Online Community on Customer Experience Feedback

Online Research Survey to Solicit Customer Experience Feedback for Treasury Retail Investment Manager (TRIM)

Phase 2 Survey - finalNov25.rtf

Online Community on Customer Experience Feedback

OMB: 1530-0070

Lets talk about digital experiences

Hello!

Thank you for your willingness to participate in our survey! Throughout this survey we’ll be asking you questions to learn more about your thoughts, experiences and opinions related to your experience with digital financial services.

Let’s get started!

For Fiscal Service to speak with the public, we are required to have approval from the Office of Management and Budget. You are not required to respond unless a currently valid OMB approval number is provided. The approval number for this project is XXXXX. This study is estimated to average XX minutes of total engagement time. If you have any comments regarding this study, please write to: Bureau of the Fiscal Service, Forms Management Officer, Parkersburg, WV 26106-1328.

How old are you (in years)?

|

TERMINATE if age <22 or age> 85

Do you or any member of your household work in any of the following fields? Check all that apply.

Advertising, marketing, sales promotion, market research, and/or marketing consulting

Public relations

Financial services such as a bank, credit union, or investment firm

Healthcare industry, hospital, doctor’s office, and/or pharmacy

Food services such as restaurants, cafeterias, and/or coffee shop

Manufacturing

None of the above

Are you or anyone in your household employed by a financial regulatory institution such as the SEC, The Federal Reserve, or the FDIC?

Yes [TERMINATE]

No

Are you or is anyone in your household a civilian employee of the federal government?

Yes [TERMINATE]

No

What was your total family income before taxes in 2019.This total should include salaries, wages, pensions, dividends, interest, and all other income for every member of your family living in your household in 2019.

Less than $19,999 [TERMINATE]

$20,000 to $39,999

$40,000 to $59,999

$60,000 to $79,999

$80,000 to $99,999

$100,000 to $119,999

$120,000 to $139,999

$140,000 to $159,999

$160,000 to $179,999

$180,000 to $199,999

Above $200,000

Prefer not to say [TERMINATE]

I don’t know [TERMINATE]

Which of the following statements best describes your involvement in your household’s financial planning?

I am the sole decision maker

I share decision making with others

I give input, but someone else usually makes the final decision

I am not usually involved in financial decision making [TERMINATE]

How familiar are you with financial terms like return, risk, interest rate, U.S. Treasury, or brokerage?

Unfamiliar: I have no idea what you’re talking about [TERMINATE]

Novice: I understand what these terms mean

Intermediate: I can hold a conversation on how my accounts are doing

Master: I can lead a conversation about how the markets affect my account performance

None of the above [TERMINATE]

When was the last time you used a mobile app or website to manage your finances? Managing your finances can include: online banking, paying a bill online, checking the balances of your accounts, investing and/or using a budgeting tool.

Within the last week

Within the last month

Within the last 3 months

Within the last 6 months

Within the last year

Over a year ago [LIMIT TO 10% OF RESPONSES]

None of the above [TERMINATE]

How would you assess your overall financial knowledge on a scale of 1 (low) to 5 (high)?

|

1 |

2 |

3 |

4 |

5 |

Financial Knowledge |

❏ |

❏ |

❏ |

❏ |

❏ |

Our ask of you is simple: Can you do your best to answer our questions honestly and accurately?

Yes, I agree to answer honestly and accurately

No, I can’t agree to that [TERMINATE]

People have a lot of different goals when they save and/or invest.

This next set of questions will ask you about yours.

What goals are you currently saving and/or investing for? Check all that apply.

Emergencies (e.g., loss of income, unexpected expenses)

Fun (e.g., vacation, recreational activities)

Having a child / childcare expenses

My child’s education

New home

New car

Wedding

Retirement

Overall financial security

Buying nice things

Leaving something behind for my family

Comfort in my old age

Home improvement

Payoff debt

Other __________

None of the above

Are you saving or investing to achieve each of your financial goals?

[ONLY SHOW OPTIONS SELECTED IN PREVIOUS QUESTION]

|

Saving |

Investing |

Both |

Emergencies (e.g., loss of income, unexpected expenses) |

❏ |

❏ |

❏ |

Fun (e.g., vacation, recreational activities) |

❏ |

❏ |

❏ |

Having a child / childcare expenses |

❏ |

❏ |

❏ |

My child’s education |

❏ |

❏ |

❏ |

New home |

❏ |

❏ |

❏ |

New car |

❏ |

❏ |

❏ |

Wedding |

❏ |

❏ |

❏ |

Retirement |

❏ |

❏ |

❏ |

Overall financial security |

❏ |

❏ |

❏ |

Buying nice things |

❏ |

❏ |

❏ |

Leaving something behind for my family |

❏ |

❏ |

❏ |

Comfort in my old age |

❏ |

❏ |

❏ |

Home improvement |

❏ |

❏ |

❏ |

Payoff debt |

❏ |

❏ |

❏ |

When do you expect to withdraw a significant portion of the money in your savings / investment accounts?

Less than 1 year

1-3 years

4-6 years

9 years

10 years or more

None of the above – I don’t have savings/investment accounts

Now that we've talked about your goals, we are going to ask you a few questions about different features a financial services website or app could have to support you.

But first, how do you like to manage your finances? Please rank as many of the options below from your most preferred (1) to your least preferred. If you do not use any of the methods listed, please select “Do not use”

Desktop website (laptop/pc) __________

Mobile website __________

Mobile app (on smartphone or tablet) __________

Bank branch __________

ATM __________

Telephone __________

Mail __________

In-person meeting __________

Remote meeting (video conferencing) __________

Do not use any of the methods listed

How important is using a website or app to complete any of the following financial service tasks?

[ITEMS WILL BE RANDOMIZED]

|

Not at all important (0) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Extremely important (10) |

Transfer from one of your accounts to another within the same financial platform |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Transfer money to another person |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Pay bills |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Check your account balance |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Transfer money to a different financial platform |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Update contact information |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Talk to someone about a product |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Research a product |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Dispute a transaction |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

File a complaint |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Open a new account |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Interact with a customer service rep |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Manage my investment portfolio |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Manage my account / set of accounts |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

When using a website or mobile app to manage your finances, how important are the following features?

[ITEMS WILL BE RANDOMIZED]

|

Not at all important (0) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Extremely important (10) |

Easy to integrate with other financial products |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Alerts me about new deposits |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Ability to easily contact customer service |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Provide content like news, research, and/or analysis |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Information about how my data is used, secured and protected |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Keep my financial data/information secure |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Easy to search and navigate |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Warns me about errors |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Warns me about potential fraud |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Notifies me about good times to sell, trade or redeem assets |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Automatic reinvestments of interest and/or dividends |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Automatic transfers to my bank when I trade or sell an asset |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

A “cash pool” within my account to fund purchases |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Alerts me about my account balances |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

When you manage your finances, what level of access would you be like to give someone else?

[ITEMS WILL BE RANDOMIZED]

|

Full Access to Manage |

Read-only Access |

No Access |

I don't know |

My spouse/significant other |

❏ |

❏ |

❏ |

❏ |

My parents |

❏ |

❏ |

❏ |

❏ |

My children under 18 (minors) |

❏ |

❏ |

❏ |

❏ |

My adult children |

❏ |

❏ |

❏ |

❏ |

Individuals with legal authority (e.g. legal guardian, trustees, power of attorney) |

❏ |

❏ |

❏ |

❏ |

My financial advisor |

❏ |

❏ |

❏ |

❏ |

A beneficiary |

❏ |

❏ |

❏ |

❏ |

When managing your finances online (either in an app or on a website), how much do you like the following security features?

[ITEMS WILL BE RANDOMIZED]

|

Dislike (0) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Like (10) |

Access to many sites after initial login (i.e. single sign-on) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Identity confirmation (i.e. multi-factor log-in with SMS) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Help with login issues (i.e. customer support) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Staying logged in between uses/logins |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Automatic logout with no activity (for security purposes) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Going to an external website to verify my identity |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Going to an external website to login |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

The next set of questions will focus on financial products like types of accounts and investments.

How many different financial service providers do you have accounts with?

|

Do you currently have a financial advisor?

Yes

No

Which of the following financial products have you heard of? Check all that apply

Savings account

Certificates of Deposit (CDs)

529 education savings plans

Individual Retirement Accounts (IRAs)

401(k)

Paper Savings Bond

Electronic Savings Bond

Corporate Bonds

Treasury Securities (Treasury Bills, Treasury Notes, TIPs)

Money Market Account

Mutual Funds

Stocks

Exchange-Traded Funds (ETFs)

None of the Above

Which of the following financial products / accounts do you own? Check all that apply

[ONLY ITEMS SELECTED IN PREVIOUS QUESTION WILL BE SHOWN]

Savings account

Certificates of Deposit (CDs)

529 education savings plans

Individual Retirement Accounts (IRAs)

401(k)

Paper Savings Bond

Electronic Savings Bond

Corporate Bonds

Treasury Securities (Treasury Bills, Treasury Notes, TIPs)

Money Market Account

Mutual Funds

Stocks

Exchange-Traded Funds (ETFs)

None of the above

How interested are you in the following products on a scale of 0 to 10, where 0 means "not at all interested" and 10 means "extremely interested" ?

[ONLY ITEMS NOT SELECTED IN PREVIOUS QUESTION WILL BE SHOWN]

|

Not at all interested (0) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

Extremely interested (10) |

Savings account |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Certificates of Deposit (CDs) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

529 education savings plans |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Individual Retirement Accounts (IRAs) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

401(k) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Paper Savings Bond |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Electronic Savings Bond |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Corporate Bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Treasury Securities (Treasury Bills, Treasury Notes, TIPs) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Money Market Account |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Mutual Funds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Stocks |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Exchange-Traded Funds (ETFs) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Have you ever used TreasuryDirect?

Yes

No [SKIP TO NEXT SECTION]

I don’t know [SKIP TO NEXT SECTION]

How have you used TreasuryDirect? (check all that apply)

Research information about treasury products

Purchase electronic savings bonds (I and E/EE bonds)

Purchase treasury securities (treasury bills, treasury notes, TIPS, floating rate notes, T-bonds)

Monitor value of my paper bonds

Manage my electronic bonds

Manage my electronic securities

Redeem my paper bonds

Convert my paper bonds to electronic bonds

Redeem my electronic bonds

Transfer treasury securities to a bank, broker, or dealer

Payroll savings plan to automatically purchase savings bonds

Other __________

When was the last time you conducted any of the following actions with TreasuryDirect?

[ONLY ITEMS SELECTED IN PREVIOUS QUESTION WILL BE SHOWN]

|

In the last week |

In the last month |

In the last quarter |

In the last 6 months |

In the last year |

Over a year ago |

Research information about treasury products |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Purchase electronic savings bonds (I and E/EE bonds) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Purchase treasury securities (treasury bills, treasury notes, TIPS, floating rate notes, T-bonds) |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Monitor value of my paper bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Manage my electronic bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Manage my electronic securities |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Redeem my paper bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Convert my paper bonds to electronic bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Redeem my electronic bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Transfer treasury securities to a bank, broker, or dealer |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Payroll savings plan to automatically purchase savings bonds |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

${custom10} |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Why have you purchased savings bonds (I and EE savings bonds) in TreasuryDirect? Check all that apply

[ONLY SHOWN FOR PEOPLE WHO HAVE PURCHASED]

I wanted to get started with investing

I wanted to get started with saving

Provides a good return on investment

I think they are a good financial product

I didn’t want to pay fees

I believe it is a safe investment

I am investing for a specific reason/goal (e.g. retirement, college, etc.)

I am saving for a specific reason/goal (e.g. retirement, college, etc.)

I wanted to buy them as a gift for someone else

I believe it helps support America’s financial future

Other __________

Why have you purchased marketable securities (Treasury Bills, Treasury Notes, TIPS, Floating Rate Notes, T-bonds) in TreasuryDirect? Check all that apply

[ONLY SHOWN FOR PEOPLE WHO HAVE PURCHASED]

I wanted to get started with investing

I wanted to get started with saving

Provides a good return on investment

I think they are a good financial product

I didn’t want to pay fees

I believe it is a safe investment

I wanted to diversify my investment portfolio

I am investing for a specific reason/goal (e.g. retirement, college, etc.)

I am saving for a specific reason/goal (e.g. retirement, college, etc.)

I believe it helps support America’s financial future

Other __________

Why haven’t you purchased electronic savings bonds (I and E/EE bonds) on TreasuryDirect within the past year?

[ONLY SHOWN FOR PEOPLE WHO HAVE PURCHASED OVER A YEAR AGO]

Not good enough return

Hard to use the site

Hard to manage my account

I forgot about it

I believe other products better meet my needs/goals

I redeemed and didn’t want to make another investment

No longer relevant for my situation

I’m waiting for my current holdings to mature

I can get what I need from my brokerage account

I’m waiting for interest rates to rise

Other __________

Why haven’t you purchased Treasury securities (Treasury bills, Treasury notes, TIPS, floating rate notes, T-bonds) on TreasuryDirect within the past year?

[ONLY SHOWN FOR PEOPLE WHO HAVE PURCHASED OVER A YEAR AGO]

Not good enough return

Hard to use the site

Hard to manage my account

I forgot about it

I believe other products better meet my needs/goals

I redeemed and didn’t want to make another investment

No longer relevant for my situation

I’m waiting for my current holdings to mature

I can get what I need from my brokerage account

I’m waiting for interest rates to rise

Other __________

How likely are you to purchase another product from TreasuryDirect?

0

1

2

3

4

5

6

7

8

9

10

How would you rate TreasuryDirect’s digital experience on a scale of 0 to 10, where 0 means “poor”; and 10 means “excellent”?

0

1

2

3

4

5

6

7

8

9

10

Considering your complete experience with TreasuryDirect, how likely would you be to recommend TreasuryDirect to a friend or colleague?

0

1

2

3

4

5

6

7

8

9

10

[THIS SECTION IS SHOWN ONLY TO POTENTIAL CUSTOMERS]

How interested are you in investing directly with the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

How interested are you in saving directly with the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

How safe do you feel sharing financial information with the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

How safe do you feel managing your finances with the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

How safe do you feel saving money directly with the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

How safe do you feel investing money directly with the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

You've been doing a great job answering the questions in this survey.

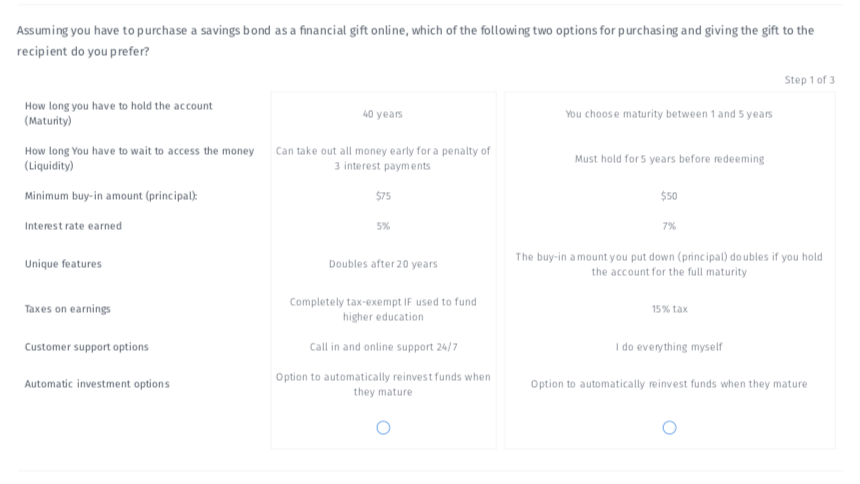

In the next three questions, you will be shown 3 sets of financial products and asked to choose the one you prefer.

[THE IMAGE BELOW IS AN EXAMPLE. ALL PRODUCTS WILL BE RANDOMLY GENERATED BASED ON A LIST OF VALID COMBINATIONS]

Now that we've spent some time talking about products for you, we are going to talk about giving financial products to others.

Have you ever given any of the following financial products as a gift? Check all that apply

529 college savings account contribution

Cash

Certificate of Deposit (CD)

Paper savings bond

Electronic savings bond

Corporate bond

Investment fund

Stocks

None of the above

No, I have never given this type of gift

What motivated you to give a financial gift?

[ONLY SHOWN TO PEOPLE WHO HAVE GIVEN A GIFT]

Wanted to support my family

Wanted to support a friend/loved one

Wanted a to give a unique gift

Wanted to give something that would keep giving in the future

Wanted to give a gift that would also teach someone the importance of money

Wanted to give a gift that would also teach someone how to manage money

Other __________

For the occasions below, for what purpose would you be interested in giving a financial product as a gift?

[ONLY SHOWN TO PEOPLE WHO HAVE GIVEN A GIFT]

New baby

Birthday

High School graduation

Religious milestone

Milestone birthday

College graduation

Marriage/union

Other __________

None of the above

On a scale of 0 to 10, what’;s your level of interest in giving a financial gift to a family member to help them learn how to save?

0

1

2

3

4

5

6

7

8

9

10

On a scale of 0 to 10, what’s your level of interest in giving a paper savings bond as a gift?

[ONLY SHOWN TO PEOPLE WHO ARE AWARE OF BONDS]

0

1

2

3

4

5

6

7

8

9

10

On a scale of 0 to 10, what’s your level of interest in giving an electronic savings bond as a gift?

[ONLY SHOWN TO PEOPLE WHO ARE AWARE OF BONDS]

0

1

2

3

4

5

6

7

8

9

10

On a scale of 0 to 10, what’s your level of interest in giving a gift certificate for the purchase of a bond or security from the U.S. Treasury?

0

1

2

3

4

5

6

7

8

9

10

On a scale of 0 to 10, what’s your level of interest in giving stocks as a gift?

[ONLY SHOWN TO PEOPLE WHO ARE AWARE OF STOCKS]

0

1

2

3

4

5

6

7

8

9

10

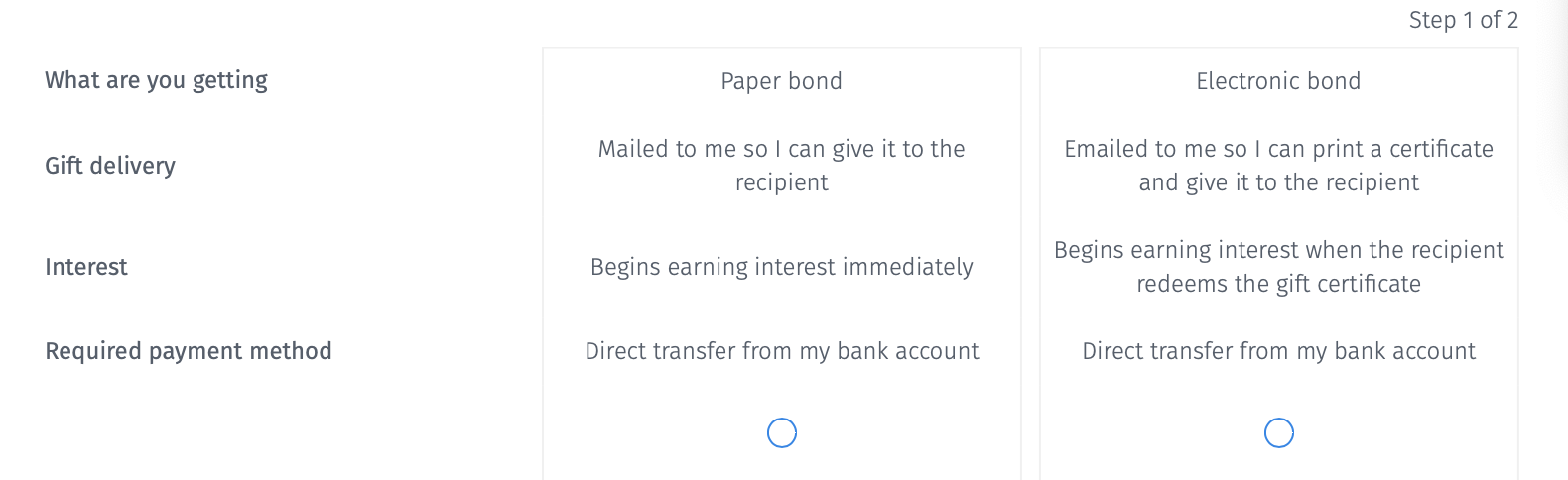

There are a lot of ways to buy and give financial gifts.

[DISPLAY TO INDIVIDUALS WHO HAVE HEARD OF BONDS] The next set of questions will show you two sets you two different options for purchasing/giving a bond as a gift.

[DISPLAY TO INDIVIDUALS WHO HAVE HEARD OF BONDS There are a lot of ways to buy and give financial gifts. The next set of questions will show you two sets you two different options for purchasing/giving a bond as a gift. For some additional background, a bond is a financial product that pays back a fixed rate of return over a set period of time. Bonds can can exist in both paper and electronic form (just like how cash can exist in physical bills or in electronic accounts).

[THE IMAGE BELOW IS AN EXAMPLE. ALL PRODUCTS WILL BE RANDOMLY GENERATED BASED ON A LIST OF VALID COMBINATIONS]

We are almost done! Before we finish up, we want to talk about how saving and investing fit into your life.

How much do the following statements describe you?

[ITEMS WILL BE RANDOMIZED]

|

Not at all like me |

2 |

3 |

4 |

5 |

Just like me |

I don’t know a lot about different saving options |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Financial decisions overwhelm me |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I feel qualified to make my own investment decisions |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I know I need to start saving money, but I don’t know where to start |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Life keeps getting in the way of making long-term financial plans |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

When I see how much I’ve saved, I get nervous that it’s not enough |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I take pride in how good I am at saving |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

If an immediate financial emergency came up, I’m not sure if I’d have enough money to cover it on my own |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I typically have money left over at the end of the month |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I like to have multiple savings accounts to help me budget |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I do my best to save for the future, but not at the expense of my life today |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I’d rather make financial sacrifices now to know that I will live more comfortably in the future |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I automatically save/invest money from my paycheck so that I don’t have to think about it |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I am very disciplined in savings and spending decisions |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I don’t have the time to research my saving and investing options |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

My financial advisor is my rock – I don’t know where I’d be without his/her advice |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I’m open to getting financial advice to help me achieve my goals |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I like to play a role in my financial planning – I can’t completely leave it up to someone else |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I don’t want anyone else to do my financial planning for me because I know my situation best |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I know how to invest my savings appropriately to achieve my financial goals |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I look at my finances frequently to make sure I’m on track to achieve my goals |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Before making a decision, I weigh the costs against the benefits. |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I like to keep track of what’s going on in financial markets |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I’m not afraid to experiment with different saving/investing strategies |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Investing is one of my hobbies |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I like to “set it and forget it” when it comes to my savings/investments |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I’m usually nervous to try new things with my savings/investments |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

It sounds like fun to invest in the stock market |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

Investing feels like a mystery to me |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

The idea of investing the money I’ve saved makes me nervous |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I look at the online experience before I sign up for a financial product |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

If I really love a product, I’ll tolerate a bad online experience |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

If a financial service provider doesn’t have an app, I’ll go with a different provider |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

I don't really trust financial institutions |

❏ |

❏ |

❏ |

❏ |

❏ |

❏ |

In making financial and investment decisions, I am:

Very conservative and try to minimize risk and avoid the possibility of any loss

Conservative, but willing to accept a small amount of risk

Willing to accept a moderate level of risk and tolerate losing money to achieve potentially higher returns

Aggressive and typically take on significant risk and am willing to tolerate large losses for the potential of achieving higher returns

Just a warning - the next few questions have some math. For some of you, that might be fun. For others, it may not be. Please do your best to answer. When in doubt, just go with your gut.

We’ve outlined the best and worst case scenarios of four hypothetical investments of $10,000 over one year.Given the potential gain or loss in any one year, which investment would you be most likely to invest your money in: PlanOne year lossOne year gainA$0 (0%)$200 (2%)B$200 (-2%)$500 (5%)C$800 (-8%)$1,200 (12%)D$2,000 (-20%)$2,500 (25%)

A

B

C

D

You have just reached the $10,000 plateau on a TV game show. Now you must choose between quitting with the $10,000 in hand or betting the entire $10,000 in one of three alternative scenarios. Which do you choose?

The $10,000 -- you take the money and run

A 50 percent chance of winning $50,000

A 20 percent chance of winning $75,000

A 5 percent chance of winning $100,000

Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

More than $102

Exactly $102

Less than $102

Don’t know

Prefer not to say

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, how much would you be able to buy with the money in this account?

More than today

Exactly the same

Less than today

Don’t know

Prefer not to say

In 2019, about what percent of your (and your spouse/partner’s) total gross household income (before taxes and deductions) did you set aside as savings?

0 percent

1 to 5 percent

6 to 10 percent

11 to 15 percent

16 to 20 percent

Over 20 percent

Other

Prefer not to answer

In 2019, about what percent of your (and your spouse/partner’s) total gross household income (before taxes and deductions) did you set aside as investments?

0 percent

1 to 5 percent

6 to 10 percent

11 to 15 percent

16 to 20 percent

Over 20 percent

Other __________

Prefer not to answer

At the end of 2019, approximately how much money did you have across all of your savings and/or investment accounts?

Less than $100

$100 to 199

$200 to 299

$300 to 399

$400 to 499

$500 to $999

$1,000 to $1,999

$2,000 to $2,999

$3,000 to $3,999

$4,000 to $4,999

$5,000 to $9,999

$10,000 to $14,999

$15,000 to $19,999

$20,000 to $39,999

$40,000 to $59,999

$60,000 to $79,999

$80,000 to $99,999

$100,000 to $119,999

$120,000 to $139,999

$140,000 to $159,999

$160,000 to $179,999

$180,000 to $199,999

$200,000 to $299,999

$300,000 to $399,999

$400,000 to $499,999

$500,000 to $599,999

$600,000 to $699,999

$700,000 to $799,999

$800,000 to $899,999

$900,000 to $999,999

$1,000,000 to $1,499,999

$1,500,000 to $1,999,999

$2,000,000 or more

Prefer not to say

I don’t know

How would you classify your overall financial situation?

No savings and significant debt

Little savings and a fair amount of debt

Some savings and some debt

Some savings and little or no debt

Significant savings and little or no debt

With regards to your retirement savings, do you think you're ahead of where you should be, behind where you should be, or right on track?

Ahead of where I should be

Right on track

Behind where I should be

I don’t know

Marital status?

Single

Engaged, Cohabitating with Partner, or other non-married Committed Relationship

Domestic Partnership

Married

Widowed

Divorced

Separated

How many financially-dependent children do you have?

|

How many grandchildren do you have?

|

What is your highest level of education?

Some high school

High school graduate or GED

Some college credit, no degree

Associate degree (e.g., AA, AS)

Bachelor’s degree (e.g., BA, AB, BS)

Master’s degree (e.g., MA, MS, MENg, Med, MSW, MBA)

Professional degree (e.g., MD, DDS, DVM, LLB, JD)

Doctorate degree (e.g., PhD, EdD)

Prefer not to answer

What is your gender?

Male

Female

Prefer not to answer

What is your race?

American Indian or Alaska Native

Asian

Black or African American

Native Hawaiian or Other Pacific Islander

White or Caucasian

Multiracial

Other

Prefer not to say

What is your race/ethnicity?

Hispanic or Latina/Latino

Not Hispanic or Latina/Latino

What of the following best describes your living situation financially?

Own your home outright and do not have any debt on it

Have a mortgage on your home

Rent

Live with someone else and don’t pay for housing

Don’t know

Which of the following best describes your employment status?

Full-time employee

Part-time employee

Unemployed

Self-employed

Home-maker

Student

Retired

Military

Prefer not to answer

| File Type | text/rtf |

| Author | Kate Vermann |

| Last Modified By | Bruce A. Sharp |

| File Modified | 2020-11-25 |

| File Created | 2020-11-25 |

© 2026 OMB.report | Privacy Policy