Form ETA 790B Employer

Agricultural Recruitment System Forms Affecting Migrant and Seasonal Farmworkers

Instruction Form ETA-790B

Form ETA 790B Employer

OMB: 1205-0552

O

MB

Approval: 1205-0NEW

MB

Approval: 1205-0NEW

Expiration Date: XX/XX/XXXX

Agricultural Clearance Order

Form ETA-790B – General Instructions

U.S.

Department of Labor

Section A

Job Offer Information

Enter the job title that most clearly describes the agricultural services or labor to be performed.

Workers needed:

Enter the total number of workers needed to perform the agricultural services or labor.

Enter the begin date for the period of intended employment. Use a month/day/year (mm/dd/yyyy) format.

Enter the end date for the period of intended employment. Use a month/day/year (mm/dd/yyyy) format.

Select “YES” or “NO” to indicate whether the job opportunity generally requires the worker to be on-call 24 hours a day, 7 days a week. For example, an employer submitting a job order for a job opportunity involving herding or production of livestock on the range, which requires the worker to be on-call up to 24/7, would mark “YES” and proceed to Item 8. All other employers must mark “NO” and complete Items A.6 and A.7.

Use Items 6a through 6h to identify the anticipated days and hours of work per day and per week. Use a numerical (99.99) format for each item below. An entry is required for each box listed in this field. Reminder: Employers may use the Form ETA-790B, Addendum C, to disclose additional information about the job opportunity (e.g., variations in anticipated days or hours of work per day and per week for different crops or agricultural activities), depending on the unique specifications of the employer’s job opportunity.

Enter the total hours of work that will normally be offered to workers per week. The entry in this field cannot be less than the sum of the entries in Items 5b through 5h.

Enter the total hours of work that will normally be offered to workers on Sunday.

Enter the total hours of work that will normally be offered to workers on Monday.

Enter the total hours of work that will normally be offered to workers on Tuesday.

Enter the total hours of work that will normally be offered to workers on Wednesday.

Enter the total hours of work that will normally be offered to workers on Thursday.

Enter the total hours of work that will normally be offered to workers on Friday.

Enter the total hours of work that will normally be offered to workers on Saturday.

Use Items 7a and 7b to identify the normal daily work schedule for the job opportunity using the standard time in the area where the work is expected to be performed (e.g., 9 a.m. to 5 p.m., 7 a.m. to 11 a.m. and 4 p.m. to 8 p.m.). Reminder: Employers may use the Form ETA-790B, Addendum C, to disclose additional information about the job opportunity (e.g., different shifts or variations in normal daily work schedule for different crops or agricultural activities), depending on the unique specifications of the employer’s job opportunity.

Enter the start time of the day that work will normally begin and select a checkbox to indicate whether the expected start time of work is “AM” or “PM.”

Enter the end time of the day that work will normally end and select a checkbox to indicate whether the expected end time of work is “AM” or “PM.”

Use Items 8a through 8e to identify the specific crop or agricultural activity; describe the duties or services to be performed by the workers and the wage(s) that will be offered, advertised, and paid to the workers for performing the agricultural services or labor.

Enter a description of the job duties or services to be performed in each crop or agricultural activity. Describe the work tasks that make up the job, summarizing each step as appropriate, and avoid using technical terms without properly defining or explaining them where usage is necessary. Reminder: Employers may use the Form ETA-790B, Addendum C, to disclose additional information about the job opportunity (e.g., duties or services related to different crops or agricultural activities), depending on the unique specifications of the employer’s job opportunity.

Enter the wage that will be offered, advertised, and paid to workers performing the job duties or services in the crop or agricultural activity. If the employer offers a range of wage rates for each crop or agricultural activity, enter the minimum wage offer in Item A.8b (Wage Offer). Note: The upper range of any wage offers will be collected in Item A.8e and in Form ETA-790B, Addendum A.

Select either “HOUR” or “MONTH” to identify the unit of pay for the wage offer entered in Item 8b Mark only one box.

If applicable, enter the piece rate that will be offered, advertised, and paid to workers performing the job duties or services in the crop or agricultural activity.

If applicable, enter the piece rate units (e.g., tree size/spacing, weight/size/number of boxes picked/packed, dimensions of bags or boxes filled) and/or any other special pay information (e.g., performance bonuses or incentives associated with performing the job duties or services) or the upper end of a wage range offered for a particular crop or agricultural activity. Examples of piece rate units include 5/8 bushel, 90 pound bag or box, 10 box bin. Examples of other special pay information related to a particular crop or agricultural activity are additional pay per acre or based on crop yield. In addition, enter the estimated hourly wage rate equivalent for each piece rate offered (i.e. what a worker might expect to earn per hour at this rate). See example below. Include or be prepared to make the method of calculating the estimated hourly wage rate equivalent(s) and supporting materials available to the SWA.

Select “YES” or “NO” to indicate whether a completed Form ETA-790B, Addendum A is attached to this agricultural clearance order providing additional information covering all identified crops or agricultural activities and all hourly or monthly rates, piece rates, or special pay rates. Example:

Important Note: Use Form ETA-790B, Addendum A to disclose all additional pay information that is related to a particular crop or agricultural activity. For additional pay information that is not related to a particular crop, including but not limited to overtime and bonus or work incentive payments that the employer will pay in addition to the basic wage rate (e.g., bonuses based on time on the job or calendar based/holiday bonuses), mark H.1 “YES” and use the Form ETA-790B, Addendum C to disclose the additional material terms and conditions of employment.

Select one of the available options to specify the frequency with which workers will be paid under this agricultural clearance order.

State all deduction(s) from the worker’s paycheck the employer is required to make by law and all other deductions not required by law that the employer will make from the worker’s paycheck and, if known, the amount(s) for each deduction. Reminder: Employers may use the Form ETA-790B, Addendum C, to disclose additional information about the job opportunity (e.g., deductions), depending on the unique specifications of the employer’s job opportunity.

Section B

Minimum Job Qualifications/Requirements

If a minimum U.S. diploma or degree is required to perform the agricultural services or labor, select the option that identifies the requirement. If no minimum U.S. diploma or degree is required, select “NONE.” Only mark one box.

If a minimum amount of experience is required to perform the agricultural services or labor, indicate the amount of experience required in months. If no minimum experience is required, enter “0” (zero). Information about the nature of the experience required may be disclosed in Item B.6.

If a minimum amount of training is required to perform the agricultural services or labor, indicate the amount of training required in months. If no minimum training is required, enter “0” (zero). If less than one month of training is required, enter “0” (zero) in Item B.3 and provide the specific number of days or weeks of training required in Item B.6. Information about the nature of the training required may be disclosed in Item B.6. Note: When answering this item, do not duplicate time requirements ― identify only the time required for the training identified in Item B.3. Do not include (add) time for the education or experience identified in Items B.1 and B.2.

Select the list of work tasks and requirements that are normally required to perform the agricultural services or labor. Check all that apply. Information about the nature of the work tasks and requirements checked may be disclosed in Item B.6. For example, if “Certification/license requirements” applies, use Item B.6 to specify the certification(s) and/or license(s) required (e.g., CDL license). Similarly, if “Driver requirements” applies, use Item B.6 to describe nature of the driving requirements, such as the farm equipment involved (e.g., self-propelled custom class combine) or whether a clean driving record is required to drive grain and transporter trucks. If “Extensive sitting or walking” is checked, use Item B.6 to explain the nature of the sitting or walking required.

Use Items 5a and 5b to identify whether the worker(s) employed under the job opportunity will be required to perform supervision of other employees.

Mark “Yes” or “No” as to whether the job opportunity supervises the work of other employees.

If “Yes” is marked in question 5a, enter the total number of employees the job opportunity will supervise.

Describe any other qualifications or requirements to perform the agricultural services or labor. Examples are quantifiable lifting requirements, level of supervision and number of workers to supervise, and types of licenses or permits. This item may also be used to provide more detailed information about the qualifications and/or requirements identified in Items B.1 through B.5. If no additional qualifications or requirements are needed and no additional information about Items B.1 through B.5 is required, enter “NONE” in the space provided. If additional space is required to fully disclose the qualification and requirement details for Item B.6, the employer may use the Form ETA-790B, Addendum C. On Addendum C, enter “B.6” in Item 1, “Job Qualifications and Requirements” in Item 2, and the additional information in Item 3.

Section C

Place of Employment Information

It is important for the employer to define the place(s) of employment (i.e., worksites) with as much geographic specificity as possible. This information is used to determine the area of intended employment, for purposes of reviewing and verifying regulatory compliance prevailing wage determinations.

For employers operating on work itineraries covering one or more areas of intended employment or those engaged in the herding or production of livestock on the range, the place of employment disclosed in Items C.1 through C.6 may be the location where the work itinerary is expected to begin; a designated pick-up point where workers will meet; or the employer’s business or office location nearest where work will be performed in the area. For agricultural associations filing as a joint employer with members, the place of employment disclosed in these fields may be the address of the agricultural association or the centralized location where workers will report for work assignments with members of the agricultural association. To disclose additional place(s) beyond the entry in Items C.1 through C.6 (e.g., subsequent locations on an itinerary), use Form ETA-790B, Addendum B.

Enter the street address of the location where work will be performed. The worksite address must be a physical location and cannot be a P.O. Box. For a rural or other location without a street address, enter “NONE” and provide as much information in Items C.2 through C.5 as possible, supplemented with additional information in Item B.6.

Enter the city in which the worksite is located.

Enter the State/District/Territory in which the worksite is located

Enter the postal (zip) code in which the worksite is located.

Enter the county in which the worksite is located.

Enter any additional information about the worksite location. Examples may include more specific information about the fields where work will be performed in close proximity to the address location, more specific directions on how workers can reach the worksite and/or Global Positioning System (GPS) coordinates, especially in very rural and isolated geographic areas. If no additional information concerning the worksite is needed, enter “NONE” in the space provided.

In circumstances where work needs to be performed at additional places of employment other than the address listed in items 1 through 5 above, submit a completed Form ETA-790B, Addendum B identifying all additional places of employment and, where required, the agricultural business that will employ workers, or to whom the employer will be providing workers.

Section D

Housing Information

Enter the street address of the location where the housing for workers is located. Use commonly understood street or highway numbers and names. For clearance orders involving agricultural labor or services on work itineraries where the use of mobile housing is permitted, enter the nearest geographic location of the mobile housing unit where it resides at the time of filing the Form ETA-790B.

Enter the city in which the housing is located.

Enter the State/District/Territory in which the housing is located.

Enter the postal (zip) code in which the housing is located.

Enter the county in which the housing is located.

Identify the type of housing that will be provided to workers at this location. Examples include camp, cabin, barracks, or two-story house (private, rental, public accommodation).

Enter the total number of housing units available to house workers at this location.

Enter the total occupancy capacity for all of the housing units identified in item 7 above.

Select whether the housing units provided to workers complies or will comply with local, State, or Federal standards.

Enter any additional information about the housing. Examples may include more specific directions on how workers can reach the housing and/or GPS coordinates, especially in very rural and isolated geographic areas; availability of family units and/or single rooms; utilities (e.g., gas, electricity, and heat); and/or arrangements for utility hookups. For mobile units, explain where the mobile units will be used (e.g., “mobile unit will travel with the workers to various range locations through Jefferson, Fremont, and Bonneville Counties (Idaho) and Teton and Lincoln Counties (Wyoming)”). If no additional information concerning the housing is needed, enter “NONE” in the space provided.

In circumstances where workers will be provided housing at additional locations and/or additional space is needed to identify all available housing units for workers at the address listed in items 1 through 5 above, mark “YES” and submit a completed Form ETA-790B, Addendum B providing additional information on housing that will be provided to workers. If no additional information concerning the housing is needed, mark “NO.”

Section E

Provision of Meals

Describe whether and, if so, how the employer will provide each worker with three (3) meals a day or furnish free and convenient cooking and kitchen facilities so that workers can prepare their own meals. Where the employer provides facilities for workers to prepare their own meals, please explain how the workers will have access to stores where they can purchase groceries and describe the facilities and space for food preparation, as well as the necessary equipment, appliances (including refrigeration), cooking accessories, and dishwashing facilities (e.g., adequate sinks with hot and cold water under pressure) that are in working condition and will be used by workers to sufficiently prepare three (3) meals a day. If the employer has an agreement with a third-party that will prepare the meals for the employer's workers, identify the vendor and explain the employer's arrangement with the vendor with sufficient detail to apprise workers how, when, and where the workers will obtain the meals from the vendor and that the employer will pay the vendor directly for the meals provided. If additional space is needed to complete the response to Item E.1, the employer may use the Form ETA-790B, Addendum C. On Addendum C, enter “E.1” in Item 1, “Provision of Meals” in Item 2, and then complete the description of the employer’s provision of meals to workers in Item 3.

Select the option designating whether the employer will charge workers for the provision of meals. If the employer intends to charge workers for the provision of meals, the daily charge per worker must be entered in currency format (e.g., $99.99).

Section F

Transportation and Daily Subsistence

Describe how the employer will provide workers daily transportation to the place(s) of employment. At a minimum, describe the arrangements for transporting workers, at no cost to workers, from employer-provided housing and, if applicable, centralized pick-up points to the places of employment at the beginning of each workday and back at the end of each workday. Please also disclose the mode(s) of transportation (e.g., vans, buses) that will be used each day, if known, as well as whether the daily transportation at no cost to workers is available to workers who do not reside in employer-provided housing. If additional space is needed, use the Form ETA-790B, Addendum C.

Describe how the employer will provide workers with transportation (a) to the place of employment from the place from which the worker has come to work for the employer (i.e., inbound) and (b) from the place of employment to the place from which the worker has come to work for the employer (i.e., outbound). At a minimum, state whether such transportation, and related daily subsistence, will be provided by the employer or paid by the employer to the worker for reasonable costs incurred (e.g., advance payment or reimbursement) and identify the modes of transportation, if known. If additional space is needed, use the Form ETA-790B, Addendum C.

Enter the amounts per day that the employer will pay for or reimburse daily meals for each worker

Enter the minimum daily subsistence amount per day in currency format (e.g., $99.99).

Enter the maximum daily subsistence amount per day with receipts in currency format (e.g., $99.99).

Section G

Referral and Hiring Instructions

Explain how prospective applicants may be considered for employment under this clearance order, including verifiable contact information for the employer or the employer’s authorized hiring representative and the methods of contact (e.g., email, phone) that prospective U.S. applicants may use to be considered for the job opportunity. Summarize how applicants are to be considered, referred, and hired. For example, indicate the days and hours that the employer or the employer’s authorized hiring representative will be available to interview workers by telephone and/or in-person and whether anybody different from the employer has hiring authority. If additional space is needed, use the Form ETA-790B, Addendum C. In Items G.2 through G.4, at least two (2) verifiable methods by which prospective U.S. workers can contact the employer and apply for the job opportunity must be identified.

Enter the area code and telephone number by which prospective U.S. workers can contact the employer and apply for the job opportunity. If a phone number is not available, leave this field BLANK and the system will insert "N/A" at submission of the application.

Enter the e-mail address by which prospective U.S. workers can contact the employer and apply for the job opportunity. The format must be [email protected]. If an e-mail address is not available, please enter "N/A"

Enter the website address by which prospective U.S. workers can contact the employer and apply for the job opportunity. The format must be domain name.domain suffix. If a website address is not available, please enter "N/A". Examples of valid suffixes include:

.gov - Government agencies .mil – Military .org - Organizations (nonprofit)

.edu - Educational institutions .com - commercial business .net - Network organizations

Section H

Additional Material Terms and Conditions of the Job Offer

Select “YES” or “NO” to indicate whether a completed Form ETA-790B, Addendum C is attached to this agricultural clearance order. Employers may use Addendum C to disclose any other material terms, conditions, and benefits (monetary and non-monetary) that will be provided by the employer under this job opportunity (e.g., production standards or OT/holiday hours not mandatory). Addendum C may also be used to elaborate or further explain material terms or conditions of the job offer previously disclosed on this clearance order (e.g., wage offer(s) and deductions, job qualifications or requirements, meals, transportation). To disclose a material term or condition of the job offer that is not covered by the Form ETA-790B using Addendum C, the employer may enter the letter “H,” followed by a sequential number, and then the name of the category for the material term or condition.

Section I

Assurances for Agricultural Clearance Orders

The employer must carefully read and agree to compliance with all the conditions of employment, including but not limited to those conditions listed in this section, for the positions covered by the agricultural clearance order, including any approved modifications or extensions thereof.

Enter the last name of the person with authority to sign on behalf of the employer.

Enter the first name of the person with authority to sign on behalf of the employer.

Enter the middle name of the person with authority to sign on behalf of the employer, if applicable.

Enter the job title of the person with authority to sign on behalf of the employer.

The person with authority to sign on behalf of the employer must sign the agricultural clearance order. An electronic or digital signature is acceptable. Read the entire application and verify all contained information prior to signing.

The person with authority to sign on behalf of the employer must date the agricultural clearance order. An electronic or digital date is acceptable. Use a month/day/full year (mm/dd/yyyy) format.

Employment Service Statement

Please read this disclosure. No entries are required

Public Burden Statement (OMB Control Number 1205-0NEW)

Please read this disclosure. No entries are required.

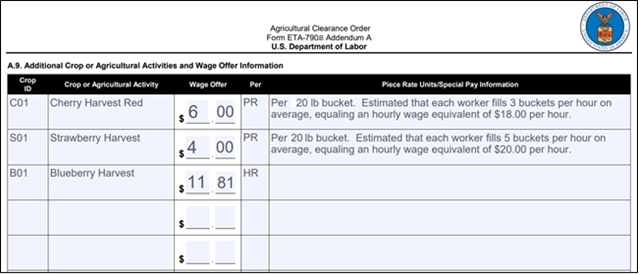

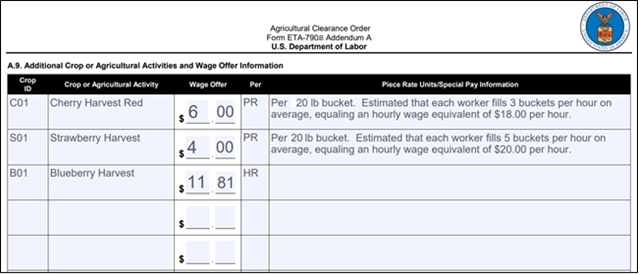

ADDENDUM A

For Disclosure of Additional Temporary Agricultural Services and Wage Offer Information (Section A, Item 9)

This Addendum must be fully completed and submitted with the Form ETA-790B when the employer needs to disclose additional information about the payment of wages for specific crops and/or agricultural activities. The employer must disclose wage information covering all the crops or agricultural activities that workers will need to perform under the agricultural clearance order. For example, where an employer has multiple applicable hourly rates (e.g., due to work in different states subject to different prevailing wages or minimum wages), the employer may disclose the distinct hourly rates by entering the crop and state on the Addendum A. The employer could enter the wage rate information for “Lettuce Harvesting – California” with the hourly wage covering work performed in California in one row, and then enter the wage rate information for “Lettuce Harvesting – Arizona” with the hourly wage covering work performed in Arizona on another row.

Addendum A will collect up to 9 rows of wage offer information for particular crops and/or agricultural activities. The employer may make one or more copies of the Addendum A to complete and attach to the Form ETA-790B.

Column 1: Crop ID

Enter the “Crop ID” designated in Item A.8a for a particular crop or agricultural activity, if applicable. An employer using large crews working on a wide array of diversified crops may designate one or more “Crop ID” in Item A.8a and then use the “Crop ID” to organize wage offer and pay information for multiple varieties of the same crops or commodities on the Addendum A.

Column 2: Crop or Agricultural Activity

Enter the name of the crop or agricultural activity.

Column 3: Wage Offer

Enter the wage offer for the crop or agricultural activity entered in Column 2 in currency format (e.g., $99.99).

Column 4: Per

Enter the unit of pay: “HR” (i.e., hour), “MO” (i.e., month), or “PR” (i.e., piece rate).

Column 5: Piece Rate Units/Special Pay Information

Enter additional information, such as the piece rate units and/or any other special pay information (e.g., performance bonuses or incentives) associated with performing the job duties or services in the crop or agricultural activity. In addition, enter the estimated hourly wage rate equivalent for each piece rate offered (i.e. what a worker might expect to earn per hour at this rate). See example below. Include or be prepared to make the method of calculating the estimated hourly wage rate equivalent(s) and supporting materials available to the SWA.

Example:

ADDENDUM B

For Disclosure of Additional Places of Employment (Section C) and/or Housing Information (Section D)

This Addendum must be fully completed and submitted with the Form ETA-790B when one or both of the following circumstances arise:

The employer needs the workers to perform the services or labor required in the agricultural clearance order at additional places of employment other than the place disclosed in Section C, Items 1 through 5; or

The employer will be providing housing at additional locations, other than the place disclosed in Section D, Items 1 through 5, and/or additional space is needed to identify all available housing units for workers at the address disclosed in Section D, Items 1 through 5.

Section C. Additional Place of Employment Information

Enter the name of the agricultural business that will employ workers, or to which labor or services will be provided by workers at the place of employment identified in Items 2 and 3, if applicable.

Enter the street address of the place where work will be performed. The place of employment must be a physical location and cannot be a P.O. Box. Employers must disclose, to the best of their knowledge at the time of filing the Form ETA-790B, geographic details related to the place of employment with enough specificity to apprise prospective applicants of any travel requirements and where they will likely have to reside to perform the services or labor. To identify the place of employment by address, enter the location information using this format: address/location, city, state, postal code, county. Although addresses are required, if available, if there is no address, the employer may enter "No Street Address Available" or “N/A”.

Enter any additional information about the geographic area of intended employment. Examples may include forest grid identification numbers, GPS coordinates, and/or directions to the place of employment, if applicable. If no additional information concerning the place of employment is needed, enter “N/A” in the space provided.

Where the employer’s work itinerary necessitates disclosure of an anticipated schedule of work at different places of employment (e.g., a Farm Labor Contractor), complete Columns 4 through 6 (Items 4, 5, and 6).

Enter the begin date for the period of intended employment at this place of employment, if applicable. Use a month/day/year (mm/dd/yyyy) format.

Enter the end date for the period of intended employment at this place of employment, if applicable. Use a month/day/year (mm/dd/yyyy) format.

Enter the anticipated total number of workers that will be employed at this place of employment.

Section D. Housing Information

Identify the type of housing that will be provided to workers at this location. Examples may include camp, cabin, barracks, or two-story house (private, rental, public accommodation).

Enter the street address where the housing for workers is located. Use this format: address/location, city, state, postal code, county. Use commonly understood street or highway numbers and names.

Enter any additional information about the housing. Examples may include more specific directions on how workers can reach the housing, especially in very rural and isolated geographic areas; availability of family units and/or single rooms available; utilities (e.g., gas, electricity, and heat); and/or arrangements for utility hookups. If no additional information concerning the housing is needed, enter “N/A” in the space provided.

Enter the total number of housing units available to house workers at this location.

Enter the total occupancy capacity for all of the housing units identified in item 4 above.

Select one or more options to indicate whether the housing units provided to workers comply or will comply with local, State, and/or Federal standards.

ADDENDUM C

For Disclosure of Additional Material Terms and Conditions of the Job Offer

Addendum C may be used to elaborate or further explain material terms or conditions of the job offer previously disclosed on this clearance order or to disclose a material term or condition of the job offer that is not covered by the Form ETA-790B.

NOTE: Addendum C will collect two sections of additional information per page. The employer may make one or more copies of the Addendum C to complete and attach to the Form ETA-790B.

Enter the Form ETA-790B Section and Item number associated with the additional information to be disclosed. For example, if additional space is required to fully disclose the qualification and requirement information for Item B.6 of the Form ETA-790B, on Addendum C, enter “B.6” in Item 1. Otherwise, enter “H” as the section, followed by a sequential number (e.g., H.1 for the first additional item disclosed, H.2 for the second additional item disclosed).

Enter the Form ETA-790B Section name associated with the additional information to be disclosed. For example, if additional space is required to fully disclose the qualification and requirement information for Item B.6 of the Form ETA790B, on Addendum C, enter “Job Qualifications and Requirements” in Item 2. Otherwise, enter a descriptive category for the additional information to be disclosed (e.g., “Additional Conditions about the Wage Offer”).

Enter the additional information to be disclosed related to Items 1 and 2 above.

Form

ETA-790B FOR DEPARTMENT OF LABOR USE ONLY

Page

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Melanie Shay |

| File Modified | 0000-00-00 |

| File Created | 2022-06-11 |

© 2026 OMB.report | Privacy Policy