Five Principles Platform Task Research Plan (1C)

Generic Information Collection Plan for Qualitative Consumer Education, Engagement and Experience Information Collections

Five Principles Platform Task Research Plan (1C)

OMB: 3170-0036

U pdate

to the Five Principles of Effective Financial Education

pdate

to the Five Principles of Effective Financial Education

Subtask 1(c) Qualitative Input from Financial Eduators

Research Plan-Draft

Contract #9531CB20A0005/9531CB21F0090

April 27, 2022

Prepared for:

Consumer Financial

Protection Bureau

Washington, DC

Submitted by:

Abt Associates

Paperwork Reduction Act Statement

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor a collection of information, nor is a person required to respond to a collection of information unless it displays a valid OMB control number. The OMB control number for this collection is 3170-0036. The time burden required to complete this collection of information is estimated to be XX minutes per response. Comments regarding this collection of information (e.g comments regarding the time burden per response, suggestions for reducing the time burden per response, and/or suggestions for maximizing the utility of the collected information) should be submitted to the Consumer Financial Protection Bureau at [email protected].

Introduction

Since its inception, the Consumer Financial Protection Bureau (CFPB) has been committed to conducting research to better understand how financial education can improve the lives of consumers. As part of this effort, in 2017, CFPB published its Five Principles of Effective Financial Education report. to guide financial educators, policymakers, and program developers as they seek to enhance the financial well-being of those they serve. These principles are:

Know the individuals and families to be served;

Provide actionable, relevant, and timely information;

Improve financial skills;

Build on motivation; and

Make it easy to make good decisions and follow-through.1

Now CFPB seeks to update these five principles to reflect the latest research and knowledge of best practices in the financial education field. In addition, the Bureau seeks to apply an equity lens to the principles, recognizing the implications that social, economic, and cultural factors may have in influencing pathways to financial well-being for different demographic groups.

Under Contract #9531CB20A0005, Abt Associates is conducting a multi-method research effort to inform this update. This work includes: 1) a literature review (Subtask 1a); 2) a program review (subtask 1b); and 3) qualitative input with financial education practitioners (Subtask 1c). The following two research questions will frame our approach to this work:

Since 2017, what have researchers and practitioners across the field of financial education learned about effective practices and approaches?

Do CFPB’s current principles reflect effective practices across an inclusive universe of programs, practitioners, and client populations? and

What principles reflect the updated research and more inclusive program base?

This document presents the research design for Subtask 1c, Qualitative Input from Financial Educators. The subtask has three primary activities: 1) development of a research design (this document); 2) data collection and analysis, and 3) a written report in which we summarize the findings from the practitioner data collection activities. Data collection will consist of an online survey and an online interactive community with frontline practitioners to gather the insights and perspectives of financial education practitioners who have direct experience working with a wide array of populations. The remainder of this plan details our approach for the survey, online community, analysis, and written report; and appendices with informed consent, data collection instruments, and detailed information about the online community.

Data Collection

The qualitative input from financial education practitioners will support the project’s two guiding research questions by: 1) gathering insights from practitioners on effective practices in financial education; and 2) and soliciting information specifically on equity-oriented financial education practices and approaches, particularly with respect to race, ethnicity, gender, and their intersections. In addition, we will use this subtask to gather suggestions for how to disseminate a revised set of effective principles to practitioners serving diverse clienteles.

Exhibit 1 shows graphically how the subtask will proceed. We will recruit practitioners by distributing invitations to particpiate through the organizational networks of our team’s expert panel members. Expert practitoners will invite their network members to complete a brief online survey. Abt will review responses to the online survey and invite a subset of those practitioners to participate in an “online community.” Each aspect of this approach is described in turn below.

Exhibit 1. Subtask 1c Activities Overview

Recruitment and Online Survey of Frontline Financial Educators

The Abt team will send a short online survey to a diverse group of frontline financial educators. The survey will serve two purposes. First, the survey will gather high-level input from these practitioners on key questions of interest (e.g., the population(s) with which they work, the types of services offered, and open ended questions about their perceptions on effective financial education strategies and approaches.) Second, we will use the survey to ask respondents if they are interested in participating in an interactive online community to discuss effective practices.

Recruitment

Our goals for recruitment are to reach a large network of practitioners who serve clients from a variety of demographic and other priority groups. Doing so serves our goals to have the survey represent feedback from wide variety of perspectives and to have a sufficiently large and diverse pool of respondents to invite to the online community.

Recruitment

Networks NALCAB

network of over 120 organizations serving Latino communities in 40

states. Change

Machine’s network of over 6,700 practitioners in 45 states. Oweesta’s

network of over 2,000 practitioners serving Native communities. Prosperity

Now’s financial coaching network National

Urban League’s network of 90 affiliates serving 300 primarily

African-American communities. National

CAPACD’s network of more than 100 organizations serving AAPI

communities in 21 states and Pacific Islands. CFPB

recommendations (i.e., CFPB’s FinEx network, YMYG cohorts) Abt’s

network of practitioner contacts

To develop the survey mailing list, our primary channels will

be the networks of our expert panel members’ organizations.2

(See survey recruitment materials in Appendix A.) As the text box

below shows, our partners’ networks include thousands of

practitioners in almost every U.S. state, most of whom serve specific

racial/ethnic communities. We will also compile the names,

affiliations, and email address of front-line financial educators

from Abt’s network.3

Abt will add specific practitioners or organizations that CFPB

recommends, as well as contacts from our Subtask 1(b) program

review.4

Based on this outreach we hope for approximately 200 – 300

survey responses. If we do not receive a sufficient response from

these channels, we will broaden our outreach to CFPB’s FinEx

listserv.5

Online Survey Implementation

The 20-question survey (see Appendix B) has a mixture of close-ended and open-ended questions about:

Program overview: types of services and clients served, including client demographics;

Financial education approaches and strategies that they have found to be effective in their practice;

CFPB’s existing five principles for effective finanical education; and

Suggestions for dissemination strategies.

The survey concludes by asking respondents if they would be interested in discussing effective practices with other practitioners in the online community. It emphasizes that expressing interest in the online community does not guarantee that a practitioner will be selected.

We will submit the consent and data collection materials in this plan to DIG and OMB, where we anticipate to be eligible for fast track approval. Once we obtain DIG and OMB approval, we will field the survey for two weeks (with a potential additional week for follow-up to increase the response rate, if needed). We will use techniques that we have found effective on past projects to raise survey response rates, such as sending personalized invitations and reminder emails that emphasize the “professional incentives” of the opportunity to advance the field of financial education (there is no monetary incentive to complete the survey).

We will field the survey through My Take, the same platform we will use for the online community. My Take’s screening surveys do not require respondents to register as part of an online community. My Take has online survey capabilities similar to other online survey platforms, such as Qualtrics. The 20-question survey will take approximately 5 to 10 minutes to complete.

The survey does not require users to provide any identifying information. However, the final section of the survey (section E) does ask users who are willing to participate in further discussion to provide their name, email address, and some information about their personal and professional backgrounds. We will use the responses from section E to to identify practitioners who are willing to be part of the online community and, in combination with other survey information, manage the flow of invitations to the community to ensure a balanced and diverse group of participants.6 We will send those invitations approximately two weeks after closing the survey (see next section for more details).

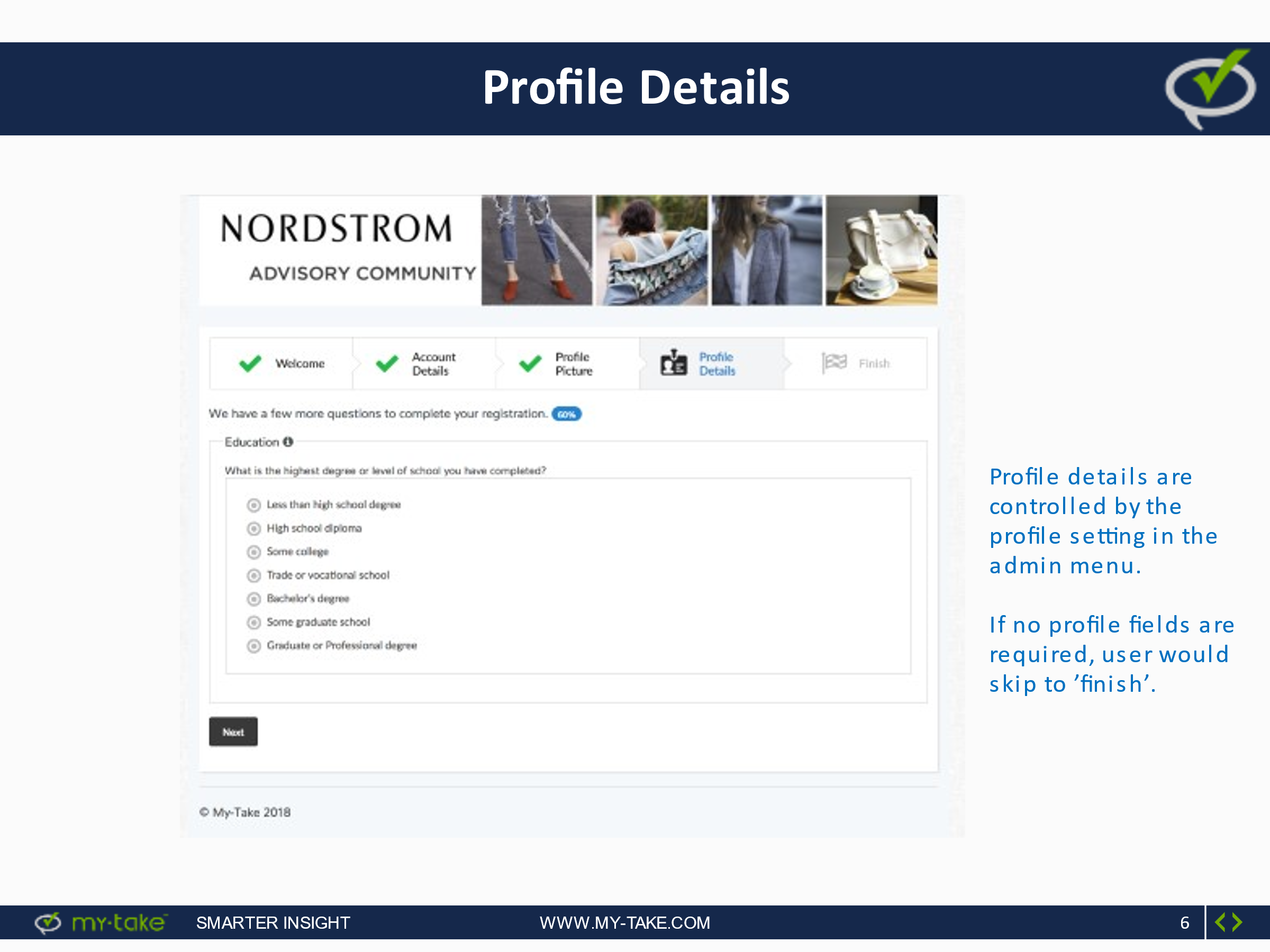

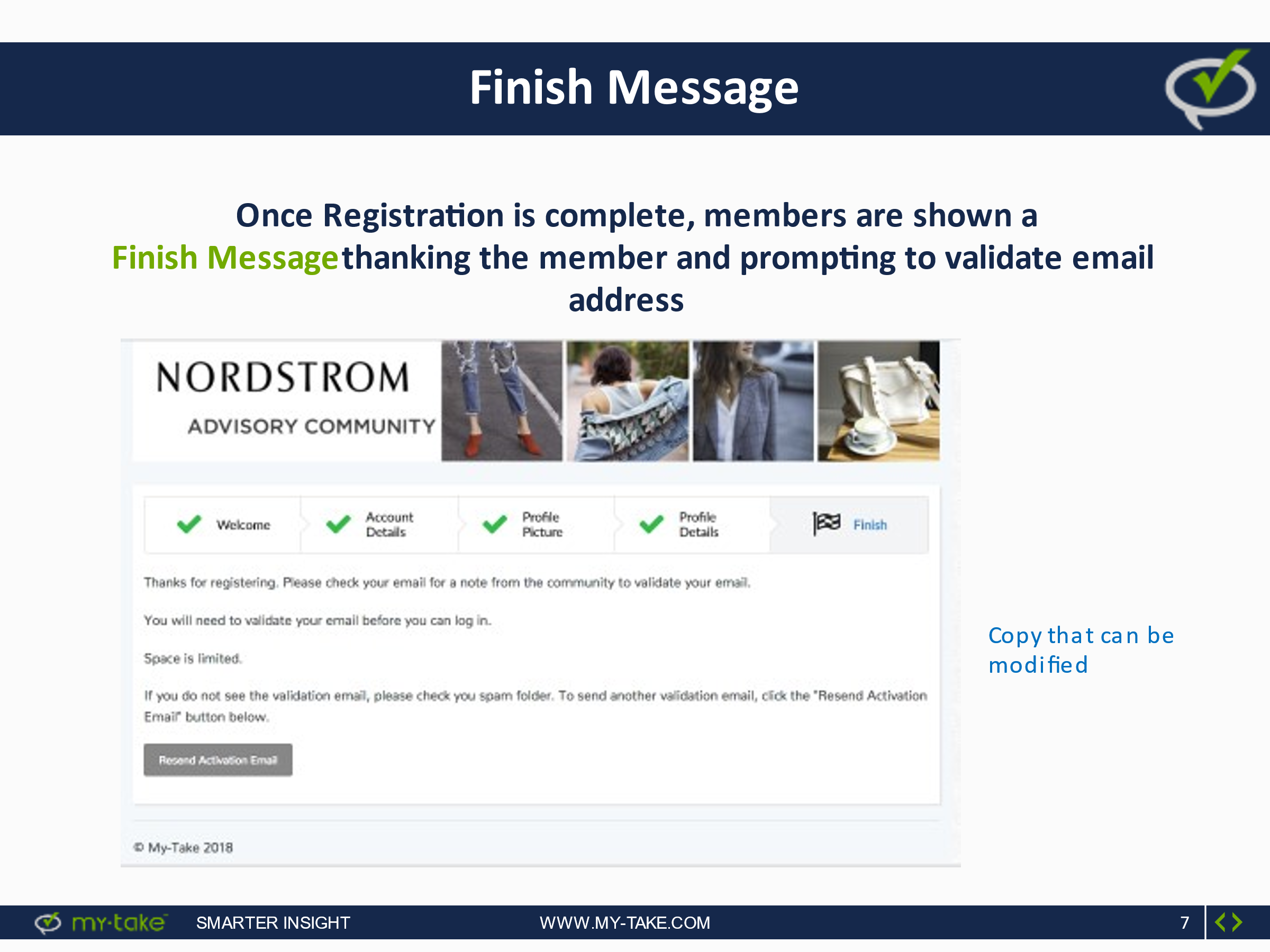

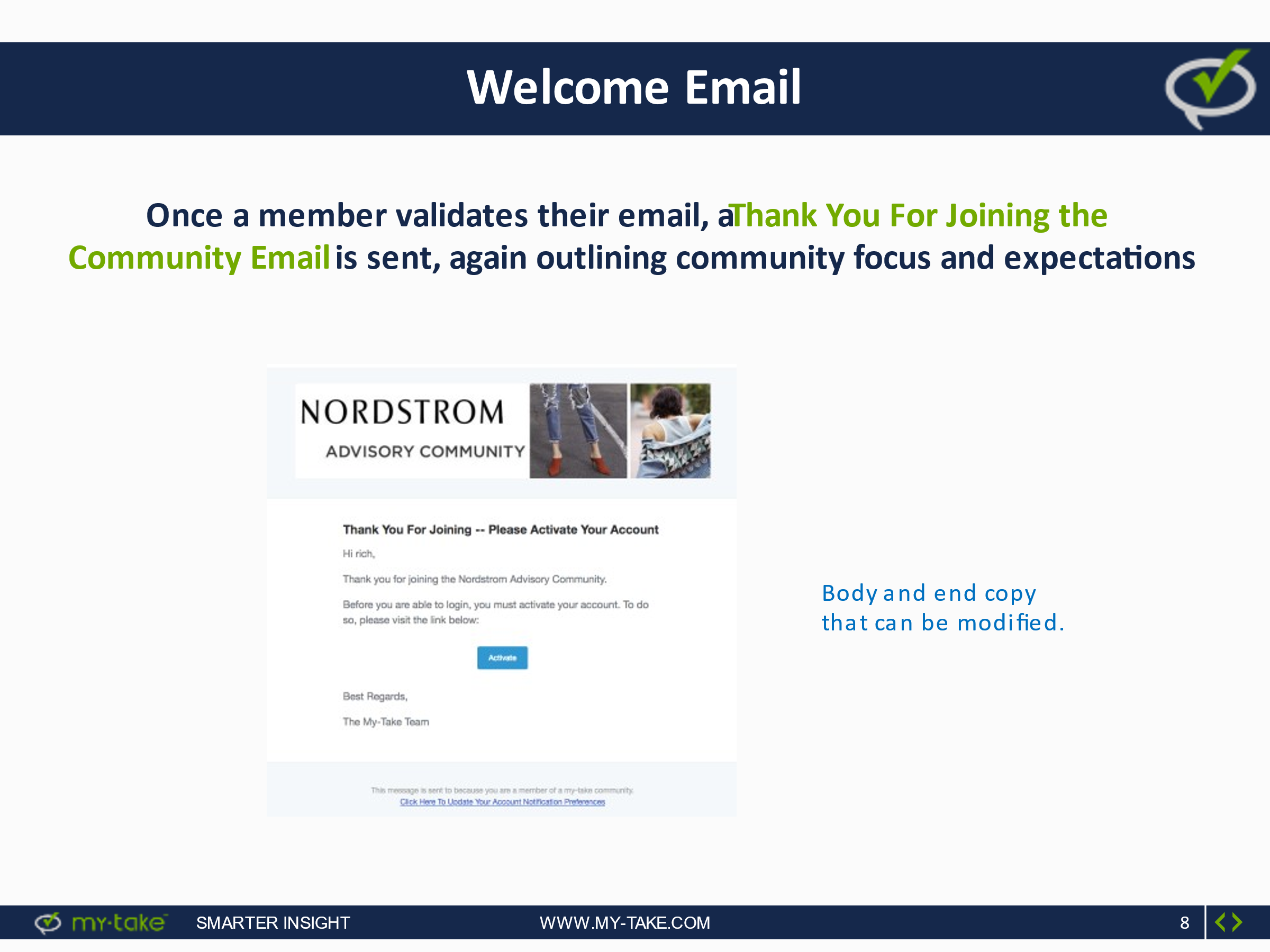

My-Take

Information Flow: Online Survey to Online Community Onboarding Abt’s

partners will send the recruitment email (Appendix A) to their

network of practitioners. The recruitment email will contain a link

to the online survey (Appendix B), which will be hosted on the My

Take platform. As part of the online survey, we will collect a name

and email. In

addition to collecting high-level information from practitioners on

key questions of interest through the online survey, the survey

will act as a screener for the online community. Based on the

survey responses, Abt will select respondents to become community

members and will send selected respondents an email with an

“onboarding” link (See Appendix C for example). To

“onboard,” respondents will provide their email,

username, and password. Respondents

will be sent a validation email that, once clicked, confirms them

as an active member. Abt

will use data from the screening survey for confirmed active

members, for the purpose of creating groups based on profile

information (for example, all practitioners who work with Native

Americans).

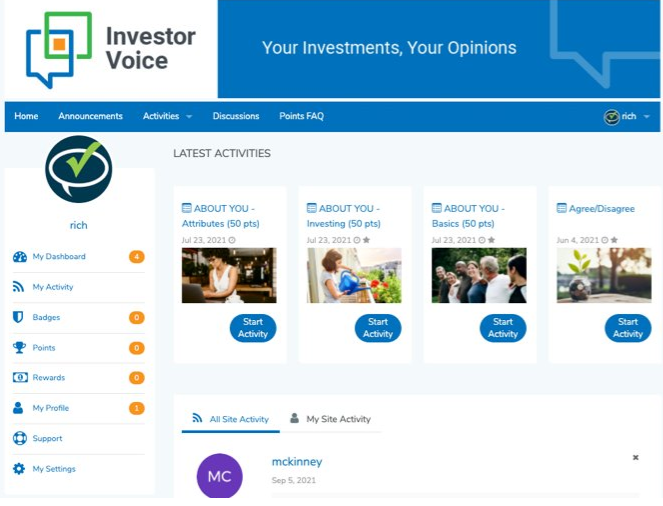

At

login, each member will see their “Community Portal”—list

of “activities” such as discussion boards. Participants

will only be able to see the activities they are assigned to. That

is, activities can be for everyone in the community or limited

(using My Take’s “group visibility” feature) (See

Appendix D for example).

As we identify practitioners for participation, we will send

them an invitation, along with a link to register for the community

(My Take calls this “onboarding”). The text box below

describes the My Take survey and onboarding process; Appendix C

shows examples of screenshots of these steps; samples of online

activities are in Appendix D.

Online Interactive Community

Online interactive communities essentially function as online focus groups.7 In online interactive communities, community members—in this case, financial educators—use an online platform (similar to a social media platform), to answer questions, provide feedback, and have discussions around a given topic. An online interactive community provides many benefits. First, it is an efficient way to reach a large number of practitioners located anywhere. We anticipate recruiting up to 150 practitioners for the online community, in recognition that practitioners will engage and contribute to varying degrees. Second, community members can log in to provide responses at times that are convenient for them during the data collection period. Third, the platforms are highly adaptive and flexible, and researchers can customize questions and topics, as relevant, for members of different cultural groups within the community. Researchers can also engage with participants multiple times often over the data collection period, which allows the team to reflect on the insights from community members and refine questions and activities in response to them.

We propose using My Take (www.my-take.com), off-the-shelf web-based application,8 as the interactive platform for hosting this data collection. During the two weeks that the online community is in session, we will seek practitioner input on the Five Principles in practice with a focus on how programs can provide effective financial education overall and to specific demographic populations. We will also seek to identify best practices and lessons learned. Finally, we can ask participants for information to inform the dissemination plan (Subtask 1e).

When a registered user (i.e., a community member) logs onto My Take, they will first encounter a dashboard with different “activities” in the online community (please see screenshots in Appendix D). We anticipate that, pending DIG approval, we will use a combination of the following activities that are available on the My Take platform:9

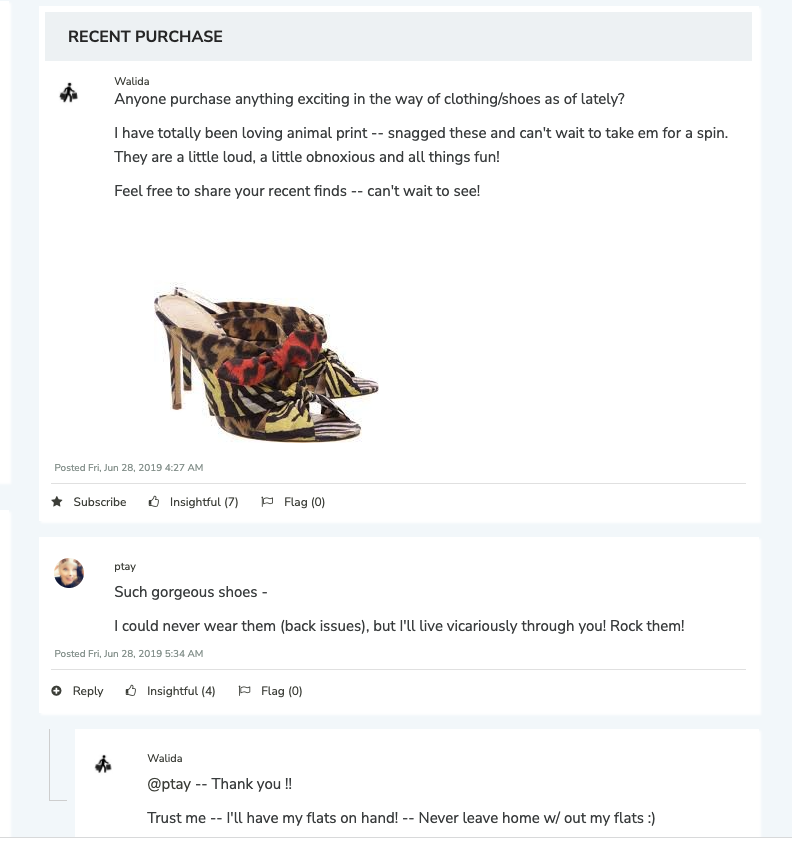

Discussions: We plan to primarily rely on My Take’s Discussion feature to collect practitioners’ insights. In Discussions, moderators (the Abt Team) will create topics and discussion questions for community members to respond to. Some Discussion boards will be open to all community members, while others will be closed—that is, only visible to selected community members (e.g., those serving a particular target population). We will use participants’ survey responses to select which closed discussions they are included in. Members can subscribe to topics to receive notifications about posts. Community members will only see the activities that are open to them on their dashboard.

The text box below shows some sample prompts to illustrate the types of questions we will use to start discussions. We have additional prompts prepared (see Appendix E) and anticipate, due to the dynamic nature of the online community, that moderators will write additional prompts and responses tailored to the comments practitioners have made in discussion boards. Appendix F provides the guidelines that Abt moderators will follow for facilitate online discussion and activities.

Example

Discussion Topics for Practitioner Interactive Online Community Five

Principles of Effective Financial Education How

do the five principles apply to your work with X community? Please

share concrete examples. (Asked for each principle) How

do the principles need to be adapted for working in your community?

Please share concrete examples. (Asked for each principle) Based

on your experience, would you change any of the five

principles to be more relevant to your work in X community?

Based

on your experience, would you add any new principles for

effective financial education in X community?

Based

on your experience, would you remove any principles? Please

describe your thinking about why to remove the principle. Based

on your experience, are some principles more important than others?

Which ones and why?

Best

Practices and Lessons Learned Are

there particular financial education strategies or approaches that

are effective for serving X community? Does

your financial education program adjust and differentiate your

methods and approaches to serve different subgroups within this

population? If so, how? Please share concrete examples. How

do you acknowledge and respond to multiple aspects of clients’

identities—for example, serving African American men or

Hispanic women?

Who

are you primarily serving? Are there subgroups and identities

within this population that seem particularly vulnerable (for

example, certain gender groups, certain age groups, or people with

certain experiences such as people with disabilities, formerly

incarcerated people, single parents)? What

challenges do organizations face in trying to serve diverse

populations? What have proven to be helpful approaches for

overcoming these challenges?

Polls: While Discussions will be the primary activity that we use for this data collection effort, we may also use My Take’s Poll activity to ask participants to respond to a single close-ended prompt, or an interactive poll where community members can rank options. For example, a poll might ask community members to rank which principle of financial education resonates most with them.

Video Chats: We may use My Take’s Video Chat activity to host live events. In a Video Chat, a team member facilitates a live discussion session. For example, we might have a CFPB staff member or a member of our expert panel (see footnote 2) present content—about topics such as tools, research insights, or other programming. These Video Chat presentations may or may not be directly related to the principles of effective financial education. Rather, the primary purpose of the Video Chats would be as additional incentives for participants to log on and engage with the community.

Idea Session:Toward the end of the community period, we may make use of the Idea Session feature (similar to other online collaboration tools like Mural) to have participants brainstorm and provide feedback on additions or modifications to the principles of effective financial education.

Participants’ incentives will be structured according to how they participate in the community. They will receive $50 for completing the onboarding process and $50 at the end of the online community if they complete the poll. We will also use My Take’s capability to distribute incentives randomly to participants who log on on a specific day—for example, 10 random users receive $25 on a certain day. Because Abt budgeted for up to $125 for 150 community members, the exact amount available for bonuses will depend on how many community members join.

We will analyze the insights collected from financial educators via the online survey and the online community in several ways. For close-ended survey responses, we will calculate descriptive statistics. For open-ended survey responses and data collected in the online community, we will employ an “applied thematic analysis”10 Using this approach, the Abt team will use both pre-determined codes on topics of interest and codes that we develop based on what emerges from the data (“emergent codes”) to identify common themes in the financial educators’ feedback.

The Abt team will summarize findings from the survey and online interactive community in a written report, which we will submit to CFPB for feedback. This report will be one of three inputs—along with the reports produced under Subtasks 1(a) and 1(b)—that we will use to update CFPB’s Five Principles of Financial Education report.11

Appendix A. Survey Recruitment Materials

Recruitment E-mail

Dear [practitioner name],

I’m writing to ask for your input on what makes for effective financial education—including financial coaching, financial counseling, and other approaches to helping people improve their financial well-being. The Consumer Financial Protection Bureau (CFPB) has identified five general principles of effective financial education and is now reviewing them through an equity lens to ensure they work well for clients of different backgrounds.

Request

Please fill out this 5-minute survey by [date].12 Please forward this email or share the link with your colleagues!

The CFPB has partnered with Abt Associates, an independent research organization, to conduct this survey.

Your insights will help shape resources for other financial education practitioners like you. Ultimately, your input will help make financial education services more effective and appropriate for a wide range of clients. We hope that you will be able to participate.

If you have any questions, you can reach a member of the Abt team at [insert study phone number] or [insert study email address].

Sincerely,

[Partner Name]

Social media post

What makes for effective financial education? [Note: please update the phrase “financial education” to the term that most resonates with your audience, such as financial coaching, financial health, financial empowerment, financial counseling, financial education, financial therapy, etc.] If you are a financial educator [Note: update this term to the most appropriate for your audience], CFPB wants your input to update its five principles of effective financial education to make sure its updated version reflect the latest knowledge in the field and practices that work for clients from a wide range of backgrounds. Click here for a 5-minute survey.13

Privacy Act Statement

5 U.S.C. 552a(e)(3)

The information you provide to Abt Associates in this survey will be used to help the Consumer Financial Protection Bureau (CFPB) update their Five Principles of Effective Financial Education report and to identify best practices that can be shared with other educators. This survey will also be used for recruitment to participate in an optional online community.

If you choose to participate in the online community, Abt Associates will use personally identifiable information (PII) you provide such as your name, email address, organization, education, gender, preferred pronouns, and race to select financial education practitioners from different backgrounds to participate.

Information collected will be treated in accordance with the System of Records Notice (SORN), CFPB.021 – CFPB Consumer Education and Engagement Records. Although the CFPB does not anticipate further disclosing the information provided, it may be disclosed as indicated in the Routine Uses described in the SORN. Direct identifying information will be kept private except as required by law.

This collection of information is authorized by Pub. L. No. 111-203, Title X, Sections 1013 and 1022, codified at 12 U.S.C. §§ 5493 and 5512.

Participation is voluntary.

A few years ago, the Consumer Financial Protection Bureau (CFPB) identified five general principles of effective financial education. CFPB has contracted with Abt Associates—a policy research firm—to collect the insights from financial educators to make sure these principles reflect the most up-to-date knowledge in the field and practices that work well for clients across a wide range of backgrounds. We will use the information we gather through this survey to help CFPB update their Five Principles of Effective Financial Education report and to identify best practices that can be shared with other educators.

We will not share any personally identifying information about you, including your name, organization, or responses that can be traced back to you, with anyone outside the research team. The answers you provide will be protected by strong data security measures.

By answering the questions on this survey, you give your informed consent to participate in this project.

If you have any questions about this project, you can contact the project director at [email protected] or 301-968-4424.

A.1. What types of client services does your organization provide? [Select all that apply.]

a. One-on-one financial coaching

b. One-on-one financial counseling

c. One-on-one financial planning

d. Debt counseling or credit repair

e. Group financial education classes or seminars

f. Peer groups on financial topics, including support groups or saving/lending circles

g. Social services or access to public benefits

h. Financial services

i. Other (please describe) ____________________

A.2. Of the services your organizaiton provides, which services do you personally offer? [Populate with selections from A.1. Select all that apply.]

a. One-on-one financial coaching

b. One-on-one financial counseling

c. One-on-one financial planning

d. Debt counseling or credit repair

e. Group financial education classes or seminars

f. Peer groups on financial topics, including support groups or saving/lending circles

g. Social services or access to public benefits

h. Financial services

i. Other (please describe) ____________________

The next question uses sliding scales for your responses about your clients’ characteristics. Please use your best estimate. The sliders should sum to 100. See an example below. [Programming note: Insert example of completed slider on gender, e.g., 80% women, 12% men, 2% non-binary, 6% unknown.]

A.3. What demographic groups does your program serve? [Set these up as sliders that sum to 100? If so, include note: Please provide your best estimate of clients with the following characteristics.]

a. Gender

Women

Men

Non-binary or trans

Not applicable or unknown

b. Race/ethnicity

African American or Black

Asian American or Pacific Islander

Hispanic or Latinx

Multiracial

Native American

White

Not applicable

c. Migration history

Native Americans

Immigrants

Refugees

None of these/not applicable

d. Language. Note: This means the language you provide services in, not the language clients speak at home.

English

Spanish

Arabic

Hmong

Swahili

French

Native language(s) (please list)

Vietnamese

Tagolog

Portuguese

Haitian Creole

Chinese

Korean

Russian

Hindi

Other language(s) (please list)

A.4. Of the clients your progam serves, which (if any) populations do you intentionally target? This means populations you intentionally target for outreach or tailor services for, not individuals you serve incidentally. [Pre-populate with answers to A.3. Select all that apply.]

a. [Pre-populated answers from above]

b. Other populations that you intentionally target for services. [Please list]

B.1 How do you define effectiveness in relation to financial education? Please do not provide any personally identifiable information in your response. (Open-ended)

B.2 Thinking of direct work with clients, what do you consider the most effective practices financial education? (Open-ended)

B.3. Are there any common practices in financial education that you consider to be ineffective? (That is, common practices you would like the field to do less of?) (Open-ended)

B.4. Do you tailor your programs or services for specific populations? That is, do you change your materials, delivery methods, or approach for clients with different characteristics in one or more of the following areas: gender, sexual orientation, (dis)abilities, immigration/citizenship status, race/ethnicity, socioeconomic status, housing status (homelessness, renting, homebuying)?

a. Yes [Go to B.2.]

b. No [Go to B.3.]

c. Other (please specify): _________ [Go to B.2.]

B.5. Please describe how you tailor your programs or services to serve different populations: [Note: insert example from subtask 1b program review.]

Population served:

Adjustments:

B.6. Which statement(s) most closely describe why you do not tailor your programs or services for different populations? [Select all that apply.]

a. Our programs and services fit all our client populations without adjustment/We do not see a need to tailor them for different groups of clients.

b. We follow a specific program design that does not allow tailoring.

c. We have not found resources that suit our different client populations.

d. We do not have staff resources to tailor our programs or services.

e. Other (please describe) ____________________________________________________________

The next questions ask for your open-ended input about the principles of effective financial education. Please provide as much detail as you can but please do not provide Personally Identifiable Information (PII) in your response.

In 2017, CFPB identified 5 principles of effective financial education in a full report and summary handout:

Know the individuals and families to be served: Financial education programs can be more effective if they are matched to people’s specific circumstances, challenges, and goals.

Provide actionable, relevant, and timely information: People are more likely to absorb information if it is connected to an upcoming decision that matters to them, at the time when they can put it to use, with concrete steps they can follow.

Improve key financial skills: To put financial knowledge to use, consumers also need to build skills. Key skills include knowing when and how to find reliable information to make financial decisions, how to process the information, and how to follow through.

Build on motivation: Financial education can help people strengthen qualities and attitudes that allow them to stay motivated. You can help people focus on their own values rather than external influences, persevere in the face of obstacles, and build confidence that they can achieve their financial goals.

Make it easy to make good decisions and follow-through: The situations people encounter can strongly influence what they actually do. You can help people follow through on their intentions by working with the influences or forces at play within their surroundings.

C.1. Taken together, do these seem like a comprehensive set of principles?

C.2. Were you aware of CFPB’s principles of effective financial education prior to today?

a. Yes [Go to C.3.]

b. No

C.3. How did you learn about CFPB’s principles of effective financial education?

a. CFPB’s mailing list

b. CFPB’s website

c. Attending a CFPB FinEx event (conference or webinar)

d. One of our funders or an intermediary network we belong to shared them

e. A colleague shared them with me

f. Other (please describe)

C.4. Thinking about your work, which of these principles resonates with you? (Select all that apply.)

Know the individuals and families to be served

Provide actionable, relevant, and timely information

Improve key financial skills

Build on motivation

Make it easy to make good decisions and follow-through

C.5. Regarding the first principle, Know the individuals and families to be served, how, if at all, would you modify this principle to better address your clients’ needs? (Open-ended)

C.6. Regarding the second principle, Provide actionable, relevant, and timely information, how, if at all, would you modify this principle to better address your clients’ needs? (Open-ended)

C.7. Regarding the third principle, Improve key financial skills, how, if at all, would you modify this principle to better address your clients’ needs? (Open-ended)

C.8. Regarding the fourth principle, Build on motivation, how, if at all, would you modify this principle to better address your clients’ needs? (Open-ended)

C.9. Regarding the fifth principle, Make it easy to make good decisions and follow-through, how, if at all, would you modify this principle to better address your clients’ needs? (Open-ended)

C.10. Would you add any additional principles? Would you remove any principles? Are some principles more important than others? (Open ended)

D.1. After updating these principles, CFPB would like to share what they learn with practitioners. How do you suggest CFPB reach practitioners?

What formats would be most engaging to practitioners? (Please rank your top three choices.)

Webinar

A short brief summarizing the principles (with a link to a full-length report, including research the principles are based on)

Infographic

Toolkit with practical examples of how to apply the principles to your work

Short video

Social media posts

Do you have recommendations for specific listservs, websites, social media channels or other ways practitioners communicate with each other that CFPB could partner with to get this information out? (Open-ended)

E.1. To help us update the principles of effective financial education, we are interested in having further conversations with practitioners about what is effective in their work. Would you be interested in participating in an online community to continue the discussion?

You would contribute to an online discussion forum at your convenience over the course of two weeks. You will be compensated $100 ($50 for completing the “onboarding” process and an additional $50 for completing an exit poll at the end of the two weeks). There is also the potential to earn additional compensation for engaging in the forum during the two weeks. Note that expressing interest in the online community does not guarantee you will be selected to participate.

a. Yes.

Name: ____________________________

Email address for invitation: ______________________ [Go to E.2.]

b. No [End]

E.2. Some of the online discussion will also be about supporting financial education practitioners from different backgrounds. Please tell us about yourself:

What trainings or certifications do you hold?

Gender/preferred pronouns

Race/ethnicity

Appendix C. My Take Screenshots: Online Community Registration

Appendix D. My Take Screenshots: Online Community

Exhibit F.1. Example 1 of a participant dashboard:

Example F.2. of a participant dashboard

Exhibit F.3. Example of a Discussion Board Menu

Exhibit F.4. Example of Discussion Board Activity

Appendix E. Online Community Discussion

This discussion board is a place where financial education practitioners—coaches, counselors, planners, educators, etc.—can discuss what makes financial education effective for the populations you serve.

Posts on this discussion board may help the Consumer Financial Protection Bureau (CFPB) update its principles of effective financial education, especially with an equity lens.

This discussion board is being moderated by Abt Associates, an independent research firm. CFPB will not see your responses.

You will receive incentive payments to thank you for your participation:

$50 for completing onboarding

$50 for completing the exit poll

You will be entered in a daily lottery for $25 each day you log on.

Required elements to join a community:

Username

Email address

Time zone

Password

We will send you an email to confirm your email address. Please click that link to complete your registration.

Moderators reserve the right to edit or delete any post that is off topic, abusive, or violates other community rules.

Privacy Notice

The information you provide to Abt Associates during moderated community activities will be used by the Consumer Financial Protection Bureau (CFPB) to inform and improve the CFPB Five Principles of Effective Financial Education.

Abt Associates may capture video, audio, and screen captures of your responses as you participate during the community activities. Recordings will only be used by the Abt Associates project team for reseacrh and will not be shared with the CFPB.

Your feedback will be kept private. Feedback may be tied to your PII such as your username; however, only de-identified and aggregated information will be included in any final or published reports shared with the CFPB. None of your identifying information will be included in the reports.

This collection of information is authorized by Pub. L. No. 111-203, Title X, Sections 1013 and 1022, codified at 12 U.S.C. §§ 5493 and 5512.

Participation is voluntary, and you may withdraw participation at any time.

Keep all posts on topic. Use an appropriate subject line relevant to the topic and thread. This is a discussion board about effective financial education (meaning education, coaching, counseling, planning, etc.). If your comment isn’t related to financial education, it’s probably off topic.

Be respectful. Some of the issues under discussion in this online community can be sensitive or difficult to discuss. Engage with respect. If someone posts a controversial comment, moderators will encourage users to use it as a point to reflect and deepen discussion.

However, the moderators reserve the right to delete any post that is off topic, inappropriate, offensive, or abusive, and to temporarily mute or permanently remove a member who does not adhere to community rules.

OPEN FORUM PROMPTS (open to all participants)

Feedback on Existing Principles

Based on your experience, do CFPB’s existing principles for financial education resonate with you? As a reminder, the principles are:

Know the individuals and families to be served: Financial education programs can be more effective if they are matched to people’s specific circumstances, challenges, and goals.

Provide actionable, relevant, and timely information: People are more likely to absorb information if it is connected to an upcoming decision that matters to them, at the time when they can put it to use, with concrete steps they can follow.

Improve key financial skills: To put financial knowledge to use, consumers also need to build skills. Key skills include knowing when and how to find reliable information to make financial decisions, how to process the information, and how to follow through.

Build on motivation: Financial education can help people strengthen qualities and attitudes that allow them to stay motivated. You can help people focus on their own values rather than external influences, persevere in the face of obstacles, and build confidence that they can achieve their financial goals.

Make it easy to make good decisions and follow-through: The situations people encounter can strongly influence what they actually do. You can help people follow through on their intentions by working with the influences or forces at play within their surroundings.

Which principle(s) resonate most for you?

Does this list of principles feel complete?

Are there any principles you would change? Please describe the need for changing the principle as well as how you would change it.

Would you add any new principles for effective financial education?

Are there any principles you would remove?

Are there some principles that you think are more important than others?

Other Effective Principles and Practices/Lessons from the Field

What other principles do you think make for effective financial education? How do you put those into principles into practice? Please share concrete examples.

Who are you primarily serving? Are there subgroups and identities within this population that seem particularly vulnerable (for example, certain gender groups, certain age groups, or people with certain experiences such as people with disabilities, formerly incarcerated people, single parents)?

Does your financial education program adjust and differentiate your methods and approaches to serve different subgroups within this population? If so, how? Please share concrete examples.

How do you acknowledge and respond to multiple aspects of clients’ identities—for example, serving African American men or Hispanic women?

What challenges do organizations face in trying to serve diverse populations? What have proven to be helpful approaches for overcoming these challenges?

Reflecting on Financial Education Broadly

What does “equitable financial education” mean to you? Please be as specific as you can.

What does it look like in practice?

How, if at all, does it differ from what is practiced in the field today?

How do you find the balance when working with clients between acknowledging systemic issues—like discrimination, predatory lending, under-employment, etc.—that may contribute to financial challenges to be more prevalent in some communities, while helping clients address how these issues affect them individually?

In the community/ies you work in, how is the term “financial education” received? What overarching term feels appropriate for the kind of work you do?

What are the benefits or challenges for financial education practitioners who come from the same or similar racial/ethnic/gender/cultural background as the clients they work with as financial educators?

What’s your experience like if you are of the same racial or ethnic background as your clients but different gender?

What’s your experience like if you are of the same gender as your clients but different racial or ethnic background?

How do you find connection with your clients about aspects of identity that you share?

How do you find connection with your clients across aspects of your identity where you differ?

What are the benefits or challenges for financial education practitioners who come from different racial/ethnic/gender/cultural background as the clients they work with as financial educators?

CLOSED FORUM PROMPTS (open to participants who work with specific communities)

Application of existing principles

How does the principle “know the individuals and families to be served” apply to your work with X community? Please share concrete examples.

What do you do that helps you understand and be respectful of the diversity within X community—for example, different experiences by gender, religion, language, region, and more?

What would a new financial education practitioner working with X community need to know before working with X community?

How does the principle “Provide actionable, relevant, and timely information” apply to your work with X community? Please share concrete examples.

How does the principle “Improve key financial skills ” apply to your work with X community? Please share concrete examples.

Are there specific financial skills you focus on with members of X community?

How does the principle “Build on motivation” apply to your work with X community? Please share concrete examples.

What would a new financial education practitioner working with X community need to know to help keep clients motivated?

How does the principle “Make it easy to make good decisions and follow-through” apply to your work with X community? Please share concrete examples.

Adaptations of existing principles

How does the principle “know the individuals and families to be served” need to be adapted for working in your community? Please share concrete examples.

How does the principle “Provide actionable, relevant, and timely information” need to be adapted for working in your community? Please share concrete examples.

How does the principle “Improve key financial skills ” need to be adapted for working in your community? Please share concrete examples.

How does the principle “Build on motivation” need to be adapted for working in your community? Please share concrete examples.

How does the principle “Make it easy to make good decisions and follow-through” need to be adapted for working in your community? Please share concrete examples.

Based on your experience, would you change any of CFPB’s existing principles to be more relevant to your work in X community? As a reminder, the principles are:

Know the individuals and families to be served

Improve key financial skills

Build on motivation

Make it easy to make good decisions and follow-through

How would you change X principle? Please describe the need for changing the principle as well as how you would change it.

Based on your experience, would you add any new principles for effective financial education in X community? Please describe the need for adding the principle and how you would apply it.

Would you remove any principles? Please describe your thinking about why to remove the principle.

Are some principles more important than others? Which ones and why?

Other Effective Principles and Practices/Lessons from the Field

Are there particular financial education strategies or approaches that are effective for serving X community?

Does your financial education program adjust and differentiate your methods and approaches to serve different populations within X community? If so, how? Please share concrete examples.

What challenges do organizations face in trying to serve these populations (as opposed to the general public)? What have proven to be helpful approaches for overcoming these challenges?

Please rank the principles according to most to least relevant to your work:

Know the individuals and families to be served

Provide actionable, relevant, and timely information

Improve key financial skills

Build on motivation

Make it easy to make good decisions and follow-through

IDEA SESSIONS

Example 1

Welcome! This section of the community is for you to brainstorm with other members about effective principles of financial education, especially to ensure they are written to promote equitable services to all communities. In this “idea session,” you’ll have a chance to brainstorm ideas, see them visualized, and provide feedback by ranking them. We’ll start with an invitation to suggest your own principles for effective financial education. My Take will put them in a chart for you to vote on them, then will present the group’s ranked choices. This will allow our full community to vet ideas and move toward an understanding of principles that resonate most with you.

Example 2

Welcome! This section of the community is for you to brainstorm with other members about how CFPB can disseminate the effective principles of equitable financial education you’re helping generate. In this “idea session,” you’ll have a chance to brainstorm ideas, see them visualized, and provide feedback by ranking them. To get us started, please tell us where you get valuable content for your work. How should CFPB distribute its revised principles for effective financial education? My Take will put them in a chart for you to vote on them, then will present the group’s ranked choices. This will allow our full community to vet ideas and move toward an understanding of principles that resonate most with you.

EXIT POLL (Example)

Thank you for participating in this online community! Before it closes, we would like your feedback on the experience. After you complete this exit poll, you will receive your $50 incentive to thank you for the time you spent contributing.

How would you rank the quality of the discussions in this online community? (Likert 1-5)

What is your top takeaway from this online community?

What is your top hope for the results of this online community?

As a practitioner, are there resources, training, or other supports you need to feel supported and effective in your work?

Appendix F. Online Community: Moderating Guidelines

The forum will discuss effective practices in general and, more specifically, integrating an equity lens into financial education. After posing these planned prompts, Abt staff will moderate the ongoing discussion. Moderating the online discussion will include asking follow-up and probe questions based on the comments that have been made, much as an interviewer does in a semi-structured interview. Abt moderators will also manage the group dynamics, similar to the role they play in managing group dynamics in a focus group.

MyTake posts will immediately be visible when users submit them (that is, moderators will not review and approve each comment before it appears). Abt moderators will check the community at least twice each business day it is open—once in the morning, once before the end of the workday. Moderators may need to check the activity and respond to discussions more frequently if there is substantial activity. Conversely, if there is very low activity, moderators will pose additional questions to elicit more responses.

We anticipate that users will have different levels of awareness, attitudes, and approaches to discussing issues including race, racism, cultural norms and variations, gender, and other aspects of identity that may be sensitive to discuss. Furthermore, conveying meaning and tone in online discussion is more difficult than in in-person or over video.14

Moderating the group may include deleting posts that are irrelevant or inappropriate. In the event a comment is controversial, moderators will attempt to use that comment as a point of reflection among users to deepen discussion, rather than opt for deleting a controversial comment as a first course of action. While we do not expect this to happen, if a discussion becomes inflamed or offensive, moderators will meet to agree upon when it is time to close comments or mute a contributor. Hiding or deleting a comment thread would be a last resort but is an option the moderators will retain if the discussion appears to be upsetting participants with no signs of resolution (e.g., a person who posted a controversial comment acknowledging the offense and trying to make amends, even if disagreement persists). Moderators will warn any contributor before muting or removing a contributor.

1 See CFPB’s Effective financial education: Five principles and how to use them (2017) available at https://files.consumerfinance.gov/f/documents/201706_cfpb_five-principles-financial-well-being.pdf

2 Abt has assembled an advisory panel consisting of experts in financial education and capability services targeted to Latinx, Native, Black, AAPI, and low-income communities to provide insights and guidance throughout this project. The expert advisory panel includes: Ms. Holly Frindell, Director of Programs at the National Association of Latino Community Asset Builders (NALCAB); Ms. Stephanie Cote (Anishinaabe), Program Officer at First Nation Oweesta Corporation; Ms. Ayanna Forston, Director of Housing and Community Development at National Urban League; and Ms. Rosalyn Epstein, Director of Financial Empowerment from National Coalition for Asian Pacific Amerian Community Development. In addition, Mr. Parker Cohen, Director of Savings and Financial Capability at Prosperity Now will serve on the panel (Prosperity Now broadly focuses its work on serving low-income families.)

3 For example, we will reach out to practitioners we have worked with on prior CFPB projects including the Family Financial Networks toolkit, Financial Well-being practitioner toolkit, Future Self toolkit, Family College Planning Tool, State of Financial Well-being Research project, Institutes of Higher Education project, and more.

4 During Subtask 1(b) of this project, the Abt team is conducting a review of effective financial education programs. We are first identifying 75-100 programs through a combination of a literature review and referrals from our expert panel and CFPB. Then, for a subset of approximately 60 programs, we are conducting an in-depth review, including the development of qualitative summaries of the program based on published information.

5 Abt sent a survey invitation through CFPB’s primary mailing list of over 100,000 subscribers for the State of Financial Well-being project in 2020. For this project, we would prefer not to use such a broad recruitment channel unless more targeted outreach fails to generate the response we anticipate.

6 We will analyze survey responses and select participants primarily based on a combination of the client communities they serve. We will use practitioners’ own characteristics as a secondary selection factor (to enable us, for example, to have a discussion board specifically for BIPOC practitioners or for practitioners who serve people from different racial/ethnic groups than their own).

7 Similar to online focus groups, in online interactive communities researchers collect insights and information on a topic of interest from participants—called “community members”—by having moderators facilitate conversations.

8 This is in line with CFPBs preference as stated in RFQ, Cybersecruity clauses section 2, part l. My Take uses uses AES256 encryption for data at rest and TLS 1.2 for data in transit.

9 While we plan to potentially use all of these activity types, we will primarily use the Discussion feature (see below). We will decide whether and when it is appropriate to use each of the activities, based on the content and discussion activities within each specific community or sub-community, as they take place in real time on the platform.

10 Guest, Greg, Kathleen M. MacQueen, and Emily E. Namey. 2012. Applied Thematic Analysis. Sage: Washington, D.C.

11 Since the written report from the survey and online interactive community will not be published on its own, we will format it as an annotated outline.

12 The link will take the practitioner to the survey (Appendix B), which will be hosted on the My-Take platform.

13 The link will take the practitioner to the survey (Appendix B), which will be hosted on the My-Take platform.

14 Johnson, D. R., Scheitle, C. P., & Ecklund, E. H. (2019). Beyond the In-Person Interview? How Interview Quality Varies Across In-person, Telephone, and Skype Interviews. Social Science Computer Review. https://doi.org/10.1177/0894439319893612

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Abt Associates |

| Author | Erin Miles |

| File Modified | 0000-00-00 |

| File Created | 2023-08-26 |

© 2026 OMB.report | Privacy Policy