W&I:Compliance, Automated Under Reporter

IRS Customer Satisfaction Surveys

CS-11-314

W&I:Compliance, Automated Under Reporter

OMB: 1545-2250

OMB #1545-1432

Attachments

AUR Mail Survey

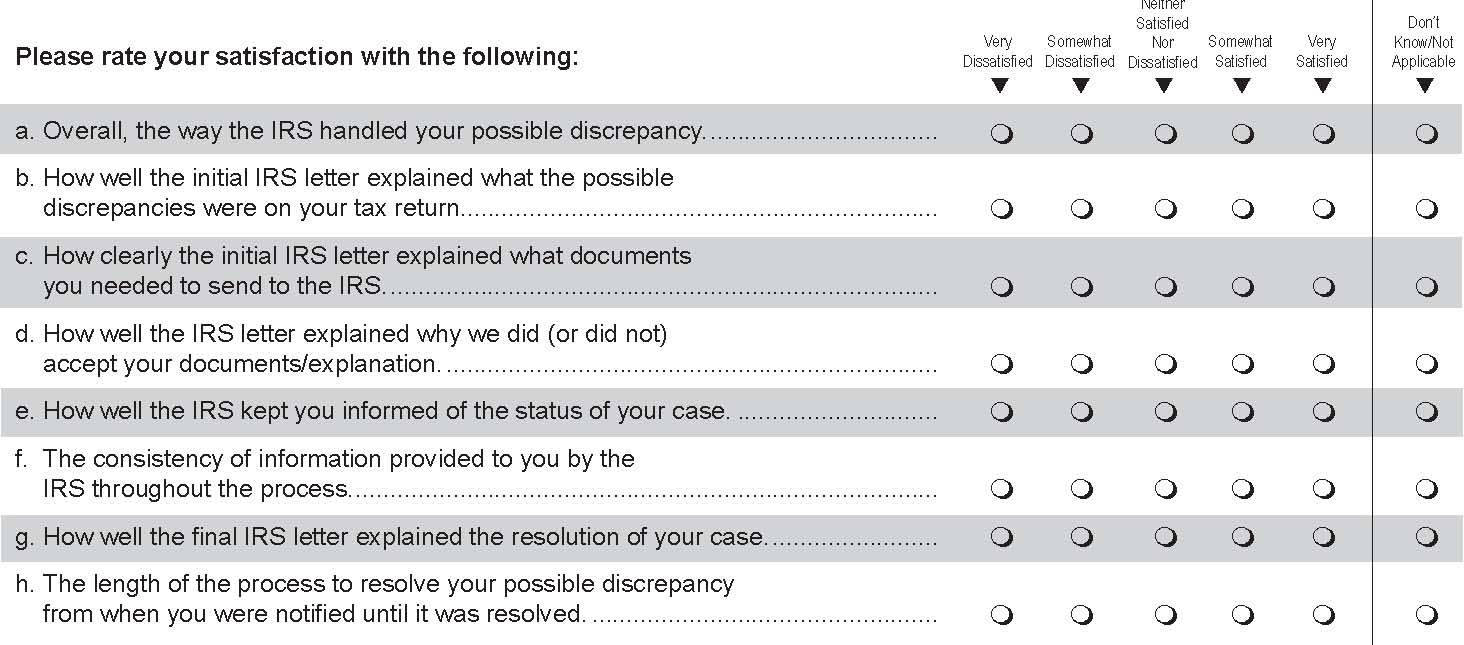

Thinking

of your experience with the process of resolving this possible

discrepancy with the IRS, regardless

of whether you agreed or disagreed with the final outcome,

please mark the option that best represents your experiences

throughout the resolution process.

In

an effort to improve its services to the public, the IRS is seeking

the opinions of taxpayers who received a notice from the IRS

pointing out a possible discrepancy on their tax return. Please

assist us by completing this brief voluntary survey, which should

take less than 5 minutes of your time. ICF will keep your identity

private to the extent permitted by law. If you have any questions

about this survey, you may call the ICF Survey Helpline at

1-888-260-0052.

2. If you answered “Very Dissatisfied” or “Somewhat Dissatisfied” to any of the

above questions, can you describe what caused you to feel that way? __________

______________________________________________________________________________

_______________________________________________________________________________

3. Did you call the IRS about your possible discrepancy using a telephone number

listed on any of the letters?

Yes (continue to 4)

No (skip to 5)

Don’t recall (skip to 5)

4. Regardless of the outcome of your case, how satisfied were you with the service

you received on these calls? Very Dissatisfied; Somewhat Dissatisfied; Neither

Satisfied Nor Dissatisfied; Somewhat Satisfied; Very Satisfied; Don’t Know/Not

Applicable

5. During the process to resolve your possible discrepancy, approximately how many

times did you contact the IRS? (Please enter zero if you did not contact the

IRS by this method). Mail ___Times; Telephone ____ Times; Fax ____ Times

6. When you were first notified of the possible discrepancy, how many months did

you expect it would take to resolve?_____ Months

7. Was the actual amount of time…?

Shorter than you expected

About equal to your expectations

Longer than you expected

8. How much do you agree with the following statements?

Strongly Disagree; Disagree; Neutral; Agree; Strongly Agree; N/A

a. I received an adequate description of the process to resolve my possible

discrepancy

b. My experience reflected the described process

c. I had the opportunity to provide information important to my case

d. I was treated with respect during the process

9. Overall, how well did the IRS meet your expectations while handling the

possible discrepancy? Much better than expected; Better than expected;

As expected; Worse than expected; Much worse than expected; N/A

If you answered “Worse than expected” or “Much worse than expected” to the above question, can you describe what caused you to feel that way?

___________________________________________________________________________

___________________________________________________________________________

10. Who prepared your taxes? (Mark only one.) You; IRS service representative at an IRS office; Professional tax preparer; Volunteer (at a volunteer tax preparation location); Friend or relative; Other;

The IRS continually looks for ways to improve its service to taxpayers who have received a notice pointing out a possible discrepancy on their tax return. Please use this space to provide your comments or suggestions for improvement. We welcome your feedback. ____________________________________________________________________________

_____________________________________________________________________________

Occasionally, the IRS asks ICF to conduct additional in-depth research on tax-related issues. Research participants may receive a small monetary incentive to participate depending on the research. If you are interested in participating in future research, please provide us with your telephone number and e-mail address (if available). This information will not be shared with the IRS and will be used only for the purpose of this research. If you have any questions about this, please contact the ICF Survey Helpline at 1-888-260-0052. Telephone number: ( __ __ __ ) __ __ __ - __ __ __ __

E-mail address:_____________________________________________________________

If you have been unable to resolve any specific problems with your tax matter through the normal IRS channels, or now face a significant hardship due to the application of the tax law, we encourage you to contact the Taxpayer Advocate Service at 1-877-777-4778.

Paperwork Reduction Act Notice

The Paperwork Reduction Act requires that the IRS display an Office of Management and Budget (OMB) control number on all public information requests. The OMB Control Number for this study is 1545-1432. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the: Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

Thank you for completing the survey. Please return this questionnaire to ICF/Scantron, P.O. Box 64529, St. Paul, MN 55164-9614.

| File Type | application/msword |

| File Title | OMB SUPPORTING STATEMENT |

| Author | sherri.a.settle |

| Last Modified By | qhrfb |

| File Modified | 2011-12-05 |

| File Created | 2011-11-30 |

© 2026 OMB.report | Privacy Policy