Reporting Guidance

SGIG CORPORATE REPORTING GUIDANCE 2010 01 27 1615.doc

OE Recovery Act Financial Assistance Grants

Reporting Guidance

OMB: 1910-5149

SMART GRID GRANT PROGRAM

RECIPIENT REPORTING GUIDANCE, V1.1

DEPARTMENT OF ENERGY (DOE) CORPORATE REPORTING

To ensure projects are effectively managed and delivering on the goals of the American Recovery and Reinvestment Act (Recovery Act), DOE will collect data on project management and execution, risk management, and job creation, in addition to what is required by Section 1512 of the Recovery Act.

Recipients are required to provide DOE information on the following issues:

Project Execution Data: Collecting data on project execution allows DOE and recipients to track performance against their Project Execution Plan (Clause 32-B of Award Agreement) and ensures the timely execution and allocation of resources to Recovery Act projects.

Risk Management Updates: Recipients will be required to provide periodic updates to DOE on risk management data submitted as part of the Project Execution Plan (Clause 32-B of Award Agreement) in order to ensure that appropriate risk management is being conducted on the project.

Jobs Data: DOE seeks to understand the full impact of Recovery Act projects on employment. Recipients should include job figures from the non-federal fund cost-share component of Recovery Act projects (Section 5A of Attachment B - Award Agreement).

Project Value Management System (PVMS) Reporting

A common structure for reporting the current status of SGIG projects will be used to deliver project status and assessment information to DOE. The input of PVMS data described below will be required. PVMS reporting will be at the Project Level. In addition, recipients will be required to provide an update the TPO through the Progress Report (SGIG Agreement, Attachment B, Federal Assistance Reporting Instructions) on the status of the milestones identified in the PEP as being either “on-track” or “off-track.” Milestones that are “on-track” are expected to be completed on-time and within budget. Those that are “off-track” are expected to occur after the target date (or not at all) or will be over the expected budget identified in the PEP. These data will be compiled into status reports to assist DOE in its reporting requirements under the Recovery Act.

Field |

|

Definition / Metrics |

Field Type |

ACWP |

Actual Cost of Work Performed |

The cost actually incurred for the work accomplished during the period of performance. |

Input |

BCWP |

Budgeted Cost of Work Performed |

Sum of all budgets for all completed work and the completed portions of ongoing work. Total budget for the scope that was actually accomplished during the period of performance. |

Input |

BCWS |

Budgeted Cost of Work Scheduled |

Planned accomplishment established in performance measurement baseline. |

Input |

ETC |

Estimate to Complete |

Current estimate for the remaining project scope. This is the estimate for all remaining work excluding contingencies. |

Input |

BAC |

Budget at Completion |

Sum of all budgets allocated to a project excluding management reserve |

Input |

1.1PVMS Reporting Frequency and Due Dates

The PVMS Data elements identified in Section 2 above shall be reported by the prime recipient to DOE on a monthly basis. The prime recipient is responsible for uploading this data into DOE’s Technical Project Management System through the web portal provided by DOE.

The recipient is required to submit the data no later than 10 business days following the end of the period of performance. The first period of performance shall be the first full calendar month following the date of definitization of the award agreement.

Risk Management Updates

Updates to the Risk Management Plan (RMP) submitted as part of the Project Execution Plan (SGIG Agreement Terms and Conditions Clause 32-B) should be submitted via the Technical Project Management System on a monthly basis. These updates should include any changes to the likelihood of occurrence, cost/schedule impact, risk consequence, or handling strategy and mitigation of the risks identified in the RMP. In addition, any new risks identified by the recipient during the project life cycle should also be included in the update.

The recipient is required to submit the data no later than 10 business days following the end of the period of performance. The first period of performance shall be the first full calendar month following the date of definitization of the award agreement.

DOE Jobs Reporting Guidance

This section provides recipients guidance on the internal DOE collection of direct jobs created and retained from Recovery Act funds. While the Office of Management and Budget (OMB) requires Recovery Act recipients to report jobs data to FederalReporting.gov on a quarterly basis, it only requires recipients to report on a subset of jobs created by DOE Recovery Act funds.

In order to capture comprehensive job figures, DOE has additional data collection requirements. These data will better enable the Department to track the number of actual jobs created under the Recovery Act and transparently show the American public how Recovery Act programs are helping create jobs and spur sustainable, economic growth.

The recipient is required to submit the data no later than 10 business days following the end of the period of performance. The first period of performance shall be the calendar quarter in which definitization of the award agreement occurred.

Internal DOE job collection differs from FederalReporting.gov in:

OMB requires recipients of Federal contracts to report jobs created by prime entities only. DOE Jobs Reporting requires recipients to report jobs created at both the prime recipient/contractor and sub-recipient/subcontractor level.

DOE Jobs Reporting aims to monitor jobs created directly from DOE Recovery Act funds and non-federal funds. Recipients will report data on jobs created from non-federal funds cost-share portion of project.

DOE Jobs Reporting provides a breakdown of jobs within the categories identified below:

Managers

Engineers

Computer-related Occupations

Environmental and Social Scientists

Construction, Electrical and Other Trades

Analysts,

Business Occupations

Recording,

Scheduling, Computer Operator Occupations

Job numbers reported to DOE will encompass all direct jobs created during the reporting timeframe as a result of the Recovery Act funding. Jobs created and retained before receiving Recovery Act funds should not be included. In addition, DOE will allow recipients to report indirect jobs (for definition of ‘indirect jobs’ see OMB Memo M-09-21, June 22, 2009) created or retained on a voluntary basis.

The DOE will verify job data reported against other reported data from recipients, including invoices and financials. If recipient reported data cannot be verified, then DOE will work with the recipients to resolve job data issues.

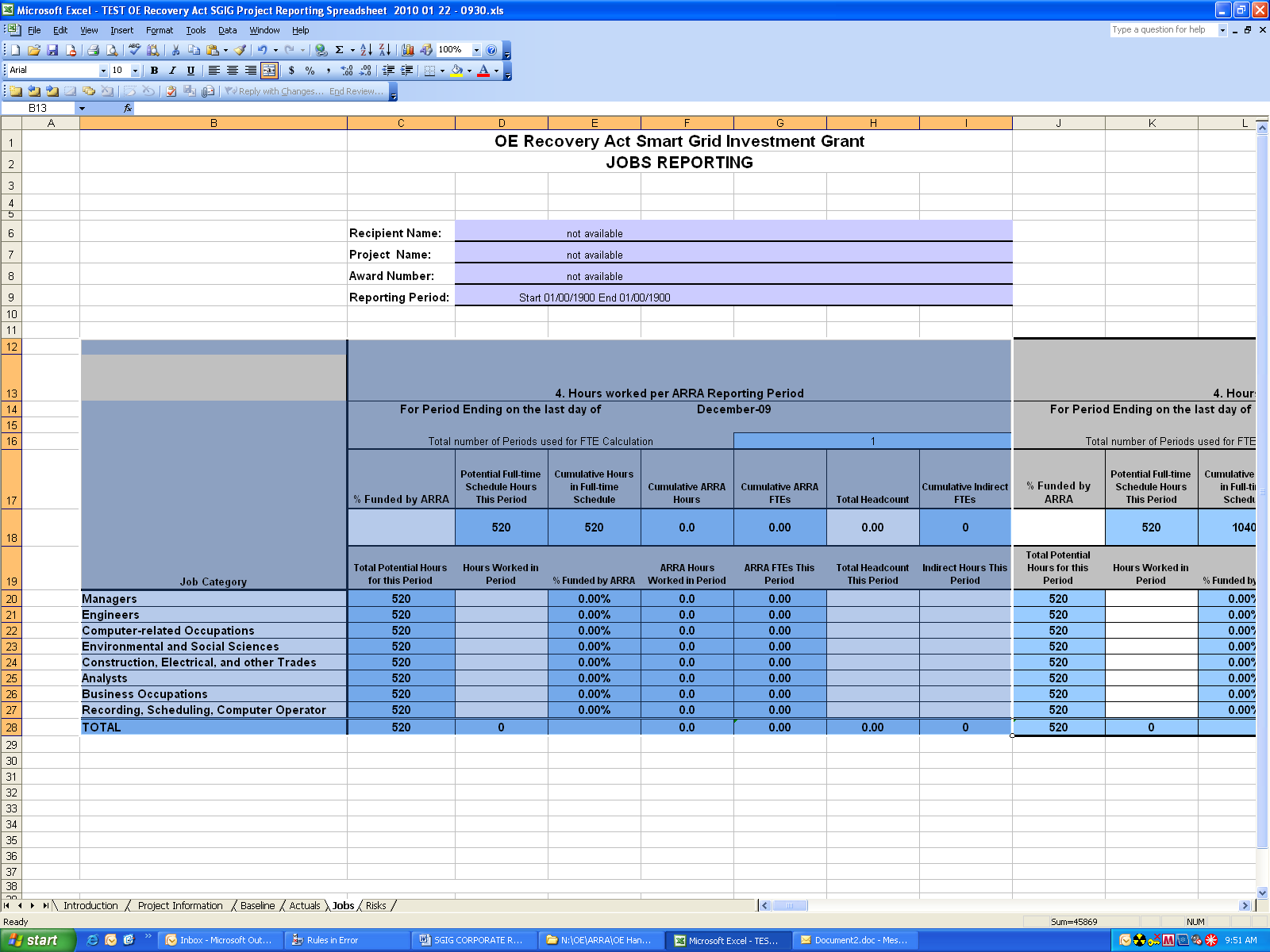

The template below allows recipients to report jobs created or retained by reporting the total hours worked for both the federal and cost share portions. The Full-time Equivalents (FTEs) will be automatically calculated by the template using the DOE formulas discussed in section 1.2 DOE FTE Calculations. The Cost Share percentage will also be calculated using the DOE formulas.

1.2DOE FTE Calculations

The jobs reported to DOE program offices should be expressed in OMB’s measurement of quarterly FTEs. The important difference is that total hours worked should include jobs at both the prime contractor/recipient and sub-contractor and sub-recipient level. Furthermore, recipients should also include the cost-share portion of the project and the number of direct jobs created for the entire project.

DOE has identified formulas for calculating FTEs, both from the Federal portion and from the entire project, and for calculating the cost share percentage for the project. These formulas are listed below for information purposes.

FTEs from Federal Recovery Funds

DOE funded FTE= Total hours worked in Jobs Created from DOE Recovery Act funds

Number of Hours in Sector Specific Full-time Schedule

Total FTEs (from federal + non-federal funds) from Recovery Act Supported Project

Total FTE= Total Hours Worked on Recovery Act-Supported Project

Number of Hours in Sector Specific Full-time Schedule

Cost Share

Cost Share= Total Cost of Recovery Act-Supported Project – DOE Recovery Act funds

Total Cost of Recovery Act-Supported Project

Or in other terms,

Cost Share = Non-federal Funds invested in Recovery Act- Supported Project

Total Cost of Recovery Act -Supported Project

1.3Example of FTE Job Calculations for DOE:

Assume recipient is preparing its second report and defines a full time schedule as 2080 hours per year or 520 hours worked per quarter.

Figure 1. Example of Job Calculations for internal DOE reporting

DOE Funded Employees |

Period 2 (10/1 – 12/31) |

Employee 1 |

520 |

Employee 2 |

520 |

Employee 3 |

260 |

Total: |

1,300 |

Full Time schedule per Employee |

520 |

|

|

Total DOE funded FTEs: 1300/ 520 = 2.5 JOBS |

|

Non-Federal Funded Employees |

Period 2 (10/1 – 12/31) |

Employee 1 |

520 |

Employee 2 |

520 |

Employee 3 |

260 |

Employee 4 |

52 |

Total: |

1,352 |

Full Time schedule per Employee |

520 |

|

|

Total Non-Federal FTEs: 1,352/ 520 = 2.6 |

|

TOTAL FTEs 2.5 DOE funded FTEs + 2.6 non-Fed funded FTEs) = 5.1 |

|

Total Cumulative Headcount = 7 3 DOE Funded Headcount + 4 non-Fed funded headcount |

|

1.4Total Cumulative Head-count

DOE Jobs Reporting requires recipients to provide a ‘Total Cumulative Head Count’ on a monthly basis. Total Cumulative Head Count allows DOE to accurately reflect the direct impact of Recovery Act funds on the American workforce.

This metric reflects the number of unique individuals that have been compensated for work under the Recovery Act since the inception of a Recovery Act project (i.e. full-time, part-time, or temporary). This number will be the number of unique workers that worked the “total hours worked in jobs created from DOE Recovery Act funds”, which is used in the FTE calculations. Total unique head count for any performance period will be greater than or equal to the FTE figure reported to DOE.

Recipients are to report the number of cumulative head-count based on the number of unique identifiers in payroll systems indicating the number of people paid using Recovery Act funding. Examples of unique identifiers may include social security numbers or work permit numbers. While these unique identifiers will not be collected by the DOE, recipients should maintain payroll records with unique identifiers that track the number of distinct individuals that received compensation. In the case of an audit, recipients will be expected to demonstrate that the number of distinct identifiers exists in their payroll records.

Total Cumulative Head Count = Cumulative number of employees hired on a full-time, part-time or temporary basis to work on a Recovery Act supported project.

The recipient is required to submit the data no later than 10 business days following the end of the period of performance. The first period of performance shall be the calendar month in which definitization of the award agreement occurred.

US DEPARTMENT OF ENERGY

OFFICE OF ELECTRICITY DELIVERY AND ENERGY RELIABILITY

| File Type | application/msword |

| File Title | DOE CORPORATE REPORTING |

| Author | eXCITE |

| Last Modified By | eXCITE |

| File Modified | 2010-01-28 |

| File Created | 2010-01-28 |

© 2026 OMB.report | Privacy Policy