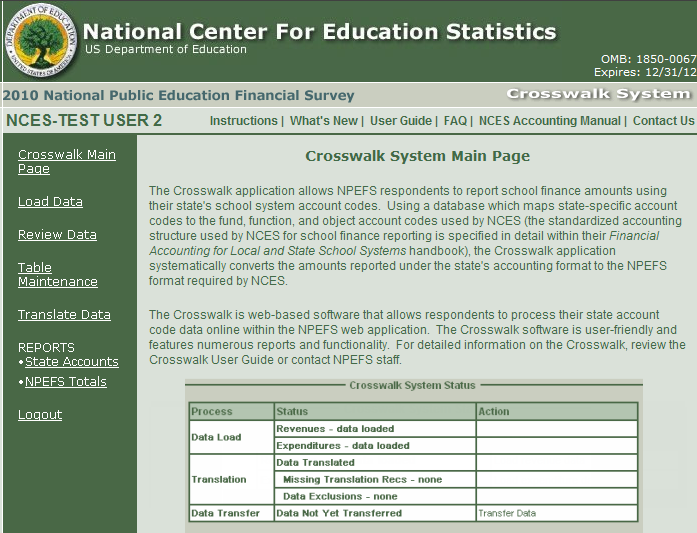

Since FY 2007, the Crosswalk software has been incorporated into the NPEFS Web application. The Crosswalk is now web-based (as opposed to downloadable) software that allows respondents to process their state account code data online within the NPEFS application. For detailed information on the new Crosswalk application or to become a new Crosswalk user, please contact Census staff.

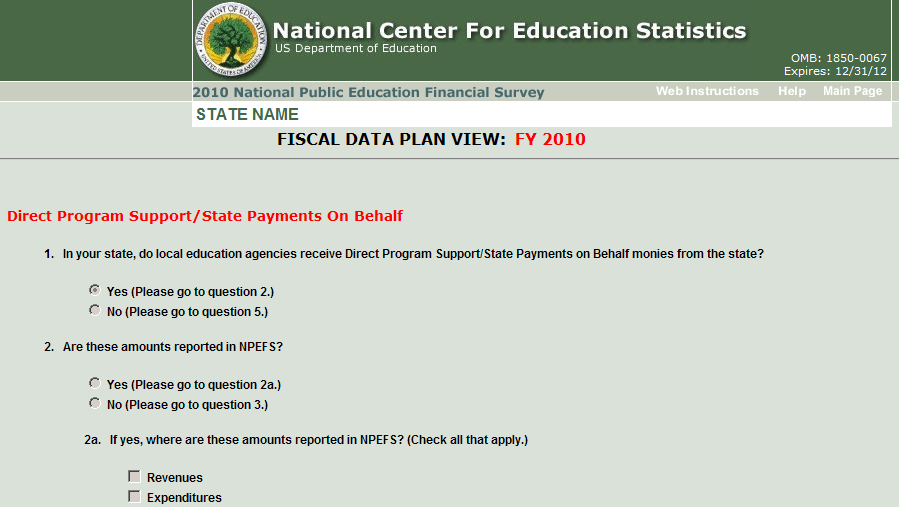

Fiscal Data Plan

The fiscal data plan is a brief survey that is completed online by each state. These questions help the Census Bureau and NCES to properly analyze each state’s data submission. The fiscal data plan:

Requests information about each state’s chart of accounts;

Catalogs each states response to questions raised about subject-matter areas, e.g., grants, change in reporting due to GASB statements; and

Gathers information about new initiatives that affect elementary-secondary fiscal reporting, e.g., school choice and charter schools.

STEPS IN DATA COLLECTION CYCLE

The data collection cycle begins with the issuance of the Federal Register Notice. This notice can be found on the Internet at: http://www.ed.gov/news/fedregister/index.html.

The Federal Register Notice outlines the authority for collecting this survey’s data and also lists the survey deadlines, submission methods, and contact information for NPEFS survey staff.

Census staff sends out a letter to all fiscal respondents. The letter includes the survey opening and closing dates and asks whether there are any states that wish to have their data “translated” using the crosswalk application.

Census mails out the survey package to all states and territories concurrent with the availability of the Internet site.

States can access the NPEFS website on January 31, 2012.

The first deadline for NPEFS submission is March 15th or as soon as possible thereafter.

The last day for original submissions of NPEFS data is August 15, 2012. This is also the last day to report revisions to the prior year’s fiscal data.

Any resubmissions of FY 2010 or FY 2011 data by SEAs in response to requests for clarification, reconciliation or other inquiries by NCES or the Census Bureau must be completed by Tuesday, September 4, 2012. All outstanding data issues must be reconciled and/or resolved by the SEAs, NCES, and the Census Bureau prior to September 4, 2012.

All reported data are reviewed and respondents queried about data anomalies.

A reported data file for the prior year containing all the state and territory is forwarded to NCES for their review.

The imputation program is run on all state’s data that do not report on standard, or have missing or combined new data.

The states review and concur with the imputed data for their state via e-mail.

NCES gives final review and concurrence on the entire data set.

The data is forwarded to the Title I office of the Department of Education.

Key data items are published by NCES in the “First Look” report and the complete data file is released on the NCES website.

This process is repeated with the current year data sets.

NPEFS Schedule FY 2011

The schedule for the NPEFS data collection cycle for Fiscal Year 2011 is in Figure 2.

Figure 2. NPEFS Schedule

NPEFS ScheduleFY 2011 Data Collection |

|

November 2011 |

Request for new crosswalk states |

February 15-17, 2012

|

Management Information Systems Conference |

January 31, 2012 |

NPEFS Officially Opens - Mail out survey letters - Survey and Fiscal Data Plan available on-line |

March 15, 2012 |

NPEFS Submission Initial Due Date |

March – September 2012

|

Editing and analysis of NPEFS Data |

April 2012 |

Non-response follow-up #1 |

June 2012 |

Non-response follow-up #2 |

July 2012 |

Summer Data Conference and Forum - CCD Awards |

Late July 2012 |

Non-response follow-up #3 - Chief State School Officer non-response letter |

August 15, 2012 |

- Last Day to submit FY 2011 NPEFS Data - Last Day to submit FY 2010 “One Year Later” revised NPEFS Data |

September 4, 2012 |

Response by SEA’s to response to requests for clarification, reconciliation or other inquiries by NCES or the Census Bureau. All data issues to be resolved. |

November2012 |

Imputed data on NPEFS website for review |

December 2012 |

NCES final review and concurrence |

January 2013 |

Final data to Department of Education Office of Elementary and Secondary Education (OESE) |

Survey Contacts

NCES

If you wish to address questions to the NCES Project Director, you may contact him at the listing below:

Stephen Cornman

National Center for Education Statistics

CCD School Finance Surveys

1990 K Street, N.W.

Suite 9104

Washington, D.C. 20006-5651

Telephone: (202) 502-7338

Fax: (202) 502-7490

Email: [email protected]

Census

Respondents should contact the NPEFS team at the Census Bureau with questions regarding proper procedures for completing the survey form (Telephone: 1(800) 437-4196, (301) 763-1571, FAX: (877) 574-6549 and e-mail [email protected]). The NPEFS staff consists of the following and may be reached at the phone number and fax number above:

Jumaane. N. Young: NPEFS Project Manager

Mary M. Church: Crosswalk Coordinator/Edit Programs/Survey Analyst

Janean M. Darden: Crosswalk/Survey Analyst

Shannon Doyle: Crosswalk/Survey Analyst

Kenneth Herrell: Survey Analyst

Kenneth. [email protected]

State CCD Coordinators

Every state education agency has a CCD coordinator who acts as a liaison between NCES and the state education agency (SEA) who facilitates NCES data requests. To obtain the name of the CCD coordinator for your state, contact your state department of education or visit the CCD web site list of coordinators at: http://nces.ed.gov/ccd/ccMembersFis.asp.

HOW TO SUBMIT FISCAL DATA

The NPEFS data (used for federal program allocations) must be submitted by 4 p.m. Eastern Standard Time on the Wednesday, August 15, 2012. The data may be submitted over the web or by mail.

NPEFS survey data is collected in several formats. You may mail a hard copy of the survey to the address listed below, or you may send in your survey data using one of the electronic formats made available through the Internet site. You may also submit NPEFS data by CD.

Instructions for Electronic Data Submissions

The URL for the Internet site is: http://surveys.nces.ed.gov/ccdnpefs.

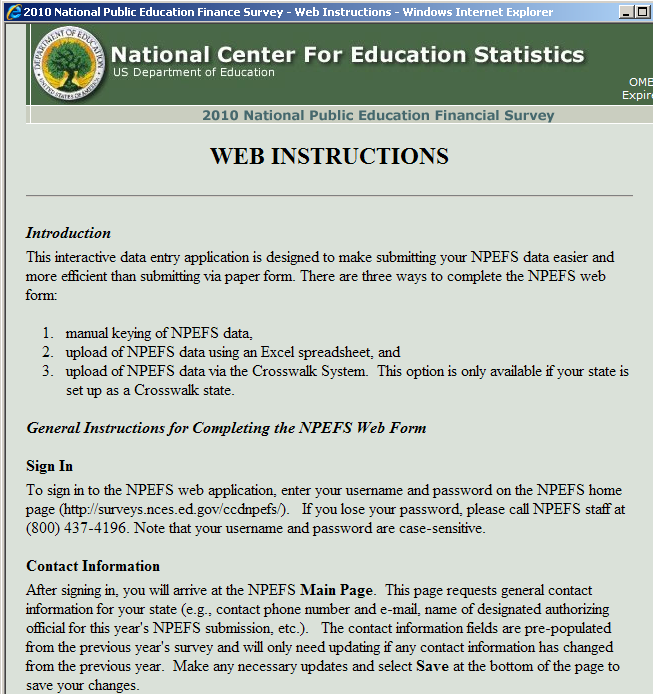

Complete instructions for electronic data submissions are in Appendix A.

Submitting Crosswalk Data

Instructions for the electronic processing and submission of NPEFS crosswalk data can be found online in the Crosswalk User’s Guide. This guide is available to all states that are participating in the crosswalk program for FY 2011.

Instructions for Mail Submissions

Regular mail submissions of the survey form must be postmarked by midnight August 15, 2012. Survey forms sent by express mail must be postmarked by midnight August 15, 2012. An SEA must show one of the following as proof of mailing:

A legible U.S. Postal Service dated postmark.

A legible mail receipt with the date of mailing stamped by the U.S. Postal Service.

A dated shipping label, invoice, or receipt from a commercial carrier.

Any other proof of mailing acceptable to the Secretary of the U.S. Department of Education.

If the survey form is mailed through the U.S. Postal Service, the Secretary does not accept either of the following as proof of mailing:

A private metered postmark.

A mail receipt that is not dated by the U.S. Postal Service.

Address: Mail the survey form to:

U.S. Census Bureau

Ms. Rosa Lindsey

ATTN: Governments Division

Washington, DC 20233-6800.

The address for FEDEX or U.P.S. or hand delivery is:

U. S. Census Bureau

Government Division

4600 Silver Hill Road

Suitland, Maryland 20746–6800

Instructions for Prior Year Data Submissions

For federal allocation purposes, NCES will only accept changes to fiscal data from SEAs for up to one year after the August 15th deadline. The revised data will go through the same edit process and will be published as final data about 18 months after the August 15th closeout. NCES will accept all changes to data for publication purposes. Changes or revisions must be received within one year of the closing date. Revisions that result in a decrease in SPPE will be forwarded to the Title I office. Please read “What’s New for FY 2011?” to learn more about prior year data submissions.

Record Keeping Requirements

Retain Documentation of Survey Preparation

Each state education agency must retain copies of completed fiscal survey forms and all documentation on the preparation of SPPE data for at least five years (as required by the U.S. Department of Education's regulations at 34 CFR 80.42). This documentation includes all finance and program records, supporting documents (such as worksheets and spreadsheets), statistical records, SEA publications, internal guidelines and control document, and any other records that are pertinent to program regulations or grant agreements.

For example, the FY 2011 survey (for the 2010-2011 school year) should be retained in state education agency archives until January 1, 2016.

Documentation Requirements

Documentation on the preparation of the fiscal survey should include the following information:

Name and title of the person who calculated the totals on the fiscal survey and his or her title;

The Department of Education reports used to obtain the aggregate numbers;

A list of the LEAs and other agencies (e.g., schools for the deaf) included or excluded from the calculations;

The item detail (spreadsheets) that resulted in each subtotal and total; and

Documentation for the average daily attendance calculation.

Working Files - Internal Guidelines

NCES strongly recommends that each SEA maintain spreadsheets, databases, or other working files of fiscal data each year. State education agencies should also develop guidelines and controls for the preparation of the fiscal survey. Establishing internal guidelines and controls is important because they provide continuity when staff assignments change and different individuals work on the survey.

Designation of Authorized State Official

The written memo designating the “authorized state official” who certified the accuracy of the fiscal submission also must be retained. Federal auditors from the Office of the Inspector General and nonfederal auditors frequently review fiscal survey submissions three to five years after they are submitted to NCES.

DATA PREPARATION, COLLECTION, REVIEW, AND SUBMISSION

Fiscal Respondent Preparation Prior to Data Collection

Obtain a copy of the Accounting Handbook. NCES requires all SEA staff that respond to the fiscal survey to adhere to the definitions and classifications in the NCES accounting handbook, Financial Accounting for Local and State School Systems, 2009 Edition (the “2009 Handbook”). States may order a free copy of the handbook from ED PUBS by calling 1(877) 433-7827. The publication number for the 2009 Handbook is 2009-325. The handbook is also available on line at: http://nces.ed.gov/pubsearch/pubsinfo.asp? . The NCES web site also has a tool for finding account codes by number or alphabetically by the account code descriptor at http://nces.ed.gov/pubs2009/fin%5Facct/codefinder.asp.

Although many states use accounting handbooks that differ from the 2009 Handbook, all states should complete the fiscal survey in accordance with the NCES handbook. In order to do this, some SEAs may have to disaggregate data reported by their LEAs and recombine the data to fit the categories specified in the 2009 Handbook. NCES questions survey responses that do not appear to conform to the generally accepted accounting principles and the 2009 Handbook specifications.

GAAFR. NCES also encourages fiscal survey respondents to become familiar with the Government Finance Officers Association (GFOA) publication, “Governmental Accounting, Auditing, and Financial Reporting, 2005 (GAAFR).” This document has gained widespread acceptance as an authoritative statement on the application of generally accepted accounting principles (GAAP) for state and local government.

Appendix C provides information on obtaining these publications by mail or on-line.

Obtain copies of your state’s chart of accounts and a copy of any instructions given to LEAs on reporting revenue and expenditure data to the SEA. Compare the state reporting requirements with those in the 2009 Handbook and determine where they are different.

Obtain copies of fiscal surveys submitted previously by your state. Try to obtain information about the steps taken to complete the survey in the past and about state guidelines or control documents that can assist you. Obtain information about special-purpose districts whose finances should be included in the survey and about expenditures by other agencies for, or on behalf of, LEAs that may not be included in LEA fiscal reports to the SEA.

PREPARING AND SUBMITTING COMPARABLE DATA

The Importance of Submitting Comparable Data

Data submitted by each state and territory in the NPEFS survey must be comparable between the states. The reasons comparable fiscal data are essential include:

Federal education program offices require comparable fiscal data for determining funding allocations to state and local education agencies. The multiple uses of fiscal data and the wide audience for publications that use the data require that SEA staff use the utmost care in responding to the fiscal survey.

Statistics from the financial survey are widely compared and analyzed to identify issues and trends in public elementary-secondary school finance and to assess the relative condition of school finance in each state.

State policy analysts and school finance researchers compare states on the basis of the reported data.

State-by-state comparisons appear in NCES publications and other U.S. Department of Education publications.

Ensuring Comparability of Submitted Data During Data Collection

Survey respondents can take the following steps to ensure that the fiscal data they submit to NCES are comparable to data submitted by other states.

Step One: Use the correct fiscal year.

Standard Fiscal Year

This year, we are collecting data for Fiscal Year 2011. For the purpose of this report, the fiscal year is the 12-month period beginning July 1 and ending June 30. Some states and LEAs use other fiscal years.

Non-standard Fiscal Year

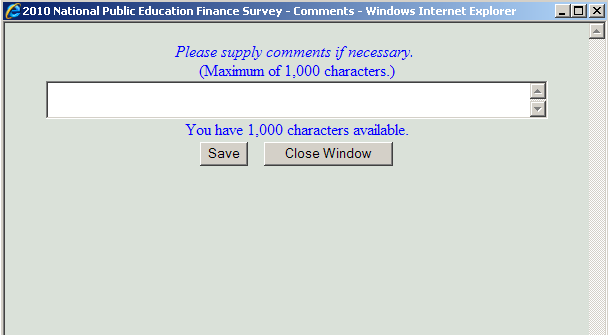

If your state is among those that use a different fiscal year, it is essential to point this out to the Census Bureau staff in a cover letter, e-mail, or “comments” section of the Internet form when submitting the survey.

For example, if a state’s 2011 fiscal year ends between July 1, 2010, and June 30, 2011 (e.g., December 31, 2010), the state need only inform Census in a cover letter of the fiscal year being reported (with exact dates). However, if the 2011 fiscal year ends after June 30, 2011 (e.g., August 31, 2011), the state should report revenues and expenditures as of the end of its fiscal year (in this example, August 31, 2011) and inform Census in a cover letter that it has done so. Fiscal data from states whose fiscal year end after June 30 of the reported fiscal year will be footnoted in NCES publications.

Step Two: Separate reporting for traditional and non-traditional prekindergarten-through grade-12 public education programs.

Co-curricular pre-K-12 education programs

The NPEFS survey collects data on both public elementary-secondary education programs and other programs funded by local school districts; however, only public elementary-secondary education program expenditures should be reported under the instruction, support services, and non-instructional services sections of the survey. Examples of public elementary-secondary education programs are:

Pre-kindergarten (programs from birth to kindergarten)

Head Start (if funded by school districts)

Special and vocational education

Summer school (even when students pay tuition to attend)

Food Services

Co-curricular activities

ROTC

Safety and driver education

Other programs

Programs outside of public elementary-secondary education should be reported under community services and direct cost programs as appropriate. Only revenues and expenditures of local education agencies (school districts) and those state government expenditures that go toward the operation of state schools should be reported on NPEFS. State direct support for and on behalf of school districts should be considered LEA expenditures for NPEFS reporting purposes. Expenditures for operating the state education agency should not be included in NPEFS. Examples of other programs are:

School construction

Day care

Head Start (if privately funded)

Adult education

Continuing education

Community/junior college

Community service programs

School district support for private education

Some states use public funds for programs that benefit both public and private school students (e.g., transporting private school students on public school buses). Expenditures for private school students should be reported on the survey in Part IV. Direct Program Support for Private School Students or in Part IX. Direct Cost Programs. Instructions for reporting the above nontraditional programs are more fully explained in later sections of this manual.

Step Three: Differentiate between Current Expenditures and Total Expenditures.

Exclude capital outlay and debt service

Current expenditures exclude capital outlay and debt service. The GAAFR defines capital outlays as expenditures resulting in the acquisition of or addition to the government's general fixed assets. Fixed assets are defined as “long-lived tangible assets obtained or controlled as a result of past transactions, events or circumstances” – including buildings, equipment, other improvements, and land.

Private sector accounting for fixed assets

In the private sector, fixed assets are often referred to as property, plant and equipment. The 2009 Handbook specifically excludes initial, additional, or replacement purchases of machinery and equipment (tools, trucks, cars, school buses, furniture, and furnishings) from current expenditures. This treatment of current expenditures may differ from state accounting practices and may make it necessary to make adjustments to current expenditures when responding to the fiscal survey.

Total expenditures include capital outlay and expenditures for programs that are outside of public elementary and secondary education. This category includes expenditures for the “other programs” as listed above.

Step Four: Distinguish between Supplies and Equipment.

Distinguishing between supplies and equipment is crucial to accurately reporting expenditures on the National Public Education Financial Survey. The 2009 Handbook specifies that purchases of supplies are considered current expenditures while equipment purchases are property expenditures. Property expenditures are included in total expenditures but not in current expenditures. Although state practices vary greatly on this subject, it is essential to adhere to the guidelines contained in the 2009 Handbook and this Instruction Booklet when responding to the fiscal survey. The decision tree is below in Figure 3, and on page E-5 (page 210 on the pdf file) of the 2009 Handbook.

The distinction between supplies and equipment is very important. The reasons are as follows:

Different accounting procedures are required for supplies and equipment.

Insurance requirements may also differ for supplies and equipment.

Some types of funds can only be used to purchase certain items; for example, some funds cannot be used to purchase equipment, and others may not be used to purchase supplies.

This distinction also affects comparisons of state per pupil expenditures and federal funding allocations to LEAs, which usually are based on current expenditures rather than total expenditures. Recall that supplies (600) fall within current expenditures while equipment is considered property (700), and property is excluded from current expenditures.

Criteria

NCES has developed a “decision tree” diagram (Figure 3, page 16) with five criteria for distinguishing between equipment and supplies (also in the 2009 Handbook, p. E-5 (page 210 on the pdf file)). An item is measured against each of the criteria, starting at the top of the decision tree. At the first “no,” the item is designated a supply. Only if the item meets all five criteria is it considered equipment.

The decision tree has a bias toward classification of items as supplies rather than equipment because of the long-term responsibilities that are assumed for an item identified as equipment. Unlike supplies, equipment must be inventoried each year of its useful life. Other accounting requirements for equipment include general fixed assets, subsidiary accession ledgers, tagging, and reconciliation of book balance to inventory.

Classifying items

By way of example, let us classify two items, a new personal computer and a flash drive. The computer is likely to meet the first criterion – “lasts more than one year.” But let us suppose that the computer begins to malfunction before a year is over. In most cases the computer would be repaired not replaced. Thus, the computer meets the second criterion – “repair rather than replace.” The process continues for the remaining criteria: Is it an independent unit? Is the cost of tagging and inventory a small percent of item cost? Did the cost exceed minimum dollar value for equipment established by state or other government unit? Finally, after there is a “yes” answer to all five criteria, the computer would be designated as equipment.

Now let us consider a flash drive. Although a flash drive might last for more than a year, when used up, it would be replaced not repaired. Thus, the response would be “no” to the second criterion, and the item would be declared a supply. Although it is not necessary to continue down the list, many of the criteria support the classification of diskettes as supplies rather than equipment. Flash drives are not independent units. Nor would the cost of keeping inventory on them represent a small percentage of the item cost. All of these criteria strengthen the classification of flash drives as supplies.

Final Determination for classification

While the criteria are helpful, survey respondents must exercise judgment in making a final determination about how to classify an item. This is particularly true for items where the distinction is unclear. It is important to remember that there are more stringent accounting requirements for any item designated as equipment and that such equipment must remain in the accounting system throughout its useful life.

Figure 3. Criteria for Distinguishing Supplies from Equipment

Step Five: Report revenue and expenditure items only once.

Double Counting by Dependent School Districts

“Double counting” of revenues and expenditures can occur when fiscal reports are submitted by overlapping political jurisdictions or when one LEA pays tuition to another to educate students who reside in the LEA that pays tuition.

Overlapping political jurisdictions sometimes report the same revenues or expenditures, particularly in the case of “fiscally dependent” school districts. These are districts that do not have the authority to raise revenues by levying taxes but that instead receive funds from another government entity such as a city or county. When an SEA allocates funds to a fiscally dependent school district, the funds are paid to a city or county government rather than directly to the dependent school district. The city or county government then transfers the revenue to the LEA.

As a result, both the school district and the city or county may report these funds as state revenue for education. Double counting may also occur if both the fiscally dependent school district and the city or county from which it receives funds report education expenditures (because the LEA is spending funds provided by the city or county).

Double Counting Tuition Payments by LEAs

Cases in which one LEA pays tuition to another for educating students may result from the particular organization of some school systems (e.g., several K-9 LEAs send their students to a regional high school that is part of a separate school district). This can also occur when students from one LEA attend school in another LEA in order to participate in a particular program or curricular offering not available in their home school district (e.g., an appropriate special education program for handicapped children). In some school districts (often termed non-operating LEAs), there are no school buildings within an LEA's boundaries and students residing in the LEA must attend school in another LEA.

Excluding tuition amounts from current expenditures

States must ensure that expenditures made by one LEA to another LEA in the same state are not included in current expenditure totals. Therefore, it is essential that tuition expenditures from LEAs within the state be accurately reported. This must be done to ensure that both the “sending LEA” and the “receiving LEA” are not reporting expenditures for the same child.

Including student counts in Average Daily Attendance

Federal regulations require that when one LEA pays tuition to another for students to be educated by the receiving LEA, the school district that pays tuition counts the students in ADA. The LEA making the tuition expenditure (sending LEA) should count the tuition expenditures and include the students in average daily attendance.

The LEA providing the education (receiving LEA) should claim any tuition received as revenue and may not claim the average daily attendance of any child for whom it receives tuition.

Step Six: Include expenditures made by SEAs for, or on behalf of, local school districts.

Retirement benefits

States often pay all or part of the retirement benefits for teachers and other LEA employees. They do so by transferring funds from the state treasury to the state employees' retirement fund.

Because school districts are bypassed in these transactions, LEAs do not report the funds to the SEA as either state revenues or as school district expenditures for employee retirement benefits. Yet these payments often represent a large percentage of an SEA's total revenues and expenditures, and substantial under-reporting can occur if the funds are not included in the survey.

Other on behalf payments

Textbooks, computers, student transportation, state textbook and computer purchases, student transportation programs, and school building construction programs are other examples of state revenues and expenditures that may not be reported by LEAs to the SEA. These revenues should be included in state revenues. State direct support expenditures for construction should be reported under Facilities Acquisition and Construction Services. State direct support for instruction, support services, and food services should be reported as expenditures in Part IV. Direct Program Support. It may be necessary for fiscal survey respondents to contact other agencies within their state government to determine if they are distributing revenues and making expenditures on behalf of LEAs in a particular state.

Step Seven: Include revenues and expenditures for special school districts.

Special service school districts

Special service school districts do not always report their revenues and expenditures to their SEAs (although they may report numbers of pupils served as well as numbers of staff and staff characteristics). Thus, survey respondents must take care to identify special LEAs within their states and to include education revenues and expenditures from those LEAs in the fiscal survey.

State education agency staff may need to contact other state agencies to alert them to the need to provide fiscal data for these special schools and school districts. Revenues and expenditures for these schools and school districts must be reported on the fiscal survey even if they are not classified in your state as “regular school districts” or “local education agencies.” However, it is also necessary to remove non-education costs such as medical and room and board costs, particularly in residential facilities.

Examples of special service school districts

Schools for handicapped

Juvenile custodial institutions

Other special education state-established entities

Schools for the deaf, blind, and mentally retarded

Charter schools

NOTE: It is important to remember that the SPPE is used only for determining federal program allocations – not for making state-by-state comparisons – because significant amounts have been subtracted by NCES from the SPPE figure. |

Step Eight: Use the correct method for reporting your state’s Average Daily Attendance (ADA).

ADA - state law

The Elementary and Secondary Education Act of 1965 requires that state education agencies calculate ADA in accordance with state law if such laws exist. Thus, if state law or regulation defines ADA, then the SEA must use that definition to calculate ADA for the NPEFS survey. The state has no discretion to use another method for calculating ADA.

Survey respondents should become familiar with any state laws regarding average daily attendance as well as instructions or rulings regarding ADA by the Attorneys General of their states.

ADA - NCES definition

However, if there is no state law or regulation regarding ADA, a state may use the definition provided by NCES. That definition requires an SEA to collect attendance figures from each school or school district in the state on a daily basis and to divide that amount by the actual number of days the school or district is in session. The resulting figures are then added for the entire state.

Regardless of which method is used, states should report an ADA figure that includes every school district, local education agency, and special school for which expenditures are reported.

A more detailed discussion of ADA is in the Expenditures section of this manual.

Completing the National Public Education Financial Survey

The Department of Education requests that each state submit responses for the fiscal data plan and the NPEFS survey. There are several steps that will assist respondents in completing the fiscal survey and ensure that the data are complete and accurate. These steps are particularly important for those who are providing CCD fiscal data to NCES for the first time. Although the Census Bureau has provided several means for reporting your survey data, these instructions may be applied to all submissions.

1. Rounding

Round all numbers to the nearest whole dollar before entering them on the survey. Any value of 0.5 and above should be rounded up, any value below rounded down. Examine one significant digit after the decimal point. For example, 1.50 would be treated as 2, while 1.49 would be treated as 1.

2. Missing and Not Applicable Data

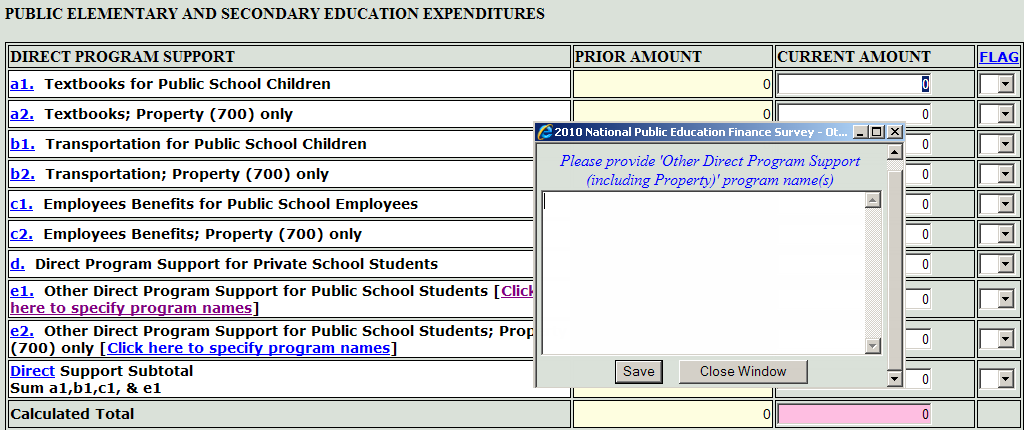

Within the NPEFS Web application, all cells are initially set to zero. When a revenue or expenditure has a reported value of zero, respondents should select the appropriate flag to identify the data item(s) as missing or not applicable.

Not Applicable – No revenue was received or expenditure made, which makes the item not applicable; or

Missing – Revenue was received or an expenditure occurred, but the value of that transaction is missing.

In both cases, the reported value should be “0.” Differentiate between “missing” and “not applicable” data by selecting “missing” (M) or “not applicable” (N) from the flag field drop-down box.

For missing data, please indicate in the comment box (on the web collection site) when the data will become available, or if data for this item are included in another reported item, or any other information that explains why the data are missing.

We expect every state to report expenditures of over $1,000 for each of the following items:

A. Revenues

1. Local Revenues

At least one of four tax revenue items

Individual Tuition

Tuition from other LEAs within state

Earnings on Investments

Food Service

Student activities

2. State Revenue

3. Federal Revenues

Direct – to LEAs

Indirect – through State Governments

Other Federal Revenues

B. Expenditures

1. Current (every item)

Instruction

Support Services

Food Services

2. Other Expenditures

a) Facilities acquisition and construction services expenditures

i) Non-Property (construction)

ii) Existing Buildings and Land (subtotal)

iii) Equipment (for new and renovated schools)

b) Other Uses - Debt Service

i) Interest and redemption of principal

3. Community services expenditures

a) Non-Property

b) Property

4. Exclusions for Title I

Title I Expenditures

Title I Carryover Expenditures

5. Average Daily Attendance

3. Negative Data

Negative numbers are not acceptable responses to the items in this collection. This survey requests data on revenues and expenditures made by public elementary and secondary education agencies in the state. Although negative expenditures are sometimes used in fund accounting, they are not appropriate for reporting expenditures made for specific functions and objects.

4. Authorization of NPEFS Submission by Authorizing Official

In the designated boxes on the cover sheet or using the options provided by the NPEFS web form, provide the name of the responding state and the name and telephone number (including area code and extension) of the person preparing the report. Also, provide the name, title, and signature of the “authorized state official” that must certify the accuracy of the fiscal submission.

NCES requests that this be a fiscal official at the highest level in the SEA (e.g., Assistant Commissioner for Finance, Assistant Commissioner for Research). For the purpose of certifying the accuracy of the NPEFS report, the individual designated as the “authorized state official” MUST have been approved, in writing, by the Chief State School Officer (CSSO).

See Appendix A. for information on the web options for authorization by the designated state official.

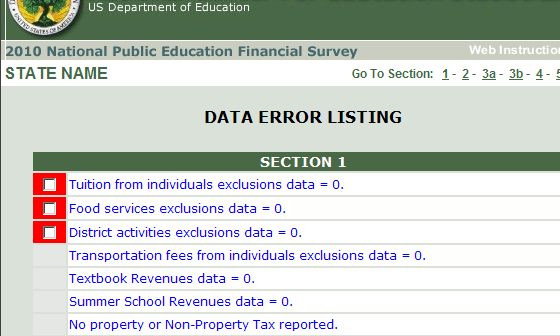

Data Review Prior to Submitting the NPEFS Survey

Check all subtotals and totals prior to submitting NPEFS data to NCES.

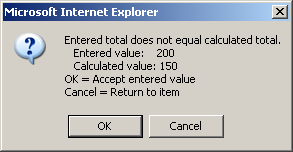

The most common errors made in completing the survey are mistakes in adding up the subtotals to determine the correct totals. The Internet form has calculated totals for each subtotal and total field. A message will appear in a dialogue box if an addition error is made. These errors are designated in the web editing system as “must fix”. You will not be able to send your NPEFS data until you have made corrections to all addition errors. See Appendix A. for more information about calculated totals in the Internet application.

Make certain to compare the fiscal data for the current year with fiscal data from the previous year.

Large differences may indicate errors such as “double counting” (e.g., placing an item under “Support Services” when it has already been included in “Instruction”) or failure to include an expenditure object (e.g. salaries) in a total. Dramatic changes in revenues or expenditures may mean that some LEAs have been erroneously included or excluded, or that a change to a states chart of accounts has meant reclassifying some revenue or expenditure items. Dramatic changes in average daily attendance may indicate double counting of students, or missing schools or districts from the attendance calculation.

Review the section in this instruction booklet entitled “Record Keeping Requirements.”

Identify the records, notes, and other materials that must be retained in the event of an audit or to assist a future staff member in understanding how the submitted numbers were compiled.

Make certain that the survey is signed or an electronic confirmation is supplied by the “authorized state official.”

This person has been designated to certify the accuracy of the submission.

-

NOTE: Initial survey data are due on March 15 of each year or as soon thereafter as possible. If an SEA cannot submit fiscal data by this deadline, the SEA should inform Census in writing of the delay and note the date by which the SEA will be able to submit the fiscal data.

NCES Response

The Census Bureau, under NCES directives, enters the data from each state's fiscal survey data into an electronic database and performs edit procedures to check for internal and longitudinal consistency. Examples of these edits are:

1. Add-Check Errors (summed values are incorrectly reported)

2. Total Revenues less than Current Expenditures

3. Instruction subtotal less than 50% of Total Current Expenditures

4. Employee Benefits greater than Salaries in any function

5. Current Expenditures for function are reported, without Property Expenditures

6. Facilities Acquisition and Construction Services (FACS) – Non-Property amount less than 50 % of Total FACS Expenditure

7. Current Expenditures increase more than 12% or decrease more than 10%

8. Exclusions subtotal increase more than 12% or decrease by more than 10%

9. Average Daily Attendance increases by more than 5% or decrease by more than 2%.

Response to Questionable Data

Questionable entries are referred to the SEA for verification or correction before publication. All state submissions are acknowledged with letters that include a summary of questions raised during the editing procedures. NCES strongly recommends that states respond in writing to resolve any questions addressed in these letters. All data collected by the Census Bureau is transmitted to NCES for their review and concurrence.

Notification of Chief State School Officers (CSSOs)

NCES may write to Chief State School Officers to remind them of the March 15 or August 15 response dates. However, states bear the full responsibility for ensuring that fiscal data are submitted to NCES on or about March 15 and that the data have been certified as accurate by the “designated state official.” States also bear the full responsibility for responding to questions raised in letters sent to the NPEFS/CCD state coordinator and for revising fiscal data submissions by 4:00 p.m. no later than the Wednesday, August 15, 2012.

Recovery of Overpayments

SEAs should be aware that all fiscal data are subject to an audit and that the U.S. Department of Education may seek to recover overpayments based on inaccurate SPPE data for the applicable programs.

OTHER CONSIDERATIONS

Federal Program Classifications

Congress routinely makes changes in the funding levels, purposes, and even titles of federal education programs. More than half of the programs listed in the 1980 NCES accounting handbook were combined into block grants or discontinued by 1990. In order to build flexibility into the National Public Education Financial Survey and allow for the possibility of annual changes in federal education aid programs, no list of programs has been included in either the 2009 Handbook or the Instruction Booklet.

Catalog of federal programs

Fiscal survey respondents are urged to become familiar with the Catalog of Federal Domestic Assistance (CFDA), an annual publication of the General Services Administration. The CFDA lists, describes, and provides uniform code numbers for all federal aid programs including those funded by the U.S. Department of Education. The Catalog is published every June and the catalog update is published every December. It lists over 1,000 assistance programs administered by more than 50 federal agencies classified by types of assistance. The U.S. General Services Administration distributes a limited number of the catalogs at no charge to federal, state, and local government offices. The URL for the website is http://www.cfda.gov and staff can be contacted toll-free at 1-866-606-8220.

A computerized system is available to answer specific queries regarding domestic assistance programs listed in the catalog. For information on the use of the Federal Assistance Programs Retrieval System (FAPRS), call the Federal Domestic Assistance

Catalog Staff at the telephone number above.

Initiatives and Programs

State and federal initiatives and programs require that special instructions be included in the manual to advise respondents on the appropriate classification of their revenues and expenditures. Below are descriptions of two programs: the Universal Service Fund and Charter Schools.

Universal Service Fund Schools and Libraries Program

On May 7, 1997, the Federal Communications Commission (FCC) adopted a Universal Service Order implementing the Telecommunications Act of 1996. The order was designed to ensure that all eligible schools and libraries have affordable access to modern telecommunications and information services. Up to $2.25 billion annually is available to provide eligible schools and libraries with discounts for approved goods and services. This discount is often referred to as the “E-rate” and administered by the Universal Service Fund. The Federal Communications Commission (FCC), established the fund to provide for affordable access to specified telecommunications services for all communities, regardless of location or economic strata.

Universal Service Administrative Company

The not-for-profit Universal Service Administrative Company (USAC) is responsible for administering the Fund under the direction of the FCC. The Schools and Libraries Division of the USAC administers the schools and libraries (SL) program. This program is popularly referred to as the E-rate program.

Discounts for schools and libraries

Eligible schools and libraries are a part of this program and may receive discounts, ranging from 20 percent to 90 percent, on authorized telecommunication goods and services. The level of discount is dependent on economic need and location (urban or rural) and is based upon the percentage of students eligible for participation in the National School Lunch or other federally approved alternative mechanisms contained in the Improving America’s Schools Act. Libraries use the discount percentage of the school district in which they are located.

Discounts can be applied to commercially available telecommunications services, Internet access, and internal connections. Eligible services range from basic local and long distance phone services, and Internet access services, to acquisition and installation of equipment to provide internal connections. You may find additional information on this program at http://www.universalservice.org/.

NPEFS Reporting Instructions for Universal Service Discounts and Revenues

If public school districts in your state are participating in the Universal Service SL program, you should account for the revenues or expenditures on the NPEFS survey as follows:

Any Universal Service Fund SL discounts received during the same fiscal year should not be reported as revenue.

Any retroactive revenues for previous fiscal years that are received in the current fiscal year via the SL program should be reported “other local revenues” Revenue code 1990.

Any school district expenditures made as a part of the SL program should be reported in NPEFS under Support Services-Instruction (function 2230), Support Service-Other Support Services (function 2580), or Facilities Acquisition and Construction Services (for improvements to the property, e.g., wiring, function 4000) and in the appropriate object class (purchased services (object 530), supplies (object 650), or property (objects734 or 735), for each function.

Charter Schools

A public school charter is generally formed by a contract between an organization and a state or local education agency. The charter or contract authorizes that organization to manage a school’s operations outside of many of the rules and regulations governing public schools in the surrounding district.

NPEFS reporting instructions for charter school revenues and expenditures

Public revenues and expenditures and average daily attendance for charter schools should be reported on the NPEFS form unless these data have already been included in data from LEAs in your state. Funding for charter schools in some states flows directly to charter schools. In other states, funding flows through LEAs. In any case, double counting of data must be avoided.

Report charter school revenues with regular public school revenues

If not otherwise included, public charter school revenues should be reported along with revenues for regular public schools under the appropriate source. Don’t forget to include student fees for textbooks, student activities, etc., in the local revenue items. If you are not getting this information from the charter schools in your state, then you should provide a best estimate.

Break out expenditures into functions/objects

If possible, the expenditures should be broken out into the functions and objects requested on the NPEFS form. However, if this is not possible, report the expenditures as a total figure under “Expenditures Part IV, Direct Program Support, e. Other Direct Program Support for Public School Students.” Add a note identifying the reported amount as charter schools expenditures.

Reporting “Exclusions” data

Expenditures from Title I must be reported with other Title I expenditures in the section titled “Exclusions from Current Expenditures for SPPE” near the end of the form.

Include average daily attendance for charter schools

The average daily attendance calculation should include students attending charter schools. These students should be treated the same as other public school students in the formula to calculate average daily attendance.

NCES Support for Fiscal Respondents

Processing Assistance

NCES and the Census Bureau offer training and other types of assistance to states responding to the fiscal survey. NCES and Bureau personnel are available to guide the state coordinators through the survey process by providing answers to processing and subject-matter questions throughout the survey processing cycle. States are encouraged to contact either agency with questions about definitions and classifications in the survey.

In addition, the Bureau takes steps to ensure that all states respond before all final deadlines and that the appropriate submission procedures are followed.

Conferences and Workshops

The NCES Elementary and Secondary Education Data Conference held each summer provides training, at NCES expense, for selected SEA personnel who complete the fiscal survey. NCES also holds workshops and trainings at the Management Information Systems conference every spring. Details are available approximately three months before each conference at http://ies.ed.gov/whatsnew/conferences/.

CCD Internet Site

The CCD web site (http://nces.ed.gov/CCD) also has links to the published data, this instruction booklet, and data and file documentation for the most recent NPEFS survey. Published data files can be accessed through the ‘Data Resources’ drop-down menu. CCD publications, handbooks, and other resources can be found on this site as well.

PUBLIC ELEMENTARY AND SECONDARY EDUCATION REVENUES FROM ALL SOURCES

Discussion of Revenues

The 2009 Handbook defines revenues as additions to assets that do not increase any liability, do not represent the recovery of expenditure, and do not represent the cancellation of certain liabilities without a corresponding increase in other liabilities or a decrease in assets. The GAAFR adds that revenues are “increases in net current assets of a governmental fund type from other than expenditure refunds and residual equity transfers. General long-term debt proceeds and operating transfers in are classified as other financing sources' rather than as revenues.”

Modified accrual accounting. The GAAFR states, “Governmental fund revenues should be recognized when they become measurable and available.” The implication of recognizing revenue when it becomes measurable and available is apparent when one considers local property tax revenue. Generally, property tax revenue is recorded even if received as much as 90 days after the end of the fiscal year if the property tax has been billed and property owners are expected to pay promptly. Notice that property tax abatements (reductions) have already been determined and that the school district knows the amount of revenue it expects to collect. In addition, the revenue becomes available when billed.

Cash basis accounting. Contrast the approach described above with that of school districts whose accounting systems are on a cash basis. Such school districts would only recognize property tax revenue when received. At the beginning of a property tax collection cycle, these districts may appear to be operating without local property tax funds.

Revenue from “other sources.” The 2009 Handbook notes that revenue from “other sources” including receipts from bond sales and inter-fund transfers are not considered revenues to LEAs. Typically, bonds are sold to finance long-term construction and property acquisition – not to finance current operations. Inter-fund transfers are not considered revenue because the same revenue would be counted twice: first, when collected and recorded in one fund, and again when transferred to another fund.

The four major sources of revenue: local, intermediate, state, and federal. The revenue code number from the 2009 Handbook is provided in parentheses. Each of these sources is described below.

I. REVENUE FROM LOCAL SOURCES (1000)

Definition

Revenue from local sources refers to money produced within the boundaries of an LEA that is available for the use of the LEA. These revenues include money collected by another government unit for use by an LEA – for example, revenue raised by a municipal government to fund a dependent school district. School districts that do not have the authority to raise funds directly and that, instead, receive revenues from another unit of government are dependent school districts. Those that have the authority to raise funds directly through local taxes are independent school districts. Revenue from local sources includes shared revenue – funds raised by another unit of government and shared in proportion to the amount collected within the LEA.

SECTION 1 |

||

|

||

PUBLIC ELEMENTARY AND SECONDARY EDUCATION REVENUES FROM ALL SOURCES |

||

|

|

|

|

|

|

REVENUE FROM LOCAL SOURCES (1000) |

Current Amount |

Flag |

a. Property Tax (1110) |

|

|

b. Non-property Tax (1120-1190) |

|

|

c. Other Local Government Units-Property Tax (1210) |

|

|

d. Other Local Government Units-Non-Property Tax (1220-1290) |

|

|

e. Tuition from Individuals (1310) |

|

|

f. Tuition from other LEAs within the State (1321) |

|

|

g. Transportation Fees from Individuals (1410) |

|

|

h. Transportation Fees from other LEAs within the State (1421) |

|

|

i. Earnings on Investments (1500-1540; not 1532) |

|

|

j. Food Services (excluding federal reimbursements) (1600-1650) |

|

|

k. District Activities (1700-1790) |

|

|

l. Other Revenue From Local Sources (1320-1350, 1420-1440, 1800, 1900-1990; not 1321, 1421,1940) |

|

|

m. Textbook Revenues (1940) |

|

|

n. Summer School Revenues (1312) |

|

|

LOCAL SOURCES OF REVENUE SUBTOTAL (1000) [Sum a-e, g, i-n.] |

|

|

Details for Revenue from Local Sources

Property Tax (1110). These are “ad valorem” taxes levied by an LEA on the assessed value of real property (e.g., dwellings and commercial property) and personal property (e.g., automobiles, boats) located within the LEA. However, penalties and interest are reported under non-property tax (1140) below. DO NOT report property taxes that go to dependent school districts here; report them in c. Other Local Government Units – Property Tax. State education agencies should instruct LEAs filing comprehensive annual financial reports (CAFRs) to include property taxes billed within the school year and collected within 60 days of the close of the school year.

b. Non-property Tax (1120-1190). These taxes include sales and use taxes (1120) imposed upon the sale and consumption of goods and services; income taxes (1130) levied on individuals, corporations, and unincorporated businesses; penalties and interest (1140) on late and delinquent taxes; and “other taxes,” such as, revenue raised through licenses and permits. DO NOT include non-property taxes that go to dependent school districts here; report them in 1220-1290.

c. Other Local Government Units – Property Tax (1210). This category is used to report property taxes raised by a unit of government for use by a dependent school district. DO NOT include penalties and interest here.

d. Other Local Government Units—Non-property Tax (1220-1290). This category is used to report non-property taxes raised by a governmental unit for use by a dependent school district. These taxes include sales and use taxes (1220); income taxes (1230) on individuals, corporations, and unincorporated businesses; penalties and interest (1240) on late or delinquent taxes; revenue in lieu of taxes (1280); and “other taxes” (1290).

e. Tuition from Individuals (1310). Tuition paid by an individual to attend school in an LEA other than the one in which he or she resides.

f. Tuition from Other LEAs Within the State (1321). Tuition from one LEA to another within the same state for educating students (e.g., an LEA receives tuition from another LEA to provide a special program for a student that is not available in the LEA where the student resides). (NOTE: Tuition from LEAs outside the state should be reported in Other Local Revenues.)