Supporting_Statement_Part B_2018_06_18_Final

Supporting_Statement_Part B_2018_06_18_Final.docx

Quarterly Financial Report (QFR)

OMB: 0607-0432

Department of Commerce

U.S. Census Bureau

OMB Information Collection Request

Quarterly Financial Report (QFR) Program

OMB Control Number 0607-0432

B. Collections of Information Employing Statistical Methods

1. and 2. Universe and Respondent Selection/Procedures for Collecting Information

The frame from which the major portion of the QFR sample is selected consists of the IRS file of those corporate entities which are required to file IRS Form 1120, 1120A or 1120S and which also have as their principal industrial activity: manufacturing, mining, wholesale trade, retail trade, information, or professional and technical services (except legal). The IRS file is sampled once each year. At the time the sample is selected, the file does not contain those corporate entities whose first income tax return has not been processed. In addition, several months elapse between the selection of this sample and its introduction into the QFR Program.

To keep the QFR sample up-to-date, staff reviews current corporate news releases and public records to identify any potential large additions and changes to the target population. Corporations thus identified and thought to meet QFR in-scope criteria are contacted to verify their in-scope status. If determined to be in-scope of the QFR, the corporation will automatically be included in the survey for the remainder of the sample year.

Nearly all corporations whose operations are within the scope of the QFR and which have total assets greater than $250 million are included in the sample with certainty. They are permanent sample members, with a one-out-of-one sampling fraction. In addition, receipts cut-off values are determined on an industry basis. If a corporation has receipts at or above the receipts cut-off value for their industry, that corporation is made a permanent sample member, with a one-out-of-one sampling fraction.

Simple random samples are selected from the eligible units in the remaining industry-by-size groups. The total sample size for the non-certainty portion of the sample remains the same from year to year. After the initial sample allocation, the sample allocation may be adjusted to ensure the time-in/time-out constraints required by SEC. 3. Burden Reduction Regarding Quarterly Financial Report Program at Bureau of the Census of the 1995 Paperwork Reduction Act are achieved.

The non-certainty sample in each industry-by-size group is divided systematically into four panels that are introduced over the next year. Each panel is in the survey for eight successive quarters. Each quarter, one panel is rotated out and a new panel is rotated into the sample. This means that the non-certainty portion of the sample for adjacent quarters is seven-eighths identical, and is one-half identical for quarters ending one year apart.

These statistical procedures yield a sample of corporations that are considered potential respondents. After an initial screening, and if the company is found to be within the scope of the program, filing of the QFR report form is mandatory.

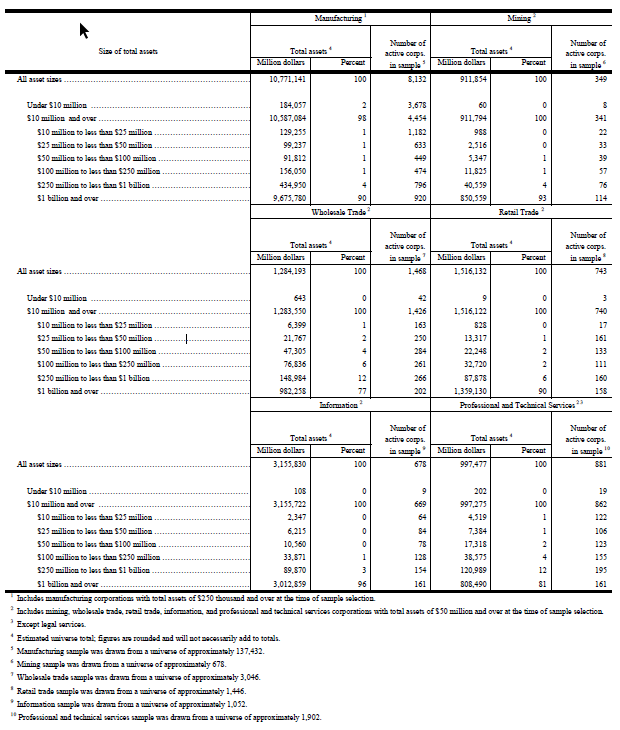

The table below, Composition of the Sample, by NAICS Sector and Size of Total Assets, summarizes the resulting sample size by industry sector and size groups.

Composition of the Sample, by NAICS Sector and Size of Total Assets

Third Quarter 2017

The QFR response rates differ by size category. On average, from 2016Q4 to 2017Q3, corporations with assets of $250 million and over achieved a response rate of about 71%; corporations below the $250 million asset level achieved a response rate of about 55%; over all asset size categories, the QFR achieved a response rate of about 61%. Data are imputed for corporations that are active but do not respond to the survey. This is done using statistical procedures that utilize previously reported data (if available) and data from current respondents of similar asset size and industry classification. The total quantity response rate, defined as the percentage of a published estimate represented by data from respondents or equivalent source data, is over 85% for the QFR major data items. Relative standard errors for key items estimates at the sector level vary but are generally less than .2. This is adequate to support the precision requirements of the survey.

Each QFR report form received is reviewed by QFR staff accountants for adherence to GAAP and QFR guidelines. Should QFR requirements dictate a classification of data different from the reporting corporation's report, the accountant is responsible for reclassifying or adjusting the data item(s). If complex problems arise, officials of the reporting corporation are contacted to discuss proposed adjustments.

Nonresponse Bias Study

A nonresponse bias analysis completed in 2018 reviewed weighted and unweighted unit response rates (URR), total quantity response rates (TQRR), relative bias, and correlated frame data for 2015q4 through 2017q3. Different reporting patterns are observed from the certainty units, typically the larger companies, and noncertainty units, typically small and medium size companies. URRs for non-certainty companies are significantly lower than for certainty companies. The Retail Trade sector, due to the timing of its business cycle, had the lowest average URR below 60%. TQRRs for the non-certainty companies are lower than those for certainty companies. Durable Goods in Wholesale Trade (421) has the lowest average TQRR of approximately 70%. A graph showing these differences for Manufacturing, Mining, Wholesale Trade, and Selected Service Industries is publically available at: https://www.census.gov/econ/qfr/documents/hist_mmw_resp_rates.pdf.

A similar graph for Retail Trade is also available at: https://www.census.gov/econ/qfr/documents/hist_ret_resp_rates.pdf.

Industries Aerospace Products and Parts (386) and Telecommunications (517) suffered from a large relative bias in both the 2014 and 2018 nonresponse bias studies. To improve nonresponse bias in the future, it is recommended to identify and target chronic certainty respondents for additional follow-up in industries 421, 386, and 517 to boost URR, TQRR, and decrease relative bias. It is also recommended to continue to identify the largest weighted noncertainty nonrespondents for additional follow-up.

3. Methods to Maximize Response

A set of QFR report forms is mailed during the last month of a company's quarter. Upon expiration of the 25-day filing requirement, a letter advising the company of its delinquency is mailed with a form. In the event of continued noncompliance, companies are contacted by telephone and advised of the report's mandatory nature. QFR also conducts courtesy calls to companies sampled for the first time informing them that they will begin receiving the QFR survey.

In addition, QFR has implemented the following efforts in order to improve the response rate:

QFR staff conducts research each quarter on non-certainty companies that have been non-respondent for two or more quarters. This research often results in the following types of actions: updating a company’s address, updating a company’s contact information, and/or removing the company from the survey due to merger and/or acquisition activity.

QFR staff conducts research annually on certainty companies that have been non-respondent for three or more quarters. This research often results in the following types of actions: updating a company’s address, updating a company’s contact information, and/or removing the company from the survey due to merger and/or acquisition activity.

QFR staff began collaborating with response and collection strategists at the Census Bureau on how to maximize response.

Implementation of Paperless Facsimile. Often companies misplace the form or don’t recall receiving it when staff are conducting non-response telephone follow-up phone calls. The Paperless Facsimile system allows companies to receive a new copy of the form via fax quickly.

Each quarter, QFR staff conduct additional non-response telephone follow-up phone calls to the top fifty non-certainty companies with the highest impact to the non-response bias.

Utilization of the Census Bureau’s Secure Messaging Center (SMC) for correspondence with companies. This secure system is often a preferred method of communication by respondents.

4. Tests of Procedures or Methods

Forms and methods used in the QFR program are subject to continued informal assessments. They have been refined as warranted to reflect changed conditions in the private sector and improved data program practices. The program has 65 years of experience collecting this information. The information requested is easily accessible by reporting corporations, and the burden associated with completing these forms is not considered significant.

The QFR report forms are in traditional corporate income statement and balance sheet formats. Reporting rules conform, for the most part, to GAAP and financial statement presentation. The QFR report short form was developed and introduced in 1981. The short form (a simplified version of the long form) was developed in response to comments from small companies and representatives of small businesses.

5. Contacts for Statistical Aspects and Data Collection

In July 2016, the QFR's statistical methods were evaluated in accordance with OMB Statistical Policy Directive No. 3, and the completed evaluation clearly supports continuation of the current methodology. In October 2005, QFR’s variable weight estimator was validated1. In addition, the QFR's primary users, the BEA and FRB, have expressed continued satisfaction with the reliability of this data series for estimation of the corporate profits component of the GDI and the Flow of Funds accounts respectively.

Ms. Brandi Maxson, Chief of the Quarterly Financial Branch for the Quarterly Financial Report Program, is responsible for collection and analysis of QFR data. She can be reached at (301) 763-6600. Mr. James W. Hunt, Chief of the Financial and Business Owners Surveys Statistical Methods Branch, is responsible for oversight of and consultation regarding the QFR statistical methods. He can be reached at (301) 763-3310.

List of Attachments

A. Letter of Support from BEA

B. Forms Used in Conducting the QFR Program:

QFR-200 (MT) and instructions QFR-200 (I)

QFR-201 (MG) and instructions QFR-201 (I)

QFR-300 (S) and instructions QFR-300 (I)

C. Cover Letters:

QFR-006 (L1)

QFR-29 (L2)

D. Internet Instrument Used in Conducting the QFR Program:

Centurion

1 https://www.census.gov/srd/papers/pdf/rrs2005-08.pdf

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Modified | 0000-00-00 |

| File Created | 0000-00-00 |

© 2026 OMB.report | Privacy Policy