CS-08-118 - Customer Satisfaction of IRS SMALL BUSINESS/SELF-EMPLOYED CUSTOMER BASE; CS-08-119 - Understanding the Effectiveness of Notice Redesigns; CS-08-125 - 2009 W&I SPEC PARTNERS SURVEY OPTION Y

Voluntary Customer Surveys to Implement E.O. 12862 Coordinated by the Corporate Planning and Performance Division on Behalf of All IRS Operations Functions

CS-08-119

CS-08-118 - Customer Satisfaction of IRS SMALL BUSINESS/SELF-EMPLOYED CUSTOMER BASE; CS-08-119 - Understanding the Effectiveness of Notice Redesigns; CS-08-125 - 2009 W&I SPEC PARTNERS SURVEY OPTION Y

OMB: 1545-1432

Appendix 1

Screener portion

We are conducting a web-based survey for the IRS to determine the effectiveness of newly redesigned IRS notices. The survey is voluntary and your identity will remain anonymous. The survey will only take about 20 minutes to complete. Thank you for agreeing to participate. We have a few preliminary questions to further determine your eligibility:

Are you at least 18 years old?

Have you paid federal taxes in the past 5 years?

Have you ever received a notice from the IRS saying you owed additional taxes or that you overpaid your taxes?

( ) No, I’ve never received a notice from the IRS

( ) Yes, I received a notice stating I overpaid

( ) Yes, I received a notice stating I owed additional taxes

( ) I’m not sure

If participant answers “Yes, I received a notice stating I overpaid”, ask the following questions:

Overall, the experience was:

( ) Much better than I initially imagined when I first received the notice

( ) Better than I initially imagined when I first received the notice

( ) Worse than I initially imagined when I first received the notice

( ) Much worse than I initially imagined when I first received the notice

If participant answers “Yes, I received a notice stating I owed additional taxes”, ask the following questions:

What did you do? Mark all that apply.

( ) Paid the amount due

( ) Called the IRS for help

( ) Visited the IRS website (IRS.gov)

( ) Visited an IRS office

( ) Looked at an IRS publication for additional information

( ) Contacted an accountant (or other tax professional) for help

( ) Submitted proof to show that the entries on my original return were correct

( ) Nothing

How

long did it take to resolve the situation?

( ) More time than I

expected

( ) Less time than I expected

Did

you have to pay additional: Mark all that apply

( ) Taxes

( ) Penalties

( ) Interest

( ) I did not have to pay any additional amount

Overall, the experience was:

( ) Much better than I initially imagined when I first received the notice

( ) Better than I initially imagined when I first received the notice

( ) Worse than I initially imagined when I first received the notice

( ) Much worse than I initially imagined when I first received the notice

Any additional comments about the experience?

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1432. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the, Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

Appendix 2

Questions for Notice Simplification Web-based survey. Focus Group Participants Questionnaire: CP2000

Introduction to CP2000

Thank you for participating in our survey. The IRS is working to improve the notices it sends to taxpayers so that they are easier to understand and easier to respond to.

In this survey you will be asked to read and review two versions of the same notice from the IRS. Read each notice as if you just received it in the mail. After you read the notices, you will be asked questions about each one.

Next screen takes participant to the document.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Directions for reading through the document (this header is just for review purposes)

Read through document. As you read, if anything is especially confusing or problematic, please highlight it with a red dot by clicking it with your mouse [and then select the option that best matches your reason for disliking the highlighted area.] If you read anything that you find especially helpful, please highlight it with a green dot by clicking it with your mouse [and then select the option that best matches your reason for liking it].

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The

participant reads (and clicks) through all pages and is taken to a

series of comprehension questions. The participant is able to go back

and review the document at any time. If the participant doesn’t

use any dots, before advancing to the comprehension questions, a

reminder will pop up:

“Do

you want to use any of the red dots to mark anything as especially

confusing or the green dots to mark anything as especially helpful.

If you do, you can go back to any page and mark the document.

Otherwise, you can continue to the questions”

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Comprehension questions (this header is just for review purposes)

Why

have you received this notice? Mark all that apply.

( ) The

income I reported on my taxes doesn’t match the amount of

income the IRS has on record

( ) I didn’t report all my

income to the IRS

( ) I need to file an amended return for 2007

( ) I owe additional taxes and must pay a penalty and interest

( ) I’m late on my installment plan payment to the IRS

How much more do you owe?_____________ How much of that is interest?_____________

The notice provides options about what you should do next. What are they? Mark all that apply.

( ) Fill out and mail the response form

( ) Pay the total amount due, including additional taxes, penalty and interest

( ) Request an installment payment plan

( ) Pay part of the money

( ) Redo your taxes (file an amended return) for 2007

( ) Contact an accountant to help you

( ) Submit paperwork to prove the amount of income you reported was correct

We’d like these questions to be timed.

After answering these comprehension questions, the participant is taken to questions about perception of the document.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Perception questions

Please tell us the extent to which you agree with the following statements, on a 10-point scale where 1 is completely disagree and 10 is completely agree.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand the changes to my taxes

Freshness

The tone of the notice is better than I expected

The notice looks better than I expected

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides me factual information to base my decision on

Inspiration

The presentation of the notice motivates me to act on it right away, not just ignore it

The notice makes me feel that IRS wants me to be well informed

After finishing this section, the participant reads through the other notice and answers all of the above questions.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Rating and behavioral questions

After answering questions about both documents, the participant answers the following questions.

After viewing both documents, which one do you prefer? Show participants small images of both notices

( ) Notice A ( ) Notice B

What was it about Notice (insert choice from previous question) that you preferred?

Does the presentation (how it looks) and tone of Notice (insert choice from previous question) make you more likely to respond?

If you received a notice like this, what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately; wait a few days/weeks until I had the time to focus on it

( ) Look for help

( ) Contact an accountant for help

( ) Call the IRS

( ) Look at the IRS website (IRS.gov) for help

( ) Find an IRS publication to find an explanation

( ) Find an IRS tax clinic

( ) Pay

( ) Pay in full

( ) Request an installment plan

( ) Not pay

( ) Wait to see if I receive another notice

( ) Other _________________________

Is there any other information that was left out, but would have helped you respond? If so, please describe.

Appendix 3

Questions for Notice Simplification Web-based survey. Focus Group Participants Questionnaire: Monthly Statement

Introduction to Monthly bill (this header is just for review purposes)

Thank you for participating in our survey. The IRS is working to improve the notices it sends to taxpayers so that they are easier to understand and easier to respond to.

In this survey you will be asked to read and review two versions of the same monthly bill from the IRS For this example, please assume you received a monthly bill in the mail because you are repaying past taxes (plus penalties and interest) you owe the IRS. Since the amount was more than you could pay all at once, you set up a monthly payment plan. Each month, the IRS sends you a monthly bill stating how much you owe.

Next screen takes participant to the document.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Directions for reading through the document (this header is just for review purposes)

Read through the bill. As you read, if anything is especially confusing or problematic, please highlight it with a red dot by clicking it with your mouse [and then select the option that best matches your reason for disliking the highlighted area.] If you read anything that you find especially helpful, please highlight it with a green dot by clicking it with your mouse [and then select the option that best matches your reason for liking it].

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The

participant reads (and clicks) through all pages and is taken to a

series of comprehension questions. The participant is able to go back

and review the document at any time. If the participant doesn’t

use any dots, before advancing to the comprehension questions, a

reminder will pop up:

“Do

you want to use any of the red dots to mark anything as especially

confusing or the green dots to mark anything as especially helpful.

If you do, you can go back to any page and mark the document.

Otherwise, you can continue to the questions”

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Comprehension questions (this header is just for review purposes)

How much do you owe this month?

How much would you have to pay to eliminate your debt?

How much of that is interest?

After answering these comprehension questions, the participant is taken to questions about perception of the document.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Perception questions

Please tell us the extent to which you agree with the following statements, on a 10-point scale where 1 is completely disagree and 10 is completely agree.

Clarity (participant would not see these subheads, they are for review purposes only)

Perception questions

Please tell us the extent to which you agree with the following statements, on a 10-point scale where 1 is completely disagree and 10 is completely agree.

Clarity (participant would not see these subheads, they are for review purposes only)

The monthly bill is well organized

It is easy for me to understand the content and wording in the monthly bill

The monthly bill is visually clear

Freshness

The tone of the monthly bill is better than I expected

The monthly bill looks better than I expected

Honesty

The monthly bill is straightforward

The monthly bill explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The monthly bill helps me understand what to do next and what will happen if I don’t follow those steps

The notice makes me feel like I can contact the IRS for help if I need it

Inspiration

The presentation of the monthly bill motivates me to act on it right away, not just ignore it

The monthly bill makes me feel that IRS wants me to be well informed

After finishing this section, the participant reads through the other notice and answers all of the above questions.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Rating and behavioral questions

After answering questions about both documents, the participant answers the following questions.

After viewing both documents, which document do you prefer? Show participants small images of both notices

( ) Monthly bill A ( ) Monthly bill B

What was it about Monthly bill (insert choice from previous question) that you preferred?

If you received a monthly bill like this, what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately, wait a few days/weeks until I had the time to focus on it

( ) Look for help

( ) Contact an accountant for help

( ) Call the IRS

( ) Look at IRS.gov for help

( ) Try to find an IRS publication to find an explanation

( ) Find an IRS tax clinic

( ) Pay

( ) Not pay

( ) Wait to see if I receive another notice

( ) Other _________________________

Is there any other information that was left out, but would have helped you respond? If so, please describe.

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1432. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the, Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

Appendix 4

Questions for Notice Simplification Web-based survey. Focus Group Participants Questionnaire: LT11

Introduction to LT11

Thank you for participating in our survey. The IRS is working to improve the notices it sends to taxpayers so that they are easier to understand and easier to respond to.

In this survey you will be asked to read and review two versions of the same notice from the IRS Read each notice as if you just received it in the mail. After you read the notices, you will be asked questions about each one.

Next screen takes participant to the document.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Directions for reading through the document (this header is just for review purposes)

Read through document. As you read, if anything is especially confusing or problematic, please highlight it with a red dot by clicking it with your mouse [and then select the option that best matches your reason for disliking the highlighted area.] If you read anything that you find especially helpful, please highlight it with a green dot by clicking it with your mouse [and then select the option that best matches your reason for liking it].

Once you’ve read all the pages, you’ll be asked a series of questions about what you just read.

The

participant reads (and clicks) through all pages and is taken to a

series of comprehension questions. The participant is able to go back

and review the document at any time. If the participant doesn’t

use any dots, before advancing to the comprehension questions, a

reminder will pop up:

“Do

you want to use any of the red dots to mark anything as especially

confusing or the green dots to mark anything as especially helpful.

If you do, you can go back to any page and mark the document.

Otherwise, you can continue to the questions”

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Comprehension questions (this header is just for review purposes)

Why

have you received this notice? Mark all that apply.

( ) I have

not paid my overdue taxes

( ) I need to file an amended return for 2007

( ) The IRS will seize my property and possessions as compensation for my overdue taxes

How much do you owe?_____________ How much of that is interest?_____________

The notice provides options about what you should do next. What are they? Mark all that apply.

( ) Contact the IRS to discuss my options

( ) Pay the total amount due, including additional taxes, penalty and interest

( ) Contact an accountant to help you

( ) Reinstate my installment payment plan

( ) Request an appeal

( ) Redo your taxes (file an amended return) for 2007

( ) Submit paperwork to prove the amount of income you reported was correct

We’d like these questions to be timed.

After answering these comprehension questions, the participant is taken to questions about perception of the document.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Perception questions

Please tell us the extent to which you agree with the following statements, on a 10-point scale where 1 is completely disagree and 10 is completely agree.

Clarity (participant would not see these subheads, they are for review purposes only)

The notice is well organized

It is easy for me to understand the content and wording in the notice

The notice is visually clear

The notice helps me understand what will happen next

Freshness

The notice looks better than I expected from the IRS

The notice addresses my specific situation; it doesn’t sound like a form letter

Honesty

The notice is straightforward

The notice explains the IRS’s decisions and the reasoning behind them

Usefulness

The typeface and type size are easy to read

The notice helps me understand what actions I can take next

The notice makes me feel like I can contact the IRS for help if I need it

The notice provides me factual information to base my decision on

Inspiration

The presentation of the notice motivates me to act on it right away, not just ignore it

The notice makes me feel that IRS wants me to be well informed

After finishing this section, the participant reads through the other notice and answers all of the above questions.

+ + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + + +

Rating and behavioral questions

After answering questions about both documents, the participant answers the following questions.

After viewing both documents, which one do you prefer? Show participants small images of both notices

( ) Notice A ( ) Notice B

What was it about Notice (insert choice from previous question) that you preferred?

Does the presentation (how it looks) and tone of Notice (insert choice from previous question) make you more likely to respond?

If you received a notice like this, what would you do? The more honest you can be about your response, the more it will help us create effective communications. Mark all that apply.

( ) Not open it immediately; wait a few days/weeks until I had the time to focus on it

( ) Look for help

( ) Contact an accountant for help

( ) Call the IRS

( ) Look at the IRS website (IRS.gov) for help

( ) Find an IRS publication to find an explanation

( ) Find an IRS tax clinic

( ) Pay

( ) Pay in full

( ) Request an installment plan

( ) Not pay

( ) Wait to see if I receive another notice

( ) Other _________________________

Is there any other information that was left out, but would have helped you respond? If so, please describe.

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-1432. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the, Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

Appendix 5

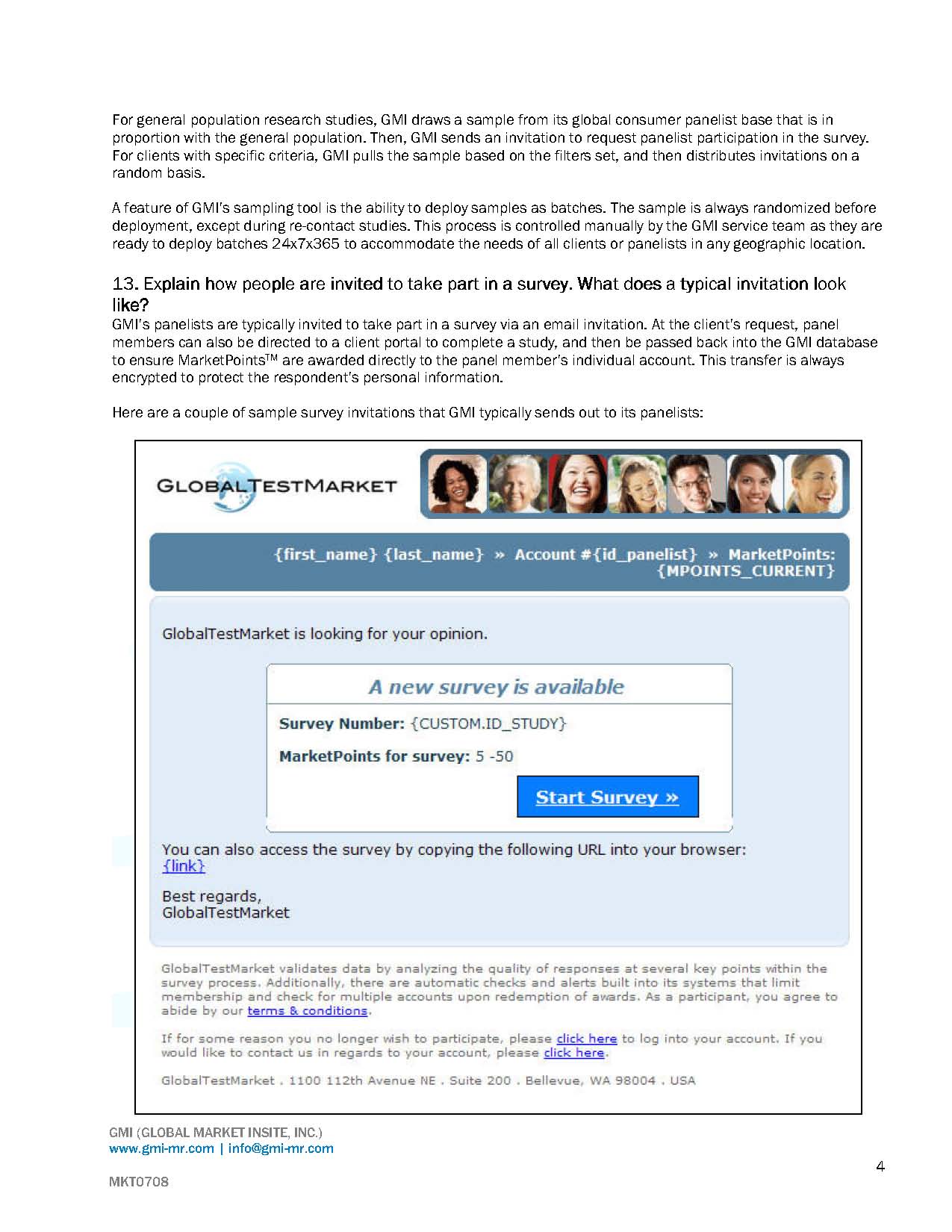

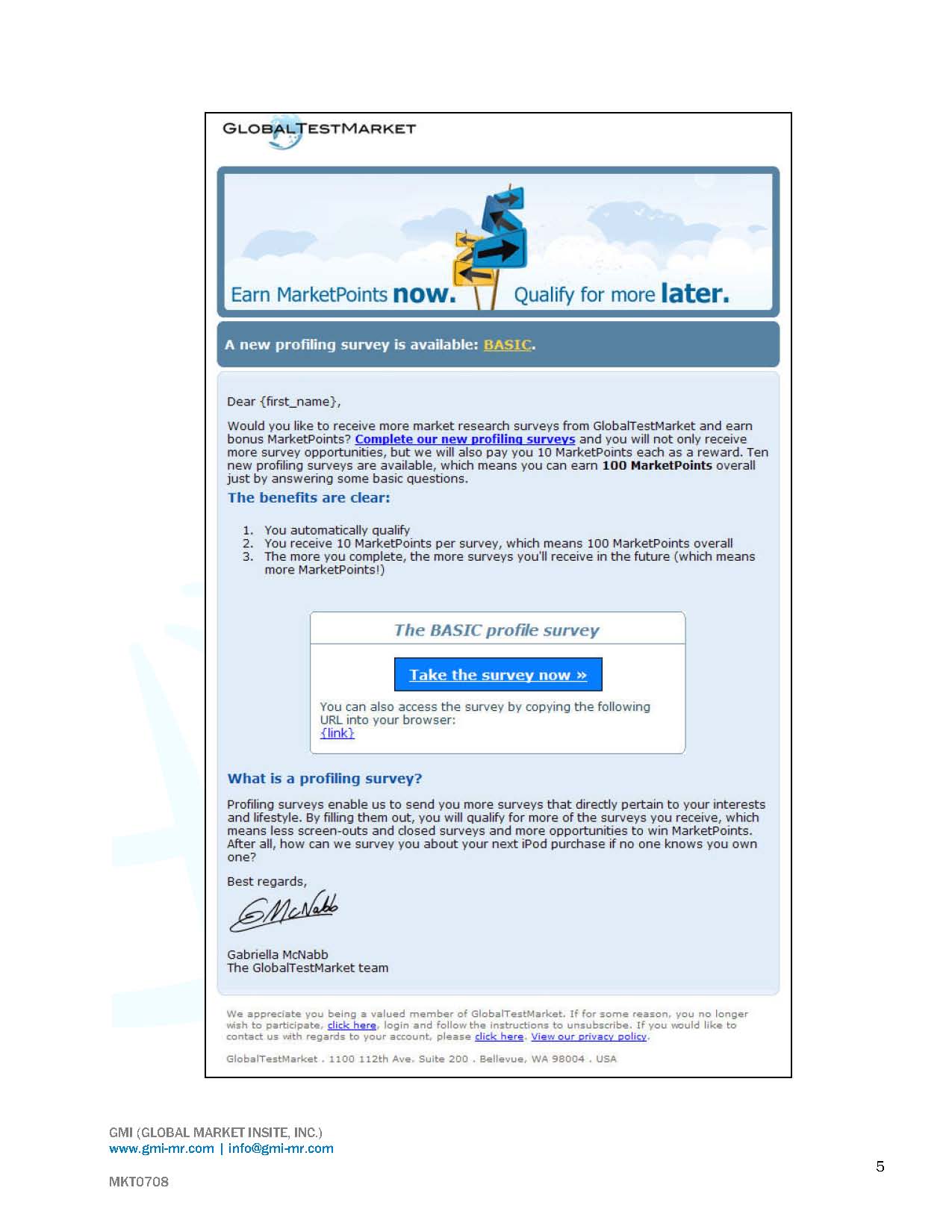

Sample Survey Invitations

OMB #1545-1432

| File Type | application/msword |

| File Title | Office of Management and Budget Clearance Package |

| Subject | Cash Economy Web Survey |

| Author | MITRE |

| Last Modified By | qhrfb |

| File Modified | 2008-12-08 |

| File Created | 2008-12-08 |

© 2026 OMB.report | Privacy Policy