Form 1025 2017 1025 Q_FEMA - NFIP_Adjuster Functional_20170901

E-Government Website Customer Satisfaction Surveys

2017 1025 Q_FEMA - NFIP_Adjuster Functional_20170901.xlsx

2017 1025 Q_FEMA - NFIP_Adjuster Functional_20170901

OMB: 1090-0008

⚠️ Notice: This form may be outdated. More recent filings and information on OMB 1090-0008 can be found here:

Document [xlsx]

Download: xlsx | pdf

Welcome and Thank You Text

Model Questions

Custom Questions

Overview

How to read this fileWelcome and Thank You Text

Model Questions

Custom Questions

Sheet 1: How to read this file

| Welcome and Thank You Text | ||||||

| The text you see here will appear at the top and bottom of your survey. Default text is included and you may modify this text as needed. | ||||||

| Model Questions | ||||||

| As discussed during the kick-off call, the model questions are part of the ForeSee methodology. For consistency within the model, these questions are standardized and have been tested and validated. Standardization of model questions allows benchmarking across companies/industries, and these questions are used in calculating scores and impacts. | ||||||

| Focus on the future behaviors; I’ve started with some that I believe are a good fit but we can certainly make adjustments. These are desired customer outcomes that are impacted by customer satisfaction. | ||||||

| Custom Questions | ||||||

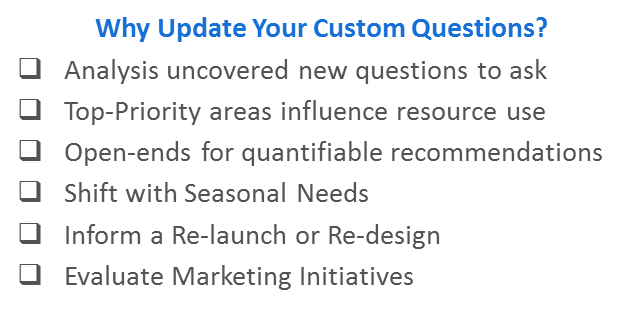

| When reviewing the custom questions tab, keep in mind these questions are used for segmentation analysis of the model data. It is suggested that you add, delete or change custom questions over time, as your needs or business objectives change. | ||||||

| Focus Area #1: Achieving Actionable Data - Know what changes are being made based on the intelligence - Change Custom Questions so that stakeholders see a clear “must do” |

||||||

| Focus Area #2: Aligning Data to Business Strategies - Update your Custom Questions as business cycles change - Integrate Executive Level questions to evaluate initiatives |

||||||

| Focus Area #3: Strategic and Tactical Value - Influence Board Room Decisions - Change Operational Approaches - Mature Your Research |

||||||

Sheet 2: Welcome and Thank You Text

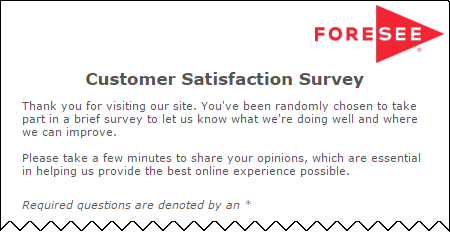

| The text you see here will appear at the top and bottom of your survey, examples below. | |||||

| Default text is included and you may modify this text as needed. | |||||

| Welcome and Thank You Text | |||||

| Welcome Text | |||||

| This survey is geared for adjusters who have worked on flood insurance claims. The National Flood Insurance Program (NFIP) would like to hear from you given your unique perspective. If you have been working the filed for awhile, please consider your most recent set of experiences when providing your opinions in this survey. By taking this brief survey, your input will help improve our process for both you the adjuster and the customers we work with. |

|||||

| Thank You Text | |||||

| Thank you for taking our survey and for helping us serve you better. |

|||||

| Example Desktop | |||||

|

|||||

|

|||||

Sheet 3: Model Questions

| Model Name | NFIP Adjuster Functional | |||||||

| Model ID | Underlined & Italicized: Re-order | |||||||

| Partitioned | No | Pink: Addition | ||||||

| Date | 9/1/2017 | |||||||

| Model Version | NA | Blue: Reword | ||||||

| Label | Element Questions | Label | Satisfaction Questions | Label | Future Behaviors | |||

| Satisfaction | Recommend Company (1=Very Unlikely, 10=Very Likely) |

|||||||

| 1 | Satisfaction - Overall | What is your overall satisfaction with the process for adjusting NFIP flood insurance claims? (1=Very Dissatisfied, 10=Very Satisfied) |

4 | Recommend Company | How likely are you to recommend purchasing NFIP flood insurance to someone else? | |||

| 2 | Satisfaction - Expectations | How well does the NFIP process for adjusting claims meet your expectations? (1=Falls Short, 10=Exceeds) |

Trust (1=Not at all Trustworthy, 10=Very Trustworthy) | |||||

| 3 | Satisfaction - Ideal | How does the NFIP process compare to your ideal process for adjusting an insurance claim? (1=Not Very Close, 10=Very Close) |

5 | Trust | Please rate your level of trust in NFIP flood insurance. | |||

| Continue in Role (1=Very Unlikely, 10=Very Likely) |

||||||||

| 6 | Continue in Role | How likely are you to continue to accept NFIP policy claims adjustment work in the future? | ||||||

Sheet 4: Custom Questions

| Model Name | NFIP Adjuster Functional | |||||||

| Model ID | 0 | Underlined & Italicized: Re-order | ||||||

| Partitioned | No | Pink: Addition | ||||||

| Date | 9/1/2017 | Blue: Reword | ||||||

| QID | Skip From | Question Text | Answer Choices | Skip To | Required Y/N |

Type | Special Instructions | CQ Label |

| How often is the initial info you receive to support a request to adjust an NFIP flood insurance claim complete? | Under 10% of the time | A | Y | Radio button, one-up vertical | Skip Logic Group* | Initial Info Lacking | ||

| 10% to 30% of the time | A | |||||||

| 31% to 50% of the time | A | |||||||

| 51% to 70% of the time | A | |||||||

| 71% to 90% of the time | A | |||||||

| Over 90% of the time | ||||||||

| A | If there are certain initial type(s) of information you most commonly find to be missing, please tell us about them here. | N | Text area, no char limit | Skip Logic Group* | OE_Initial Info Lacking | |||

| How often is the property owner typically on site when you visit? | Under 10% of the time | A | Y | Radio button, one-up vertical | Skip Logic Group* | Owner On Site | ||

| 10% to 30% of the time | A | |||||||

| 31% to 50% of the time | A | |||||||

| 51% to 70% of the time | A | |||||||

| 71% to 90% of the time | A | |||||||

| Over 90% of the time | A | |||||||

| I rarely if ever work on site | ||||||||

| A | How often do you feel the property owner understands your role and how it impacts their flood insurance claim? | Under 10% of the time | B | Y | Radio button, one-up vertical | Skip Logic Group* | Owner Understanding | |

| 10% to 30% of the time | B | |||||||

| 31% to 50% of the time | B | |||||||

| 51% to 70% of the time | B | |||||||

| 71% to 90% of the time | B | |||||||

| Over 90% of the time | ||||||||

| B | Please tell us what you most commonly hear about from property owners about what they don't understand. | N | Text area, no char limit | Skip Logic Group* | OE_Owner Concerns | |||

| How long does it typically take until you receive notice of an examiner's review of your initial adjuster report? | Usually within a week | Y | Radio button, one-up vertical | Examiner Review Timing | ||||

| 2 weeks | ||||||||

| 3 weeks | ||||||||

| 4 weeks | ||||||||

| 5 or 6 weeks | ||||||||

| More than 6 weeks | ||||||||

| How often have you had to update your preliminary adjuster report after the examiner reviews it? | Never or very rarely | Y | Radio button, one-up vertical | Skip Logic Group* | Update Examiner Requests | |||

| Infrequently | ||||||||

| Sometimes | A | |||||||

| Frequently | A | |||||||

| Always or very frequently | A | |||||||

| A | Do you find that specific examiners request more updates than others? | Yes | Y | Radio button, one-up vertical | Skip Logic Group* | Updates Examiner Specific | ||

| No | ||||||||

| Don't know | ||||||||

| How often does the examiner request a change in the loss value assessment following your submission of preliminary or updated adjuster reports? | Never or very rarely | Y | Radio button, one-up vertical | Skip Logic Group* | Loss Change Requested | |||

| Infrequently | A, B | |||||||

| Sometimes | A, B | |||||||

| Frequently | A, B | |||||||

| Always or very frequently | A, B | |||||||

| A | Do you find that specific examiners request more change in loss assessments than others? | Yes | Y | Radio button, one-up vertical | Skip Logic Group* | Loss Change Examiner Specific | ||

| No | ||||||||

| Don't know | ||||||||

| B | How often is the examiner's requested change in loss-value a small or negligible amount, given your initial assessment following the site visit? | Never or very rarely | Y | Radio button, one-up vertical | Skip Logic Group* | Loss Change Small | ||

| Infrequently | ||||||||

| Sometimes | ||||||||

| Frequently | ||||||||

| Always or very frequently | ||||||||

| How often do you have to request additional documents from the property owner following your visit or an examiner's review of your initial or amended adjuster reports? | Never or very rarely | Y | Radio button, one-up vertical | Skip Logic Group* | Extra Owner Info Needed | |||

| Infrequently | ||||||||

| Sometimes | A | |||||||

| Frequently | A | |||||||

| Always or very frequently | A | |||||||

| A | How long does it typically take until you receive the requested documents back from the property owner after you request them? | Usually within a week | Y | Radio button, one-up vertical | Skip Logic Group* | Extra Owner Info Return Time | ||

| 2 weeks | ||||||||

| 3 weeks | ||||||||

| 4 weeks | ||||||||

| More than 4 weeks | ||||||||

| How do you feel about the requirements to be certified as an adjuster to handle NFIP flood insurance program claims? (Please select all that apply.) | Requirements are overly complex | A | Y | Checkbox, one-up vertical | Skip Logic Group* | Adjuster Certification | ||

| Requirements are difficult to fulfill | A | |||||||

| Requirements change too often | A | |||||||

| I have no issue with the requirements/certification process | Mutually Exclusive | |||||||

| A | Please use this space to share any examples of certification process steps or requirements changes that you felt were unneccessary or that could be improved: | N | Text area, no char limit | Skip Logic Group* | OE_Certification | |||

| 5-10 years | ||||||||

| More than 10 years ago | ||||||||

| Which types of properties do you work with when adjusting flood insurance claims? (Please select all that apply.) | Residential | N | Checkbox, one-up vertical | Property Type | ||||

| Business | ||||||||

| Other property | ||||||||

| When did you handle a flood insurance claim as an adjuster for the first time? | Within the past three months | N | Radio button, one-up vertical | Adjuster Service Length | ||||

| 3-6 months | ||||||||

| 7-12 months | ||||||||

| 1-2 years | ||||||||

| 3-5 years | ||||||||

| 5-10 years | ||||||||

| More than 10 years ago | ||||||||

| We want to hear from you! If you have any thoughts on how we can improve or streamline the FEMA - NFIP flood insurance process from YOUR perspective as an adjuster, please share them here. | N | Text area, no char limit | OE_Improve | |||||

| In which state do you live? | Alabama | N | Drop down, select one | State | ||||

| Alaska | ||||||||

| Arizona | ||||||||

| Arkansas | ||||||||

| California | ||||||||

| Colorado | ||||||||

| Connecticut | ||||||||

| Delaware | ||||||||

| District of Columbia | ||||||||

| Florida | ||||||||

| Georgia | ||||||||

| Hawaii | ||||||||

| Idaho | ||||||||

| Illinois | ||||||||

| Indiana | ||||||||

| Iowa | ||||||||

| Kansas | ||||||||

| Kentucky | ||||||||

| Louisiana | ||||||||

| Maine | ||||||||

| Maryland | ||||||||

| Massachusetts | ||||||||

| Michigan | ||||||||

| Minnesota | ||||||||

| Mississippi | ||||||||

| Missouri | ||||||||

| Montana | ||||||||

| Nebraska | ||||||||

| Nevada | ||||||||

| New Hampshire | ||||||||

| New Jersey | ||||||||

| New Mexico | ||||||||

| New York | ||||||||

| North Carolina | ||||||||

| North Dakota | ||||||||

| Ohio | ||||||||

| Oklahoma | ||||||||

| Oregon | ||||||||

| Pennsylvania | ||||||||

| Rhode Island | ||||||||

| South Carolina | ||||||||

| South Dakota | ||||||||

| Tennessee | ||||||||

| Texas | ||||||||

| Utah | ||||||||

| Vermont | ||||||||

| Virginia | ||||||||

| Washington | ||||||||

| West Virginia | ||||||||

| Wisconsin | ||||||||

| Wyoming | ||||||||

| I live outside of the United States | ||||||||

| Prefer not to respond |

| File Type | application/vnd.openxmlformats-officedocument.spreadsheetml.sheet |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy