Supporting Statement Part A - Supplementary

0264 - Land Leasing in Oklahoma Part A_2020Jul29.docx

Quick Response for Cooperator-funded Surveys Generic Clearance

Supporting Statement Part A - Supplementary

OMB: 0535-0264

Supporting Statement – Part A

LAND LEASING SURVEY IN OKLAHOMA

OMB No. 0535-0264

This supporting statement addresses the new data collection effort for a land leasing survey in Oklahoma. This project will collect data from a sample of farmers and ranchers with

income and/or expenses of land rented, as well as

any operations that have positive values for income from recreational avenues.

The reference period will be year 2020. The survey is planned for the even number years. A separate request will be made for each iteration.

Data collected under this supporting statement are for a cooperative agreement between the National Agricultural Statistics Service (NASS) and Oklahoma State University (OSU). Oklahoma State University, as well as many farmers and ranchers in Oklahoma, have been interested in land rental rates for

agricultural operations above what is provided in the Cash Rents and Leases Survey (0535-0002). While the purpose of the Cash Rents and Leases Survey is to provide county-level cash rent estimates for pasture, irrigated, non-irrigated cropland, it does limit and exclude important data that is useful to producers in Oklahoma. Example land rental arrangements not included are crop share rent, pasture rent, winter annual rent, and recreational land rent.

A. JUSTIFICATION

This survey is being conducted through a cooperative agreement with Oklahoma State University under a full-cost recovery basis. NASS has cooperative agreements with State Departments of Agriculture and Land Grant Universities to fulfill its mission of providing timely, accurate, and useful statistics in service to United States agriculture. These cooperators often seek the assistance of NASS to provide statistics beneficial to agriculture, but are not covered by NASS’s annual Congressional appropriation. General authority for conducting cooperative projects is granted under U.S. Code Title 7, Section 450a which states that USDA officials may, “enter into agreements with and receive funds…for the purpose of conducting cooperative research projects…”

NASS benefits from these cooperative agreements by: (1) obtaining additional data to update its list of farm operators; (2) encouraging both parties to coordinate Federal survey activities and activities funded under a cooperative agreement to reduce the need for overlapping data collection and/or spread out respondent burden; and (3) facilitating additional promotion of NASS surveys and statistical reports funded by annual Congressional appropriations.

Respondents benefit from these cooperative agreements by: (1) having their reported data protected by Federal Law (U.S. Code Title 18, Section 1905; U.S. Code Title 7, Section 2276; and Public Law 107-347, Title V (CIPSEA)); (2) having data collection activities for Federal and Cooperative surveys coordinated to minimize respondent burden; and (3) having high-quality agricultural data that are important to a state or region be collected and published.

1. Explain the circumstances that make the collection of information necessary. Identify any legal or administrative requirements that necessitate the collection. Attach a copy of the appropriate section of each statute and regulation mandating or authorizing the collection of information.

The primary function of the National Agricultural Statistics Service (NASS) is to prepare and issue current official state and national estimates of crop and livestock production, value, disposition, and resource use.

General authority for these data collection activities is granted under U.S. Code Title 7, Section 2204. This statute specifies that "The Secretary of Agriculture shall procure and preserve all information concerning agriculture which he can obtain ... by the collection of statistics ... and shall distribute them among agriculturists."

Oklahoma State University, as well as many farmers and ranchers in Oklahoma, have been interested in land rental rates for agricultural operations above what is provided in the Cash Rents and Leases Survey (0535-0002).

The NASS Cash Rent Survey which is conducted annually in all States except Alaska concentrates on three key items; cash rents for - irrigated cropland, non-irrigated cropland and pastureland. These data will be used to satisfy the requirement originally specified in the 2008 Farm Bill to publish county level cash rent data for both crop land and pasture land. The Land Leasing in Oklahoma survey will expand the scope of this survey to collect data for land rented for specific crops, share rent, improved pasture acres, winter grazing acres, and recreational uses.

To assist producers with this data need, the Oklahoma State University, Department of Agricultural Economics (OSU-DAE), has been collecting and publishing statistical estimates biennially for more than 30 years - before USDA-NASS was tasked with the Cash Rents County Estimates as specified in the 2008 Farm Bill. The OSU-DAE obtained useful statistics to assist producers in making sound rental agreements. Again, due to the diverse nature of the state, OSU-DAE felt it necessary to provide more descriptive land breakouts such as pasture estimates into native pasture and improved pasture due to large price differences and input costs associated with each type of pasture.

A recent data request highlighted this limit: A data user (landlord) was trying to re-negotiate the rental rate with their lessee on a large amount of Bermuda grass pastureland. They were given the pasture rate from the USDA-NASS 2017 Cash Rents Survey for the county ($10/ac), district ($12/ac), and the State ($13/ac). The data user was able to find the OSU-DAE pasture rates for 2016/2017 for Bermuda (Improved Pasture) in his Region ($24.55) and at the State level ($22.79). The data user would have lost $12 to $14/per acre if used only the USDA-NASS Cash Rents Survey data alone.

The OSU-DAE also felt it necessary to provide more descriptive information of cropland as well. Depending on the area, soil condition, drainage, etc. some crops may not produce well in those conditions, which limits what the lessee can plant. A great example of this is the Northwest Region of the state where in many cases, the only crop that can be produced is a small grain (wheat or rye). The non-irrigated cropland rate does not truly represent the value that would be just small grain-only ground. This limit can significantly change the negotiable value between a renter and lessee.

Oklahoma is also a very unique state because of its access to the stocker industry. Many producers winter pasture livestock in Oklahoma for producers in the Southeast (predominantly Mississippi to Florida) on a contractual basis with pay determined by animal gain. Producers background these cattle for the precursor to the feed lots because of the cheap cost of gain. Oklahoma producers rent through the winter on small grains or over the summer on native grass and improved pasture. The OSU-DAE information collected on this type of agreement is the only published source of this information for producers. Lastly, OSU-DAE collects data for share rent agreements: They collect data about receipts and expenses that each party pays or receives for various commodities. This is the only source of this data for Oklahoma producers.

2. Indicate how, by whom, and for what purpose the information is to be used. Except for a new collection, indicate the actual use the agency has made of the information received from the current collection.

NASS will conduct a survey of agricultural operations in Oklahoma. According to the NASS report “Farms and Land in Farms, 2019 Summary”, there are an estimated 77,300 farms in Oklahoma. Selected farmers will be asked to provide data on

Cash rent and acreage either rented by the operator or rented from the operator by selected crops,

Form of the lease agreement for cash rented acreage,

Share percentage and acreage either rented by the operator or rented from the operator by selected crops,

Form of the lease agreement for share rented acreage,

Rent and acreage either rented by the operator or rented from the operator for pasture leases,

Form of the lease agreement for pasture leases,

Rent and acreage either rented by the operator or rented from the operator for winter grazing,

Form of the lease agreement for winter grazing,

Rent and acreage either rented by the operator or rented from the operator for recreational leases, and

Form of the lease agreement for recreational leases.

The OSU-DAE surveys producers every other year to obtain data for the publication that is usually released in January of odd years (2017, 2019, 2021, etc.). The OSU-DAE only publishes number of reports by item, means, medians (if not disclosing information), distributions (with open ended tails to prevent disclosure) at a district (eastern district & western district) and state-level upholding all disclosure requirements set forth by USDA-NASS.

3. Describe whether, and to what extent, the collection of information involves the use of automated, electronic, mechanical, or other technological collection techniques or other forms of information technology, e.g., permitting electronic submission of responses, and the basis for the decision for adopting this means of collection. Also describe any consideration of using information technology to reduce burden.

During this data collection, NASS will mail out a paper questionnaire along with a cover letter and return envelope. Operators who do not respond to this mailing will be contacted for a Telephone Interview by a trained National Association of State Departments of Agriculture (NASDA) enumerator.

4. Describe efforts to identify duplication. Show specifically why any similar information already available cannot be used or modified for use for the purposes described in Item 2 above.

NASS cooperates with State departments of agriculture, land grant universities, and other State and Federal agencies to conduct surveys. Wherever possible, surveys meet both State and Federal needs, thus eliminating duplication and minimizing reporting burden on the agricultural industry.

Data collection for both the Federal Cash Rents and Land Leasing in Oklahoma surveys are coordinated to prevent duplication. The OSU-DAE acknowledges the Federal Cash Rent estimates in the Extension Bulletin publication and properly sources USDA-NASS.

5. If the collection of information impacts small businesses or other small entities (Item 5 of OMB Form 83-I), describe any methods used to minimize burden.

This information collection will not have a significant economic impact on small entities. Out of the estimated sample size of 2,700, over 95 percent of the samples are estimated as small operations (i.e. have TVP less than $1 million dollars).

6. Describe the consequence to Federal program or policy activities if the collection is not conducted or is conducted less frequently, as well as any technical or legal obstacles to reducing burden.

Due to the diverse nature of the state, the OSU-DAE felt it necessary to provide more descriptive rent breakouts such as pasture estimates into native pasture and improved pasture due to large price differences and input costs associated with each type of pasture.

A recent data request highlighted this limit: A data user (landlord) was trying to re-negotiate the rental rate with their lessee on a large amount of Bermuda grass pastureland. They were given the pasture rate from the USDA-NASS 2017 Cash Rents Survey for the county ($10/ac), district ($12/ac), and the State ($13/ac). The data user was able to find the OSU-DAE pasture rates for 2016/2017 for Bermuda (Improved Pasture) in his Region ($24.55) and at the State level ($22.79). The data user would have lost $12 to $14/per acre if used only the USDA-NASS Cash Rents Survey data alone.

To assist producers with this data need, the Oklahoma State University, Department of Agricultural Economics (OSU-DAE), has been collecting and publishing statistical estimates biennially for more than 30 years - before USDA-NASS was tasked with the Cash Rents County Estimates. The OSU-DAE obtained useful statistics to assist producers in making sound rental agreements. Again, due to the diverse nature of the state, OSU-DAE felt it necessary to provide more descriptive land breakouts such as pasture estimates into native pasture and improved pasture due to large price differences and input costs associated with each type of pasture. This effort has not impacted the federal program. Response rates have continued to remain strong for the federal program despite the OSU-DAE data collection effort as well. Routinely, OSU-DAE has publicly encouraged all producers to respond to our Federal surveys to provide Oklahoma Producers with better data to make important decisions on.

7. Explain any special circumstances that would cause an information collection to be conducted in a manner inconsistent with the general information guidelines in 5 CFR 1320.5.

There are no special circumstances associated with this information collection.

8. Provide a copy and identify the date and page number of publication in the Federal Register of the agency's notice, required by 5 CFR 1320.8 (d), soliciting comments on the information collection prior to submission to OMB. Summarize public comments received in response to that notice and describe actions taken by the agency in response to these comments.

The Federal Register Notice soliciting comments was published on December 10 2018.

Describe efforts to consult with persons outside the agency to obtain their views on the availability of data, frequency of collection, the clarity of instructions and record-keeping, disclosure, or reporting format (if any), and on the data elements to be recorded, disclosed, or reported.

The Oklahoma State University requested and received input on these questions from stakeholders, peer-review research, and cooperating agencies. Since OSU does house the extensions service, those specialist and educators were tapped to provide input on this data collection effort. In turn those specialist and educators could get input from local producers and provide important feedback.

Trent Milacek, NW Area Extension Specialist, 580-237-7677

Scott Clawson, NE Area Extension Specialist, 918-686-7800

JJ Jones, SE Area Extension Specialist, 580-332-7011

Claude Bess, SE District Extension Director, 580-332-4100

9. Explain any decision to provide any payment or gift to respondents.

No payment or gifts will be provided to respondents.

10. Describe any assurance of confidentiality provided to respondents and the basis for the assurance in statute, regulation, or agency policy.

Questionnaires include a statement that individual reports are confidential. U.S. Code Title 18, Section 1905; U.S. Code Title 7, Section 2276; and Public Law 107-347, Title V (CIPSEA) provide for confidentiality of reported information. All employees of NASS and all enumerators hired and supervised under a cooperative agreement with the National Association of State Departments of Agriculture (NASDA) must read the regulations and sign a statement of compliance.

Additionally, NASS employees and NASS contractors comply with the OMB implementation guidance document, “Implementation Guidance for Title V of the E-Government Act, Confidential Information Protection and Statistical Efficiency Act of 2002 (CIPSEA).” CIPSEA supports NASS’s pledge of confidentiality to all respondents and facilitates the agency’s efforts to reduce burden by supporting statistical activities of collaborative agencies through designation of NASS agents, subject to the limitations and penalties described in CIPSEA.

The following confidentiality pledge statement will appear on all NASS questionnaires.

The information you provide will be used for statistical purposes only. Your responses will be kept confidential and any person who willfully discloses ANY identifiable information about you or your operation is subject to a jail term, a fine, or both. This survey is conducted in accordance with the Confidential Information Protection provisions of Title V, Subtitle A, Public Law 107-347 and other applicable Federal laws. For more information on how we protect your information please visit: https://www.nass.usda.gov/confidentiality.

All individuals who may access these confidential data for research are also covered under Titles 18 and CIPSEA and must complete a Certification and Restrictions on Use of Unpublished Data (ADM-043) agreement.

11. Provide additional justification for any questions of a sensitive nature.

There are no questions of a sensitive nature.

12. Provide estimates of the hour burden of the collection of information. The statement should indicate the number of respondents, frequency of response, annual hour burden, and an explanation of how the burden was estimated. If this request for approval covers more than one form, provide separate hour burden estimates for each form and aggregate the hour burdens in Item 13 of OMB Form 83-I. Provide estimates of annualized cost to respondents for the hour burdens for collections of information, identifying and using appropriate wage rate categories.

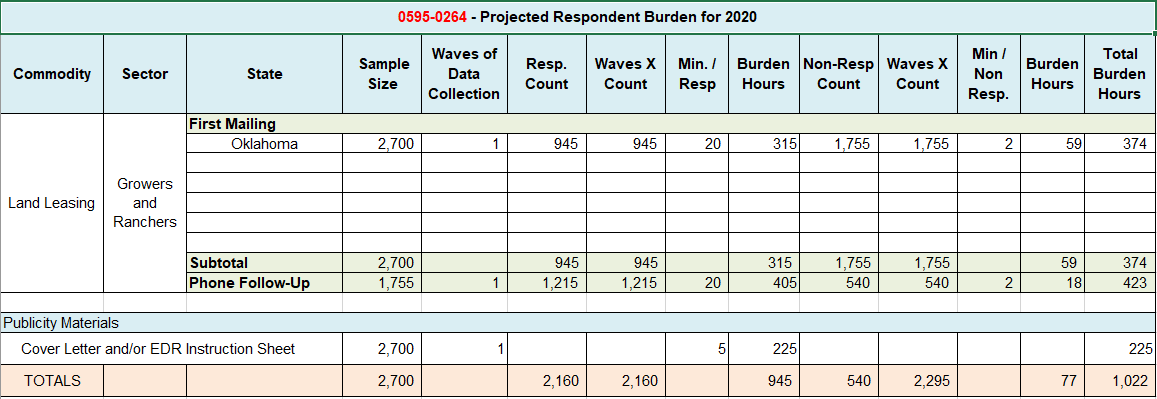

Burden hours based on the average completion time per questionnaire are summarized below.

Burden hour calculations are shown below. The minutes-per-response figures were estimated based on consultation with Oklahoma State University Department of Agricultural Economics and stakeholders. Cost to the public of completing the questionnaire is assumed to be comparable to the hourly rate of those requesting the data. Reporting time of 1,022 hours is multiplied by $37.47 per hour for a total cost to the public of $ 38,294.34.

NASS uses the Bureau of Labor Statistics’ Occupational Employment Statistics (most recently published on March 31, 2020 for the previous May) to estimate an hourly wage for the burden cost. The May 2019 mean wage for bookkeepers was $20.65. The mean wage for farm managers was $38.63. The mean wage for farm supervisors was $25.25. The mean wage of the three is $28.18. To calculate the fully loaded wage rate (includes allowances for Social Security, insurance, etc.) NASS will add 33% for a total of $37.47 per hour.

13. Provide an estimate of the total annual cost burden to respondents or record-keepers resulting from the collection of information.

There are no capital/start-up or ongoing operation/maintenance costs associated with this information collection.

14. Provide estimates of annualized cost to the Federal government; provide a description of the method used to estimate cost which should include quantification of hours, operational expenses, and any other expense that would not have been incurred without this collection of information.

The projected annual cost to conduct the Land Leasing in Oklahoma Survey is approximately $24,100, most of which is staff costs. The costs will be reimbursed by the Oklahoma State University. There will be no cost to the Federal government.

15. Explain the reasons for any program changes or adjustments reported in Items 13 or 14 of the OMB Form 83-I (reasons for changes in burden).

This is a new request, so there is no current inventory.

16. For collections of information whose results will be published, outline plans for tabulation and publication. Address any complex analytical techniques that will be used. Provide the time schedule for the entire project, including beginning and ending dates of the collection of information, completion of report, publication dates, and other actions.

The Regional Field Office (RFO) is responsible for manually editing and processing the questionnaires. The RFO creates and provides editing guidelines to help ensure that all questionnaires are edited and analyzed in a consistent manner. After the data has been key entered and run through computer edits, survey data will be made available to approved Oklahoma State University personnel for analysis and summarization through a secure data enclave operated by the NORC at the University of Chicago. Only summarized data that meets NASS disclosure standards will leave the data lab.

The Client anticipates publication in January 2021.

2020 Survey:

Survey design July - August, 2020

Sample selection August, 2020

Questionnaire design April, 2020 - June, 2020

Mail Survey October, 2020

Phone Follow-up October, 2020 – November, 2020

End of Data Collection November, 2020

Publication January, 2021

17. If seeking approval to not display the expiration date for OMB approval of the information collection, explain the reasons that display would be inappropriate.

No approval is requested for non-display of the expiration date.

18. Explain each exception to the certification statement identified in Item 19, “Certification for Paperwork Reduction Act Submissions” of OMB Form 83-I.

There are no exceptions to the certification statement.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Supporting Statement |

| Author | brouka |

| File Modified | 0000-00-00 |

| File Created | 2021-01-13 |

© 2026 OMB.report | Privacy Policy