Short Form

TDC-ON Attitudes Survey-Short Form.docx

Collection of Qualitative Feedback on Agency Service Delivery

Short Form

OMB: 1545-2256

Request for Approval under the “Generic Clearance for the Collection of Routine Customer Feedback” (OMB Control Number: 1545-2256)

TITLE OF THE STUDY:

IRS OLS Taxpayer Digital Notifications Outbound Notices (TDC-ON) MVP Taxpayer Attitudes Survey

PURPOSE:

The goal of TDC-ON MVP is to improve the individual taxpayer experience of receiving communications from the IRS. Currently, the IRS communicates with taxpayers almost solely by physical mail; the MVP will attempt to ensure that taxpayers are able to easily and securely receive notices via physical mailings and digitally through a secure environment built into Online Account. This survey focuses on validating if taxpayers who are able to authenticate and log into Online Account would use a digital document repository of IRS notices.

The study will be conducted using an unmoderated online survey with individual taxpayers on certain pages on IRS.gov. Participation is completely voluntary and anonymous, and no personally identifiable information will be collected.

DESCRIPTION OF RESPONDENTS:

Individual taxpayers interacting on IRS.gov.

TYPE OF COLLECTION: (Check one)

[ ] Customer Comment Card/Complaint Form [ ] Customer Satisfaction Survey

[ ] Usability Testing (e.g., Website or Software [ ] Small Discussion Group

[ ] Focus Group [X] Other: Online Survey

CERTIFICATION:

I certify the following to be true:

The collection is voluntary.

The collection is low-burden for respondents and low-cost for the Federal Government.

The collection is non-controversial and does not raise issues of concern to other federal agencies.

The results are not intended to be disseminated to the public.

Information gathered will not be used for the purpose of substantially informing influential policy decisions.

The collection is targeted to the solicitation of opinions from respondents who have experience with the program or may have experience with the program in the future.

Name: Kira Prin ([email protected])

To assist review, please provide answers to the following question:

Personally Identifiable Information:

Is personally identifiable information (PII) collected? [ ] Yes [X] No

If Yes, will any information that is collected be included in records that are subject to the Privacy Act of 1974? [ ] Yes [ ] No

If Yes, has an up-to-date System of Records Notice (SORN) been published? [ ] Yes [ ] No

Gifts or Payments:

Is an incentive (e.g., money or reimbursement of expenses, token of appreciation) provided to participants? [ ] Yes [X] No

BURDEN HOURS:

Category of Respondent |

No. of Respondents |

Participation Time |

Burden |

Unmoderated Survey (Category 1, Individuals) |

400 |

10 minutes |

66.66 hours |

Totals |

|

|

66.66 hours |

FEDERAL COST:

There is no estimated annual cost to the Federal government.

If you are conducting a focus group, survey, or plan to employ statistical methods, please provide answers to the following questions:

The selection of your targeted respondents

Do you have a customer list or something similar that defines the universe of potential respondents and do you have a sampling plan for selecting from this universe?

[X] Yes [] No

If the answer is yes, please provide a description of both below (or attach the sampling plan)? If the answer is no, please provide a description of how you plan to identify your potential group of respondents and how you will select them?

A link to the survey is anticipated to display within the promotions box in Online Account and on various pages on IRS.gov. Soliciting taxpayer feedback through IRS.gov and IRS applications like Online Account helps to ensure that the target population is recruited; however, to ensure statistically significant results, the survey should remain posted for at least three full weeks and/or until a minimum of 400 quality responses has been collected.

The primary source for recruiting will be a request for volunteers on to be determined pages of IRS.gov. Participants must be individual taxpayers who:

• Are at least 18 years old

• Have filed taxes within the past 5 years

• Does their own taxes (i.e., a family member or a tax professional does not do it for them)

OR

• Has a tax professional help them file their taxes (i.e. CPA, enrolled agent, family member, etc.)

In addition, participants should:

• Have received notices in the mail from the IRS within the past five years AND

• Be familiar with Online Account

The survey will close once a minimum of 400 quality responses has been collected. Based on previous surveys posted to IRS.gov, approximately 300-400 participants may get screened out at the beginning of the survey.

Administration of the Instrument

How will you collect the information? (Check all that apply)

[X] Web-based or other forms of Social Media

[ ] Telephone

[ ] In-person

[ ] Other, Explain

Will interviewers or facilitators be used? [ ] Yes [X] No

Please make sure that all instruments, instructions, and scripts are submitted with the request.

See page 4 for a list of all survey questions. See page 9 for survey screenshots.

PRA Language

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-2256. This survey will take around 15 minutes to complete. All responses are confidential. If you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to:

Internal Revenue Service

Tax Products Coordinating Committee

SE:W:CAR:MP:T:T:SP

1111 Constitution Ave. NW

Washington, DC 20224

Introduction

Thank you for participating in this survey. We would like to understand more about your interactions with the Internal Revenue Service (IRS) and your usage habits regarding IRS.gov. This survey is estimated to take between 5 and 15 minutes of your time.

Intro Questions

[Notes: Section headers are for internal use only; all questions will be required except for the open-ended response questions.]

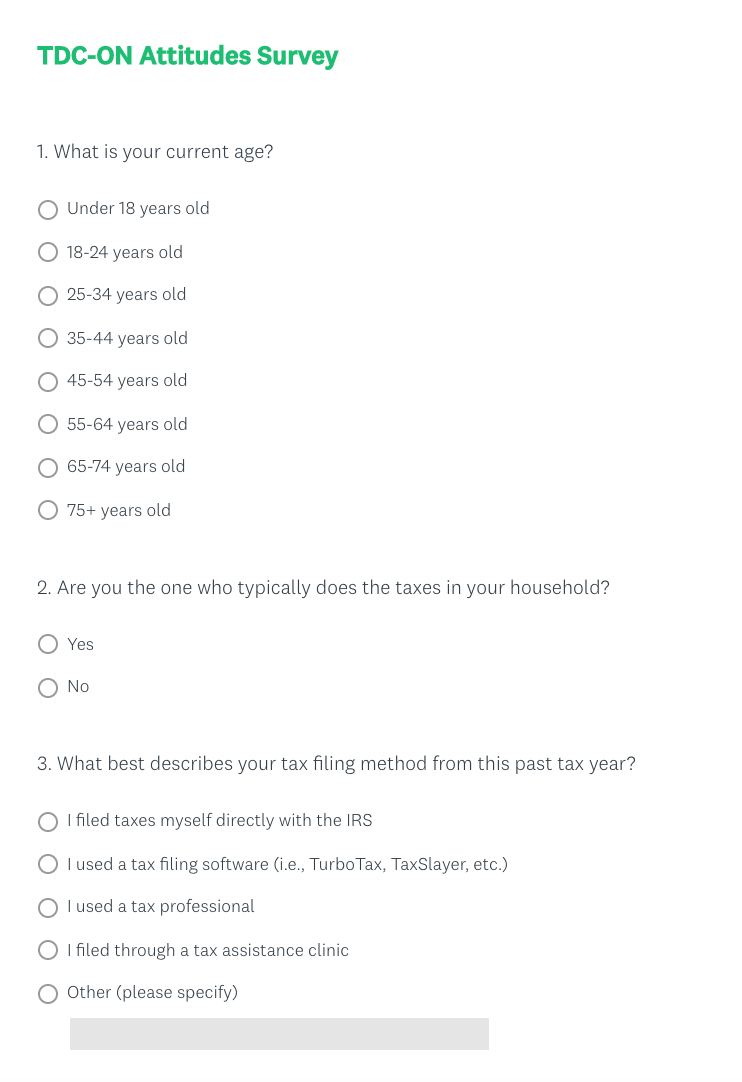

What is your current age?

Under 18 years old [Terminate]

18-24 years old

25-34 years old

35-44 years old

45-54 years old

55-64 years old

65-74 years old

75+ years old

Are you the one who typically does the taxes in your household?

Yes

No [Terminate]

What best describes your tax filing method from this past tax year?

I filed taxes myself directly with the IRS

I used a tax filing software (i.e., TurboTax, TaxSlayer, etc.)

I used a tax professional

I filed through a tax assistance clinic

Other (please specify)

Are you an accountant or other tax professional?

Yes [Terminate]

No

Did you owe the IRS money or receive a refund at the end of the last tax year?

Owed money

Received refund [Skip to Q7]

Neither [Skip to Q7]

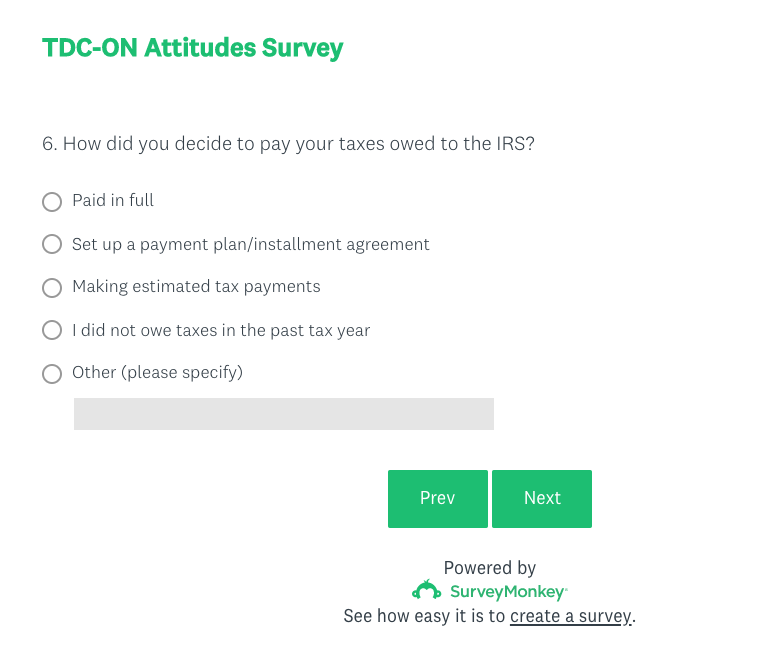

How did you decide to pay your taxes owed to the IRS?

Paid in full

Set up a payment plan/installment agreement

Making estimated tax payments

I did not owe taxes in the past tax year

Other, please specify

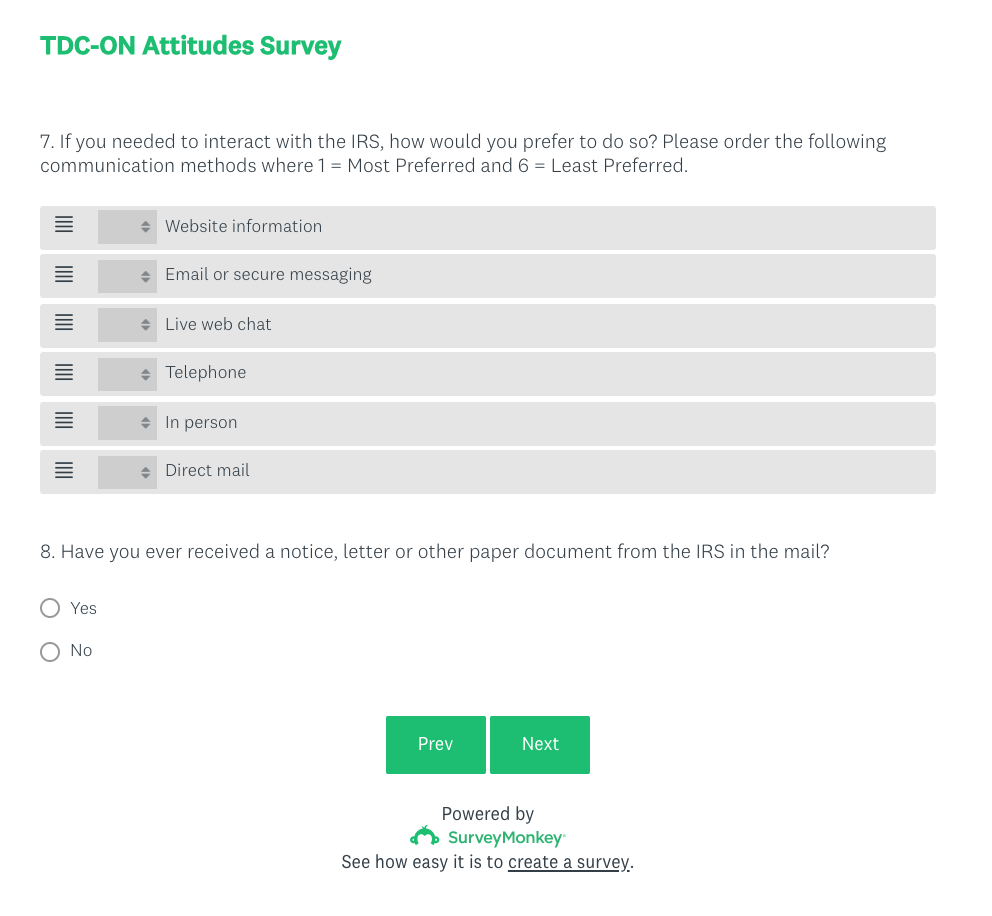

If you needed to interact with the IRS, how would you prefer to do so? Please order the following communication methods where 1 = Most Preferred and 6 = Least Preferred. [Responses randomized]

Telephone

Email or secure messaging

Website information

Live web chat

Direct mail

In person

Have you ever received a notice, letter or other paper document from the IRS in the mail?

Yes

No [Skip to text before Q11]

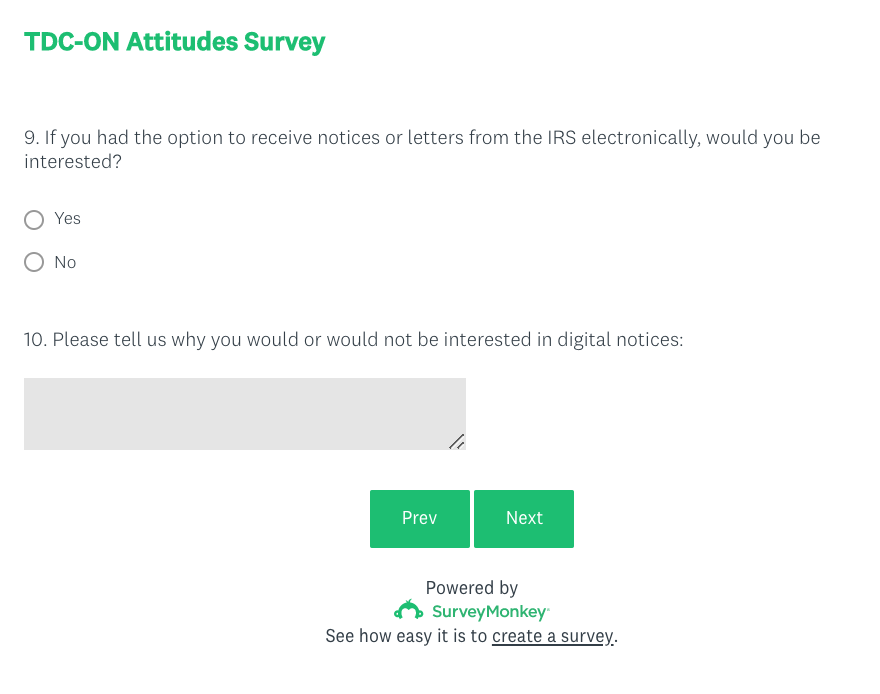

If you had the option to receive notices or letters from the IRS electronically, would you be interested?

Yes

No

Please tell us why you would or would not be interested in digital notices: [Open-end]

Platform & Usage Questions

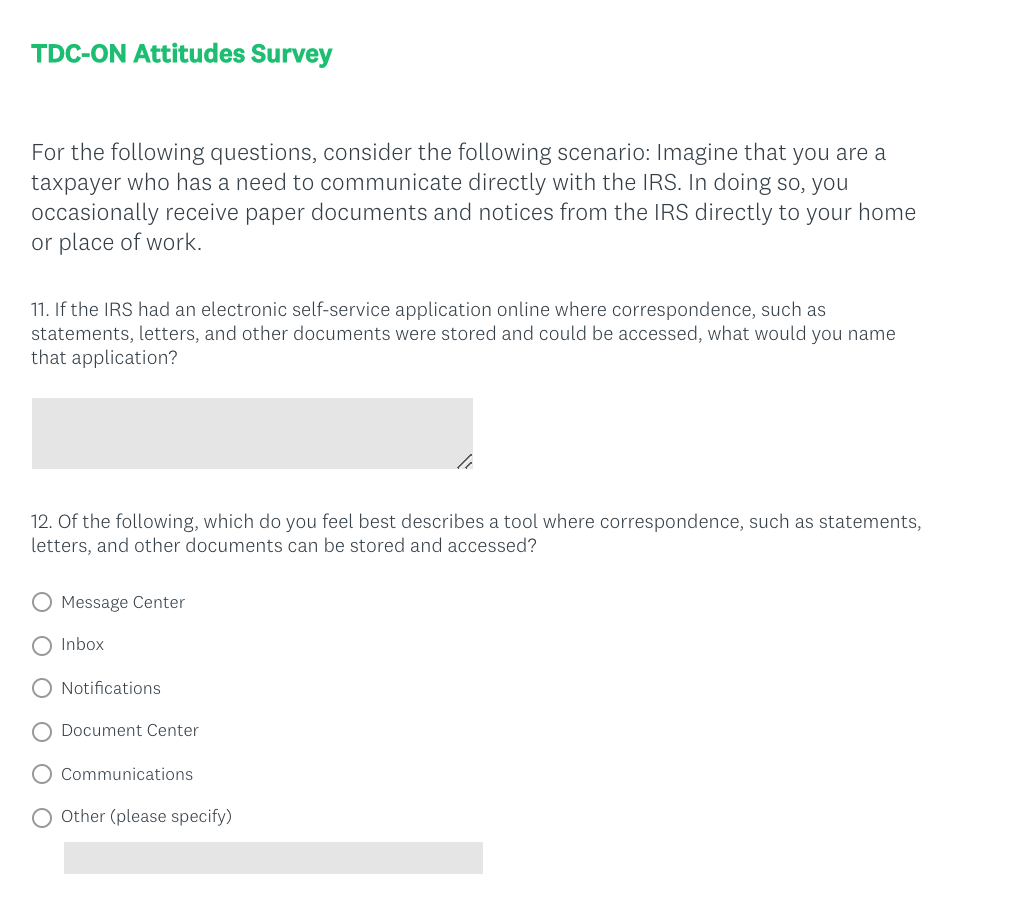

For the following questions, consider the following scenario: Imagine that you are a taxpayer who has a need to communicate directly with the IRS. In doing so, you occasionally receive paper documents and notices from the IRS directly to your home or place of work.

If the IRS had an electronic self-service application online where correspondence, such as statements, letters, and other documents were stored and could be accessed, what would you name that application? [Open-end]

Of the following, which do you feel best describes a tool where correspondence, such as statements, letters, and other documents can be stored and accessed? [Responses randomized]

Message Center

Inbox

Notifications

Document Center

Communications

Other – Please specify

If the IRS had an electronic self-service application online where correspondence, such as statements, letters, and other documents were stored and could be accessed, which of the following activities would be most important to you? Order all activities where 1 = Most Important and 6 = Least Important.

Open and read a document or notice

Easily see the name of each document or notice

Ability to delete documents or notices

Reorder documents or notices

Ability to tell which documents or notices have been read and have not been read

Download a document or notice

If the IRS tool allowed you to see the name of each document or notice, but did NOT allow you to open, read, or download the notice itself, how useful would it be to you?

Extremely useful

Very useful

Somewhat useful

Not useful at all

If the IRS tool informed you that a notice was going to come in the mail, but did NOT allow you to open, read, or download it electronically, how useful would that be to you?

Extremely useful

Very useful

Somewhat useful

Not useful at all

Notice Title Questions

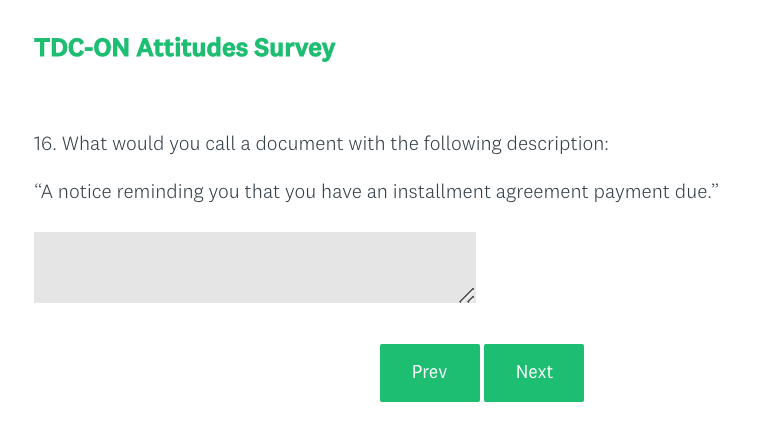

What would you call a document with the following description: “A notice reminding you that you have an installment agreement payment due.” [Open-end]

Which of the following best describes a document with the following description: “A notice reminding you that you have an installment agreement payment due”? [Responses randomized]

Installment Agreement Reminder Notice

Payment Reminder Notice

Balance Due Notice

Billing Invoice

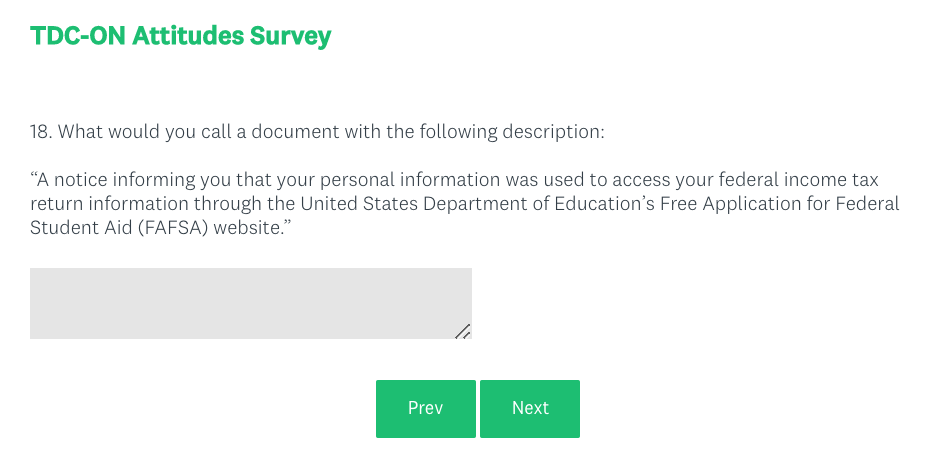

What would you call a document with the following description: “A notice informing you that your personal information was used to access your federal income tax return information through the United States Department of Education’s Free Application for Federal Student Aid (FAFSA) website.” [Open-end]

Which of the following best describes a document with the following description: “A notice informing you that your personal information was used to access your federal income tax return information through the United States Department of Education’s Free Application for Federal Student Aid (FAFSA) website”? [Responses randomized]

Notification of access to the IRS Data Retrieval Tool (FASFA tool)

Notification of FAFSA Access

Notification of FAFSA Inquiry

IRS FAFSA Access Notice

IRS FAFSA Inquiry Notice

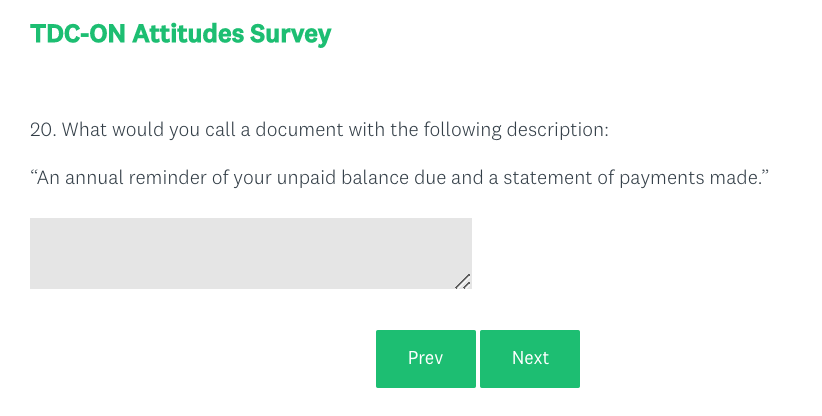

What would you call a document with the following description: “An annual reminder of your unpaid balance due and a statement of payments made.” [Open-end]

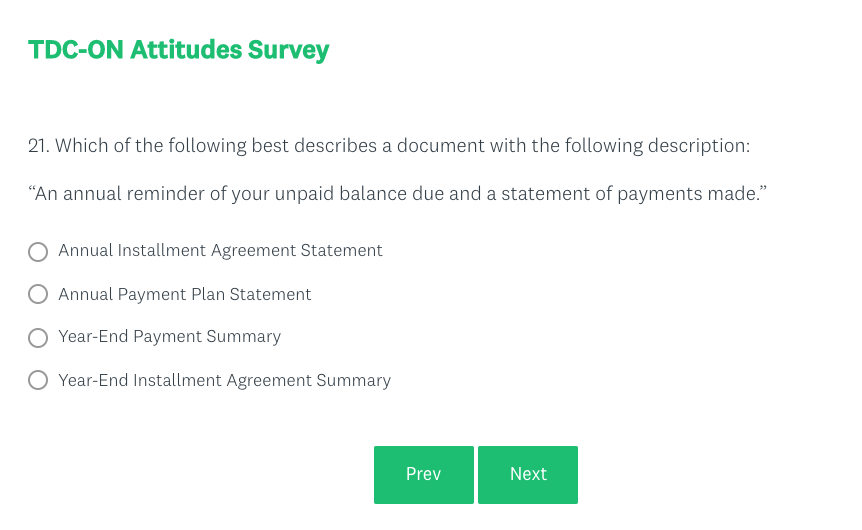

Which of the following best describes a document with the following description: “An annual reminder of your unpaid balance due and a statement of payments made”? [Responses randomized]

Annual Installment Agreement Statement

Annual Payment Plan Statement

Year-End Payment Summary

Year-End Installment Agreement Summary

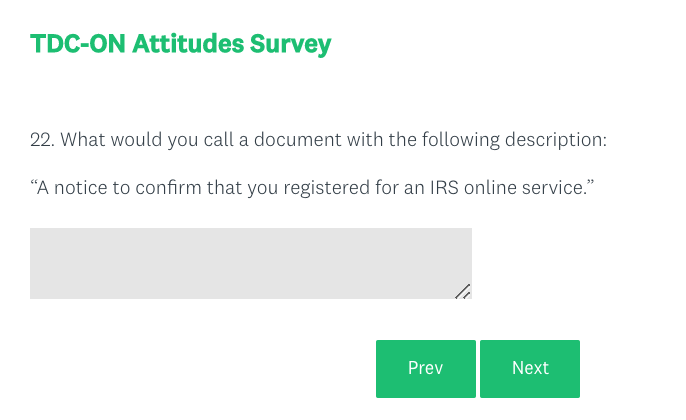

What would you call a document with the following description: “A notice to confirm that you registered for an IRS online service.” [Open-end]

Which of the following best describes a document with the following description: “A notice to confirm that you registered for an IRS online service”? [Responses randomized]

Online Services eAuthentication Acknowledgement Notice

Online Activity Notice

Digital Activity Notice

eAuthentication Notice

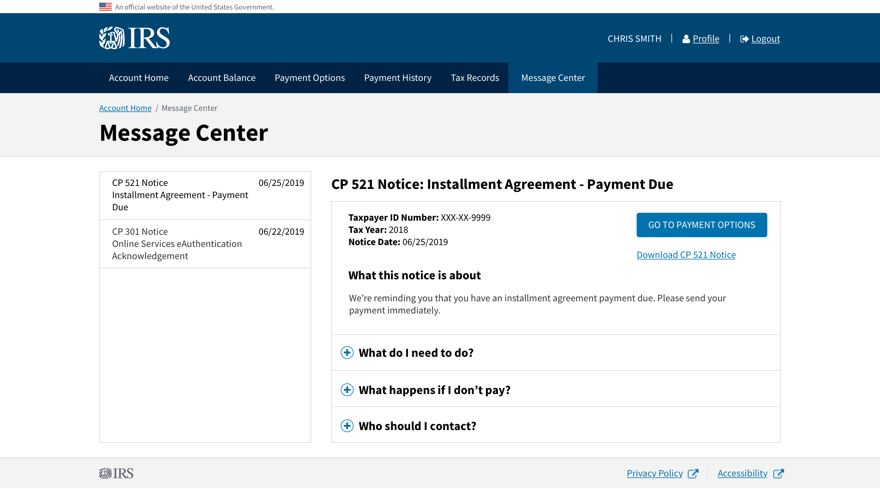

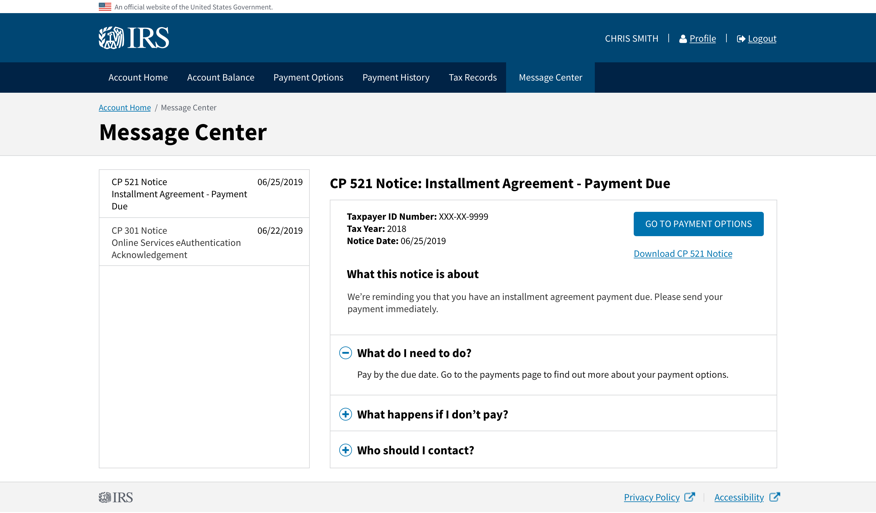

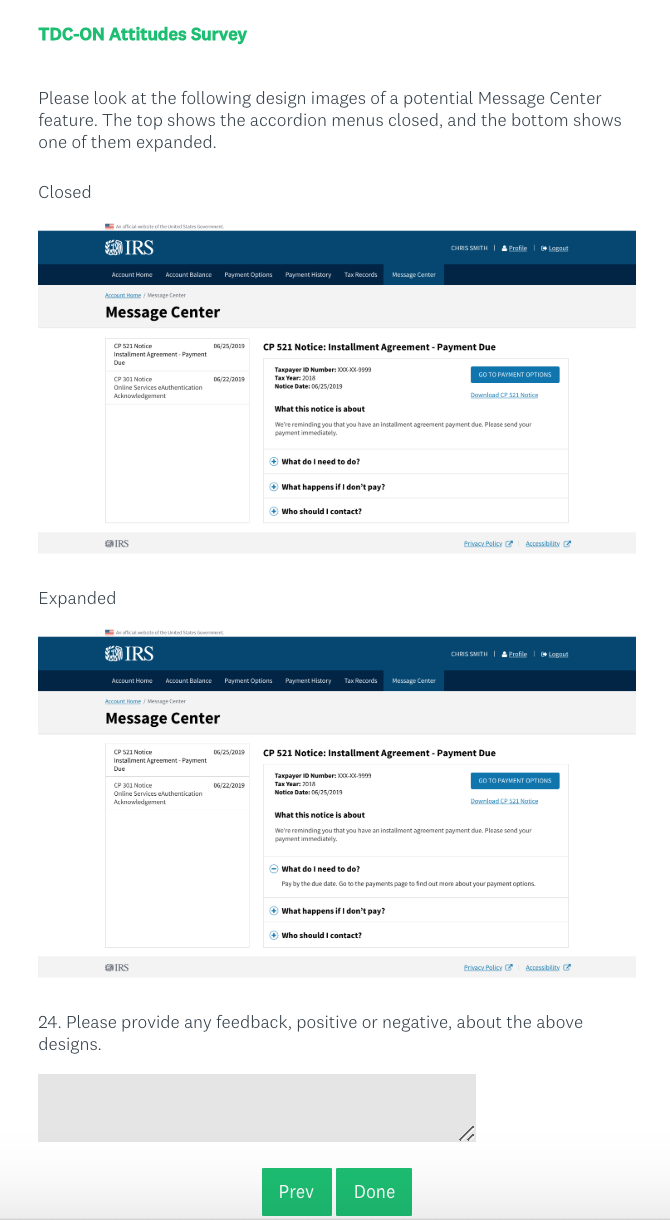

Please look at the following design images of a potential Message Center feature. The top shows the accordion menus closed, and the bottom shows one of them expanded.

Closed

Expanded

Please provide any feedback, positive or negative, about the above designs. [Open-end]

Screenshots

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| File Title | Fast Track PRA Submission Short Form |

| Author | OMB |

| File Modified | 0000-00-00 |

| File Created | 2021-01-14 |

© 2026 OMB.report | Privacy Policy