SNAP Online Purchasing Pilot

FNS Generic Clearance For Pre-Testing, Pilot, And Field Test Studies

Attachment A - Online Purchasing Pilot RFV 07-29

SNAP Online Purchasing Pilot

OMB: 0584-0606

OMB Control No.: 0584-0606

Expiration Date: 03/31/2019

USDA Food and Nutrition Service

Supplemental Nutrition Assistance Program

Electronic Benefits Transfer

Online Purchasing Pilot

Request for Volunteers

September XX, 2016

1.3.1 Internet Shopping Workgroup 2

1.3.2.1 Mandatory Use of Acculynk 3

1.3.2.2 Routing Through Acculynk 4

1.3.2.3 Acculynk Commercial PIN-Debit Services 4

1.3.4 Agricultural Act of 2014 5

1.4 Online Purchasing Pilot Vision 5

1.4.1 Demonstration Authority and Evaluation 6

1.4.2 Report to the Secretary 6

1.4.3 PIN Debit vs. Credit Transactions 6

1.5.2 Integration with Acculynk 8

1.5.3 Initial Pilot Activities 10

1.5.4 Rollout to Additional Areas and Retailers 11

1.6 Partner Responsibilities 11

1.6.1 Food and Nutrition Service 11

Chapter 2 – Detailed Requirements 17

2.2 Rules and Standards Governing EBT 17

2.2.1 FNS SNAP Laws, Rules and Policies 17

2.2.2 State Laws and Regulations 21

2.2.3 Quest Operating Rules 21

2.3 Basic Requirements to Participate as an EBT Internet Retailer 22

2.3.1 Authorization by FNS as a SNAP Retailer 23

2.3.1.1 Application for Authorization as a SNAP Retailer 23

2.3.1.2 SNAP Retailer Eligibility 24

2.3.1.3 Eligibility Determination 25

2.3.2 Acculynk Requirements 27

2.3.2.3 Coding Requirements 29

2.4 Operational System Requirements 30

2.4.1 Mandatory Transaction Types 30

2.4.1.1 Online PIN Purchase 31

2.4.1.3 Other Mandatory Transaction Types 34

2.4.1.4 Optional Transaction Type 34

2.4.1.4 Prohibited Transaction Types 35

2.4.2 Purchase Checkout Process for SNAP and Cash EBT 36

2.4.2.1 Order Destination and Timing 36

2.4.2.2 Definition of Eligible SNAP Foods 38

2.4.2.3 Eligible Product Identification 39

2.4.2.4 Ability to Accept Split Tender 39

2.4.2.5 Selection of EBT Payment Method 40

2.4.2.7 Calculation of SNAP Payment 41

2.4.2.8 Authorization of SNAP Purchase Transaction 41

2.4.2.9 Calculation and Authorization of Cash EBT 42

2.4.3 Customer Receipt and Notification 42

2.4.4.2 Manufacturer’s Coupons 46

2.4.5 Nonprofit Cooperatives and CSAs 47

2.4.6.3 Security Practices and Policies 50

2.4.6.4 Privacy Practices and Policies 50

Chapter 3 – Pilot Application, Selection and Evaluation 60

3.8 State and Community Partners 62

3.9.2.1 RFV Participation Application Form 63

3.9.2.3 Additional Documentation for Retailer Application 65

3.9.4 Withdrawal of Proposal 66

3.10.1 Baseline Requirements 66

3.10.3.1 Privacy and Data Security 68

3.10.3.2 System Changes and Rollout Plan 68

3.10.3.4 Website Business Model 68

3.10.4 Selection Announcement 69

3.11.3 Joint Application Design 70

3.11.4 System Design and Development 70

3.11.6 Training and Marketing Materials 71

3.11.7 Implementation and Rollout 71

3.12 Online Purchasing Pilot Evaluation 72

3.12.1 Evaluation Contractor Responsibilities 72

3.12.1.1 Online Purchasing Implementation Analysis 72

3.12.1.2 Online Purchasing Impact Analysis 72

3.12.1.3 Online Purchasing Integrity Analysis 73

3.12.1.4 Data Collection Process 73

3.12.2 Retailer Responsibilities 74

3.12.2.2 Pilot Participants 75

Appendix A – State Specific Information 76

Appendix B – Letter of Intent to Apply 77

Appendix C – Statement of Support from Community Organizations 78

Appendix D – Request for Volunteers (RFV) Participation Application Form 79

Appendix E – FNS Retailer Application Forms 106

Table 2-1 – FNS SNAP Policy Citations 18

Table 3-1 – RFV and Pilot Timeline 61

Table 3-2 – Documentation Requirements 72

Table A-1 – State Specific Information 76

Term |

Acronym Explanation |

Definition |

ANSI |

American National Standards Institute |

Promotes United States voluntary consensus and conformity to standards and systems across and within various industries and sectors of the economy |

API |

Application Program Interface |

Set of routines, protocols, and tools for building software applications that specify how software components should interact. |

Applicant

|

|

Entity proposing to volunteer its website for the EBT Online Purchasing Pilot by submitting a formal response to this solicitation |

BIN (also known as IIN) |

Bank Identification Number (Issuer Identification Number) |

First six digits of the PAN which are used to identify the card issuer and route transactions for authorization |

CVV (also known as CVN, CVC) |

Card Verification Value (Card Verification Number, Card Verification Code) |

A 3- or 4-digit code recorded on the back of a commercial credit/debit card which allows a retailer to verify that the person making a purchase is actually in possession of the card. The code is not embossed on the card or included in the magnetic stripe. For online transactions, this code is sometimes referred to as CVV2 or CVN2. |

DES |

Data Encryption Standard |

PIN encryption method required by FNS regulations and the EBT payment industry – current standard is DES3 |

Eligible Food |

|

Defined by the Food and Nutrition Act of 2008 as any food or food product for home consumption and also includes seeds and plants which produce food for consumption. The Act prohibits the following items from being purchased with SNAP benefits: alcoholic beverages, tobacco products, hot food, and any food sold for on-premises consumption. Additional information can be found at http://www.fns.usda.gov/snap/eligible-food-items. |

EBT

|

Electronic Benefits Transfer |

Debit card system for government cash and food assistance benefits |

EBT Processor |

|

Company contracted by a State agency to run a turnkey transaction processing system for EBT |

Farm Bill |

|

Common name for the Agricultural Act of 2014 (PL-113-79). |

FNS

|

Food and Nutrition Service |

The agency within USDA that administers government food assistance programs |

Internet Retailer |

|

Internet site authorized by FNS to accept EBT cards and redeem SNAP benefits |

ISO |

International Organization for Standardization |

Performs the same functions as ANSI, but at the international level |

PAN |

Primary Account Number |

The 16-19 digit EBT card number entered as payment for purchases. |

Participant or Selected Site |

|

Online retailer website selected through this RFV to participate in this demonstration project |

PCI |

Payment Card Industry |

Credit and debit card industry and individual organizations such as Discover, MasterCard and VISA |

PCI Certification |

|

Official assurance that merchant is in compliance with the industry’s set of security and privacy rules |

PII |

Personally Identifiable Information |

Information that can be used to uniquely identify, contact, or locate a single person or can be used with other sources to uniquely identify a single individual |

PIN |

Personal Identification Number |

Cardholder selected four-digit identifier required to be entered at the point of sale for all EBT transactions |

POS |

Point of Sale |

Usually refers to the terminal or other device used to generate transaction requests at the time a purchase is made |

Retailer |

|

Entity authorized by FNS to accept EBT cards and redeem SNAP benefits |

RFV

|

Request for Volunteers |

Document to solicit partners to voluntarily participate in a pilot program at no cost to the government |

ROD |

Retailer Operations Division |

Division within FNS Regional Operations and Support responsible for retailer authorization, fraud detection and monitoring |

RPMD |

Retailer Policy and Management Division |

Division within FNS SNAP that is responsible for EBT, policy development, system support and program innovation |

SNAP

|

Supplemental Nutrition Assistance Program |

Formerly known as the Food Stamp Program, SNAP provides a basic safety net to ensure that low income Americans receive adequate nutrition |

State Agency |

|

Organization within State government responsible for contracting with an EBT processor and operating SNAP and cash assistance programs |

TPP |

Third Party Processor |

Commercial entity contracted by merchants to route transactions for approval and manage settlement |

UAT |

User Acceptance Testing |

Testing of all functional aspects of system changes related to EBT online purchasing |

USDA

|

United States Department of Agriculture |

The federal department responsible for agricultural production, rural services and food assistance programs |

Website |

|

Applicant’s online purchasing system, its owners and its development staff |

1.1 Overview

The Agricultural Act of 2014 (PL-113-79), also known as the Farm Bill, calls upon the Secretary of the United States Department of Agriculture (USDA) to authorize retail food stores to accept Supplemental Nutrition Assistance Program (SNAP) benefits via online transactions, subject to the results of a number of demonstration projects conducted to test the feasibility of allowing such transactions. The USDA’s Food and Nutrition Service (FNS) will be conducting these projects in order to collect sufficient information to provide the Secretary with a recommendation on whether allowing online purchases with SNAP benefits is in the best interest of the Program.

This Request for Volunteers (RFV) combines the need to conduct a demonstration project with the extensive groundwork started by an FNS industry work group in 2010-2011, and invites retailers, currently operating websites that sell SNAP-eligible foods and meet the inventory requirements to be authorized as an FNS retailer, to apply for participation in the project.

This chapter provides information about past, present and future activities related to authorization of Internet Retailers to accept SNAP and cash EBT benefits online. Chapter 2 provides details on the requirements and conditions for participation in the pilot, and Chapter 3 addresses the application process and timeframes.

1.2 Purpose

Online grocery shopping has been a reality for many years. FNS sees this as an opportunity to address the needs of the elderly and disabled, who cannot easily go out to shop. It will also be beneficial for those that have transportation problems or live in areas considered to be food deserts.

The purpose of this RFV is to solicit a small number of experienced Internet Retailers to test the implementation of EBT online purchasing and to prepare all necessary parties to accept and process EBT transactions originating from websites. FNS also plans to conduct an evaluation of the pilot as it rolls out, to determine client usage and satisfaction.

1.3 Background

For many years it was impossible to use EBT cards online due to the requirement that every EBT electronic transaction include a customer-entered PIN. Signature transactions and purchase ‘pre-authorization’ are not allowed in the EBT environment. The government programs covered by EBT are exempt from certain requirements of Regulation E which governs consumer protections for credit and commercial debit cards. If someone steals a client’s EBT benefits, they are not replaced. Therefore the PIN is viewed as the ultimate form of identification in the EBT world. Secure PIN-entry requires an American National Standards Institute (ANSI) compliant device that can encrypt the PIN using the Data Encryption Standard (DES) algorithm from the point of entry. Computer keyboards and mobile devices are not ANSI-compliant. Until a few years ago, all secure online solutions required special user hardware and/or software and were impractical. Online purchases made with a commercial credit or debit card typically required the customer to enter a card verification value (CVV) to prove that they have the card in their possession. EBT cards do not have CVVs. Most online retailers still do not accept PIN-based transactions. Instead, they handle commercial branded debit cards like signature-based credit cards for online transactions.

Over the years we have received increasing numbers of inquiries from online retailers looking to accept EBT transactions, as well as from SNAP clients and advocates asking why they cannot shop online. We had to explain the barriers caused by the PIN requirement, but were not able to offer a solution.

1.3.1 Internet Shopping Workgroup

In fall of 2008, an open discussion on ways to surmount this problem was held at an EBT industry meeting. That led to establishment of an Internet Shopping Workgroup with representatives from FNS, State agencies, EBT processors and other technical consultants.

This group worked diligently to identify technical and Program policy issues that relate directly to online commerce. A technical subgroup came together to address each technical issue and develop logical standard solutions. This was done to ensure that EBT remains interoperable and follows common standards applicable to all online transactions, regardless of the retailer, State or processor. These were thoroughly documented and shared with a group of retailers and third party processors (TPP) that had expressed interest in online EBT or were already active in the EBT community. FNS held a conference call with this larger group to review the changes and field questions. As there were no significant concerns expressed, it was agreed that the documented modifications could be used for a pilot. See Section 2.2.4, Technical Standards and Appendix G – ANSI Standard X9.58 Coding for specific details about the changes.

FNS also identified over 25 legislative, regulatory, policy and operations issues and decided how to handle each. These cover a wide range of concerns and are discussed in Sections 2.3 Basic Requirements to Participate as an EBT Internet Retailer, 2.4 Operational System Requirements and 2.5 Waivers and Conditions.

1.3.2 Acculynk Solution

In February 2009, a company named Acculynk announced that they had an online PIN-entry solution that had been accepted by regional banking networks. The Internet Shopping Workgroup contacted Acculynk and held several meetings. They are the technology provider of PaySecure™, a software-only service for Internet PIN debit payments that utilizes a graphical PIN-pad for the secure entry of a consumer’s PIN online. The customer requires no special hardware, software or security certificates; they only need their card number and PIN. PaySecure™ is the standard for Internet PIN debit, with 4 issued patents and over 20 pending patents; 11 Electronic Fund Transfer (EFT) network partnerships; 6,000+ U.S. merchants live; and 9,000+ bank issuers.

After serious review and discussions with Acculynk, the Internet Shopping Workgroup agreed that PaySecure™ would be the best solution for EBT’s PIN-entry and security concerns. It is secure and intuitive for the user and requires little change for EBT processors. However, the service does charge the merchant a fee similar to other payment cards, and websites will need to determine whether the transaction and upfront development costs are a good business decision.

1.3.2.1 Mandatory Use of Acculynk

FNS is aware that several other companies are in the process of developing alternative secure PIN-entry solutions, However, as of the date of this RFV’s release PaySecure™ is the only method that is payment card industry (PCI) certified and proven in the marketplace. Therefore, unless the applicant is aware of another recognized, PCI compliant, PIN-entry solution, for this pilot, FNS will require all selected sites to contract with Acculynk for PIN-entry services. Under no circumstances may the website design or implement its own methods for PIN capture.

We will continue to require that online retailers use an industry recognized, PCI compliant, method for Internet PIN-entry. If the demonstration project is successful FNS will review any new PIN-entry solutions to ensure that they meet minimum standards.

1.3.2.2 Routing Through Acculynk

For the demonstration, Acculynk will also act as the TPP, routing all transactions directly to the EBT processor’s gateway, so any Acculynk fees would be instead of, not in addition to, the fees the retailer pays to its TPP. This service will require a contract between Acculynk and the retailer. Since this contract will include a commitment for a minimum time period that may exceed the length of the pilot, FNS will allow selected websites to continue operating as authorized Internet Retailers after conclusion of the pilot (see Section 2.5, Waivers and Conditions for more information).

1.3.2.3 Acculynk Commercial PIN-Debit Services

As noted above, Acculynk also provides secure PIN-entry services for purchases made with commercial debit and bank Automated Teller Machine (ATM) cards. Neither FNS nor Acculynk requires acceptance of commercial PIN-debit as a condition of participation in this demonstration project. However, participating retailers are not prohibited from negotiating directly with Acculynk for these services, either.

Online merchants may wish to discuss the potential cost differential between signature, PIN, and PINless debit with Acculynk in order to make an informed decision. If they opt to do so, retailers selected for pilot participation may implement commercial PIN or PINless debit before, during or after EBT implementation. As part of the evaluation of the demonstration project, FNS is very interested in comparing the EBT and commercial customer experiences and perceptions and, with the retailer’s permission, would like to include the latter group for data collection, voluntary surveys and interviews.

1.3.3 Economic Changes

Because most grocery websites charge fees for delivery, some thought that EBT customers could not afford to shop online. Others felt that few SNAP clients had access to personal computers. The EBT population had been generally overlooked by most online grocery services. However, economic changes have caused the SNAP caseload to grow significantly. Currently there are 43 million people receiving SNAP benefits totaling $5.4 billion per month (as opposed to 27 million people receiving $2.8 billion in October 2007). Many of the 21 million families are recently unemployed, have computers and are used to shopping online. Cellular technology has also increased Internet access. As a result, many online sites have come to recognize that SNAP customers represent a significant market. More and more online retailers have expressed interest in accepting EBT.

1.3.4 Agricultural Act of 2014

In February 2014, Congress passed The Agricultural Act of 2014. Section 4011(b) establishes additional requirements for acceptance of SNAP benefits by online retailers and calls for demonstration projects to test the feasibility of allowing certain retailers to accept SNAP benefits through online purchases if they can meet designated criteria. Specifically, the Farm Bill requires any retailer wanting to participate in these demonstration projects to submit a plan that includes, among other things:

A method for ensuring that only eligible foods can be purchased with SNAP benefits online; the Act prohibits the use of SNAP funds for payment of delivery, ordering, convenience, or other fees or charges

A description of how households will be educated about the availability and process for online purchasing

Adequate testing of the online purchasing process before launching

Provision of data requested by FNS that will allow for the evaluation of access, ease of use and program integrity

In lieu of requiring a narrative plan, FNS has developed an application form that addresses all of the necessary requirements. The RFV outlines the additional legislative, regulatory and operational requirements for participation in the Online Purchasing Pilot in Chapter 2, and addresses the application process in Chapter 3.

1.4 Online Purchasing Pilot Vision

Eventually, FNS hopes to incorporate Internet Retailers into our regular authorization process. But due to the nature of online purchasing, FNS must revise regulations, develop a standard authorization process addressing unique concerns related to Internet Retailers, analyze the processes for monitoring and detecting fraud for online transactions and strengthen them to address the unique nature of Internet commerce. FNS expects this pilot will provide the data needed to inform these activities.

1.4.1 Demonstration Authority and Evaluation

FNS has authority to waive SNAP regulations, but not the law. However, Under Section 17 of the Food and Nutrition Act of 2008 (7 U.S.C. 2026) the Secretary may undertake research that will help improve the administration and effectiveness of SNAP. This provides authority to conduct demonstration projects that deviate from law, but requires an evaluation component.

The evaluation will involve analysis of additional transaction, user account and customer service data and statistics submitted to FNS (or an FNS-selected evaluation contractor) from the EBT processor, retailer website, Acculynk and/or State agencies. It will also include interviews with clients, online retailer representatives, State agency staff, Acculynk and EBT processors. The process for submitting such data will include appropriate restrictions on the exchange of personally identifiable information (PII).

FNS will use the collected information to assess the impact of online purchasing for the various parties involved in the pilot, identify implementation issues and analyze program integrity concerns. Evaluation requirements are addressed in more detail in Section 3.12.

1.4.2 Report to the Secretary

The Farm Bill also requires FNS to submit a report of its findings based on the results of the evaluation to the Secretary of Agriculture. The Secretary will subsequently make a recommendation based on that report and other criteria deemed appropriate by that office to Congress on whether or not online shopping should be implemented program-wide. Should the Secretary recommend implementation, FNS will develop the process for ongoing authorization of Internet Retailers in SNAP, including the necessary regulatory and policy changes that specifically address web-based merchants, their eligibility to participate in SNAP and their responsibilities as authorized retailers.

1.4.3 PIN Debit vs. Credit Transactions

Online PIN debit transactions differ significantly from credit and signature debit transactions. The Fair Credit Billing Act (PL93-495), which applies only to revolving credit accounts, prohibits retailers from actually charging the customer until the goods are about to be delivered, shipped or picked up. Therefore, the “purchase” transaction actually consists of a preauthorization, where the retailer transmits the customer’s card number, billing address, CVV and estimated amount of the sale. This estimate can be padded, often by as much as 50 percent. If approved, a hold for that amount is placed against the remaining credit limit. When the order is ready, the retailer transmits a second “advice” message with the final amount (which may be higher or lower than the originally authorized amount) when the customer is no longer present. This finalizes the sale amount and releases the hold on any remaining funds. Split orders can also be debited separately.

Because the EBT infrastructure requires a PIN for every purchase transaction, and PINs may never be stored, the above dual transaction process cannot be supported. The only way that EBT can work online is to debit the account in real time upon approval of the online transaction. When completing the order for an EBT transaction, the retailer must provide an immediate refund of any overestimated value, out of stock items or substitutions. Because the customer will not be present to enter a PIN as required for in-store refunds, online retailers will be authorized to perform a special type of refund transaction with no PIN for both SNAP and cash EBT. This non-PIN refund will also be available for online retailers to perform subsequent product returns or other customer credits.

These differences require a significant change in mindset regarding system logic and workflow for online transactions. See Section 2.4.1.1.2, EBT PIN Purchase Process for more specific details.

1.5 Pilot Description

Due to the number of steps that must occur prior to a SNAP recipient actually using their EBT card to purchase groceries online, the scope of this pilot will be very limited. The pilot requires a commitment from the States, EBT processors, and retailers. Each State establishes a contract with a host processor to authorize EBT transactions. Allowing online purchases will require significant system upgrades for both the EBT processor and the State where a selected online retailer is conducting business. As of release of this RFV, one EBT processor, Xerox State and Local Solutions1, has agreed to perform these system upgrades in the near term. Unless other EBT processors are able to divert resources to perform the necessary system upgrades, the pilot will be limited to States contracting with Xerox in 2017.

Therefore, our primary objective with this RFV is to identify a small number of qualified online retailers accepting transactions from customers living in at least one of the following states: CT, DE, GA, IA, IL, IN, LA, MA, ME, MD, MI, MS, NJ, NY, OH, OK, PA, SC, UT and VA . Note, however, that many of these States have concerns about the level of effort required to support implementation of the Online Purchasing Pilot. It will be essential for the State to approve use of their system for the pilot. FNS will work closely with potential participants to negotiate State approval of their proposed pilot areas. We recommend that retailer applicants contact the States in which they are interested to gain support prior to responding to this RFV. Additional States beyond those listed above can be considered only if additional EBT Processers make the necessary system upgrades or plan to do so in the near term. See Appendix A, Table A-1 for a list of States and their EBT processors.

Our second objective is to select a variety of website types, sizes, geographical locations, business models and distribution methods in order to ensure that any future Program changes address the full scope of potentially eligible online retailers.

1.5.1 Pilot Participants

In order to launch the initial demonstration project, FNS has decided to limit the pilot to only certain types of SNAP retailers. Group living and dining facilities, meal delivery services and restaurants will be excluded, but may be considered in the future if authorization of Internet Retailers is implemented nationwide. All other types of food merchants that meet the eligibility requirements specified in Section 2.3.1.2, SNAP Retailer Eligibility may apply.

Additionally, FNS will consider such factors as online sales expertise and track record of the applicant, past customer satisfaction, product delivery in food deserts or to other vulnerable populations, data security and privacy practices and ability to make all necessary system changes to support SNAP redemption as part of the selection process. See Section 3.10 for more information about the participant selection process.

1.5.2 Integration with Acculynk

The requirements for calculating a SNAP transaction total and recommendations on how to design the payment type selection screen are discussed in detail in Section 2.4.2, Purchase Checkout Process for SNAP and Cash EBT. When that is complete, the website will send the transaction to Acculynk through a secure Internet connection, rather than to its regular TPP. Then the PaySecure™ PIN-pad will be invoked and appear over the checkout screen (see Figure 1-1 on the following page). PaySecure™ does not allow PIN entry via the keyboard, so the customer must use the mouse pointer or touch screen to select the numbers. The cardholder enters the PIN and Acculynk’s system scrambles the numbers on the pad after each digit is selected. The procedure has the look and feel of the POS PIN selection process and is very intuitive for the user.

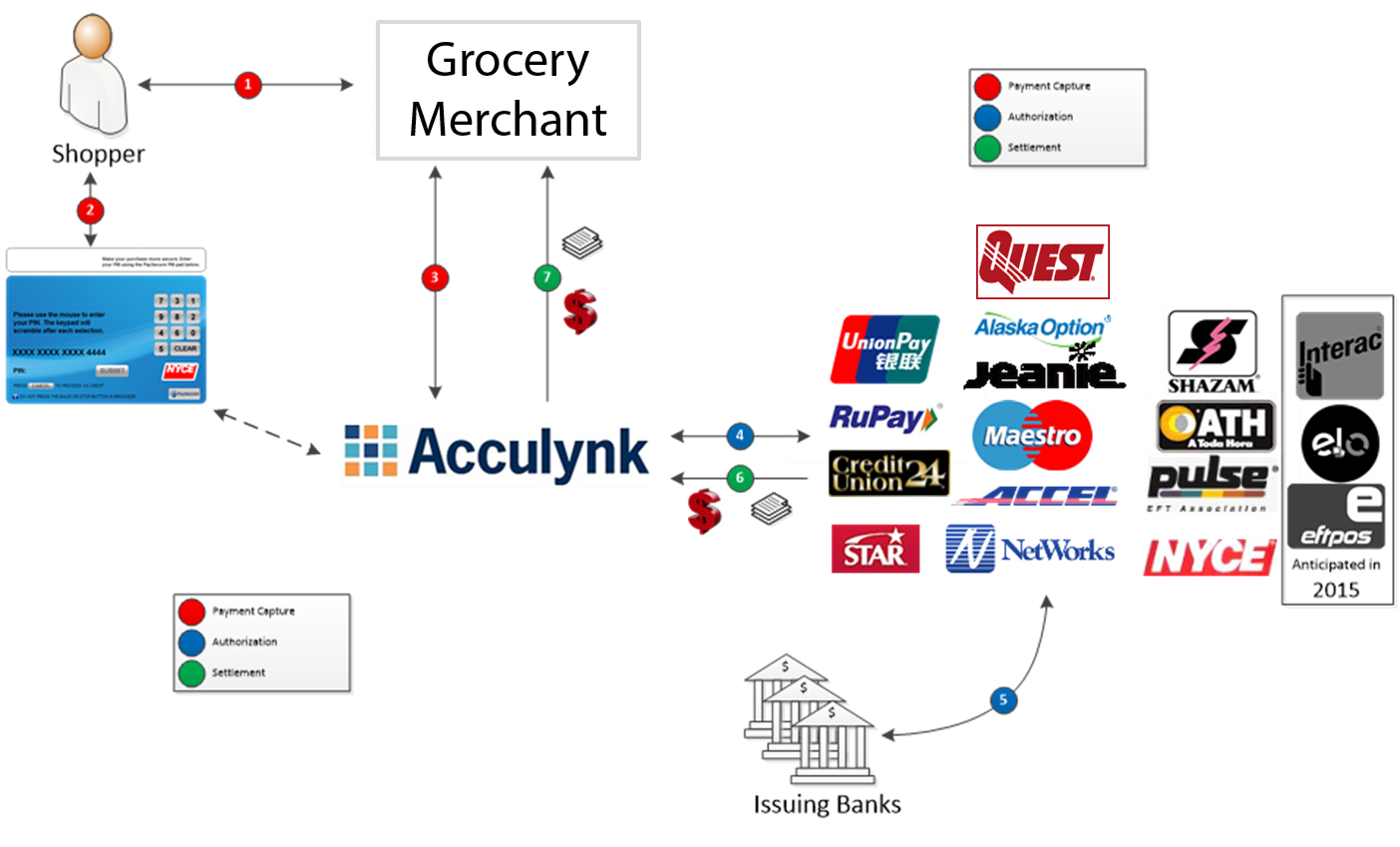

Figure 1-1 Acculynk Sample PIN Entry Screen

When the customer selects ‘Submit PIN”, Acculynk returns control to the website. The website will then use the PaySecure™ Application Program Interface (API) to request card authorization. Acculynk will route the transaction to the correct State’s EBT authorization system. The message response received by Acculynk will be returned to the retailer as a response to the API call.

Settlement will be handled directly by Acculynk for the pilot. Acculynk will provide the website with settlement and reporting information.

Figure 1-2 Acculynk Transaction Flow

A

shopper checks out at the website. When

prompted, the shopper enters the PIN number using the PaySecure PIN

Pad, hosted by Acculynk. When

PIN collection is complete, the website makes an authorize request

to Acculynk. Acculynk

routes the authorization request to the appropriate debit network

or EBT processor. The

debit network routes the authorization request to the appropriate

issuing bank, where the PIN is confirmed and funds are verified and

removed. Authorization approval goes back through the network and

Acculynk to the website The

debit networks or EBT processors fund Acculynk and provide

reporting. Acculynk

funds the website and provides reporting.

1.5.3 Initial Pilot Activities

Once the participating retailers are selected, FNS expects the pilot to last for at least one year. This will give selected participants, Acculynk, the EBT processor and FNS the time needed to perform the necessary contract negotiations, and to design, develop, test and implement changes to systems and workflow.

The initial implementation will begin with one retailer participant in a single State or part of a State, as determined by the participant and State. If the participant opts for a statewide pilot, then customer usage can be determined by the Bank Identification Number (BIN) assigned to that State’s EBT card. If the selected site wishes to pilot in a smaller area, then it will be the participant’s responsibility to manage limitation to eligible EBT cardholders within the designated area, e.g., by ZIP code. This phase of the pilot will operate for a minimum of one month before further expansion to ensure that all periodic and data collection processes work as planned for all involved parties, but may run longer depending on pilot results.

1.5.4 Rollout to Additional Areas and Retailers

Once all parties agree that their systems perform properly, the initial participant may expand to additional Xerox or other Internet-ready States or areas at a rate that is agreeable to the participant, EBT processor(s) and State agencies. At that time, FNS will also allow additional selected websites to join the pilot. As with the initial stage, each new participant must operate in a single State, or part of a State, for a minimum of one month before further expansion. In addition, each new State system added to the pilot must run for at least one month with one selected site before adding additional participants. Participants must commit to actively pilot for a minimum of six months in order to generate sufficient experience and data for the proposed evaluation.

In all, FNS expects that the Online Purchasing Pilot will involve two to three State agency EBT systems and three to five online retailer participants in the demonstrations and evaluation process. However, FNS reserves the right to select fewer or more participants or State agencies depending on the quantity and quality of applications received. If the demonstration projects are deemed a success, FNS expects to allow selected sites to continue acceptance of online EBT purchases through the duration of any resulting contracts or agreements with Acculynk. FNS will then work with all of the EBT processors and States to develop a rollout strategy to implement online transactions nationwide.

1.6 Partner Responsibilities

1.6.1 Food and Nutrition Service

The FNS SNAP Retailer Policy and Management Division (RPMD) is responsible for EBT, policy development, retailer systems support and program innovations such as this Online Purchasing Pilot. The Regional Operations and Support’s Retailer Operations Division is responsible for retailer authorization, fraud detection and monitoring. For the pilot, FNS will be responsible for the following:

Overall management of the demonstration projects

Issuance of RFV and responses to related inquiries

Evaluation and selection of participants

Authorization of participants as SNAP Internet Retailers

Notification of new Internet Retailer authorizations and deauthorizations to EBT processor and Acculynk

Interpreting and making determinations about SNAP legislation, regulations and policies applicable to participants

Approval of necessary waivers

Review and approval of all technical documentation for design and development of EBT online purchasing system modifications

User acceptance testing (UAT) of all participant, EBT processor and Acculynk systems

Monitoring and assessing pilot implementation

Approving rollout to additional States and EBT processors

Identifying lessons learned and making appropriate changes to near-term process

Reporting to Secretary and Congress as mandated in the Farm Bill

Noting necessary legislation for addressing online retailers in SNAP

Establishing regulations (including changes to current regulations) and associated standard operating procedures for future Internet Retailer authorization process

Working with industry leaders on related future changes to operating rules and message standards

1.6.2 Participant Website

Applicants for this RFV must make a substantial commitment to carry out the project without any form of payment from the government. To be considered responsive, applicants must thoroughly address all mandatory requirements detailed in Section 3.9, Proposals and in the Instructions for Completion of the Online Purchasing Pilot RFV Participation Application Form. The applicant must also agree that, if selected, it will comply with all of the following requirements:

Meeting all conditions for FNS retailer eligibility and authorization

Continuing to meet these requirements after authorization

Ensuring equal treatment of EBT customers except for sales tax exclusion and other Program or pilot-specific requirements.

Complying with conditions of all online purchasing waivers issued by FNS

Submitting all additional documentation required for SNAP licensing based on the site’s business model that may subsequently be requested by FNS

Complying with FNS rules regarding acceptance of SNAP funds only for eligible foods and fraud prevention.

Reporting changes of ownership or address

Being reauthorized at least every five years

Entering into a contract with Acculynk for secure PIN-entry services using PaySecure™ for all SNAP, and if desired, cash EBT transactions and/or commercial PIN debit payment acceptance

Conforming to Acculynk specifications related to message format, system interfaces and other technical requirements including PINless refunds (see Section 2.3.2.2 for more information)

Submitting all EBT purchase transactions to Acculynk for PIN-entry and routing

Identifying SNAP-eligible foods in its product database and updating as new products are added

For SNAP transactions, programming the system to meet all requirements specified in Section 2.4, Operational System Requirements

If opting to accept cash EBT, programming the system to meet cash requirements specified in Section, 2.4 Operational System Requirements

Ensuring that EBT purchase and refund transactions contain additional mandatory SNAP/cash EBT data elements

Providing documentation for SNAP-related website design changes to FNS and allowing for comments and recommendations

Allowing FNS to perform testing of website’s EBT functionality and interfaces with Acculynk

Piloting in first State for a minimum of one month to ensure that all systems are operating properly and a minimum of six months overall

Working in good faith with FNS, the EBT processor and affected State agencies to establish a schedule of rollout to other States from which the website accepts sales

Maintaining Payment Card Industry (PCI) certification for its online shopping site

Providing adequate service levels and timely delivery/pickup/shipping to EBT customers in accordance with FNS-approved waivers

Prohibiting the sale or sharing of PII data belonging to EBT cardholders without explicit consent of the EBT customer

Continuing to ensure that the website employs optimal security and privacy practices

Working with FNS and the evaluation contractor to identify appropriate methods to collect evaluation data from their employees, the system and customers

Providing ongoing evaluation data as required by the RFV and the FNS evaluation contractor

1.6.3 Acculynk

Acculynk has agreed to work with retailers, FNS and the EBT processor to ensure the success of EBT online purchasing. Acculynk will be responsible for the following:

Certifying to the EBT processor’s message specifications for online purchasing

Developing and clearly documenting message format and interface specifications for websites to use for all SNAP and cash EBT transactions

Obtaining FNS approval of these specifications to ensure that they meet regulatory and ANSI standards

Programming necessary changes for EBT

Allowing FNS to test EBT functionality and interfaces with websites and EBT processor

Verifying that the participant is PCI-compliant

Testing and certifying that the selected site conforms to their standards

Contracting with each pilot participant for secure PIN-entry services using PaySecure™ for all SNAP and cash EBT transactions

Ensuring that all websites submitting EBT transactions through them have been authorized by FNS to accept SNAP benefits for online transactions

Using PaySecure™ to collect and process PIN data and DES encrypt results

Converting data submitted by website and encrypted PIN to EBT processor’s specified format

Validating completeness of data prior to transmission

Routing transactions to EBT processor for authorization

Receiving message responses and transmitting them back to the website

Assigning a unique identification number to each approved transaction that must be used for subsequent refunds

Validating refunds against original purchases to ensure that their total value does not exceed the purchase amount

Settling funds for all online EBT transactions to the participant

Providing daily and monthly transaction and settlement reports to the participant

Working with evaluation contractor to provide information on implementation process and lessons learned

Providing other contracted services negotiated with the participant

1.6.4 EBT Processor

The EBT processor, Xerox State and Local Solutions, will work closely with FNS and Acculynk to ensure that online EBT transactions are properly received, processed, transmitted and settled. The EBT processor will be responsible for the following:

Designing, developing and implementing changes necessary for online purchasing

Making system changes and revising TPP certification specifications to implement X9.58-2013 changes necessary for online purchasing

Establishing an agreement with Acculynk and certifying them as a TPP under the updated specifications

Adding fields to transaction records to capture delivery/pickup/shipping street address and ZIP

Submitting demonstration project design details and related documents for FNS review and approval

Accepting online transactions only from Acculynk to ensure the integrity of PIN-entry

Checking all transactions against the current list of FNS-authorized stores to ensure that:

The online retailer is currently authorized by FNS as an Internet Retailer

Online purchase transactions from any merchant not authorized by FNS as an Internet Retailer are denied

PINless refunds from any merchant not authorized by FNS as an Internet Retailer are denied

Regular POS (i.e., card present) transactions performed by an Internet Retailer are denied

Validating that transactions conform to their specifications

Validating remaining requirements (account, card number PIN, funds, etc.)

Approving or denying the transaction

Sending the response message back to Acculynk

Storing and securing transaction data and including them in existing reports and files

Creating a separate, expanded daily file of transactions performed by pilot participants for submission to FNS

Settling funds for all participants to Acculynk

Allowing FNS to test EBT functionality and interfaces with Acculynk websites

Maintaining a test system to allow end to end testing for Acculynk and retailer websites as needed

Reporting to State agencies and FNS

Working with evaluation contractor to provide information on implementation process and lessons learned

Fulfilling any additional State agency requirements

Chapter 2 – Detailed Requirements

Parts of this chapter address requirements that apply equally to Internet sites and to brick and mortar stores. Therefore, retail chains and stores that are currently authorized to accept SNAP benefits may already be familiar with much of the content of this section. Even so, we recommend that they read all of the requirements very carefully.

2.1 Introduction

Large scale SNAP and cash EBT programs have been operating successfully since the mid-1990s. Over time, various rules and standards have been developed and issued by different organizations to bring operational order to the payment process. These rules and standards were designed to facilitate fair and equitable treatment of EBT customers, minimize the potential for fraud, standardize processes for retailers and ensure interoperability among States. They work very well for face-to-face transactions where the card is present, the customer enters a PIN to prove identity and payment is made at the same time as goods are exchanged.

Due to the nature of Internet commerce, however, a number of changes to these rules are required. Chapter 2 describes the necessary rule changes, requirements for Internet sites to participate in this project, system operations, transaction flow, waivers needed and their conditions.

2.2 Rules and Standards Governing EBT

We expect that many potential applicants for this demonstration project already redeem EBT benefits at their brick and mortar locations and thus are familiar with these rules and standards. This section provides an overview of all of the documented requirements that have an impact on EBT transactions, regardless of the merchant type or method of operation. For those that have never participated in EBT, we provide links so that you can become more familiar with the basic requirements.

2.2.1 FNS SNAP Laws, Rules and Policies

SNAP is governed by the Food and Nutrition Act of 2008 and United States Code of Federal Regulations (CFR) Title 7 Parts 271 – 285. For the purposes of this RFV, the most pertinent Parts of the SNAP regulations are 274, Issuance and Use of Program Benefits and 278, Participation of Retail Food Stores, Wholesale Food Concerns and Insured Financial Institutions. In addition, a number of policy memoranda provide further interpretation of the regulations.

Table 2-1 lists key requirements for retailers accepting EBT.

Table 2-1 – FNS SNAP Policy Citations

Citation |

Requirement |

SEC 3, [7 U.S.C. 2012](k)(1) |

Limits bottle or can deposit fees that can be paid for with SNAP benefits only to the reimbursable amount and container product types specified by State law, whether or not the deposit fee is included in the shelf price.2 |

SEC 3, [7 U.S.C. 2012](o)(1)(A) |

Defines “Retail food store” as an establishment or house-to-house trade route that sells food for home preparation and consumption and meets one of the following criteria: offers for sale, on a continuous basis, a variety of at least seven foods in each of four categories of staple foods (meat/poultry/fish, bread/cereals, vegetables/fruits, dairy), including perishable foods in at least three of the categories (Criterion A3); or has more than 50 percent of the total gross retail sales of the establishment or route in staple foods (Criterion B);staple foods are defined at SEC 3 [7 U.S.C. 2016] (q). |

SEC 7 [7 U.S.C. 2016](b) |

Benefits issued to eligible households shall be used by them only to purchase food from retail food stores which have been approved for participation in SNAP.4 |

SEC 7 [7 U.S.C. 2016](k)(2) |

A retail food store seeking to accept SNAP benefits through online transactions shall establish recipient protections regarding privacy, ease of use, access, and support similar to the protections provided for transactions made in retail food stores; ensure benefits are not used to pay delivery, ordering, convenience, or other fees or charges; clearly notify participating households at the time a food order is placed of any delivery, ordering, convenience, or other fee or charge associated with the food purchase and that any such fee cannot be paid with benefits provided under the Act; ensure the security of online transactions by using the most effective technology available that FNS considers appropriate and cost-effective and that is comparable to the security of transactions at retail food stores; and meet other criteria as established by FNS. |

SEC 7 [7 U.S.C. 2016](k)(4)(B) |

To be eligible to participate in an online purchasing demonstration project, a retailer shall submit a plan for FNS approval that includes a method of ensuring that benefits may be used to purchase only eligible items under this Act; a description of the method of educating participant households about the availability and operation of online purchasing; adequate testing of the online purchasing option prior to implementation; provision of data as requested by FNS to analyze the impact of the project on participant access, ease of use, and program integrity; reports on progress, challenges, and results, as determined by FNS; and such other criteria, including security criteria, as established by FNS. |

SEC 3 [7 U.S.C. 2012](o)(4) |

Adds community supported agriculture (CSA) as a retailer type authorized to accept advance payment from SNAP benefits for agriculture shares. |

SEC 10 [7 U.S.C. 2019] |

Retail food stores authorized to accept and redeem benefits through online transactions may accept benefits prior to the delivery of food if the delivery occurs within a reasonable time of the purchase, as determined by FNS. |

274.7(a) and 278.2(a) |

SNAP benefits may be accepted by an authorized retail food store only from eligible households or the households’ authorized representative, and only in exchange for eligible foods; eligible foods are defined at 7 CFR 271.2 |

274.7(c) |

No minimum dollar amount per transaction or maximum limit on the number of transactions shall be established. Nor shall transaction fees be imposed on SNAP households using the EBT system to access their benefits. |

274.8(a)(2) |

Transactions require primary account number (PAN), unique terminal identification number, and retailer identification numbers assigned by FNS, and require verification of a PIN for all transactions (purchases, refunds, voids, and balance inquiries) except manual vouchers. |

274.7(f) and 278.2(b) |

SNAP benefit shall be accepted for eligible foods at the same prices and on the same terms and conditions applicable to cash purchases of the same foods at the same store, except that tax shall not be charged on eligible foods purchased with SNAP benefits. No retail food store may single out SNAP clients for special treatment in any way. |

274.8(b) |

POS terminals must meet ANSI and International Organization for Standardization (ISO) standards where applicable. |

274.8(b) |

Requires use of EBT ISO 8583 Processor Interface Technical Specifications contained in the ANSI standard X9.58, which delineates a standard message format for retailers and third parties. |

274.8(b)(3)(ii)(C) and 274.8(b)(6)(iii) |

PIN encryption utilizing the DES algorithm shall occur from the point of entry in a manner which prevents the unsecured transmission of the PIN between any points in the system. |

274.8(b)(6)(i) |

Balance information shall not be displayed on the screen of the POS terminal except for balance-only inquiry terminals. |

274.8(b)(7) |

Households shall be provided printed receipts at the time of transaction, with date, merchant's name and location, truncated card number, transaction type, transaction amount, and remaining balance for the SNAP account. The household's name shall not appear on the receipt. |

274.8(b)(9) |

Minimum transaction set must include refund transactions. All transactions involving refunds for goods originally purchased with SNAP benefits, whether from an error in scanning or the return of an item, must be credited to the SNAP EBT account. The customer may not receive cash refunds or store credit. |

278.2(e) |

Except as provided by SEC 3 [7 U.S.C. 2012](o)(4) and SEC 10 [7 U.S.C. 2019] above, food retailers may not accept SNAP benefits before delivering the food. The only additional exception is for nonprofit food buying cooperatives, which may accept benefits up to 14 days prior to food delivery5 |

Policy Memo BRD/EBT 2001-1 |

Card must be present for key entered transactions. |

BRD Policy Memo 2007-1 |

When a manufacturer’s coupon is used for an item purchased with SNAP, the discount or amount of funds saved must be credited to the SNAP EBT account (or only the net value deducted). Crediting the SNAP benefit account eliminates a potential avenue for fraud. Sales tax, if applicable, that must be collected from the customer for the coupon savings, must also be paid by SNAP customers, but with another type of tender. |

Please note that while the Federal government itself must comply with online website accessibility standards under Section 508 of the Americans with Disabilities Act, these requirements are not mandatory for retailers under this pilot. However, FNS encourages selected participants to provide such access to its customers. Applicants with Section 508 compliant sites will be considered more favorably in the selection process.

2.2.2 State Laws and Regulations

Approximately 35 State agencies also issue cash benefits through EBT. The remaining States use other methods such as prepaid branded electronic payment cards. Cash programs are the responsibility of the States, not FNS. States generally favor allowing Internet Retailers authorized by FNS under this pilot to accept cash EBT as well. Funds from the cash account may be used to pay for SNAP-ineligible products such as paper goods or for fees. While each State has its own eligibility rules and payment levels, cash EBT accounts and transactions are handled in a very similar manner to SNAP accounts.

Some States have features to block certain merchant type codes in order to limit card usage to what Federal and State laws deem suitable for cash recipients. However, SNAP-authorized food retailers do not generally fall into those categories.

2.2.3 Quest Operating Rules

Both SNAP and cash EBT are governed by the Quest Operating Rules in most States. The remaining States generally follow the same rules except for some small differences in adjustment policies. The Quest Operating Rules are published by the National Automated Clearinghouse Association (NACHA). They outline the responsibilities of issuers, acquirers, merchants, and third party service providers and address issues such as settlement, error resolution, and use of the Quest mark.

At least one provision will require modification for online purchasing. Quest Operating Rules currently prohibit refunds to the cash account. Cash refunds never apply to eligible items purchased using SNAP benefits. However, cash account refunds may be needed for online transactions in which a refund is necessary for items that were originally purchased with cash EBT benefits because there is no other way to reimburse the customer for overpayments or returned items. This has been brought to the attention of the committee responsible for the rules. We do not expect that there will be any problems making the necessary modifications once the demonstration project is complete.

For more information click on the following:

Complete Quest Operating Rules

Appendix A – State Specific Information for listing of Quest States

2.2.4 Technical Standards

As noted above, FNS rules require that the EBT transaction messages arriving at the EBT processors for authorization must meet specifications contained in the EBT version of the ISO 8583 transaction message standard. The name of this standard is X9.58. For brick and mortar stores, it is the responsibility of the merchant’s TPP to convert transaction data to this standard. The merchant must then conform to the TPP’s EBT message specifications.

A number of changes were made to X9.58 in 2013 to accommodate online transactions. Acculynk will act as the TPP for the Online Purchasing Pilot transactions, and will be responsible for coding them to meet X9.58 specifications for online purchases and refunds. This will not be the responsibility of the pilot participants, who instead must code to Acculynk’s EBT message specifications (see Section 2.3.2.2). For those desiring additional information, Appendix G – ANSI Standard X9.58 Coding contains a summary of changes and messaging codes applicable to online SNAP retailers.

2.3 Basic Requirements to Participate as an EBT Internet Retailer

Any retailer wishing to participate in the Online Purchasing Pilot should be sure that they will be able to meet these basic requirements. Every selected site must successfully complete the activities described in this section. Failure to do so within a reasonable time will result in the retailer being dropped from the pilot, having their Internet Retailer SNAP authorization withdrawn, and being replaced by another participant.

2.3.1 Authorization by FNS as a SNAP Retailer

In order to redeem SNAP benefits, food merchants must meet the eligibility requirements outlined in Federal regulations. Once the store has been licensed by FNS it must continue to comply with those and other FNS rules governing EBT and interaction with SNAP customers. Retailer fraud and collusion with customers to trade SNAP benefits for cash or ineligible products such as alcohol and cigarettes are grounds for disqualification, in some cases, permanently.

For more information about program rules that apply to retailers please download our FNS Retailer Training Guide.

2.3.1.1 Application for Authorization as a SNAP Retailer

Every applicant for this RFV must complete a SNAP Retailer application as described below, and enclose it electronically with their RFV response (see Section 3.9.1 for proposal submission instructions). Do NOT use the FNS online application process to apply as an Internet Retailer for this demonstration project. Please bear in mind that these forms were designed for brick and mortar retailers, so some questions will not apply. Copies of the application forms can be found in Appendix E – FNS Retailer Application Forms.

2.3.1.1.1 FNS-252-C Corporate Supplemental Application

For supermarket chains that have more than ten brick and mortar locations authorized to accept SNAP, FNS assigns a corporation ID number to link each location to the corporate level information. Applicants that already have multiple locations authorized in this manner should complete Appendix E – Form FNS-252-C, Corporate Supplemental Application. As an alternative, an applicant that already has a corporation ID may provide an updated copy of its FNS-developed chain retailer spreadsheet with a new row added to reflect appropriate data for its website. If you need a copy of this spreadsheet, please contact the FNS SNAP Retailer Service Center at (877) 823-4369.

2.3.1.1.2 FNS-252- Supplemental Nutrition Assistance Program Application for Stores

All other applicants must complete the full application, Appendix E – Form FNS-252. You must also provide digitally scanned copies of the following:

One current business license in your name or the name of your business

Government issued photo identification for all owners, partners, and corporate officers; and in Community Property States, spouses of owners and partners

Government issued Social Security Number documentation for all owners, partners, and corporate officers; and in Community Property States, spouses of owners and partners

2.3.1.2 SNAP Retailer Eligibility

To be eligible for authorization, the applicant’s website must sell food for home preparation and consumption, normally displayed in a public area, which meets one of two criteria, briefly described below.

Criterion A: The website must offer for sale, on a continuous basis, a variety of qualifying foods in each of four categories of staple foods (meat/fish, breads/cereals, fruits/vegetables and dairy)

Criterion B: More than 50 percent of the total gross retail sales of the website must consist of staple foods

As previously noted, FNS is in the process of implementing enhanced eligibility rules, as required by the Farm Bill. These changes may affect the definition of staple foods and increase the minimum variety of food types, stock keeping units and perishable products required for eligibility.

There is a possibility that these changes will be implemented prior to the start of pilot operations. Your website and order fulfillment site(s), e.g., warehouse, brick and mortar store, etc., must meet the staple food requirements in effect at the time of FNS-authorization.

For information about the current retailer eligibility requirements go to Retail Store Eligibility USDA Supplemental Nutrition Assistance Program.

For information on the proposed changes go to Enhancing Retailer Standards in the Supplemental Nutrition Assistance Program (SNAP). Final regulations may contain substantial changes from this proposed rule.

2.3.1.3 Eligibility Determination

This is normally determined by visual inspection, marketing structure, business licenses, accessibility of food items offered for sale, tax records, purchase and sales records, counting of stock keeping units, or other inventory or accounting recordkeeping methods that are customary or reasonable in the retail food industry. FNS reserves the right to request additional documentation of food sales such as noted above if needed.

Brick and mortar stores often receive an onsite visit prior to authorization. Depending on the size and nature of the business conducted on your website, we may request an onsite visual inspection of your warehouse or other stock location.

Applicants that fail to provide the necessary information and onsite access, or do not meet the requirements identified in Section 2.3.1.2, SNAP Eligibility, will not be selected for this pilot.

2.3.1.4 Special Situations

There are additional issues and requirements for certain types of retailers. These are described below.

2.3.1.4.1 Retailers Excluded from the Pilot

FNS authorizes a variety of retailer types that provide prepared meals for SNAP clients. These include, but are not limited to communal dining facilities, group homes, shelters, rehabilitation centers, meals on wheels programs and restaurants. Because this demonstration project is designed to evaluate online purchasing of food products for home preparation and consumption, meal services and restaurants may not apply for pilot participation.

2.3.1.4.2 Retailers Already Eligible to Charge Customers in Advance

Nonprofit food buying cooperatives and agricultural producers that offer community supported agriculture (CSA) shares are currently eligible to accept SNAP benefits up to 14 days in advance of delivery. While they are allowed to apply for pilot participation, there are additional website design issues. These retailers should pay special attention to Section 2.4.5, Nonprofit Cooperatives and CSAs.

2.3.1.4.3 Sites Owned by Already Authorized Retailers

Under FNS rules, each store location is authorized individually based on its own circumstances and inventory. The eligibility of websites owned by already authorized, or otherwise eligible, retailers will be based on the products actually sold on the website and stocked at the fulfillment site(s) for online orders, not on their in-store inventories. The website will be authorized as an Internet Retailer store type under a separate FNS number and be treated by FNS as a distinct retail firm.

2.3.1.4.4 Multiple Website Operations

Just as different store locations require separate FNS authorization and receive separate FNS numbers, online merchants that run multiple websites for different populations or a single website that can direct different populations to different product inventories require separate FNS authorization. This is because the product inventory available to each of the populations will be different, perhaps significantly, and product inventory is what is used to determine a retailer’s eligibility to redeem SNAP benefits.

In addition, FNS’s ability to monitor transactions and identify potentially fraudulent activity depends on an understanding of the geographic limitations of any retailer’s customers.

As an example, a company that provides home delivery of its full line of products in its own local area, but also ships a more limited inventory of products nationally will require two separate FNS authorizations. Eligibility for each operation will be based on the level of sales and products sold under that operation only.

If the applicant‘s website(s) falls under this description, only one of the operations will be selected for the pilot. The response to the RFV must provide a description of the overall operation and potential FNS authorizations that will be required in the future. However, the application itself and all related answers to specific questions must be limited to just one of the operations.

2.3.1.4.5 Delivery Services

Independent delivery services6 that do not have their own food inventory and only deliver/ship products obtained at other retail establishments are not eligible to be authorized as FNS retailers and, therefore, may not apply to be pilot participants

2.3.1.4.6 Third Party Products

Many websites serve as an aggregator or marketplace for other businesses or individuals. The website’s purpose is to list the products belonging to these third parties and, in many cases, accept online payment for them. If the website owner has no food inventory of its own and merely purveys products owned, stored and shipped by the third parties, they do not meet the qualifications for SNAP authorization, and may not apply for the Online Purchasing Pilot.

However, some website owners do have their own food inventory, but also feature products sold and shipped directly by third parties. These sites must meet the eligibility requirements identified in Section 2.3.1.2 based solely on their own inventory and sales. Furthermore, at least 50% of their SNAP-eligible food sales must come from their own inventory. Third party products will not be considered SNAP-eligible and they may not be purchased on the website with SNAP EBT benefits. They may, however, be purchased with cash EBT benefits. This must be clearly explained on the site so that SNAP clients understand the difference between the two product types, and know which products are eligible and which are not.

2.3.2 Acculynk Requirements

Acculynk is the payment processor for this EBT pilot and also sets pricing for the PaySecure™ platform. All pilot applicants must agree to work in good faith with Acculynk to negotiate services and pricing for secure PIN-entry, refund handling, transaction routing and settlement.

Selected participants must contract directly with Acculynk for these services, and conform to their specifications and requirements.

2.3.2.1 Contract

It is absolutely required for a selected participant to have such a contract in place if it wishes to participate in this pilot. We recommend that you contact Acculynk (see Section 3.4, Points of Contact) soon after reading this RFV, to discuss services, pricing structure, and requirements for EBT. If a selected site fails to have a contract in place within a reasonable time, FNS reserves the right to select another applicant for the pilot. Without an Acculynk contract, the website will not be authorized to accept any EBT benefits.

2.3.2.2 Specifications

Selected websites must conform to Acculynk’s message specifications and other requirements. The following EBT specific information must be included in the message for all purchases and refunds:

2.3.2.2.1 Static Data that May be Contained in an Acculynk Table for the Retailer

Terminal ID

Card Acceptor ID Code

Card Acceptor Name/Location

National Point of Service Condition Code

Merchant Type

FNS Authorization Number

2.3.2.2.2 Variable Data that Must be Submitted with Each Transaction

Card Number - PAN

Account Type (SNAP or cash)

Transaction Type (purchase, refund, balance inquiry)

Amount

Date and Time

Delivery ZIP Code (9 characters)

2.3.2.2.3 Data Not Applicable to EBT Transactions

Expiration Date (default is 4912)

Card Verification Value (CVV)

2.3.2.2.4 Important Data Returned in Response

Approval/Denial Response Code

SNAP Account Balance

Cash Account Balance

2.3.2.3 Coding Requirements

The PIN-entry process requires the addition of PaySecure™ EBT code to the checkout page. Coding can typically be done with minimal technical resources, with implementation time of two to four weeks. The process uses a combination of industry standard Simple Object Access Protocol (SOAP) based application program interfaces and JavaScript which supports a number of features (some optional).

The Acculynk technology team, including a project manager, quality assurance specialist and web developer will be available throughout the implementation process to assist merchants.

For more information about Acculynk message specifications contact

the Acculynk representative identified in Section

3.4, Points of Contact.

2.4 Operational System Requirements

This section describes the EBT-specific functionality that websites authorized as SNAP Internet Retailers must provide.

2.4.1 Mandatory Transaction Types

The full set of face-to-face SNAP transactions that EBT processors and TPPs for brick and mortar stores are required to provide are:

PIN POS Purchase

PIN POS Refund

PIN POS Void

PIN POS Balance Inquiry

POS Reversal

Manual Voucher Authorization (signature based)

Manual Voucher Clear

Adjustment

However, retailers themselves are not required to use manual vouchers or allow in-lane balance inquiry if they do not wish to do so (although an alternative balance inquiry process must be available). Cash EBT transaction requirements usually include:

PIN POS Purchase

PIN POS Purchase with Cash Back

PIN POS/ATM Cash Only Withdrawal (cash received without purchase)

PIN POS Balance Inquiry

PIN POS Void

POS/ATM Reversal

Adjustment

Essentially, every electronic EBT transaction initiated by a customer or retailer requires the cardholder to enter a PIN. However, the Internet environment has additional challenges that must be considered. Therefore, the transaction types that websites must be able to perform will be substantially different from those done in brick and mortar locations. Internet Retailers must be able to support the types of transactions addressed below.

2.4.1.1 Online PIN Purchase

Unlike commercial credit and debit, signature-based transactions are not allowed under EBT. The PIN is the only form of identification that the EBT client has. Therefore, FNS will continue to require that every purchase or other debit to the customer account be accompanied by a securely entered PIN. The only PIN-entry method that FNS will accept at this time is Acculynk’s PaySecure™. Any website that wishes to accept cash EBT must meet the same conditions for cash account debits.

EBT PINs may never be stored for future use in subsequent transactions, either in the website or in any other system maintained by the retailer. The PIN must always be captured and immediately encrypted by Acculynk. They do not store the PIN value after the transaction response is received, either.

In addition, neither Acculynk nor the EBT processors support preauthorization as done in the credit/signature debit environment. As a result, SNAP and cash EBT transactions must always be performed in real time at the time of online PIN entry, with immediate debit of funds from the cardholder’s account and settlement to the retailer within two business days.

2.4.1.1.1 Special Needs of Food Retailers

This creates some problems for the grocery and Internet industries. Many supermarkets that provide home delivery, or put together orders for pickup, deal with products that are sold by weight (e.g., produce, meats, fish and deli items). Therefore, prices for those items are only estimated and could be less or more once the order is fulfilled.

There may be instances where an item is not available at the time the order is put together. Companies have different ways of dealing with this: substitute with a similar product which could cost more or less, backorder, split the delivery, or remove the product from the order total.

2.4.1.1.2 EBT PIN Purchase Process

Based on input from State and industry partners, FNS has established the following guidelines for use during the pilot. The website may “pad” the amount initially debited from the customer’s EBT account by no more than 10 percent of the calculated price of any weighed items, but must provide a subsequent refund for any amount overcharged. For example, if the total EBT order comes to $50, of which $15 is calculated for weighed meat and produce, the Internet retailer may “pad” the debited amount by up to $1.50 (10 percent of $15), and charge the customer up to $51.50. This must be clearly explained to the customer before the transaction is submitted for authorization.

Once the order is fulfilled, if the final price is less than the amount originally debited from the customer, the website must provide an immediate refund to credit the difference back to their account using the process described in Section 2.4.1.2, EBT PINless Refund. If the final price is more than the amount originally debited, the retailer is liable for the difference and may not charge the EBT customer. So if, in the above example, the weighed items actually totaled $15.25, the retailer would provide a refund of $1.25.

Because of the inherent delay built into online commerce, FNS will provide a waiver to all pilot participants, allowing them to collect funds up to seven (7) days in advance of delivery/pickup. Therefore, items cannot be backordered longer than that timeframe. This waiver and all of its related conditions are discussed more thoroughly in Section 2.5, Waivers and Other Conditions, Prepayment.

The actual mechanics of selecting and performing a SNAP PIN purchase are described more thoroughly in Section 2.4.2, Purchase Checkout Process for SNAP and Cash EBT.

2.4.1.1.3 Denial for Insufficient Funds

It should be noted that if a transaction is denied for insufficient funds, the return message will include current account balances for both the SNAP and cash accounts. This information should be presented on the screen to the client so that they can opt to perform another transaction for a lesser amount or select different tender.

2.4.1.2 EBT PINless Refund

This is a new EBT transaction type developed specifically for Internet Retailers. Although most States do not support POS refunds for cash EBT accounts, pilot participants will use the PINless refund process for both SNAP and cash EBT. In almost all cases, refunds will be performed when the customer is offline, and therefore, it will not be possible to capture the cardholder PIN. This transaction type will only be accepted from Internet Retailers; it may not be used by any brick and mortar stores. The process will be used for all instances where funds are due back to the customer. In addition to refunds for overestimated costs, as described above, it may be used for out of stock and returned items. At a minimum, there must be a process in place for human entry of a PINless refund transaction (e.g., through a customer service representative); however, websites are encouraged to integrate automated refund processes into their existing operations for the issues described above.

FNS will provide a waiver to each selected site to allow PINless refunds. In no case may shipping charges be deducted from money refunded for items purchased with SNAP. The full value of any returned food item purchased with SNAP must be credited back to the client’s SNAP account. Any shipping charges due for SNAP returns must be paid through an alternative payment method. Refunds for items purchased with cash EBT are not subject to these restrictions. This waiver and all of its related conditions are discussed more thoroughly in Section 2.5.1, Waivers and Conditions, PINless Refund.

2.4.1.2.1 FNS Timeliness Requirements for Refunds

EBT refunds at brick and mortar locations are processed when the client is present to enter the PIN, so they are immediate. This is not the case for the online environment. FNS will expect that refunds for overestimated weight, substitutions, and out of stock items be made at the time the order is fulfilled or shortly thereafter. Post-delivery refunds, such as those for returned items or customer complaints, must be processed within two (2) company business days after receipt of the returned item or complaint.

2.4.1.2.2 Acculynk Refund Process

All PINless refunds must flow through Acculynk and comply with their specifications. These transactions must contain the authorization number of the original approval so that refunds can be accurately traced. Acculynk maintains a database of all approved transactions for up to 18 months. When a refund request is submitted Acculynk matches it against their database to ensure that it does not exceed the value of the original purchase. The system can track multiple refunds for the same purchase, ensuring the total of all refunds does not exceed the original purchase amount. If the value of the refund is excessive, Acculynk denies the transaction and sends it back to the website without forwarding it for authorization.

2.4.1.2.3 Website Refund Process

Because refunds are sometimes needed based on emails, telephone calls, and receipt of products returned in the mail, every site must have a method to securely enter refund requests manually. The right to do so must be limited to authorized personnel using a password protected user ID. This may be set up in any manner that is effective for the website, as long as it can produce a transaction message that meets Acculynk specifications.

Websites that estimate for weighed items, or have the potential for out of stock products or substitutions, should also consider developing code to automatically create refund transactions at the time the order is finalized to correct overcharges. Automation of this process will help ensure that resulting refunds are timely.

2.4.1.2.4 Refund Notification

EBT customers must receive a receipt or other notification for every refund so that they have a record of the transaction and remaining balances (see Section 2.4.3 Customer Receipt and Notification for information on content, method and timing).

2.4.1.3 Other Mandatory Transaction Types

Websites must be prepared to handle reversals and adjustments in accordance with Acculynk specifications. PINs are not required in reversal messages.

2.4.1.4 Optional Transaction Type

Websites may also employ a void transaction for the last purchase made, but if they do so, the customer must enter the PIN again. EBT processors cannot accept PINless voids. These are usually necessary when a clerk has miskeyed the sale amount so the need for them in the online environment is almost non-existent. Therefore, voids will not be a mandatory transaction type for Internet Retailers. If a situation arises where the sale must be cancelled after it has been processed, the website may perform a PINless refund instead.

2.4.1.4 Prohibited Transaction Types

The FNS authorization for all participants in the pilot will be as an Internet Retailer, only (store type code IR). The valid list of Internet Retailers will be shared with the EBT processor and Acculynk to ensure that only approved retailers perform online transactions. In addition, they will be used by the EBT processor to prevent any retailer coded as IR from doing the following types of transactions:

2.4.1.4.1 Unsupported Transactions