Tax Record for Account Study

Collection of Qualitative Feedback on Agency Service Delivery

Tax Records for Account Study_07AUG2017

Tax Record for Account Study

OMB: 1545-2256

Tax Records for Account Study

Phase 1 – Moderated Study

Survey Screener

NOTE – DO NOT ASK – GENDER (Recruit a mix.)

Female

Male

Are you a U.S. citizen?

Yes

No (Terminate call – Skip to bottom of script.)

How well do you speak English?

Very well

Well

Not well (Terminate call – Skip to bottom of script.)

Not at all (Terminate call – Skip to bottom of script.)

Sometimes we need to speak with those who have and those who have not been part of a market research study in the past. When, if ever, was the last time you participated in a market research study? _______________

THANK AND TERMINATE IF LESS THAN SIX MONTHS AGO.

If over six months ago: What was the topic of that study? _________________________

These research study sessions will be audio and/or video recorded for internal use only. Therefore, we will ask you to sign a consent form stating that you agree to be recorded; would you be agreeable to that?

Yes

No (Terminate call - Skip to bottom of script.)

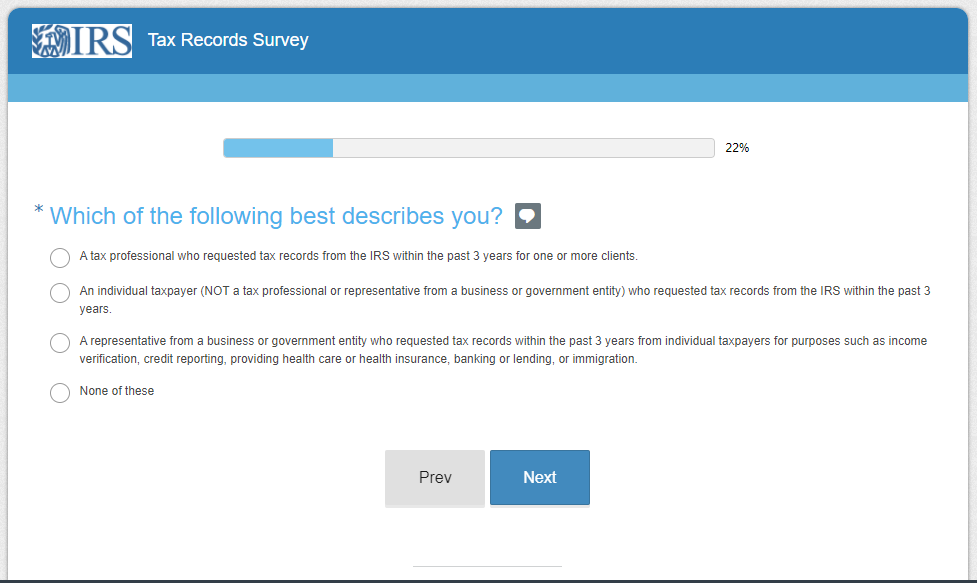

Which of the following best describes you? (Recruit to appropriate group date/time)

A parent of a college student who requested your tax records from the IRS within the past 3 years for the purposes of completing a student financial aid application (also known as the FAFSA). (GROUP 1)

An individual taxpayer who requested your tax records from the IRS within the past 3 years for the purposes of obtaining a loan (such as for a mortgage or home refinance). (GROUP 2)

A tax professional who requested tax records from the IRS within the past 3 years for one or more clients. (GROUP 3 – Skip to Q11)

A representative for a business or government entity who requested tax records within the past 3 years from individual taxpayers for purposes such as income verification, credit reporting, providing health care or health insurance, banking or lending, or immigration. (GROUP 4 – Skip to Q11)

None of these (Terminate call – Skip to bottom of script.)

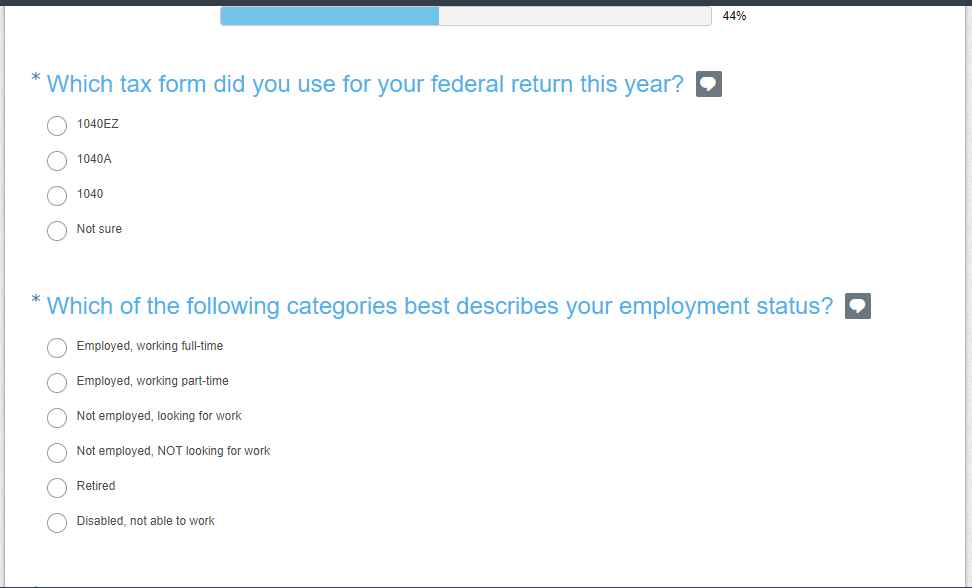

What is your employment status? (Recruit a mix)

Working full time

Working part time

Working in a second career (full-time or part-time)

Not working and not looking for work

Which of the following best describes why you are not working for pay and not looking for work?

Completely retired

Homemaker

Student

On disability

Never worked

Other

Unemployed and looking for work

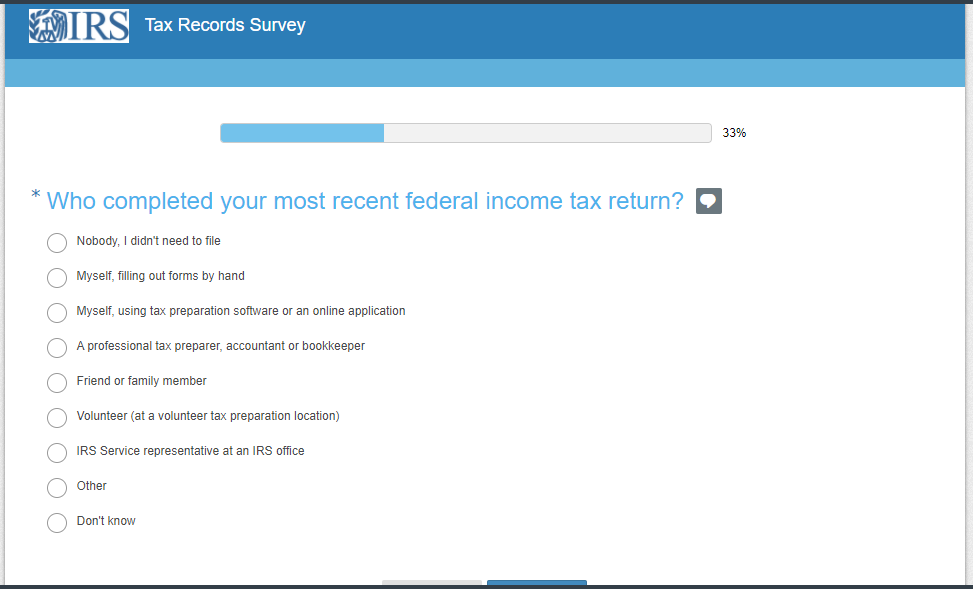

Who completed your most recent federal income tax return? (Recruit a mix)

Nobody, I didn’t need to file (Terminate call – Skip to bottom of script.)

Myself, filling out forms by hand

Myself, using tax preparation software or an online application

A professional tax preparer, accountant or bookkeeper

Friend or family member

Volunteer (at a volunteer tax preparation location)

IRS Service representative at an IRS office

Other (Terminate call – Skip to bottom of script.)

Don’t know (Terminate call – Skip to bottom of script.)

Which tax form did you use for your federal return this year?

1040EZ

1040A

1040

Not sure

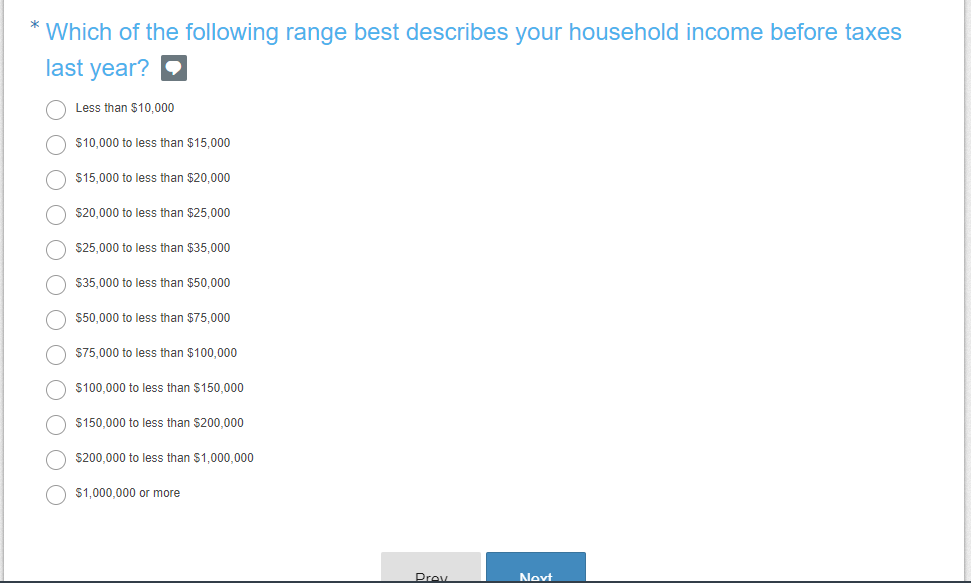

Which of the following ranges best describes your household income before taxes last year? (Recruit a mix)

Less than $10,000

$10,000 to less than $15,000

$15,000 to less than $20,000

$20,000 to less than $25,000

$25,000 to less than $35,000

$35,000 to less than $50,000

$50,000 to less than $75,000

$75,000 to less than $100,000

$100,000 to less than $150,000

$150,000 to less than $200,000

$200,000 to less than $1 million

$1 million or more

How would you rate your level of expertise with federal tax terminology?

1 (zero experience) (Terminate call - Skip to bottom of script.)

2

3

4

5 (expert) (Terminate call - Skip to bottom of script.)

What is / was your occupation and for which organization do / did you work?

____________________________________________

Do you currently work, or have you ever worked, for any of the following?

Tax services industry (as an enrolled agent, certified public accountant, tax attorney, or other tax professional) (OK if GROUP 3 only – otherwise, Terminate.)

Department of Treasury (Terminate call – Skip to bottom of script.)

Internal Revenue Service (Terminate call – Skip to bottom of script.)

How do you primarily access the Internet?

Smartphone

Tablet

Laptop

Desktop

Other

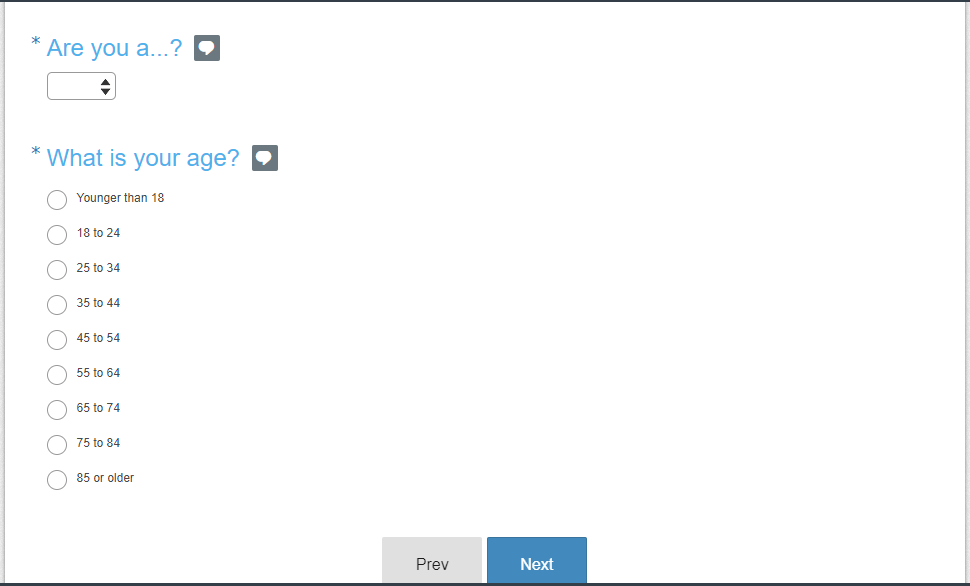

Please tell me which of the following ranges your age falls within: (Recruit a mix)

Younger than 18 (Terminate call - Skip to bottom of script.)

18-24

25-34

35-44

45-54

55-64

65-74

75-84

85 or older

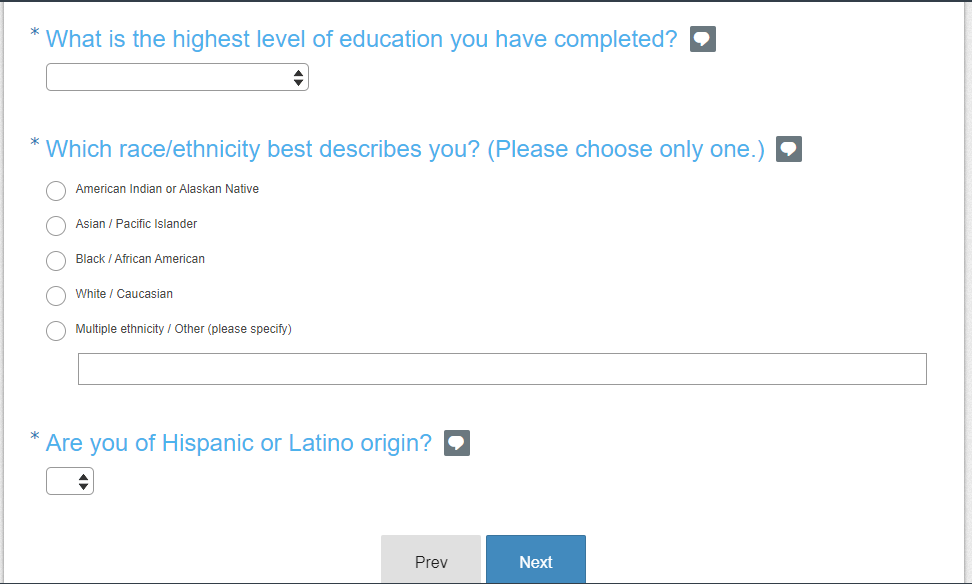

What is the highest level of education you have completed? (Recruit a mix)

Less than High School

High School Graduate/GED

Some College/Associate Degree

Vocational or Technical School

4-year College Graduate

Some Graduate School

Graduate Degree

Some Post-Graduate work

Doctorate Degree

Which group best describes you? (Recruit a mix)

White/Caucasian

Black/African American

American Indian or Alaskan Native

Asian

Other ________________

Are you of Hispanic or Latino origin?

Yes

No

Interview Protocol

Background (5 minutes)

Hello everyone, my name is Heather. Welcome to our group discussion today. We’re going to be here for about 75 minutes.

Before we start, I would like to thank you for your time and agreeing to participate in this group today. This should be a good discussion because we’re going to be talking about income taxes.

I work here at Mediabarn, and I have been hired as a researcher to guide our discussion today. My role is to gather your thoughts and ideas about the various topics we’ll discuss.

I want to stress that there are no "right" or "wrong" answers - we're simply looking for your honest reactions, regardless of whether they're positive or negative.

Outline general ground rules:

I would like the discussion to be informal, so there’s no need to wait for me to call on you to respond. In fact, I’d encourage you to respond directly to the comments other people make. If you don’t understand a question, please let me know. I am here to ask questions, listen, and make sure everyone has a chance to share.

If we seem to be stuck on a topic, I may interrupt you and if you aren’t saying much, I may call on you directly. If I do this, please don’t feel bad about it; it’s just my way of making sure we obtain everyone’s perspective.

I do ask that we all keep each other’s identities, participation and remarks private.

I hope you’ll feel free to speak openly and honestly.

We will be recording the discussion, because we don’t want to miss any of your comments.

Information discussed is going to be analyzed as a whole, and participant names will not be used in any analysis of the discussion.

Does anyone have any questions before we proceed?

Introduction (5 minutes elapsed; 5 minutes)

To get started, let’s go around the room. I’d like you to take about 30 seconds each to tell us your first name and a little bit about yourself (such as your career, your family, etc.).

Topic: Requesting Tax Records – Process (10 minutes elapsed; 15 minutes)

We’re going to be talking today primarily about requesting tax records from the Internal Revenue Service, or IRS.

For Individual Taxpayers:

First, what do you typically do with your tax return and other documents once you’ve filed your return?

Do you keep physical copies? Electronic copies?

How many of you have tried to request a copy of your tax record?

How did you do that? (Get details on whether via phone, online, other means)

How did you receive it? (Print it out, receive in mail, other?)

What did you do with the tax record once you received it?

Did you look at your tax record?

How often do you do this?

Do you have any suggestions on ways to improve this process?

What would make you more likely to go online to get your tax records?

What is the best name to call what we’re talking about?

I have been referring to this as “tax records…” Is that the correct term?

What about “transcript?”

Is there another word or phrase that would be more accurate to you?

For Tax Professionals:

Tell me about the process you go through when requesting tax records for your clients.

How do you typically do this? (Get details on whether via phone, online, other means)

What are the steps?

How long does it take?

How do you receive them? (Print it out, receive in mail, other?)

How often do you do this?

Do you have any suggestions on ways to improve this process?

What is the best name to call what we’re talking about?

I have been referring to this as “tax records…” Is that the correct term?

What about “transcript?”

Is there another word or phrase that would be more accurate to you?

For Businesses:

How do you let people know what you need and why you need it?

How do you usually receive tax information from individuals? (Electronic copies, via mail, others?)

What is acceptable?

What is preferred / ideal?

Do you have any concerns about the validity of the information?

Do you have any suggestions on ways to improve this process?

What is the best name to call what we’re talking about?

I have been referring to this as “tax records…” Is that the correct term?

What about “transcript?”

Is there another word or phrase that would be more accurate to you?

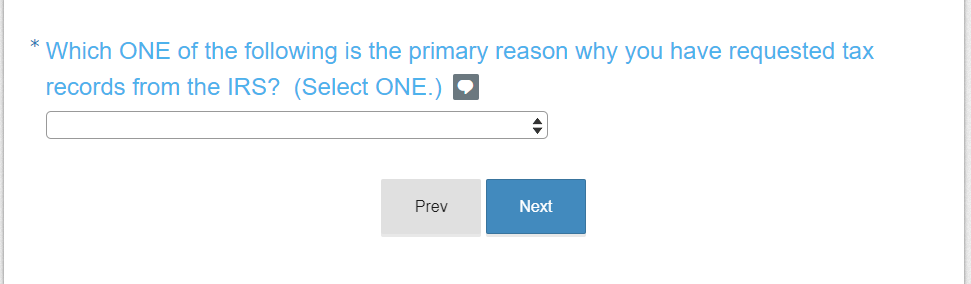

Topic: Requesting Tax Records – Reasons (25 minutes elapsed; 10 minutes)

For Individual Taxpayers:

Why did you need your tax record?

Was it a request that came from someone else?

Would you have been able to provide the necessary information on your own, without having to contact the IRS?

Why/why not?

For Tax Professionals:

Why do you need to request tax records for your clients?

Do you do this for all clients, or only in certain circumstances?

For Businesses:

Why do you need to gather tax information from individuals?

What decisions are you making based on this information?

Topic: Expectations / Meeting Needs (35 minutes elapsed; 15 minutes)

What are your expectations when you request tax records from the IRS?

Are your current expectations different from the expectations you had before you made this request for the first time? If Yes, in which ways are your expectations different? (Did anyone expect to see a copy of an actual return?)

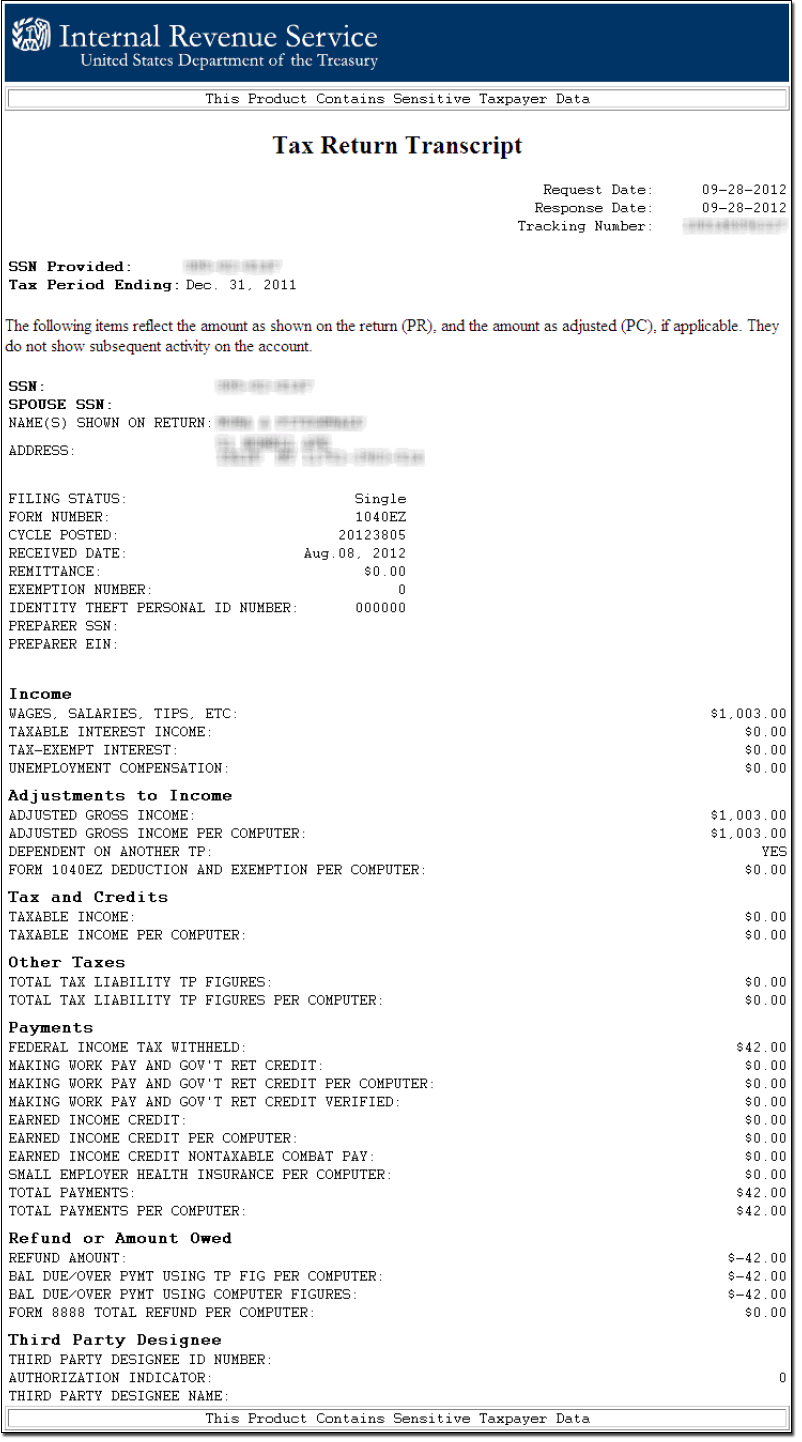

I’d like to have you look at an example of a current tax transcript.

Display Tax Return Transcript Screen

Does this look familiar to you, in terms of its format or layout?

What do you like about this?

What do you not like about this?

How well does this meet your expectations?

How well does this meet your information needs?

What other features or information do you want to see included here?

This is call “transcript.” Based on the information you see here, is that the correct term?

I know when we talked about this earlier, we said ____________; do you still feel that way?

What is the best name to call what this is?

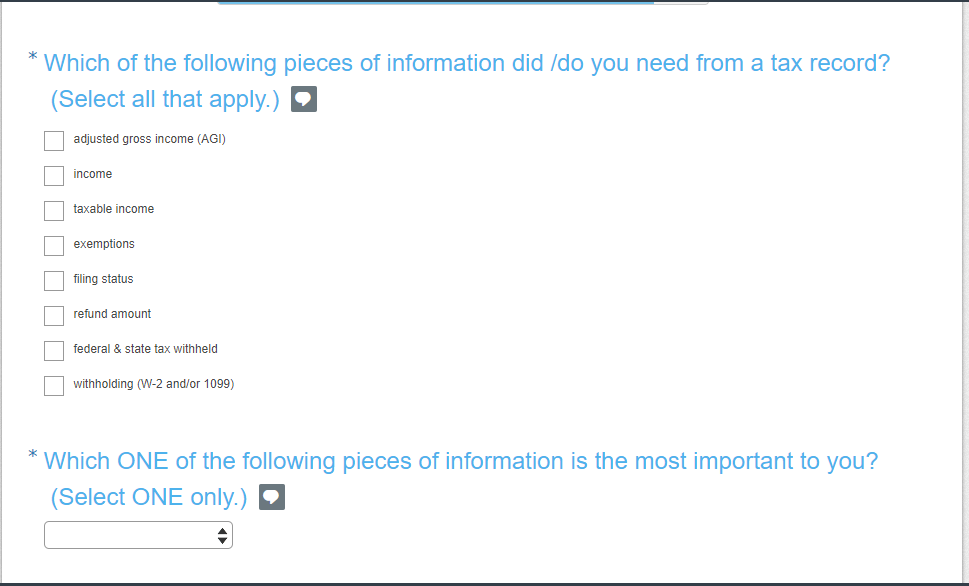

TOPIC: Data Points (50 minutes elapsed; 10 minutes)

Finally, I’d like to talk about the actual data that is included in a tax record.

What specific pieces of information do/did you need from a tax record?

I’d like to show you a list of a subset of items that could be included on a tax record

Display Data Point List

Please take a moment to rank these in order of importance to you, with #1 being most important and #8 being least important.

Let’s go around now, and please read to me your ranking for each item.

It looks as though ______________ is an important item to many of you. Why is that?

________________is also important. Tell me about that one.

And tell me about _____________, as that seemed to be one of the least important. Why is that?

If the IRS could provide to you 5 or 6 of these items, would that provide to you enough information? Or would you still need to request your tax record?

(Check with observers for additional questions)

WRAP-UP (1 hour elapsed; 5 minutes)

We’re just about finished for the evening.

Did any of you have any additional comments about what we’ve been discussing today?

Those are all the questions I had for you. Thank you for your feedback - it really does help.

Hopefully this was interesting for all of you as well. We will be sending your Amazon gift card to the email address we have used to correspond with you. Thanks again and have a good evening!

Tax Return Transcript

Data Point List

Adjusted gross income

Income

Taxable income

Exemptions

Filing status

Refund amount

Federal & state tax withheld

Withholding (W-2 and/or 1099)

Phase 2 – Unmoderated Study

Survey Monkey Screen Shots

The Paperwork Reduction Act requires that the IRS display an OMB control number on all public information requests. The OMB Control Number for this study is 1545-2256. Also, if you have any comments regarding the time estimates associated with this study or suggestions on making this process simpler, please write to the, Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, Washington, DC 20224.

| File Type | application/vnd.openxmlformats-officedocument.wordprocessingml.document |

| Author | Heather Gay/Mediabarn |

| File Modified | 0000-00-00 |

| File Created | 2021-01-14 |

© 2026 OMB.report | Privacy Policy